Understanding The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF (Dist)

Table of Contents

Understanding Net Asset Value (NAV) in ETFs

Net Asset Value (NAV) represents the net value of an ETF's underlying assets. For ETFs, it's calculated by subtracting the ETF's liabilities from the total value of its assets, then dividing by the number of outstanding shares. This provides a per-share value. It's a crucial indicator of the ETF's intrinsic worth.

The NAV differs from the market price, which is the price at which the ETF shares are traded on the exchange. Discrepancies between NAV and market price can occur due to supply and demand fluctuations during trading hours. For the Amundi Dow Jones Industrial Average UCITS ETF (Dist), several factors influence its NAV:

- Underlying Asset Performance: The primary driver is the performance of the Dow Jones Industrial Average (DJIA) components. Increases or decreases in the value of these stocks directly impact the ETF's NAV.

- Dividends Received and Reinvested: Dividends paid by the companies within the DJIA are usually reinvested into the ETF, affecting the NAV positively.

- Expenses and Management Fees: The ETF's operational expenses and management fees reduce the overall value of assets, impacting the NAV negatively.

- Currency Fluctuations: If the ETF holds assets in different currencies, fluctuations in exchange rates can influence the NAV.

Simplified NAV Calculation Example:

Let's imagine the Amundi Dow Jones Industrial Average UCITS ETF (Dist) holds assets worth €100 million and has liabilities of €1 million. If there are 10 million outstanding shares, the NAV would be (€100 million - €1 million) / 10 million shares = €9.90 per share. Keywords: NAV calculation, ETF NAV, Amundi ETF NAV, market price vs NAV, Dow Jones Industrial Average ETF NAV.

Accessing the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is straightforward. You can typically locate it in these places:

- Amundi's Official Website: The asset manager's official website usually provides up-to-date NAV information for all their ETFs.

- Financial News Sources: Major financial news websites and data providers often publish ETF NAV data.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will generally display the current or previous day's NAV.

NAV updates typically occur at the end of each trading day, reflecting the closing prices of the underlying assets. Regularly checking the NAV is essential for monitoring the ETF's performance and understanding your investment returns. Changes in the NAV directly reflect gains or losses in your investment. Keywords: Amundi ETF NAV data, find ETF NAV, real-time NAV, daily NAV update.

The Importance of NAV for Investment Decisions

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) plays a crucial role in various investment decisions:

- Performance Evaluation: Tracking NAV changes over time provides a clear picture of the ETF's performance against its benchmark (the DJIA).

- ETF Comparison: NAV helps compare the Amundi Dow Jones Industrial Average UCITS ETF (Dist) to other similar ETFs tracking the DJIA or other indices.

- Buy/Sell Signals: While not the sole factor, NAV can be considered alongside other indicators when deciding to buy or sell the ETF.

- Return Calculation: The difference between the initial NAV and the current NAV, adjusted for any distributions, allows calculation of your investment returns.

- Long-Term Strategy: Understanding NAV is vital for long-term investment strategies, allowing for informed rebalancing and adjustments to your portfolio allocation. Keywords: investment decisions, ETF performance, compare ETFs, buy/sell signals, long-term investment.

Conclusion: Mastering the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Dist)

In summary, the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is a fundamental metric for evaluating its performance and making informed investment choices. Understanding how it's calculated, where to find it, and its role in investment decisions empowers you to monitor your portfolio effectively. Regularly monitor the NAV and use this knowledge to make strategic decisions. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF (Dist) and its NAV to optimize your investment strategy. Keywords: Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV, ETF investment strategy, understand NAV, monitor ETF performance.

Featured Posts

-

Prepustanie V Nemecku H Nonline Sk Prinasa Komplexny Prehlad Situacie

May 25, 2025

Prepustanie V Nemecku H Nonline Sk Prinasa Komplexny Prehlad Situacie

May 25, 2025 -

60 Minute Delays Reported On M6 Southbound Following Road Accident

May 25, 2025

60 Minute Delays Reported On M6 Southbound Following Road Accident

May 25, 2025 -

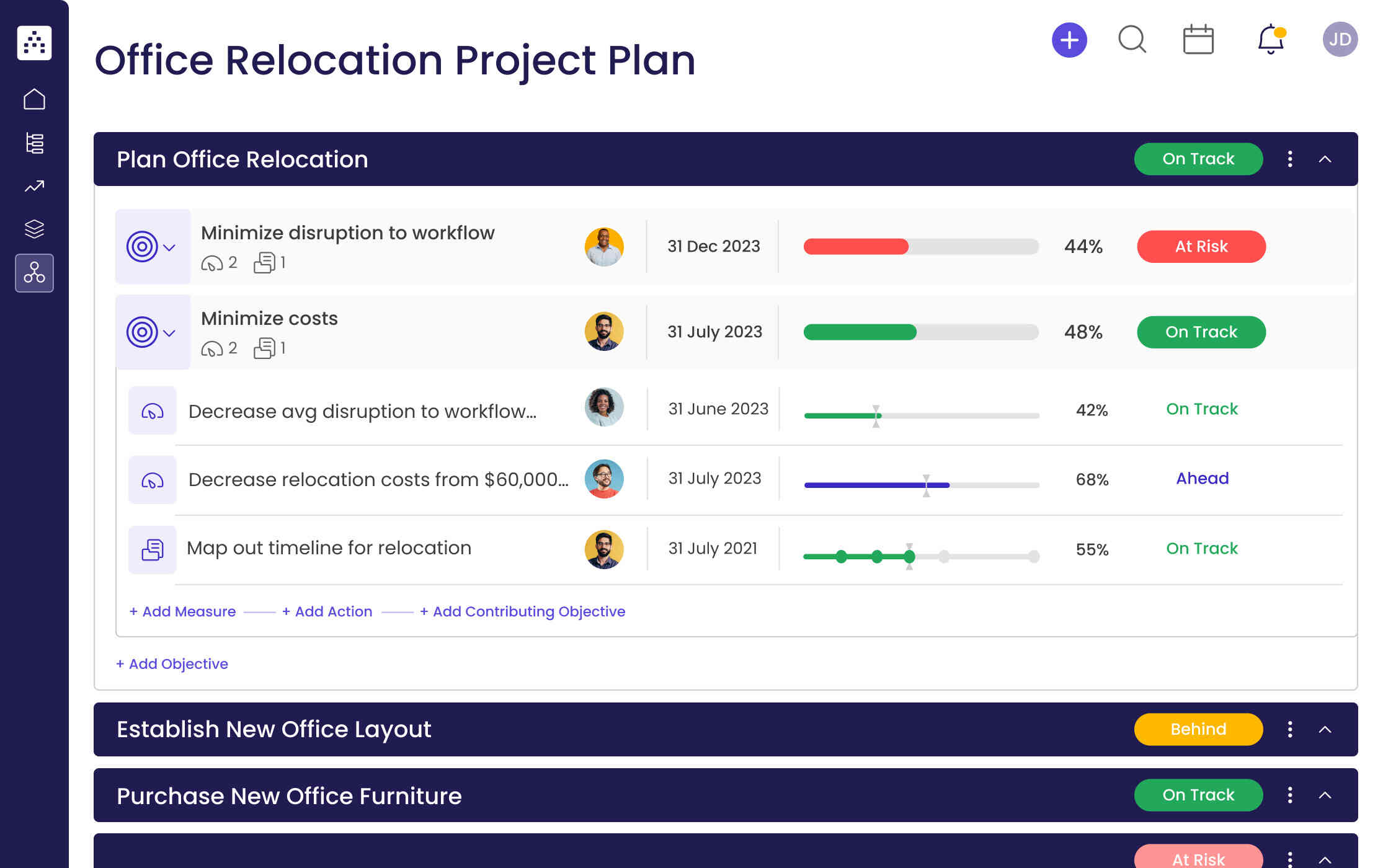

Escape To The Countryside A Step By Step Relocation Plan

May 25, 2025

Escape To The Countryside A Step By Step Relocation Plan

May 25, 2025 -

Trumps Tariff Relief Hints Boost European Stock Markets Lvmh Dips

May 25, 2025

Trumps Tariff Relief Hints Boost European Stock Markets Lvmh Dips

May 25, 2025 -

Finding Affordable Flights Around Memorial Day 2025

May 25, 2025

Finding Affordable Flights Around Memorial Day 2025

May 25, 2025

Latest Posts

-

Yurskiy V Mossovete Vecher Pamyati I Vospominaniy

May 25, 2025

Yurskiy V Mossovete Vecher Pamyati I Vospominaniy

May 25, 2025 -

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 25, 2025

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 25, 2025 -

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025 -

Jack Draper Wins First Atp Masters 1000 Championship In Indian Wells

May 25, 2025

Jack Draper Wins First Atp Masters 1000 Championship In Indian Wells

May 25, 2025 -

Pokolenie Peremen Chto Udalos Dostich

May 25, 2025

Pokolenie Peremen Chto Udalos Dostich

May 25, 2025