Understanding The Recent Gold Price Decline: Two Weekly Losses In 2025

Table of Contents

The Role of Rising Interest Rates in the Gold Price Decline

The Federal Reserve's monetary policy plays a significant role in influencing gold prices. Higher interest rates generally increase the opportunity cost of holding non-yielding assets like gold. This is because higher rates make alternative investments, such as bonds and other fixed-income securities, more attractive.

Impact of Federal Reserve Policy

- Increased interest rates make bonds and other fixed-income securities more attractive. Investors seeking returns may shift their portfolios away from gold and towards higher-yielding options. This reduced demand directly impacts the gold price.

- A stronger dollar resulting from higher rates negatively impacts gold prices (as gold is priced in USD). As the dollar strengthens, the price of gold in other currencies increases, reducing international demand. The inverse relationship between the gold price and the US dollar is well-documented.

- Increased borrowing costs impacting businesses and consumer spending, reducing demand for gold. Higher interest rates can slow economic growth, leading to decreased investment in gold as a safe haven asset.

Global Interest Rate Trends

The gold price decline isn't solely a US phenomenon. Rising interest rates globally contribute to the decreased demand for gold as a safe haven asset. Central banks worldwide are adjusting their monetary policies, impacting the overall investment landscape.

- Analysis of interest rate hikes in major economies (e.g., Europe, Asia): A coordinated global increase in interest rates amplifies the downward pressure on gold prices.

- Impact of these hikes on investor sentiment toward gold: As investors see more lucrative options in fixed-income investments, the appeal of gold diminishes, further driving down prices.

- Comparison of current interest rate environment with previous periods of gold price fluctuations: Historical data can provide valuable context, revealing how past interest rate hikes have affected gold prices and what we might expect in the future.

The Influence of a Strengthening US Dollar on Gold Prices

A stronger US dollar significantly impacts gold prices, creating a headwind for the precious metal. This is because gold is priced in US dollars, and a stronger dollar makes gold more expensive for investors holding other currencies.

Dollar's Impact on Commodity Prices

- Explanation of the inverse relationship between gold and the US dollar: As the dollar strengthens, gold becomes more expensive, reducing demand. Conversely, a weaker dollar typically boosts gold prices.

- Charts showing the correlation between dollar strength and gold price movements: Visual representations of this inverse relationship clearly illustrate the impact of currency fluctuations on gold.

- Discussion of factors driving the US dollar's recent strength: Understanding the underlying reasons for a strong dollar, such as increased investor confidence or geopolitical factors, is vital for predicting future gold price movements.

Geopolitical Factors and the Dollar

Geopolitical stability (or instability) significantly influences the dollar's strength and consequently affects gold prices. In times of uncertainty, investors often flock to the dollar as a safe haven, while gold may see reduced demand.

- Examples of geopolitical events impacting the US dollar: Major international events, such as conflicts or economic crises, can shift investor confidence and alter the dollar's value.

- Analysis of how these events affect investor confidence and gold demand: Geopolitical risk can influence the demand for gold as a safe-haven asset, leading to price fluctuations.

- Discussion of safe-haven demand for the dollar vs. gold during times of uncertainty: Investors often weigh the relative safety of the dollar versus gold, influencing the price of each.

Shifting Investor Sentiment and Market Speculation

Investor sentiment and market speculation play a crucial role in gold price fluctuations. A shift in investor perception can significantly impact demand and, consequently, price.

Decreased Safe-Haven Demand

- Discussion of the current economic outlook and its impact on investor sentiment: A positive economic outlook can reduce the perceived need for gold as a safe haven, leading to decreased demand.

- Analysis of gold's role as a hedge against inflation and economic uncertainty: Gold's traditional role as an inflation hedge is a key factor influencing investor sentiment.

- Comparison of current investor sentiment with previous periods of gold price volatility: Understanding historical patterns can provide insights into the current market dynamics.

Technical Analysis and Market Trends

Technical analysis and market trends offer additional clues to understand the recent gold price decline. Analyzing various indicators can provide insights into potential future price movements.

- Brief explanation of relevant technical indicators (e.g., moving averages, RSI): Technical indicators can signal potential support and resistance levels.

- Analysis of trading volume and its correlation with price movements: High trading volume often accompanies significant price changes.

- Mention of any significant market events impacting gold prices (e.g., major sell-offs): Major news events and market disruptions can trigger significant price swings.

Conclusion

The recent gold price decline, marked by two consecutive weekly losses in 2025, is a complex issue with multiple contributing factors. Rising interest rates, a strengthening US dollar, and shifting investor sentiment have all played a significant role in the 2025 gold market. Understanding these influences is crucial for investors to make informed decisions about their gold investments. By staying informed about global economic trends, market fluctuations, and the latest updates on the gold price, you can better navigate the ever-changing landscape of the gold market and effectively manage your gold investment strategy. Continue researching the latest developments to make informed choices about your gold price investments.

Featured Posts

-

Lab Owner Convicted For Falsifying Covid Test Results During Pandemic

May 04, 2025

Lab Owner Convicted For Falsifying Covid Test Results During Pandemic

May 04, 2025 -

Thunderbolts A Deep Dive Into Marvels Latest Team

May 04, 2025

Thunderbolts A Deep Dive Into Marvels Latest Team

May 04, 2025 -

Subtle Signs Fans Interpret Anna Kendricks Body Language With Blake Lively

May 04, 2025

Subtle Signs Fans Interpret Anna Kendricks Body Language With Blake Lively

May 04, 2025 -

Heatwave Warning 5 South Bengal Districts On High Alert

May 04, 2025

Heatwave Warning 5 South Bengal Districts On High Alert

May 04, 2025 -

45 000 Rare Book A Bookstores Unexpected Find

May 04, 2025

45 000 Rare Book A Bookstores Unexpected Find

May 04, 2025

Latest Posts

-

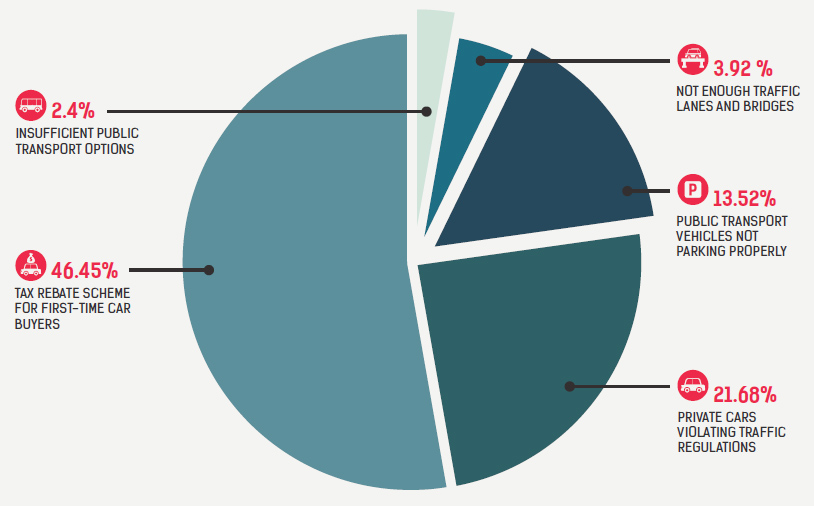

Addressing The Issue Of Slow Traffic Movement In Darjeeling

May 04, 2025

Addressing The Issue Of Slow Traffic Movement In Darjeeling

May 04, 2025 -

Darjeelings Traffic Problems A Detailed Analysis

May 04, 2025

Darjeelings Traffic Problems A Detailed Analysis

May 04, 2025 -

Darjeeling Traffic Congestion Causes And Solutions

May 04, 2025

Darjeeling Traffic Congestion Causes And Solutions

May 04, 2025 -

Holi In West Bengal Me T Department Predicts Extreme Temperatures And High Tides

May 04, 2025

Holi In West Bengal Me T Department Predicts Extreme Temperatures And High Tides

May 04, 2025 -

West Bengal Weather Forecast High Tide And Heat Warning For Holi

May 04, 2025

West Bengal Weather Forecast High Tide And Heat Warning For Holi

May 04, 2025