Understanding The Rising Federal Debt And Its Implications For Mortgages

Table of Contents

The Mechanics of Federal Debt and Interest Rates

The mechanics of how rising federal debt affects mortgage rates are multifaceted. Essentially, increased government borrowing to finance the national debt intensifies the demand for loanable funds, creating a ripple effect throughout the financial system.

How Government Borrowing Impacts Interest Rates

- Increased demand for funds competes with private sector borrowing: When the government borrows heavily, it competes with businesses and individuals for available capital. This increased competition drives up the price of borrowing – interest rates.

- Higher demand leads to higher interest rates across the board, including mortgages: This upward pressure on interest rates isn't limited to government bonds; it extends to all types of borrowing, including mortgages. The higher the demand, the higher the rates lenders charge to compensate for the increased risk and competition.

- The Federal Reserve's role in managing interest rates and inflation in response to the debt: The Federal Reserve (the Fed), the central bank of the U.S., plays a crucial role. It attempts to manage inflation and interest rates through monetary policy tools. However, the Fed's ability to control inflation and interest rates is directly influenced by the level of national debt and the government's fiscal policies.

Inflation's Role in Mortgage Rates

Rising federal debt can contribute to inflation. Increased government spending, particularly deficit spending, can inject more money into the economy, potentially exceeding the capacity of the economy to produce goods and services. This imbalance leads to a rise in prices.

- Government spending can fuel inflation: Large-scale government spending programs, if not carefully managed, can contribute significantly to inflationary pressures.

- The Federal Reserve combats inflation by raising interest rates: To combat inflation, the Fed typically raises interest rates. Higher interest rates make borrowing more expensive, cooling down economic activity and reducing demand, which helps curb inflation.

- The impact of higher interest rates on mortgage affordability: This action, while aimed at taming inflation, directly impacts mortgage rates, making homeownership less affordable. Higher interest rates translate to higher monthly mortgage payments, potentially pricing many buyers out of the market.

The Impact of Rising Federal Debt on the Housing Market

The implications of a rising federal debt extend beyond interest rates; they significantly affect the housing market's health and stability.

Affordability Challenges

Higher mortgage rates, a direct consequence of increased federal debt, create significant affordability challenges for potential homebuyers.

- Impact on first-time homebuyers: First-time homebuyers, often relying on smaller down payments and tighter budgets, are particularly vulnerable to rising mortgage rates. Higher payments can make homeownership unattainable for many.

- Decreased home sales volume: As affordability decreases, the number of home sales typically declines. Fewer buyers in the market can lead to a slowdown in the housing market's overall activity.

- Effect on home prices – potentially slowing price appreciation or causing a decline: Reduced demand can put downward pressure on home prices, potentially slowing or reversing the upward trend often seen in a robust housing market.

Investor Behavior and Market Volatility

Uncertainty surrounding the federal debt and its potential economic consequences can significantly impact investor behavior in the housing market.

- How investors might react to economic uncertainty: Investors may become hesitant to invest in mortgage-backed securities or other housing-related investments due to the increased risk associated with economic uncertainty.

- Potential impact on mortgage-backed securities: The value of mortgage-backed securities, a key component of the mortgage market, can fluctuate based on investor sentiment and perceptions of economic risk.

- Implications for market stability: Reduced investor confidence and increased volatility can destabilize the housing market, creating uncertainty and potential for price corrections.

Government Policies and Their Influence

Government policies, both fiscal and monetary, play a crucial role in shaping the federal debt level and its impact on the mortgage market.

Fiscal Policy's Role

Fiscal policy, encompassing government spending and taxation, directly influences the level of the federal debt.

- Impact of deficit spending: Consistent deficit spending, where government spending exceeds revenue, contributes to the accumulation of national debt.

- Effects of tax cuts or increases: Tax cuts can stimulate the economy but also increase the deficit, whereas tax increases can reduce the deficit but potentially stifle economic growth.

- Relationship between fiscal policy and monetary policy: Fiscal and monetary policies are intertwined; the Fed often adjusts monetary policy to counteract the inflationary or deflationary effects of fiscal policy decisions.

Monetary Policy's Response

The Federal Reserve's monetary policy actions are crucial in managing interest rates and mitigating the impacts of rising federal debt.

- Tools the Federal Reserve employs (e.g., federal funds rate): The Fed uses various tools, including the federal funds rate (the target rate for overnight lending between banks), to influence interest rates across the economy.

- Trade-offs between controlling inflation and supporting economic growth: The Fed faces a challenging trade-off: controlling inflation often requires raising interest rates, which can slow economic growth and potentially harm the housing market.

- Effectiveness of monetary policy in mitigating the impacts of rising debt: The effectiveness of monetary policy in mitigating the negative impacts of rising debt depends on various factors, including the scale of the debt, the overall economic climate, and the Fed's ability to anticipate and respond to economic changes.

Conclusion

The connection between rising federal debt and mortgage rates is undeniable. Increased government borrowing pushes up interest rates, impacting affordability and creating challenges for both homebuyers and the housing market overall. Government fiscal and monetary policies play crucial roles in managing this complex interplay. Understanding these dynamics – the mechanics of debt, its influence on inflation and interest rates, and the subsequent impacts on the housing market – is critical for informed decision-making.

Call to Action: Stay informed about changes in the federal debt and its impact on mortgage rates. Regularly monitor economic indicators such as inflation and interest rate forecasts, and consult with financial professionals to make informed decisions about your mortgage and financial planning in the context of the evolving national debt landscape. Understanding the rising federal debt and its implications for mortgages is crucial for navigating the housing market effectively.

Featured Posts

-

Wnba Draft 2024 Paige Bueckers Expected As A Top Selection

May 19, 2025

Wnba Draft 2024 Paige Bueckers Expected As A Top Selection

May 19, 2025 -

Boyleyma Efeton Dodekanisoy Analysi Tis Dikastikis Diadikasias Me 210 Enorkoys

May 19, 2025

Boyleyma Efeton Dodekanisoy Analysi Tis Dikastikis Diadikasias Me 210 Enorkoys

May 19, 2025 -

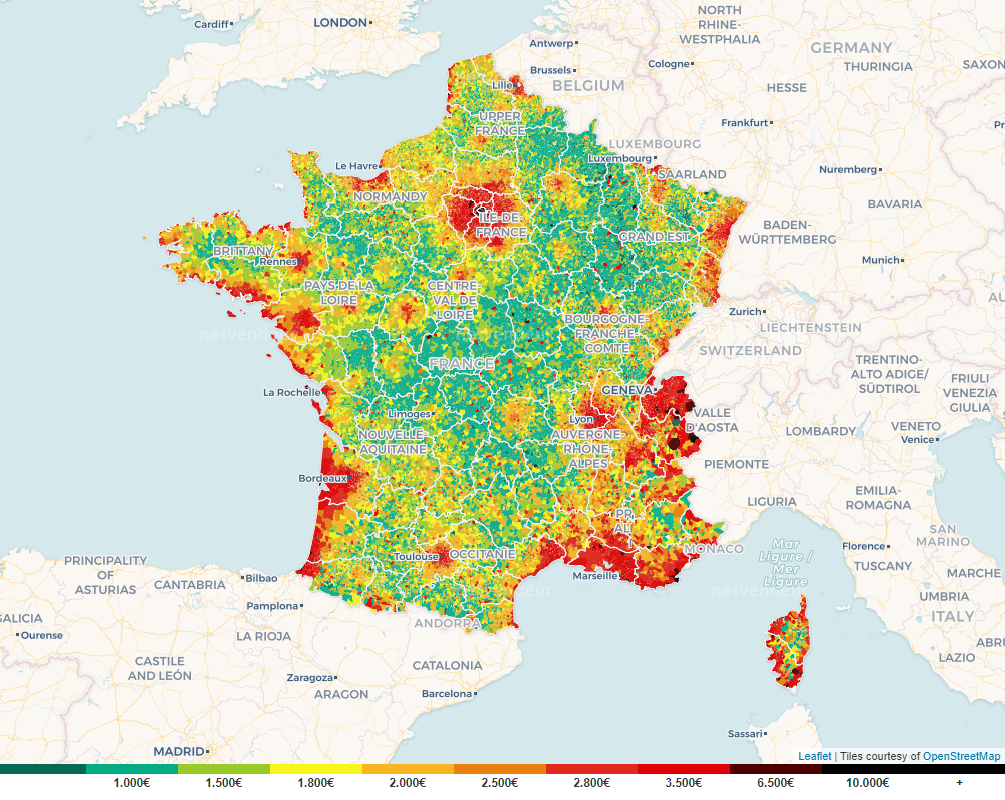

Prix Immobiliers France Carte Interactive Des Prix Des Maisons Par Region

May 19, 2025

Prix Immobiliers France Carte Interactive Des Prix Des Maisons Par Region

May 19, 2025 -

Mets Vs Blue Jays Queens Series Preview

May 19, 2025

Mets Vs Blue Jays Queens Series Preview

May 19, 2025 -

Kibris Sorunu Stefanos Stefanu Nun Oenerileri Ve Etkileri

May 19, 2025

Kibris Sorunu Stefanos Stefanu Nun Oenerileri Ve Etkileri

May 19, 2025