Understanding The Recent Surge In Bitcoin Mining Activity

Table of Contents

The Role of Bitcoin's Price in Fueling Mining Activity

The profitability of Bitcoin mining is directly tied to Bitcoin's price. This correlation is fundamental to understanding the recent surge in activity. When the price of Bitcoin rises, the reward for successfully mining a block—currently 6.25 BTC—becomes significantly more valuable. This increased profitability incentivizes more miners to join the network, leading to a more competitive and robust ecosystem.

- Higher Bitcoin prices make mining more profitable, attracting more miners. A higher Bitcoin price means miners can earn more from their efforts, covering operational costs and generating profit. This attracts both individual miners and large-scale mining operations.

- Increased miner participation leads to a higher hash rate (overall network security). The hash rate represents the total computational power dedicated to securing the Bitcoin network. A higher hash rate makes the network more resistant to attacks, enhancing its security and stability.

- Price volatility can lead to fluctuations in mining activity. While a rising price generally boosts activity, sharp price drops can make mining unprofitable, causing some miners to temporarily shut down their operations. This volatility introduces inherent risk into Bitcoin mining.

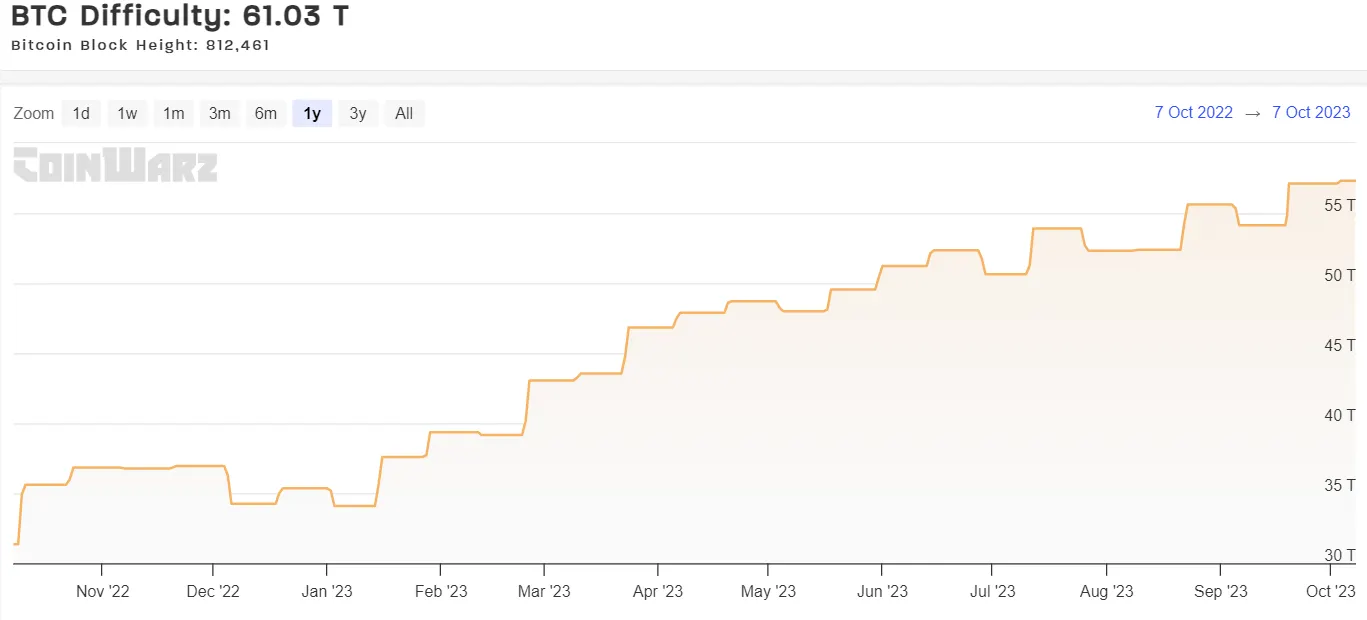

- Mining difficulty adjusts to maintain a consistent block generation time, impacting profitability. The Bitcoin network automatically adjusts the "mining difficulty" – a measure of how computationally hard it is to mine a block – to maintain a consistent block generation time of approximately 10 minutes. Increased miner participation leads to a higher difficulty, reducing individual profitability. This dynamic equilibrium ensures the network's stability.

Technological Advancements and Efficiency Gains in Bitcoin Mining

Technological advancements in Application-Specific Integrated Circuits (ASICs) have played a crucial role in the recent surge of Bitcoin mining activity. These specialized chips are designed solely for Bitcoin mining, offering significantly improved efficiency compared to earlier generations of hardware.

- Advances in ASIC technology lead to higher hash rates per unit of power. Modern ASICs are significantly more efficient, producing a much higher hash rate for the same amount of energy consumed. This translates to lower operating costs and higher profitability for miners.

- Increased efficiency reduces operating costs for miners. Lower energy consumption means lower electricity bills, a major expense for Bitcoin miners. This makes mining more accessible and profitable, even with fluctuations in Bitcoin's price.

- Specialized mining farms and their economies of scale play a significant role. Large-scale mining operations, often located in areas with cheap electricity, benefit from economies of scale, further reducing their operational costs. These farms utilize advanced cooling systems and other infrastructure optimizations.

- More efficient cooling systems are vital for large-scale operations. ASICs generate a considerable amount of heat. Efficient cooling systems are essential to maintain optimal operating temperatures and prevent hardware damage, impacting the overall efficiency and profitability of mining operations.

The Influence of Institutional Investors and Large-Scale Mining Operations

The growing involvement of institutional investors and large-scale mining operations has significantly impacted Bitcoin mining activity. These entities bring substantial capital and expertise to the market, driving technological innovation and increasing the overall hash rate.

- Increased institutional interest leads to significant capital investment in mining infrastructure. Large corporations and investment funds are allocating significant capital to build and expand mining operations, fueling the recent surge.

- Large-scale mining operations can afford more advanced and energy-efficient equipment. These operations have the resources to invest in the latest ASIC miners and other infrastructure improvements, enhancing their efficiency and profitability.

- This increased participation impacts the decentralization of Bitcoin mining. The concentration of mining power in the hands of a few large players raises concerns about the potential centralization of the Bitcoin network, a critical aspect of its design.

- Concentrated mining power presents potential risks. While beneficial for network security in some ways, this concentration could create vulnerabilities if a single entity or a small group gains too much control.

Regulatory Changes and Their Impact on Bitcoin Mining Activity

Regulatory landscapes across different countries significantly influence Bitcoin mining activity. Supportive regulations can attract mining operations, while restrictive measures can limit them.

- Supportive regulations attract mining operations. Jurisdictions with clear, favorable regulatory frameworks and energy policies often become attractive locations for Bitcoin miners.

- Restrictive regulations limit mining activity. Countries with strict regulations or outright bans on cryptocurrency mining discourage activity within their borders.

- Energy policies play a crucial role in influencing mining locations. The cost of electricity is a major factor in determining the profitability of mining. Regions with abundant and affordable renewable energy sources are particularly attractive.

- Environmental concerns regarding energy consumption are increasingly important. The high energy consumption associated with Bitcoin mining has raised environmental concerns. Regulations promoting sustainable energy sources and environmentally friendly mining practices are becoming increasingly crucial.

Conclusion

The recent surge in Bitcoin mining activity is a multifaceted phenomenon shaped by the interplay of Bitcoin's price, technological advancements, institutional investment, and regulatory environments. Understanding these driving forces is paramount for navigating the evolving cryptocurrency market. Staying informed about the latest developments in Bitcoin mining activity is essential. Continue your research into the intricacies of Bitcoin mining activity to gain a deeper understanding of this critical aspect of the cryptocurrency ecosystem.

Featured Posts

-

Ray Alshmrany Fy Antqal Jysws Lflamnghw Fydyw Kaml

May 08, 2025

Ray Alshmrany Fy Antqal Jysws Lflamnghw Fydyw Kaml

May 08, 2025 -

Nba Playoffs Triple Doubles Quiz Can You Name The Leader

May 08, 2025

Nba Playoffs Triple Doubles Quiz Can You Name The Leader

May 08, 2025 -

Arsenal Vs Psg Nevilles Prediction And What It Means For The Gunners

May 08, 2025

Arsenal Vs Psg Nevilles Prediction And What It Means For The Gunners

May 08, 2025 -

Wga And Sag Aftra Strike What It Means For Hollywood

May 08, 2025

Wga And Sag Aftra Strike What It Means For Hollywood

May 08, 2025 -

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Dikkat

May 08, 2025

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Dikkat

May 08, 2025