US-China Trade Talks: Implications For The Copper Commodity Market

Table of Contents

China's Role as a Dominant Copper Consumer

China's voracious appetite for copper is a defining factor in the global copper market. Its massive consumption stems from its rapid industrial growth and ambitious infrastructure development projects. China is a significant consumer of refined copper, primarily driven by its booming construction, manufacturing, and electronics sectors. The Chinese economy's reliance on copper is undeniable.

- Significant consumer of refined copper: China consumes a substantial portion of the world's refined copper, using it extensively in buildings, power grids, and electronics manufacturing.

- Impact of stimulus packages: Government stimulus packages aimed at boosting economic growth often lead to increased infrastructure projects, thus significantly increasing copper demand.

- Renewable energy's influence: The growth of renewable energy sectors, particularly solar and wind power, further fuels China's copper demand, as these technologies rely heavily on copper wiring and components.

- Historical correlation: Historical data clearly demonstrates a strong correlation between Chinese economic growth and copper prices. Periods of robust economic expansion in China are typically accompanied by rising copper prices, and vice versa.

Impact of Trade Tensions on Copper Prices

Trade tensions and tariffs between the US and China significantly impact copper price volatility and disrupt supply chains. The uncertainty created by these trade disputes makes it difficult for businesses to plan effectively, impacting investment and production.

- Past trade tensions and copper futures: Examining past trade disputes reveals a clear pattern: heightened tensions often lead to increased volatility in copper futures prices.

- Tariffs and import costs: Tariffs imposed on copper imports into the US or China increase the cost of the commodity, affecting both producers and consumers.

- Alternative sourcing: In response to trade disruptions, both countries may seek alternative sourcing options, impacting existing supply chains and potentially leading to price fluctuations.

- Impact on investment decisions: The uncertainty surrounding trade relations discourages investment in copper mining and processing projects, as businesses hesitate to commit capital in a volatile environment.

How Trade Agreements Influence Copper Market Stability

Conversely, trade agreements between the US and China can foster market stability and encourage investment in the copper sector. Predictable trade relations lead to more stable copper prices, encouraging long-term investment strategies.

- Favorable trade agreements and predictable prices: Trade agreements that promote free and fair trade contribute to more predictable copper prices, reducing risk for businesses.

- Reduced risk and increased investment: A stable trade environment encourages increased investment in copper mining and processing facilities, leading to improved efficiency and production.

- New market access: Trade agreements can open up new market access for copper producers, allowing them to expand their reach and increase sales.

- Sustainability initiatives: Trade deals can often incorporate provisions promoting sustainable practices within the copper industry, ensuring responsible sourcing and environmental protection.

The Future Outlook for Copper in the Context of US-China Relations

Predicting future copper prices requires considering various economic forecasts and potential trade scenarios between the US and China. Geopolitical risks also play a significant role.

- Economic forecasts and copper demand: Different economic forecasts suggest varying levels of copper demand in the future, depending on the pace of global economic growth and infrastructure investment.

- Further trade negotiations: The outcome of future trade negotiations will significantly influence the copper market outlook, potentially leading to either greater stability or increased volatility.

- Geopolitical risks and supply: Geopolitical instability in copper-producing regions can disrupt supply, leading to price increases.

- Long-term outlook and green energy: The long-term outlook for copper is positive, driven by the growing demand for copper in green energy technologies and the increasing electrification of various sectors.

Conclusion

US-China trade talks significantly impact the copper commodity market, creating price volatility, supply chain disruptions, and influencing investment decisions. Understanding China's dominant role as a copper consumer and the effects of trade tensions and agreements is crucial for navigating this dynamic market. To effectively participate in the copper market, stay informed about the latest developments in US-China trade relations. Monitor copper futures prices closely and consult with experts to mitigate risks and identify investment opportunities. Keep a close eye on US-China trade talks and their impact on the copper commodity market to make informed decisions.

Featured Posts

-

Analyzing The Effects Of Trumps Tariffs On Us Manufacturers

May 06, 2025

Analyzing The Effects Of Trumps Tariffs On Us Manufacturers

May 06, 2025 -

Trumps Unclear Stance On The Constitution A Deep Dive

May 06, 2025

Trumps Unclear Stance On The Constitution A Deep Dive

May 06, 2025 -

Halle Bailey Responds To Ddgs Dont Take My Son Diss Track

May 06, 2025

Halle Bailey Responds To Ddgs Dont Take My Son Diss Track

May 06, 2025 -

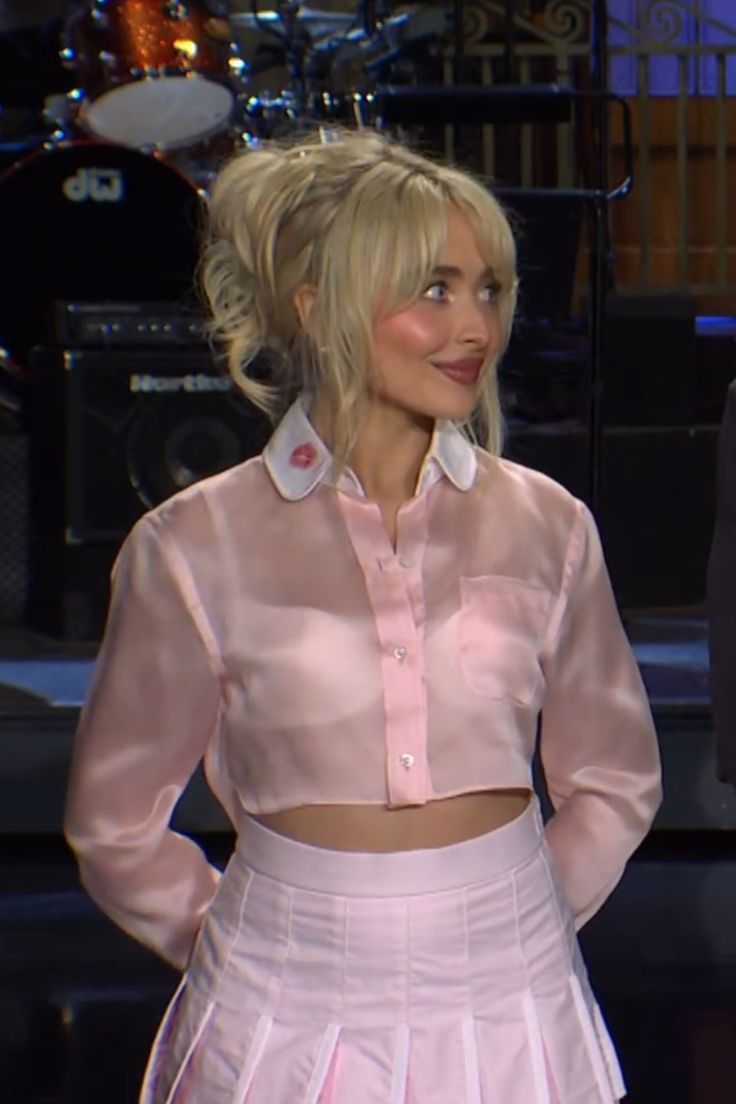

Snl Sabrina Carpenter Teams Up With Fun Size Castmate For Surprise Performance

May 06, 2025

Snl Sabrina Carpenter Teams Up With Fun Size Castmate For Surprise Performance

May 06, 2025 -

Dylan Beard Life As A Walmart Deli Worker And Elite Runner

May 06, 2025

Dylan Beard Life As A Walmart Deli Worker And Elite Runner

May 06, 2025

Latest Posts

-

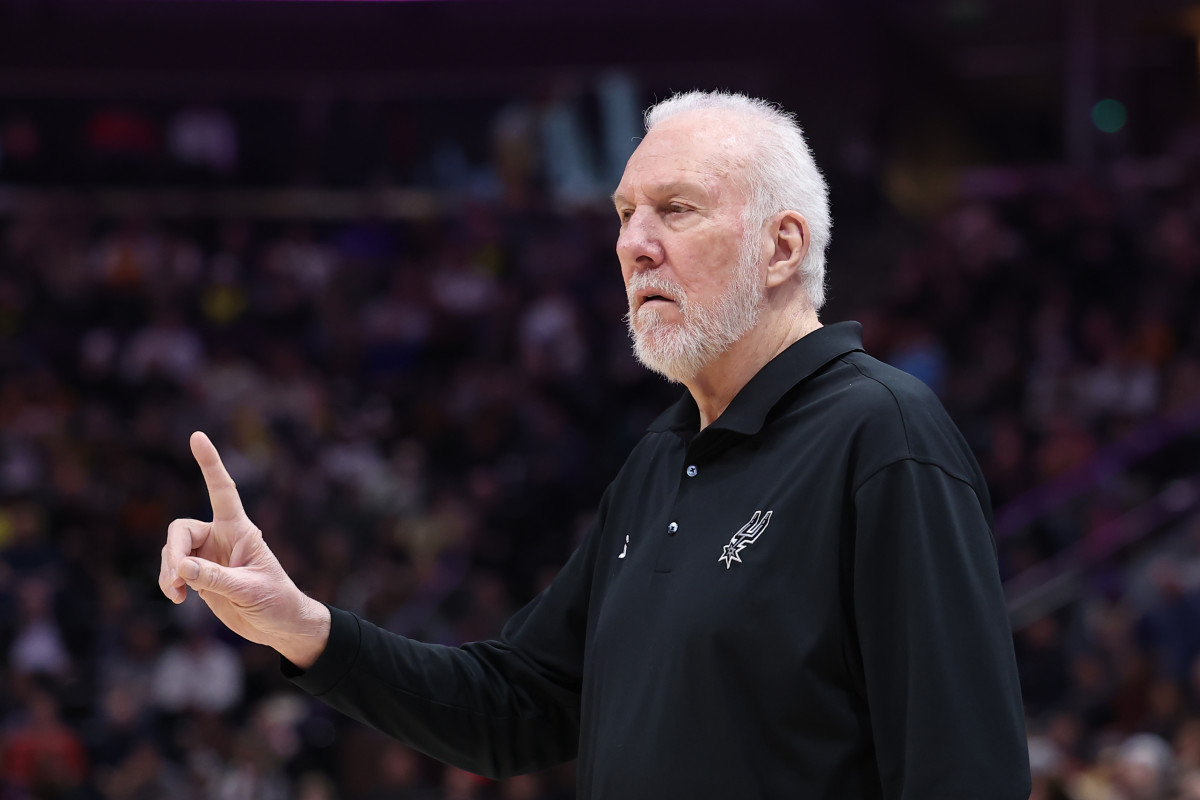

The End Of An Era Gregg Popovichs Retirement From The San Antonio Spurs

May 06, 2025

The End Of An Era Gregg Popovichs Retirement From The San Antonio Spurs

May 06, 2025 -

Nba Legend Gregg Popovichs Retirement Reflecting On An Unparalleled Coaching Career

May 06, 2025

Nba Legend Gregg Popovichs Retirement Reflecting On An Unparalleled Coaching Career

May 06, 2025 -

San Antonio Spurs Coach Gregg Popovich Announces Retirement After 29 Years

May 06, 2025

San Antonio Spurs Coach Gregg Popovich Announces Retirement After 29 Years

May 06, 2025 -

Gregg Popovich A Legacy Forged Over 29 Seasons And Record Breaking Wins

May 06, 2025

Gregg Popovich A Legacy Forged Over 29 Seasons And Record Breaking Wins

May 06, 2025 -

San Antonio Spurs Popovichs Absence And The Search For A New Coach

May 06, 2025

San Antonio Spurs Popovichs Absence And The Search For A New Coach

May 06, 2025