Understanding The Recent Increase In Bitcoin Mining Operations

Table of Contents

The Role of Bitcoin's Price in Fueling Mining Operations

The profitability of Bitcoin mining is intrinsically linked to the price of Bitcoin itself. This correlation is fundamental to understanding the recent surge in mining activity. A higher Bitcoin price directly translates into increased revenue for miners.

- Higher Bitcoin price = increased miner revenue: The more valuable Bitcoin becomes, the more miners earn for successfully verifying transactions and adding new blocks to the blockchain.

- Increased revenue incentivizes new miners to enter the market and existing miners to expand operations: Attractive profits encourage both individual miners and large-scale mining farms to invest in more powerful hardware and expand their operations.

- Historical examples: Past Bitcoin price rallies have consistently been accompanied by significant increases in mining activity. The bull runs of 2017 and 2021 serve as clear examples of this direct relationship between Bitcoin price and the intensity of Bitcoin mining operations.

- Impact of price volatility: While a high price is generally positive, significant price volatility can create uncertainty. Sharp price drops can reduce profitability, potentially forcing some miners to shut down operations or reduce their scale.

Advancements in Bitcoin Mining Hardware and Efficiency

Technological progress in Bitcoin mining hardware, specifically Application-Specific Integrated Circuits (ASICs), has played a crucial role in driving the recent surge. These specialized chips are designed solely for Bitcoin mining, offering significantly improved efficiency.

- Improved hash rate (processing power) per unit of energy consumed: Modern ASICs deliver exponentially higher processing power compared to their predecessors, requiring less energy to achieve the same level of mining performance.

- Reduced operational costs for miners: Improved energy efficiency directly translates into lower operational costs, increasing profitability and making mining more accessible to a wider range of participants.

- Leading ASIC manufacturers and their latest products: Companies like Bitmain, MicroBT, and Canaan have consistently released more powerful and energy-efficient ASIC miners, driving competition and innovation in the industry. These advancements contribute directly to the increase in Bitcoin mining operations.

- Impact on the overall network hash rate: The collective computing power (hash rate) of the Bitcoin network has grown dramatically due to the widespread adoption of these advanced ASIC miners, enhancing the network's security and resilience.

Institutional Investment and Large-Scale Mining Farms

The growing involvement of institutional investors is another key driver of the recent boom in Bitcoin mining operations. Large corporations and investment funds are increasingly allocating capital to this sector.

- Increased capital injection into the industry: Institutional investment provides substantial funding for the development of large-scale, highly efficient mining farms. This influx of capital facilitates expansion and innovation.

- Development of large-scale, highly efficient mining farms: These farms leverage economies of scale to minimize costs and maximize profitability, further contributing to the overall increase in Bitcoin mining activity.

- Benefits and risks of institutional involvement: While institutional investment brings significant capital, it also raises concerns about potential market manipulation and centralization of mining power.

- Examples of publicly traded mining companies: The rise of publicly traded Bitcoin mining companies, such as Riot Blockchain and Marathon Digital Holdings, demonstrates the growing institutional interest in the sector.

Geographic Shifts in Bitcoin Mining Activity

The geographical distribution of Bitcoin mining activity is also shifting, influenced by factors such as energy costs, regulations, and climate.

- Factors influencing location choices: Regions with low electricity costs, favorable regulatory environments, and suitable climates (for cooling purposes) are attracting a significant influx of mining operations.

- Regions experiencing significant growth: Countries in North America, Central Asia, and parts of Europe are witnessing substantial growth in Bitcoin mining activity.

- Environmental impact and regulatory responses: The high energy consumption of Bitcoin mining is raising environmental concerns, leading to varying regulatory responses across different jurisdictions. Some regions are implementing stricter regulations, while others are offering incentives to attract mining operations.

- Impact of government policies: Government policies play a significant role in shaping the geographical landscape of Bitcoin mining, with supportive regulations attracting investment and restrictive policies deterring it.

The Environmental Impact of Increased Bitcoin Mining

The substantial increase in Bitcoin mining operations raises valid concerns about energy consumption and its environmental impact.

- Carbon footprint of Bitcoin mining: The energy used for Bitcoin mining contributes to carbon emissions, prompting discussions about sustainability.

- Sustainable energy sources for mining: The adoption of renewable energy sources, such as hydro, solar, and wind power, is crucial for mitigating the environmental impact of Bitcoin mining.

- Initiatives aimed at reducing environmental impact: Various initiatives are underway to promote sustainable practices in Bitcoin mining, including the use of renewable energy and carbon offsetting programs.

- Comparison to other industries: While the energy consumption of Bitcoin mining is a concern, it's essential to compare it with the energy consumption of other industries to gain a more balanced perspective.

Conclusion

The recent surge in Bitcoin mining operations is a complex phenomenon driven by several interconnected factors: the appreciating price of Bitcoin, significant advancements in mining hardware, substantial institutional investment, and geographical shifts in mining activity. Understanding these factors is crucial for navigating the evolving landscape of cryptocurrency. However, we must also acknowledge and actively address the environmental implications of this increased activity. It's crucial to adopt sustainable practices and explore innovative solutions to minimize the carbon footprint associated with Bitcoin mining.

Stay informed about the future of Bitcoin mining and its impact on the cryptocurrency ecosystem. Continue researching sustainable mining practices and the influence of regulations on Bitcoin mining operations. The future of Bitcoin mining depends on balancing innovation and sustainability.

Featured Posts

-

Aeroport Permi Posledstviya Silnogo Snegopada

May 09, 2025

Aeroport Permi Posledstviya Silnogo Snegopada

May 09, 2025 -

Car Dealerships Push Back Against Enforced Ev Adoption

May 09, 2025

Car Dealerships Push Back Against Enforced Ev Adoption

May 09, 2025 -

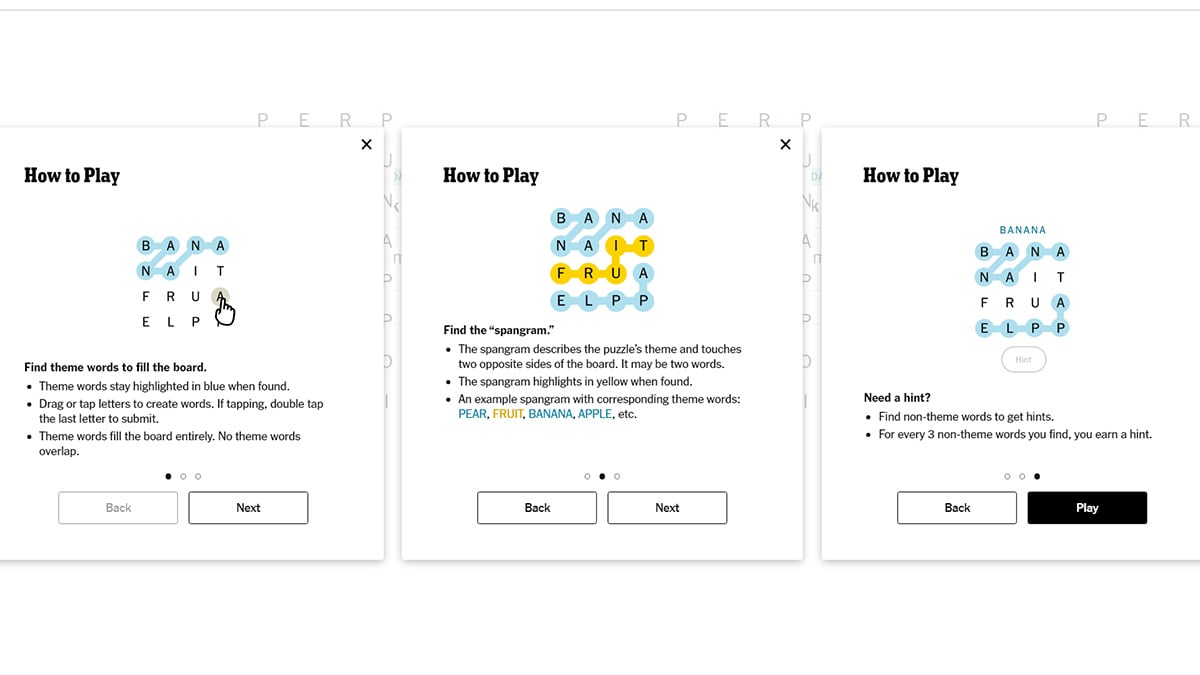

Unlocking The Nyt Strands Crossword April 12 2025 Solutions And Strategies

May 09, 2025

Unlocking The Nyt Strands Crossword April 12 2025 Solutions And Strategies

May 09, 2025 -

Uk Visa Restrictions Report Reveals Potential Nationality Bans

May 09, 2025

Uk Visa Restrictions Report Reveals Potential Nationality Bans

May 09, 2025 -

Wynne And Joanna All At Sea Exploring The Depths Of Their Adventure

May 09, 2025

Wynne And Joanna All At Sea Exploring The Depths Of Their Adventure

May 09, 2025