Understanding The Reasons Behind CoreWeave (CRWV) Stock's Thursday Drop

Table of Contents

Impact of Overall Market Downturn

Broad Market Trends

Thursday's market performance wasn't solely focused on CoreWeave. A broader downturn in the tech sector and overall economic anxieties likely played a significant role in CRWV's stock price decline. This wasn't an isolated incident; the broader market experienced considerable volatility.

- Market Indices: The Nasdaq Composite and the S&P 500 both experienced notable percentage drops on Thursday, indicating a general negative trend across the market. For example, the Nasdaq fell by X%, while the S&P 500 decreased by Y%. These figures highlight the pervasive negative market sentiment.

- Economic News: Any significant economic news, such as disappointing inflation data, shifts in interest rate expectations, or geopolitical uncertainties, could significantly influence investor sentiment and trigger widespread selling across various sectors, including technology.

- Data Points: Concrete data on these indices and economic news releases would provide a quantifiable understanding of the broader market context. For instance, a rise in bond yields or a decline in consumer confidence would point to potential reasons for widespread investor concern.

Specific News and Announcements Affecting CoreWeave (CRWV)

Lack of Positive Catalysts

The absence of positive news or announcements from CoreWeave itself could have contributed to the stock price drop. Investor expectations play a crucial role in stock valuation. Without positive catalysts, a stock may be vulnerable to selling pressure.

- Press Releases: A review of CoreWeave's press releases and public statements from Thursday is critical. Was there a lack of positive news regarding partnerships, product launches, or financial performance?

- Negative Interpretations: Even seemingly neutral announcements could be interpreted negatively in a down market. Investors may have reacted to any subtle hints of potential challenges facing CoreWeave.

- Silence as a Factor: If no news was released, the silence itself could have fueled speculation and contributed to the selling pressure. Investors often react negatively to the lack of communication, especially during periods of market uncertainty.

Analyst Ratings and Price Target Adjustments

Changes in Analyst Sentiment

Changes in analyst ratings and price targets can significantly impact a stock's performance. Downgrades or lowered price targets often trigger selling, as investors react to revised expectations.

- Analyst Actions: It's crucial to identify if any key investment banks or analysts issued downgrades or adjusted their price targets for CRWV stock around Thursday.

- Price Target Adjustments: Details on adjusted price targets are critical. Lowered targets reflect a less optimistic outlook for CoreWeave’s future performance. The reasoning behind these adjustments should be carefully analyzed.

- Market Impact: The collective effect of multiple analyst downgrades can amplify the negative sentiment, contributing to a significant sell-off.

Technical Analysis and Trading Volume

Chart Patterns and Trading Activity

Technical analysis offers insights into price movements. High trading volume combined with specific chart patterns can indicate a significant sell-off.

- Chart Patterns: Analyzing CRWV's charts for patterns like a breakdown of key support levels or the formation of bearish candlestick patterns could provide clues about the price decline.

- Trading Volume: High trading volume on Thursday compared to previous days would indicate substantial selling pressure driving the price down.

- Technical Indicators: Examining other technical indicators like RSI or MACD can reveal potential overselling conditions or momentum shifts.

Conclusion

The CoreWeave (CRWV) stock drop on Thursday was likely a multifaceted event. The confluence of a broader market downturn, a lack of positive catalysts from CoreWeave, potential analyst downgrades, and negative technical indicators likely contributed to the significant price decline. Understanding these interconnected factors is crucial for interpreting market fluctuations. To stay informed about CoreWeave stock, monitor future CRWV performance, and make informed investment choices, it's essential to stay updated on market news, analyst reports, and company announcements. Continuously analyze the factors impacting CoreWeave’s stock price to make well-informed investment decisions regarding CRWV.

Featured Posts

-

Jaw Dropping Antiques Roadshow Couple Arrested For Smuggling National Treasure

May 22, 2025

Jaw Dropping Antiques Roadshow Couple Arrested For Smuggling National Treasure

May 22, 2025 -

Wordle Puzzle 1367 Hints Clues And Answer For March 17th

May 22, 2025

Wordle Puzzle 1367 Hints Clues And Answer For March 17th

May 22, 2025 -

The Evolution Of The Goldbergs From Pilot To Present Day

May 22, 2025

The Evolution Of The Goldbergs From Pilot To Present Day

May 22, 2025 -

Noumatrouff Mulhouse Programmation Hellfest

May 22, 2025

Noumatrouff Mulhouse Programmation Hellfest

May 22, 2025 -

Mum Jailed For Tweet After Southport Stabbing Homelessness Sentence

May 22, 2025

Mum Jailed For Tweet After Southport Stabbing Homelessness Sentence

May 22, 2025

Latest Posts

-

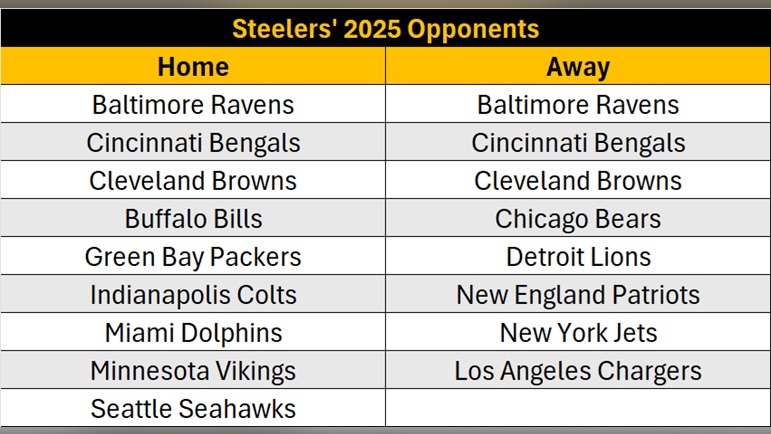

Pittsburgh Steelers 2025 Schedule Predictions And Analysis

May 22, 2025

Pittsburgh Steelers 2025 Schedule Predictions And Analysis

May 22, 2025 -

Music World Mourns The Loss Of Adam Ramey From Dropout Kings

May 22, 2025

Music World Mourns The Loss Of Adam Ramey From Dropout Kings

May 22, 2025 -

Tribute To Adam Ramey Remembering The Dropout Kings Vocalist

May 22, 2025

Tribute To Adam Ramey Remembering The Dropout Kings Vocalist

May 22, 2025 -

Remembering Adam Ramey Dropout Kings Vocalist Dies Unexpectedly

May 22, 2025

Remembering Adam Ramey Dropout Kings Vocalist Dies Unexpectedly

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Passes Away

May 22, 2025

Adam Ramey Dropout Kings Vocalist Passes Away

May 22, 2025