Understanding The Unfolding Bond Market Crisis

Table of Contents

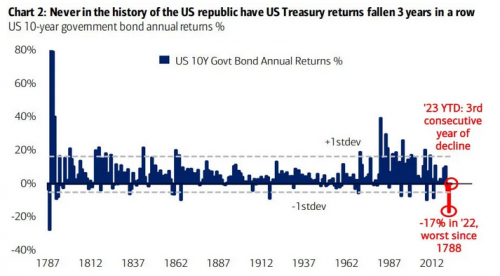

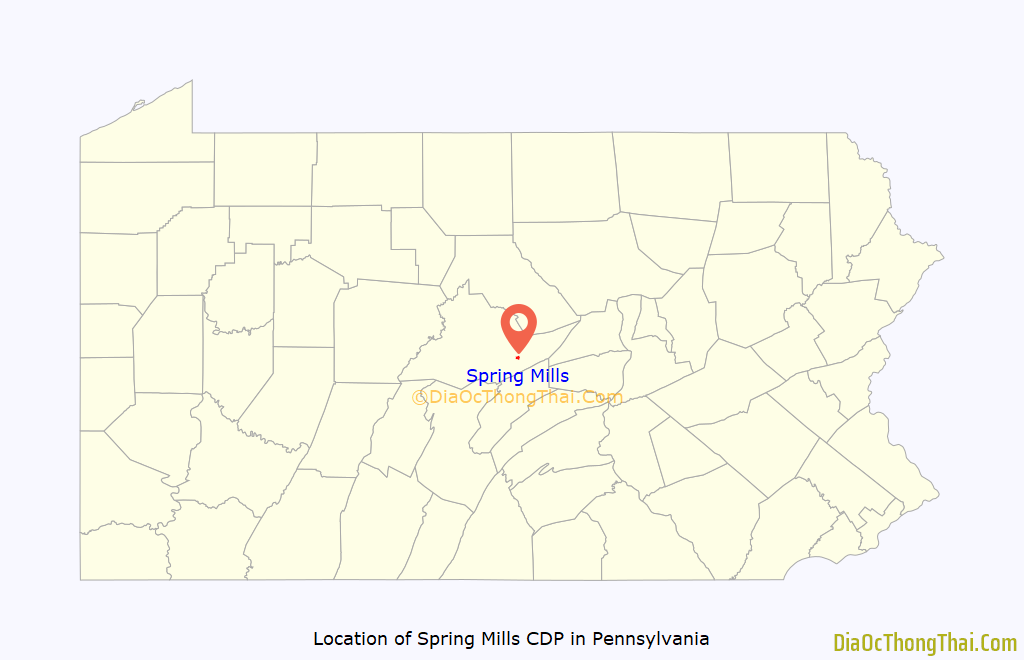

Rising Interest Rates and Their Impact on Bond Prices

Rising interest rates are a primary driver of the current bond market crisis. The relationship between interest rates and bond prices is inverse: as interest rates rise, bond prices fall. This is because newly issued bonds offer higher yields, making existing bonds with lower coupon payments less attractive. This inverse relationship, often referred to as duration risk, is particularly impactful for longer-term bonds. The impact of interest rate hikes is felt most acutely by those holding longer-maturity bonds, as their prices decline more significantly than those of shorter-term bonds.

- Increased interest rates lead to decreased bond prices. This is a fundamental principle of bond valuation. When interest rates increase, the opportunity cost of holding a lower-yielding bond increases.

- Longer-term bonds are more sensitive to interest rate changes (duration risk). The longer the maturity of a bond, the greater its price sensitivity to interest rate fluctuations.

- Central banks' actions play a crucial role in interest rate fluctuations. The Federal Reserve (in the US) and other central banks worldwide directly influence interest rates through monetary policy decisions. Their actions to combat inflation are a key driver of the current rising interest rate environment.

- Investors need to reassess their bond portfolios given the current environment. A portfolio heavily weighted towards long-term bonds is particularly vulnerable in a rising interest rate environment. Rebalancing and diversification are crucial strategies.

The Role of Inflation in the Bond Market Crisis

High inflation significantly erodes the purchasing power of bond returns. Inflation reduces the real yield of a bond – the return after adjusting for inflation. Investors are increasingly concerned about the real return they are receiving on their fixed income investments, especially with inflation remaining stubbornly high in many economies. This leads to a shift in investment strategies, with investors seeking inflation hedges to protect their capital.

- High inflation reduces the real return on bonds. If inflation is higher than the bond's yield, the investor experiences a net loss of purchasing power.

- Investors seek inflation hedges, such as TIPS (Treasury Inflation-Protected Securities) or other inflation-linked assets. TIPS, for instance, adjust their principal value based on inflation, offering a degree of protection against inflation erosion.

- Inflation expectations influence future interest rate movements and bond yields. If inflation is expected to remain high, central banks are likely to continue raising interest rates, further impacting bond prices.

- Understanding inflation's impact is critical for effective investment decisions. Investors need to factor inflation into their investment analysis to accurately assess the real return on their bond investments.

Government Debt and Sovereign Bond Yields

The level of government debt plays a significant role in the bond market crisis. High government debt levels can lead to increased sovereign bond yields, as investors demand a higher risk premium to compensate for the perceived increased risk of default. Credit rating agencies constantly assess the creditworthiness of governments, and downgrades can significantly increase borrowing costs and put further upward pressure on sovereign bond yields.

- High government debt can lead to increased sovereign bond yields. Investors perceive higher risk with increased debt, demanding higher yields to offset that risk.

- Credit rating downgrades increase borrowing costs for governments. A lower credit rating signals increased risk to lenders, resulting in higher interest rates for the government.

- Investors assess the risk of default when investing in sovereign bonds. The risk of a government defaulting on its debt is a crucial factor influencing sovereign bond yields.

- Fiscal policy plays a significant role in influencing government debt and bond yields. Government spending and tax policies directly impact debt levels and investor confidence.

Navigating the Bond Market Crisis: Strategies for Investors

The current bond market crisis necessitates a reassessment of investment strategies. Investors need to adopt a more cautious approach, focusing on risk management and diversification.

- Diversify your portfolio across different asset classes. Reducing reliance on bonds and incorporating other asset classes, such as equities or real estate, can help mitigate risk.

- Consider shorter-term bonds to reduce duration risk. Shorter-term bonds are less sensitive to interest rate fluctuations.

- Implement active or passive management strategies depending on your risk tolerance. Active management involves actively trading bonds, while passive management involves holding a diversified portfolio of bonds.

- Regularly review and adjust your investment portfolio. Market conditions are constantly evolving, requiring regular portfolio adjustments to align with changing circumstances.

Conclusion

The unfolding bond market crisis presents significant challenges for investors. Rising interest rates, high inflation, and concerns about government debt are key drivers of this crisis. Understanding these interconnected factors is crucial for navigating this challenging environment. The inverse relationship between interest rates and bond prices, the erosion of purchasing power due to inflation, and the impact of government debt on sovereign bond yields are all critical considerations.

Call to Action: Stay informed about developments in the bond market and adapt your investment strategy accordingly. Thoroughly research and understand the risks associated with investing in bonds during this period of market uncertainty. Learn more about managing risk in the current bond market crisis by exploring resources and expert opinions. Don't let the current bond market crisis catch you off guard; take proactive steps to protect your investments and build a resilient portfolio capable of weathering this storm. Understanding the intricacies of the bond market crisis is the first step towards mitigating risk and making sound investment choices.

Featured Posts

-

Prakiraan Cuaca Jawa Tengah 24 April 2024 Antisipasi Hujan

May 29, 2025

Prakiraan Cuaca Jawa Tengah 24 April 2024 Antisipasi Hujan

May 29, 2025 -

Paramedics Dominate At Police And Emergency Services Games

May 29, 2025

Paramedics Dominate At Police And Emergency Services Games

May 29, 2025 -

Spring Valleys 88 36 Rout Of Spring Mills Game Recap And Highlights

May 29, 2025

Spring Valleys 88 36 Rout Of Spring Mills Game Recap And Highlights

May 29, 2025 -

The X Files To Breaking Bad How One Role Shaped A Television Icon

May 29, 2025

The X Files To Breaking Bad How One Role Shaped A Television Icon

May 29, 2025 -

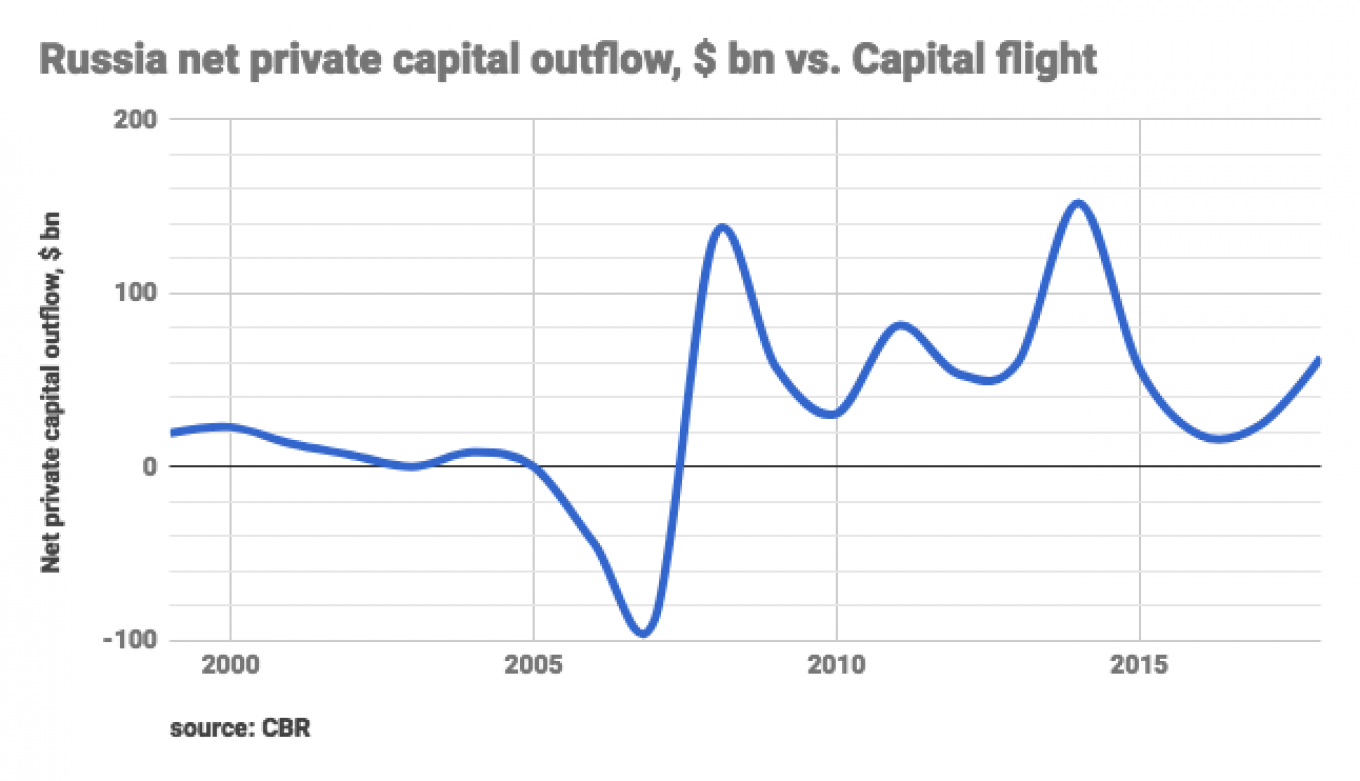

The Transformation Of Russias Economy Under Putins War Aims

May 29, 2025

The Transformation Of Russias Economy Under Putins War Aims

May 29, 2025

Latest Posts

-

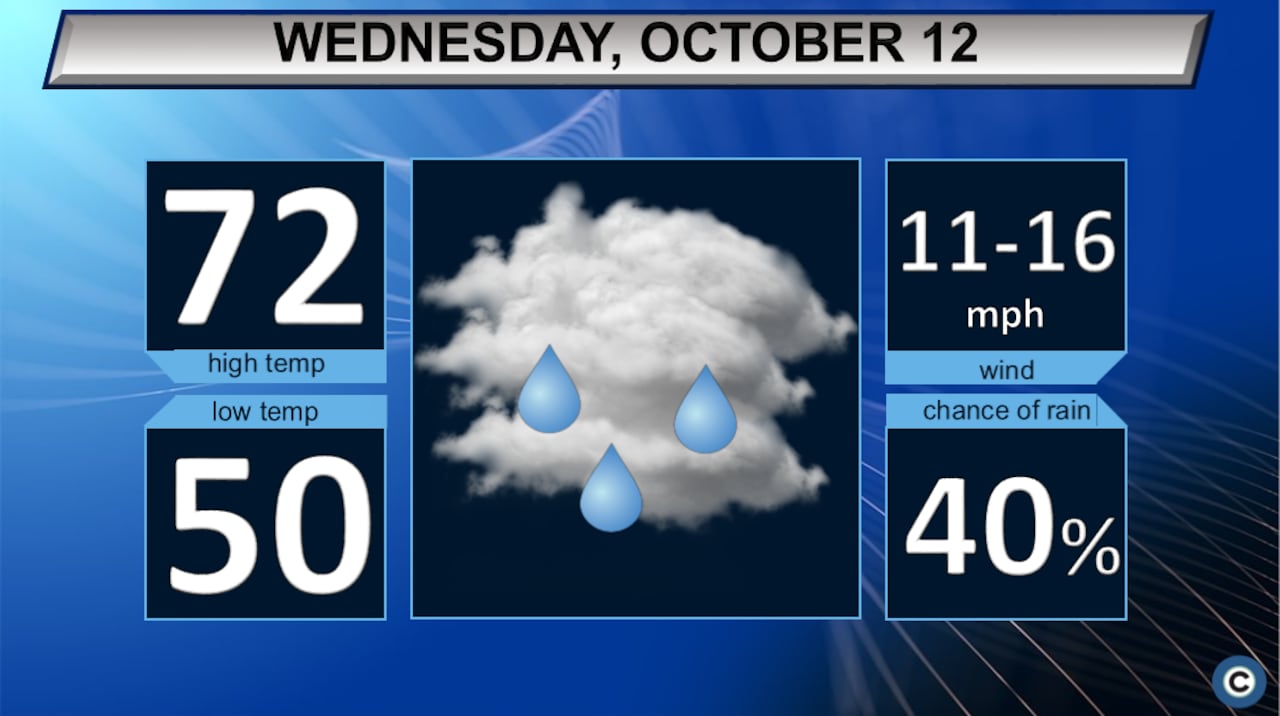

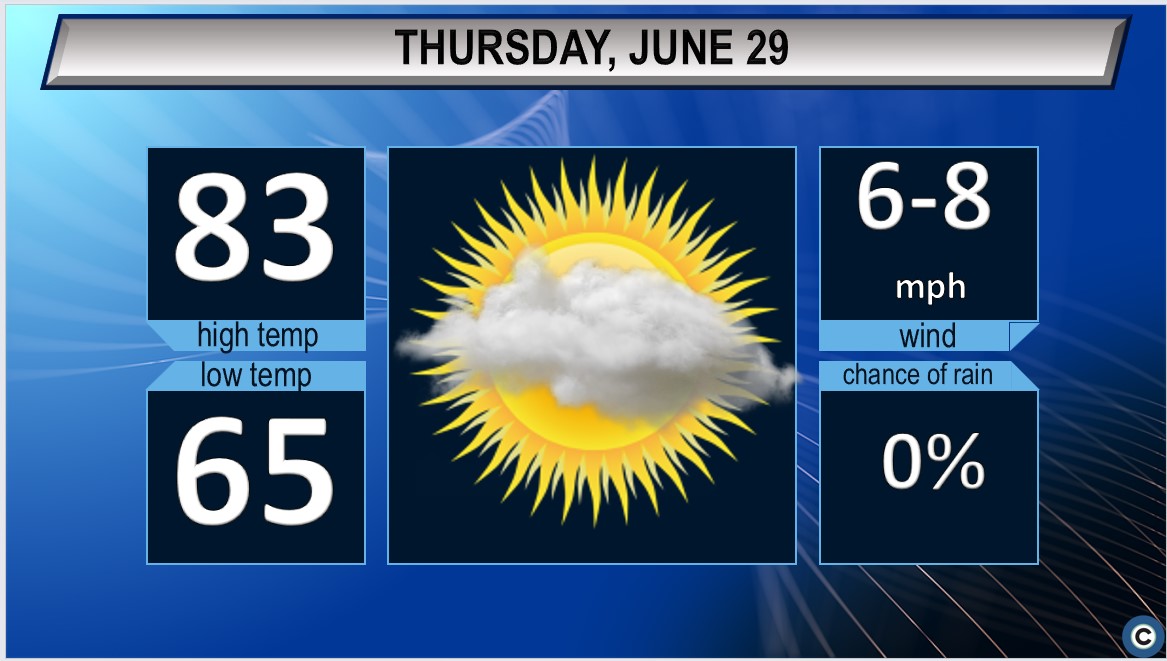

Northeast Ohio Weather Update Expect Rain Thursday

May 31, 2025

Northeast Ohio Weather Update Expect Rain Thursday

May 31, 2025 -

Thursday Rain Forecast For Northeast Ohio

May 31, 2025

Thursday Rain Forecast For Northeast Ohio

May 31, 2025 -

Northeast Ohio Thursday Rain Returns

May 31, 2025

Northeast Ohio Thursday Rain Returns

May 31, 2025 -

Northeast Ohio Weather Thursday Rain Forecast

May 31, 2025

Northeast Ohio Weather Thursday Rain Forecast

May 31, 2025 -

Increased Fire Risk Prompts Special Weather Statement For Cleveland Akron

May 31, 2025

Increased Fire Risk Prompts Special Weather Statement For Cleveland Akron

May 31, 2025