US-China Trade Soars Before Trade Truce Deadline

Table of Contents

Increased Exports from China to the US

The most striking feature of this recent trade surge is the significant increase in Chinese exports to the United States. This jump in US imports from China suggests a number of factors at play, all contributing to a potentially volatile situation.

Specific Product Categories Driving the Surge

Several key product categories have experienced particularly significant growth in exports from China to the US. This includes:

- Electronics: Smartphones, computers, and other electronic devices have seen a considerable increase in imports.

- Consumer Goods: A wide range of consumer goods, from clothing and toys to household appliances, have contributed to the surge.

- Agricultural Products: While subject to ongoing trade disputes, certain categories of agricultural products have seen increased imports from China.

The sheer volume of these goods entering the US market indicates a significant push from Chinese producers and potentially anticipatory stockpiling by US importers. Precise figures are still being analyzed, but preliminary data suggests an increase in the US trade deficit with China. This surge in Chinese exports and US imports highlights the complexity of the trade war and its impact on global supply chains.

Reasons Behind Increased Chinese Exports

Several factors have likely contributed to this surge in Chinese exports:

- Preemptive Stockpiling: US companies, anticipating the potential for increased tariffs or trade restrictions, may be stockpiling goods before any new measures are implemented. This stockpiling activity artificially inflates short-term trade figures.

- Increased Chinese Production: China's manufacturing sector may be experiencing a period of increased output, leading to more goods available for export. This could be linked to domestic economic stimulus programs or global demand. The efficiency of the Chinese supply chain is a major factor.

- Economic Stimulus Measures: Government initiatives aimed at boosting the Chinese economy could be indirectly driving increased production and exports.

Understanding these diverse economic stimulus measures and their influence on export growth is crucial to interpreting the current trade surge.

US Exports to China: A Less Dramatic Rise (or Decline)

While Chinese exports to the US have soared, the growth in US exports to China has been significantly less dramatic, or potentially even negative in some sectors. This disparity underscores the ongoing imbalances in the trade balance between the two nations.

Comparison of US Export Growth to Chinese Export Growth

A direct comparison reveals a considerable difference between the growth trajectory of US exports to China and Chinese exports to the US.

- Agricultural Exports: While some agricultural products are seeing increased exports, overall growth remains hampered by existing tariffs and trade restrictions.

- Tech Exports: The export of high-tech goods remains a sensitive area, with significant ongoing trade restrictions limiting US market access in China.

This contrast in export growth highlights the need for a more balanced and reciprocal trade relationship. The trade balance remains a major point of contention.

Impact of Existing Tariffs and Trade Restrictions

Existing tariffs and trade restrictions continue to heavily influence US exports to China.

- Tariff Impact: Specific sectors remain significantly impacted by tariffs imposed during previous trade negotiations, reducing the competitiveness of US goods in the Chinese market.

- Trade Restrictions: Non-tariff barriers, such as regulations and licensing requirements, also impede US exports to China, making market access difficult. These trade restrictions are a key factor in limiting growth.

The persistent impact of these trade negotiations and their effect on market access is critical to understanding the current dynamics.

Implications for the Upcoming Trade Truce

The pre-deadline surge in trade raises questions about the potential for a longer-term agreement and the overall outlook for US-China trade relations.

The Potential for a Longer-Term Agreement

The surge in trade could be interpreted as a positive sign, indicating a potential for a more lasting trade agreement. This trade agreement, potentially building on the phase one deal, could benefit both economies. It's important to remember that economic stability is a shared goal.

Uncertainty and Risks Despite the Trade Surge

Despite the positive trade figures, significant uncertainties and risks remain:

- Trade Uncertainty: The future of US-China trade relations remains highly uncertain, with the possibility of further disputes or policy changes.

- Geopolitical Risks: Broader geopolitical tensions between the US and China could negatively impact trade relations.

- Economic Volatility: Global economic conditions could also significantly influence the trade relationship between these two major players.

These lingering concerns highlight the continued trade uncertainty and potential geopolitical risks threatening the future trade relations between the US and China.

Conclusion

The recent surge in US-China trade before the anticipated trade truce deadline presents a complex picture. While the increase in Chinese exports to the US is significant, the less dramatic growth (or potential decline) in US exports to China highlights an ongoing imbalance. The underlying reasons for this surge – including preemptive stockpiling and increased Chinese production – need careful consideration. While the potential for a more enduring trade agreement exists, significant uncertainties and risks remain. The US-China trade relationship continues to be a source of economic volatility, and the implications for the global economy are far-reaching. The potential for a meaningful trade deal depends greatly on addressing these structural issues.

Call to Action: Stay updated on the evolving US-China trade relationship by subscribing to our newsletter for the latest news and analysis on the US-China trade truce and its impact on the global economy.

Featured Posts

-

Liverpool Fc Transfer News Jeremie Frimpong Deal Agreed Contact Pending

May 22, 2025

Liverpool Fc Transfer News Jeremie Frimpong Deal Agreed Contact Pending

May 22, 2025 -

The Evolution Of The Goldbergs From Pilot To Present Day

May 22, 2025

The Evolution Of The Goldbergs From Pilot To Present Day

May 22, 2025 -

Huizenprijzen Nederland Klopt De Abn Amro Analyse Volgens Geen Stijl

May 22, 2025

Huizenprijzen Nederland Klopt De Abn Amro Analyse Volgens Geen Stijl

May 22, 2025 -

Blake Livelys Family Supports Her Amidst Reported Feud With Taylor Swift And Gigi Hadid

May 22, 2025

Blake Livelys Family Supports Her Amidst Reported Feud With Taylor Swift And Gigi Hadid

May 22, 2025 -

Unbelievable The Truth Behind A 21 Year Old Peppa Pig Mystery

May 22, 2025

Unbelievable The Truth Behind A 21 Year Old Peppa Pig Mystery

May 22, 2025

Latest Posts

-

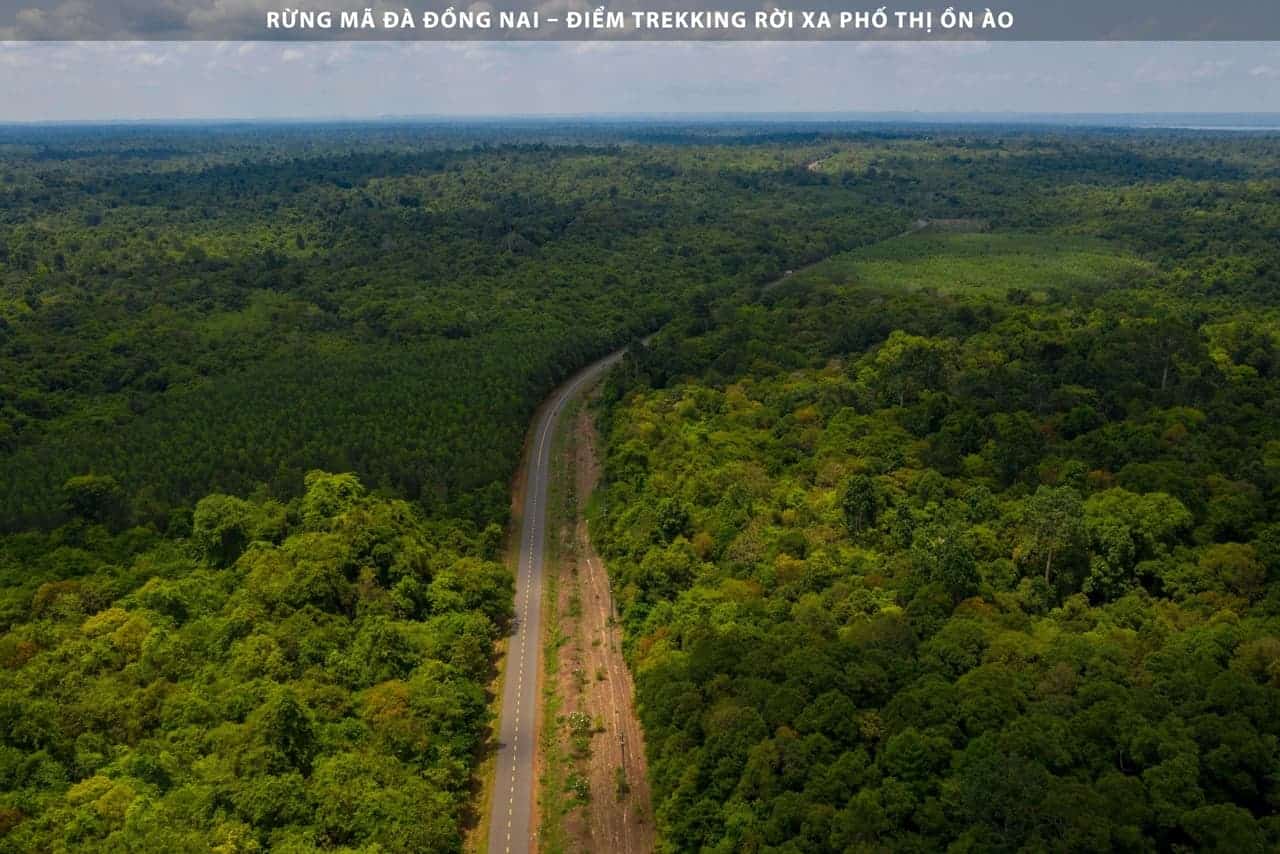

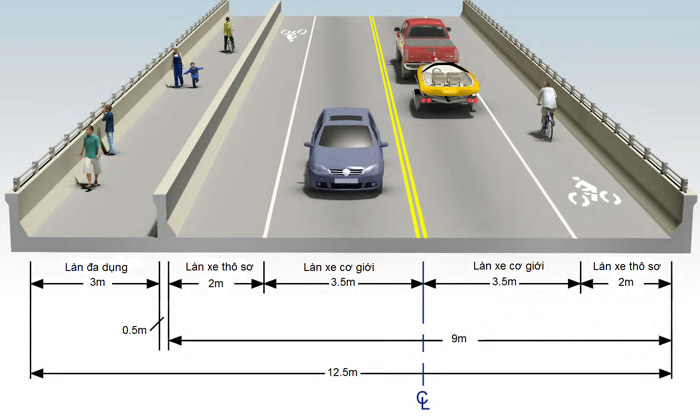

Dong Nai De Xuat Xay Dung Tuyen Duong 4 Lan Xe Qua Rung Ma Da Den Binh Phuoc

May 22, 2025

Dong Nai De Xuat Xay Dung Tuyen Duong 4 Lan Xe Qua Rung Ma Da Den Binh Phuoc

May 22, 2025 -

Duong Cao Toc Dong Nai Vung Tau San Sang Thong Xe 2 9

May 22, 2025

Duong Cao Toc Dong Nai Vung Tau San Sang Thong Xe 2 9

May 22, 2025 -

Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Ket Noi Binh Phuoc

May 22, 2025

Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Ket Noi Binh Phuoc

May 22, 2025 -

Ntt Multi Interconnect At Be X

May 22, 2025

Ntt Multi Interconnect At Be X

May 22, 2025 -

Dong Nai Kien Nghi Xay Duong 4 Lan Xe Xuyen Rung Ma Da Noi Binh Phuoc Thuc Day Phat Trien Kinh Te

May 22, 2025

Dong Nai Kien Nghi Xay Duong 4 Lan Xe Xuyen Rung Ma Da Noi Binh Phuoc Thuc Day Phat Trien Kinh Te

May 22, 2025