Understanding The Oil Market: Price Trends And News (April 23, 2024)

Table of Contents

Global Oil Supply and Demand Dynamics

The global oil market is a complex interplay of supply and demand. Understanding these dynamics is crucial to grasping current and future oil price movements.

OPEC+ Production Levels and Their Impact

The Organization of the Petroleum Exporting Countries (OPEC), along with its allies (OPEC+), plays a significant role in regulating global crude oil production. Their decisions regarding production quotas directly impact the global oil supply.

- Recent OPEC+ meetings: Decisions made in these meetings often involve production cuts or increases, influencing the overall supply available in the market.

- Production cuts/increases: These adjustments aim to stabilize prices or respond to changing market conditions. Significant cuts can lead to higher prices, while increases can put downward pressure.

- Member country compliance: Adherence to agreed-upon production quotas by member countries is crucial for the effectiveness of OPEC+ decisions. Non-compliance can significantly impact market stability.

Keywords: OPEC, OPEC+, crude oil production, oil supply, oil output, production quotas, cartel

Global Oil Consumption Patterns

Global oil consumption patterns are influenced by various factors, primarily economic growth and seasonal variations. Understanding these patterns is vital to predicting future oil demand.

- Economic growth in key regions: Strong economic growth in major oil-consuming regions, such as Asia and North America, usually translates to increased energy consumption and higher oil demand.

- Seasonal variations: Oil demand often fluctuates throughout the year, with peaks during winter months (due to heating) and summer months (due to increased travel).

- Impact of alternative energy sources: The growing adoption of renewable energy sources like solar and wind power is gradually reducing global reliance on oil, influencing long-term demand projections.

Keywords: oil demand, global oil consumption, energy consumption, economic growth, renewable energy, seasonal demand

Strategic Petroleum Reserves (SPR)

Strategic Petroleum Reserves (SPRs), maintained by various governments, act as a safety net during times of supply disruptions. Their release can help stabilize prices and mitigate the impact of unexpected events.

- Recent SPR releases: Governments may release oil from their SPRs in response to significant supply shocks or geopolitical crises, influencing market supply and prices.

- Government policies regarding SPRs: Government policies regarding the management and utilization of SPRs vary, impacting their effectiveness in managing oil price volatility.

- Impact on market stability: The strategic release of oil from SPRs can help prevent sharp price spikes and contribute to overall market stability.

Keywords: Strategic Petroleum Reserve, oil reserves, energy security, price stability, supply shock

Geopolitical Factors Influencing Oil Prices

Geopolitical events are major drivers of oil price volatility. Instability in oil-producing regions or conflicts involving major players can significantly impact global supply and prices.

Geopolitical Instability and its Effect on Oil Prices

Political unrest, sanctions, and armed conflicts in major oil-producing regions often cause disruptions to oil supply, leading to price spikes.

- Examples of recent geopolitical events impacting oil markets: The war in Ukraine serves as a prime example, significantly impacting global oil supplies and causing substantial price increases. Other conflicts and sanctions can have similar ripple effects.

- Impact on oil supply chains: Geopolitical instability can severely disrupt the smooth flow of oil from producers to consumers, creating bottlenecks and shortages.

Keywords: geopolitical risks, oil price volatility, sanctions, international relations, supply chain disruptions

The Role of Major Oil-Producing Countries

Major oil-producing countries like Russia, Saudi Arabia, and the United States exert significant influence on global oil markets through their production strategies and political alliances.

- Production strategies: Decisions by these countries regarding their oil production levels directly influence global supply and, consequently, prices.

- Political alliances: Alliances and geopolitical tensions between these countries can impact cooperation on production levels and overall market stability.

Keywords: Russia oil production, Saudi Aramco, US oil production, oil exporters, geopolitical alliances

Analyzing Current Oil Price Trends and Predictions

Analyzing current oil price trends and forecasts is crucial for investors, businesses, and policymakers alike. This section will examine recent price movements and explore expert predictions.

Recent Price Movements

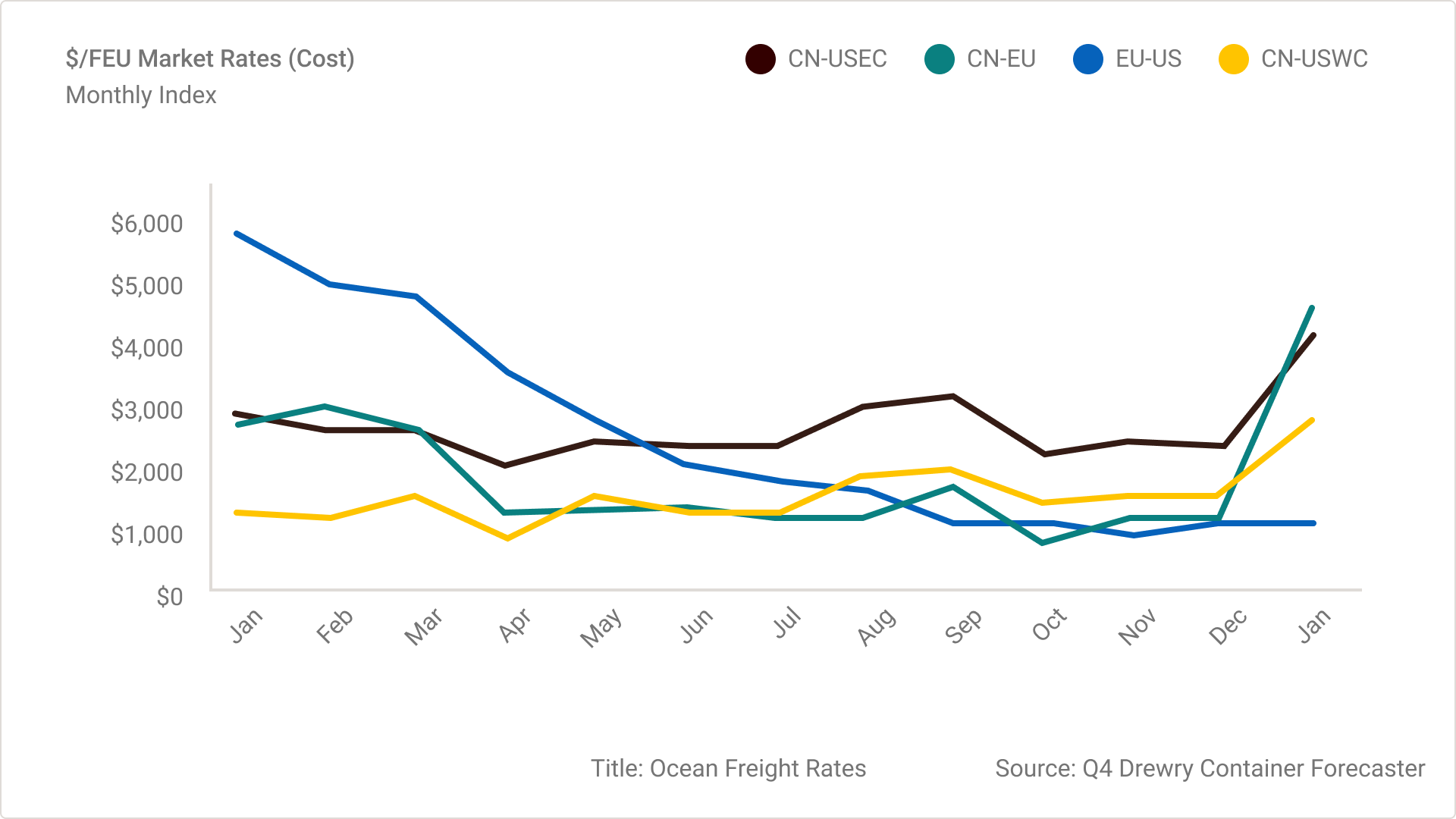

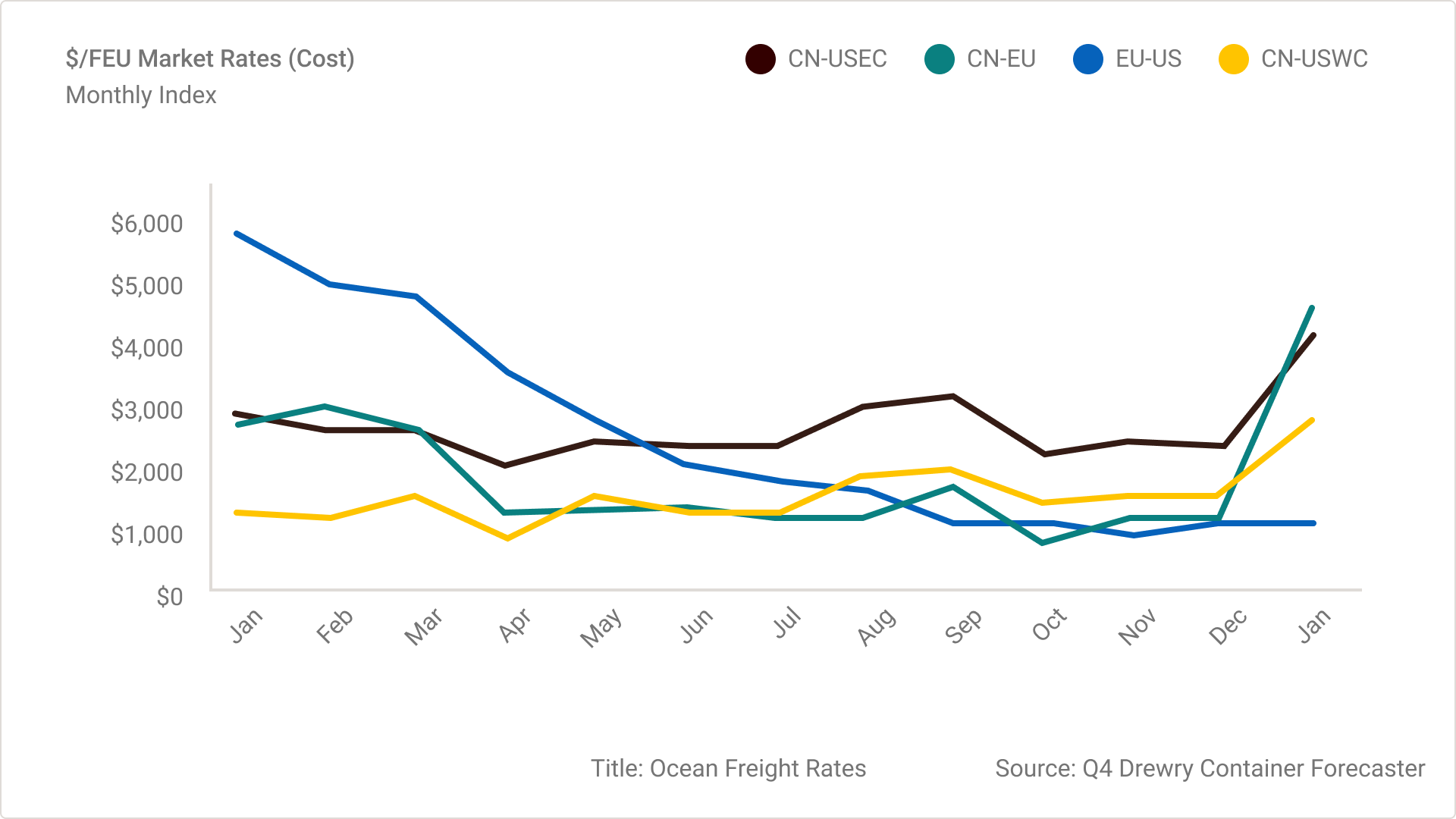

Recent oil price movements have been influenced by a combination of factors, including OPEC+ decisions, global economic growth, and geopolitical events.

- Charts illustrating price trends: Analyzing charts showing Brent crude and West Texas Intermediate (WTI) crude prices helps to visualize recent price fluctuations and identify key turning points.

- Explanations for upward/downward movements: Understanding the factors driving these price movements—e.g., supply disruptions, changes in demand, or geopolitical developments—is essential for predicting future trends.

Keywords: oil price forecast, oil price chart, crude oil prices, Brent crude, WTI crude, price volatility

Market Forecasts and Predictions

Experts offer various forecasts regarding future oil price movements, often based on analyses of supply and demand dynamics, geopolitical risks, and technological advancements.

- Short-term and long-term predictions: Short-term predictions often focus on immediate market conditions, while long-term predictions consider broader economic trends and the potential impact of alternative energy sources.

- Factors driving these forecasts: These forecasts typically consider OPEC+ policies, economic growth rates, geopolitical risks, and the adoption of renewable energy technologies.

Keywords: oil market outlook, future oil prices, energy market analysis, commodity prices, energy transition

Conclusion: Understanding the Oil Market – Key Takeaways and Next Steps

Understanding the oil market requires a careful consideration of global supply and demand dynamics, geopolitical factors, and market forecasts. The interplay of OPEC+ production decisions, global economic growth, geopolitical events, and the development of alternative energy sources significantly shapes oil prices. Staying informed about these factors is crucial for investors, businesses, and consumers alike. Understanding these forces allows for better decision-making and risk management within this ever-changing market. Stay informed about the ever-changing oil market by regularly checking our website for the latest updates on oil price trends and news.

Featured Posts

-

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 24, 2025

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 24, 2025 -

Nbas Second Investigation Into Ja Morant What We Know

Apr 24, 2025

Nbas Second Investigation Into Ja Morant What We Know

Apr 24, 2025 -

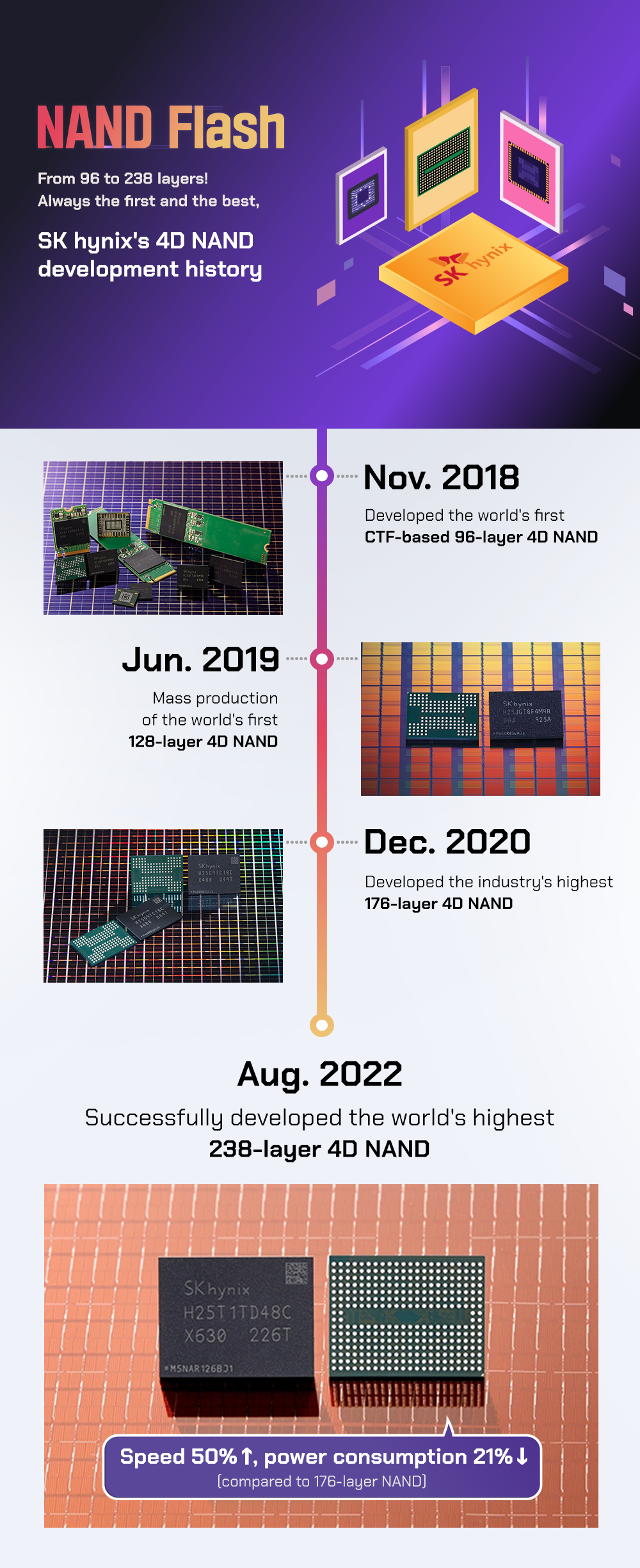

Dram Market Shift Sk Hynix Emerges As Potential Leader With Ai Boost

Apr 24, 2025

Dram Market Shift Sk Hynix Emerges As Potential Leader With Ai Boost

Apr 24, 2025 -

T Mobile To Pay 16 Million For Data Breaches Spanning Three Years

Apr 24, 2025

T Mobile To Pay 16 Million For Data Breaches Spanning Three Years

Apr 24, 2025 -

Remembering Jett Travolta John Travolta Posts Birthday Tribute

Apr 24, 2025

Remembering Jett Travolta John Travolta Posts Birthday Tribute

Apr 24, 2025