Understanding The Scholar Rock Stock Drop On Monday

Table of Contents

News and Announcements Impacting Scholar Rock Stock

Often, significant stock price movements are triggered by specific news events. Let's examine any announcements that might have influenced the Scholar Rock stock drop on Monday. While specific details would need to be drawn from real-time news sources on the day in question, here's how such news would be analyzed:

-

Specific news item 1 (Example): Suppose a clinical trial for a key drug candidate yielded disappointing results. This negative news would likely trigger a sell-off, as investor confidence in the drug's potential and Scholar Rock's future revenue streams would be shaken. The impact would be immediate and substantial, leading to a sharp decrease in the Scholar Rock stock price.

-

Specific news item 2 (Example): Alternatively, imagine a delay in regulatory approval for another drug. This would also negatively affect investor sentiment, resulting in a Scholar Rock stock drop as the anticipated timeline for market entry and potential profits is pushed back. The severity of the impact would depend on the specifics of the delay and the importance of the drug to Scholar Rock's overall portfolio.

-

Analyzing the Sentiment: The overall sentiment surrounding any news release is critical. Negative press, even if partially speculative, can quickly spread and significantly influence trading activity, accelerating a Scholar Rock stock drop. Conversely, positive news could mitigate the effects of broader market downturns.

Broader Market Trends and Their Influence

It's important to consider the broader market context when analyzing the Scholar Rock stock drop. Monday's decline might not have been solely attributable to company-specific news.

-

Market Indices: The performance of relevant market indices, such as the NASDAQ Biotechnology Index and the S&P 500, on Monday should be examined. A general downturn in the biotech sector or the broader market could have contributed to the Scholar Rock stock drop, regardless of company-specific news.

-

Macroeconomic Factors: Factors like interest rate hikes, inflation concerns, or geopolitical instability can significantly impact investor sentiment and risk appetite. A risk-off environment could lead to investors selling off even fundamentally strong stocks like Scholar Rock's, resulting in a temporary decline.

-

Sector-Specific Trends: Trends within the biotechnology industry itself, such as changes in regulatory landscapes or emerging competitive threats, could also play a role in influencing the Scholar Rock stock price.

Investor Sentiment and Trading Activity

Understanding investor sentiment and trading activity on Monday provides crucial insights into the Scholar Rock stock drop.

-

Price Fluctuations: A detailed analysis of the intraday price movements would reveal the magnitude and timing of the decline. This helps identify potential triggers and the speed at which the market reacted.

-

Trading Volume: A spike in trading volume alongside the price drop indicates increased selling pressure. Conversely, low volume might suggest a more orderly decline driven by a smaller group of investors.

-

Social Media and Analyst Reports: Monitoring social media sentiment and analyst reports provides further insight into investor reactions and their expectations regarding Scholar Rock's future performance.

Scholar Rock's Long-Term Prospects

While Monday's Scholar Rock stock drop is concerning, it's crucial to assess the company's long-term prospects. A single day's price movement doesn't define the company's overall health.

-

Pipeline and Financial Health: Examining Scholar Rock's drug pipeline, its financial stability (cash reserves, revenue streams), and its competitive landscape provides a more holistic view. A strong pipeline and robust financials can mitigate the impact of short-term negative news.

-

Future Catalysts: Identifying potential catalysts for future stock price recovery (e.g., positive clinical trial data, regulatory approvals, successful partnerships) is important for long-term investors.

Navigating the Scholar Rock Stock Drop and Looking Ahead

The Scholar Rock stock drop on Monday was likely a result of a combination of factors: company-specific news, broader market trends, and investor sentiment. Understanding the interplay of these elements is crucial for navigating future price fluctuations. To make informed investment decisions regarding Scholar Rock stock performance and investment outlook, continue monitoring the Scholar Rock stock price and stay informed about future developments. Keep up-to-date with news from reliable sources and conduct thorough research before making any investment decisions.

Featured Posts

-

Ubers New Subscription Model A Game Changer For Drivers

May 08, 2025

Ubers New Subscription Model A Game Changer For Drivers

May 08, 2025 -

Kyren Paris Late Homer Powers Angels To Rain Soaked Victory Over White Sox

May 08, 2025

Kyren Paris Late Homer Powers Angels To Rain Soaked Victory Over White Sox

May 08, 2025 -

Nantes Psg Yi 1 1 Lik Skorla Esitliyor Mac Raporu

May 08, 2025

Nantes Psg Yi 1 1 Lik Skorla Esitliyor Mac Raporu

May 08, 2025 -

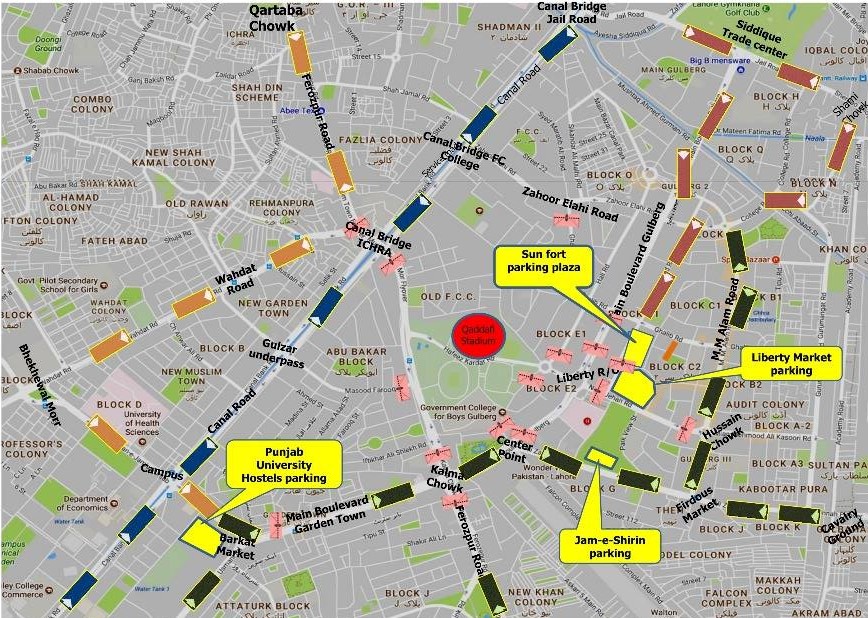

School Hours Altered Psl Matches Affect Lahore Schools

May 08, 2025

School Hours Altered Psl Matches Affect Lahore Schools

May 08, 2025 -

La Accion De Pulgar Que Llego Al Corazon De Los Fanaticos Del Flamengo

May 08, 2025

La Accion De Pulgar Que Llego Al Corazon De Los Fanaticos Del Flamengo

May 08, 2025