Understanding The Next Key Price Levels Of AAPL Stock

Table of Contents

Analyzing Current Market Sentiment and Trends for AAPL

To understand the next key price levels of AAPL stock, we need to analyze current market sentiment and trends. This involves examining both technical and fundamental factors, as well as the broader macroeconomic environment.

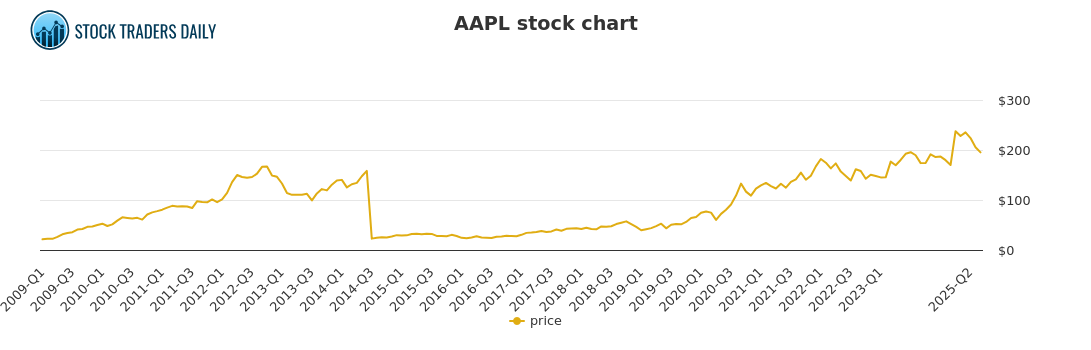

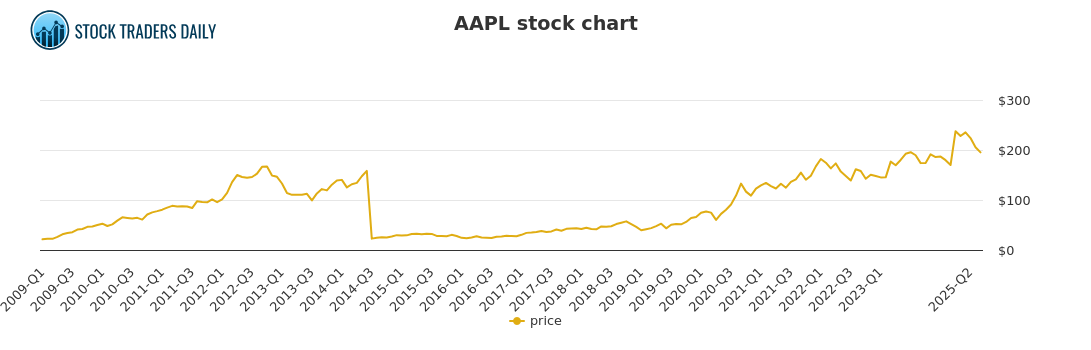

Technical Analysis of AAPL Stock Charts

Technical analysis of AAPL stock charts provides valuable insights into potential price movements. Key indicators to consider include:

- Moving Averages: Analyzing 50-day and 200-day moving averages can reveal short-term and long-term trends. A bullish crossover (50-day crossing above 200-day) often suggests a positive outlook for AAPL technical analysis.

- Relative Strength Index (RSI): The RSI helps identify overbought or oversold conditions. An RSI above 70 suggests AAPL might be overbought, while below 30 suggests it might be oversold.

- Moving Average Convergence Divergence (MACD): The MACD helps identify momentum changes. A bullish crossover (MACD line crossing above the signal line) indicates potential upward momentum.

- Support and Resistance Levels: Identifying key support and resistance levels on the AAPL chart can help predict potential price reversals. Breaks above resistance levels often signal bullish trends, while breaks below support levels suggest bearish trends. Analyzing AAPL support levels is crucial for risk management.

- Chart Patterns: Recognizing chart patterns like head and shoulders, triangles, or flags can provide further insights into potential price movements. Understanding AAPL chart patterns improves the accuracy of price predictions.

Fundamental Analysis of Apple's Financial Performance

Fundamental analysis focuses on Apple's financial health and its long-term prospects. Key aspects to consider include:

- AAPL Earnings: Analyzing Apple's recent earnings reports provides insights into its profitability and growth trajectory. Strong earnings usually support higher AAPL stock prices.

- Apple Revenue Growth: Consistent revenue growth indicates strong demand for Apple products and services. Sustained Apple revenue growth is a positive signal for long-term investors.

- Apple Product Innovation: Apple's ability to innovate and introduce new products is crucial for maintaining its competitive edge. Successful product launches can significantly boost investor sentiment and AAPL stock prices.

- Competitive Landscape: Analyzing the competitive landscape, including rivals like Samsung and Google, is essential to assessing Apple's market position and future growth potential.

Impact of Macroeconomic Factors on AAPL

Broader economic factors significantly influence AAPL stock price. Key considerations include:

- AAPL and Inflation: High inflation can negatively impact consumer spending, potentially affecting demand for Apple products.

- AAPL and Interest Rates: Rising interest rates can increase borrowing costs for businesses and consumers, impacting Apple's profitability and investor sentiment.

- AAPL and Global Economy: Global economic slowdowns or geopolitical uncertainties can negatively impact Apple's sales and profits.

Predicting Potential Key Price Levels for AAPL Stock

Based on the analysis above, we can attempt to predict potential key price levels for AAPL stock. These predictions are speculative and should not be considered financial advice.

Short-Term Price Targets for AAPL

Based on current technical indicators and market sentiment, a short-term (1-3 months) price target range of $160-$180 might be plausible. This AAPL short-term forecast assumes continued positive momentum in the market and sustained strong demand for Apple products. This AAPL price prediction short term is subject to change based on evolving market conditions.

Medium-Term Price Targets for AAPL

Over a medium-term horizon (6-12 months), a price target range of $190-$220 could be considered. This AAPL medium-term forecast is based on the assumption of continued innovation, positive earnings reports, and a generally stable global economy. This AAPL price prediction medium term is subject to considerable uncertainty.

Long-Term Price Targets for AAPL

Predicting AAPL long-term price targets (beyond 1 year) is highly speculative. However, a sustained positive trend could lead to potential long-term price appreciation, with a significant growth potential tied to future product innovation and expansion into new markets. This AAPL long-term forecast is highly dependent on successful execution of the company's long-term strategy. Any AAPL price prediction long term should be viewed with caution.

Risk Management and Considerations for AAPL Investors

Investing in AAPL stock involves inherent risks. It's crucial to acknowledge these risks and implement appropriate risk management strategies.

Potential Risks and Challenges Facing AAPL

Potential downsides include:

- AAPL Risks: Increased competition from rivals, supply chain disruptions, and changes in consumer demand pose significant risks.

- AAPL Challenges: Regulatory changes and economic downturns could also negatively impact Apple's performance. Understanding these AAPL investment risks is critical before investing.

Strategies for Mitigating Risk

To mitigate risks:

- AAPL Risk Management: Diversify your investment portfolio to reduce reliance on a single stock.

- AAPL Investment Strategies: Consider dollar-cost averaging to reduce the impact of market volatility and utilize stop-loss orders to limit potential losses.

Conclusion: Key Takeaways and Call to Action

Predicting AAPL stock price levels is challenging, requiring a thorough understanding of market sentiment, technical and fundamental analysis, and risk management. While short-term and medium-term price targets have been suggested, these are speculative. By understanding the next key price levels of AAPL stock and utilizing sound investment strategies, you can navigate the market effectively. Start your own AAPL stock price analysis today! Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Lego Master Manny Garcia Visits Veterans Memorial Elementary School Photo Highlights

May 25, 2025

Lego Master Manny Garcia Visits Veterans Memorial Elementary School Photo Highlights

May 25, 2025 -

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 25, 2025

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 25, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Analysis

May 25, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Analysis

May 25, 2025 -

Jordan Bardella Leading The French Presidential Election

May 25, 2025

Jordan Bardella Leading The French Presidential Election

May 25, 2025 -

Test Po Filmam S Olegom Basilashvili

May 25, 2025

Test Po Filmam S Olegom Basilashvili

May 25, 2025

Latest Posts

-

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025 -

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025 -

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025 -

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025