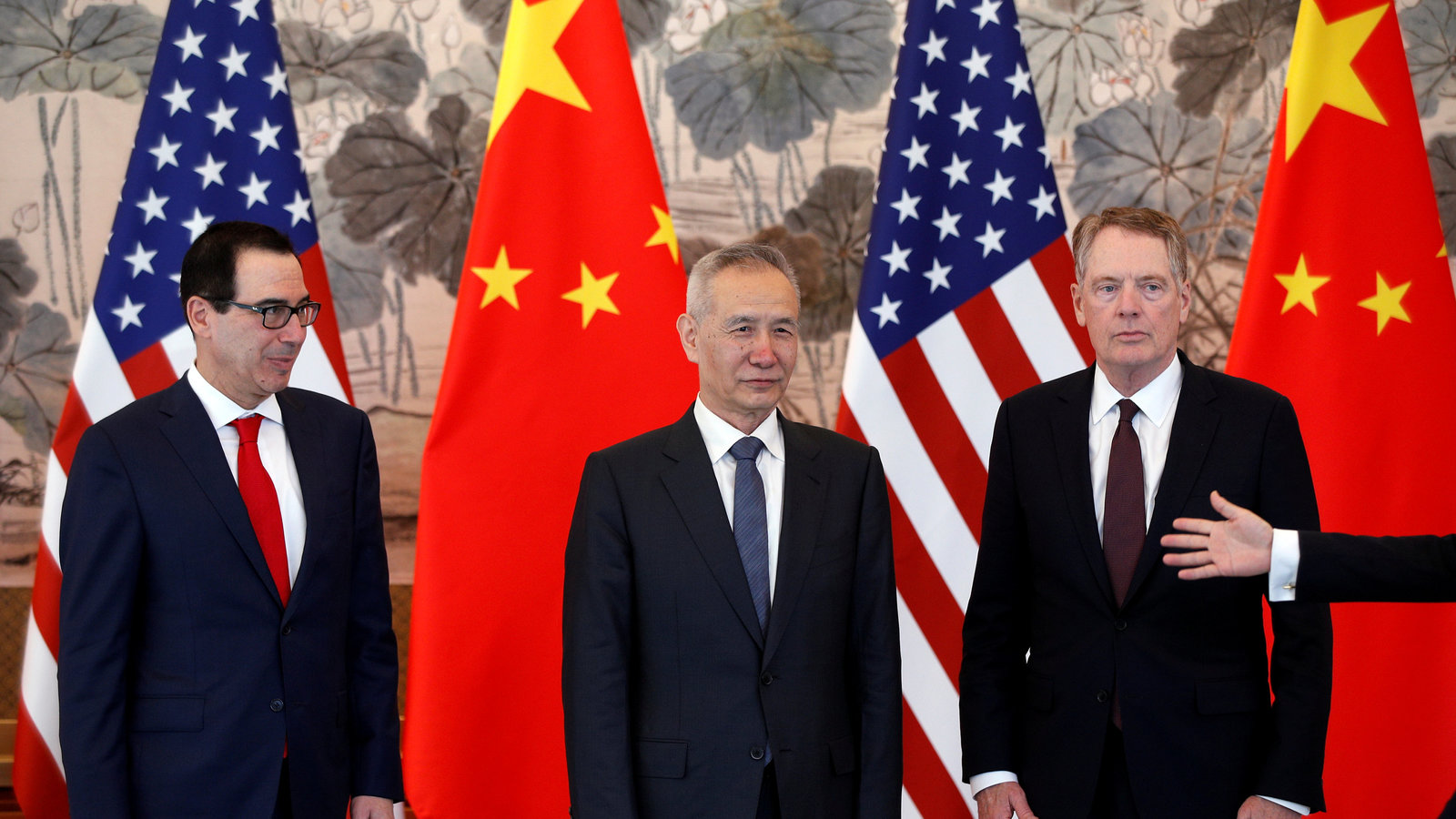

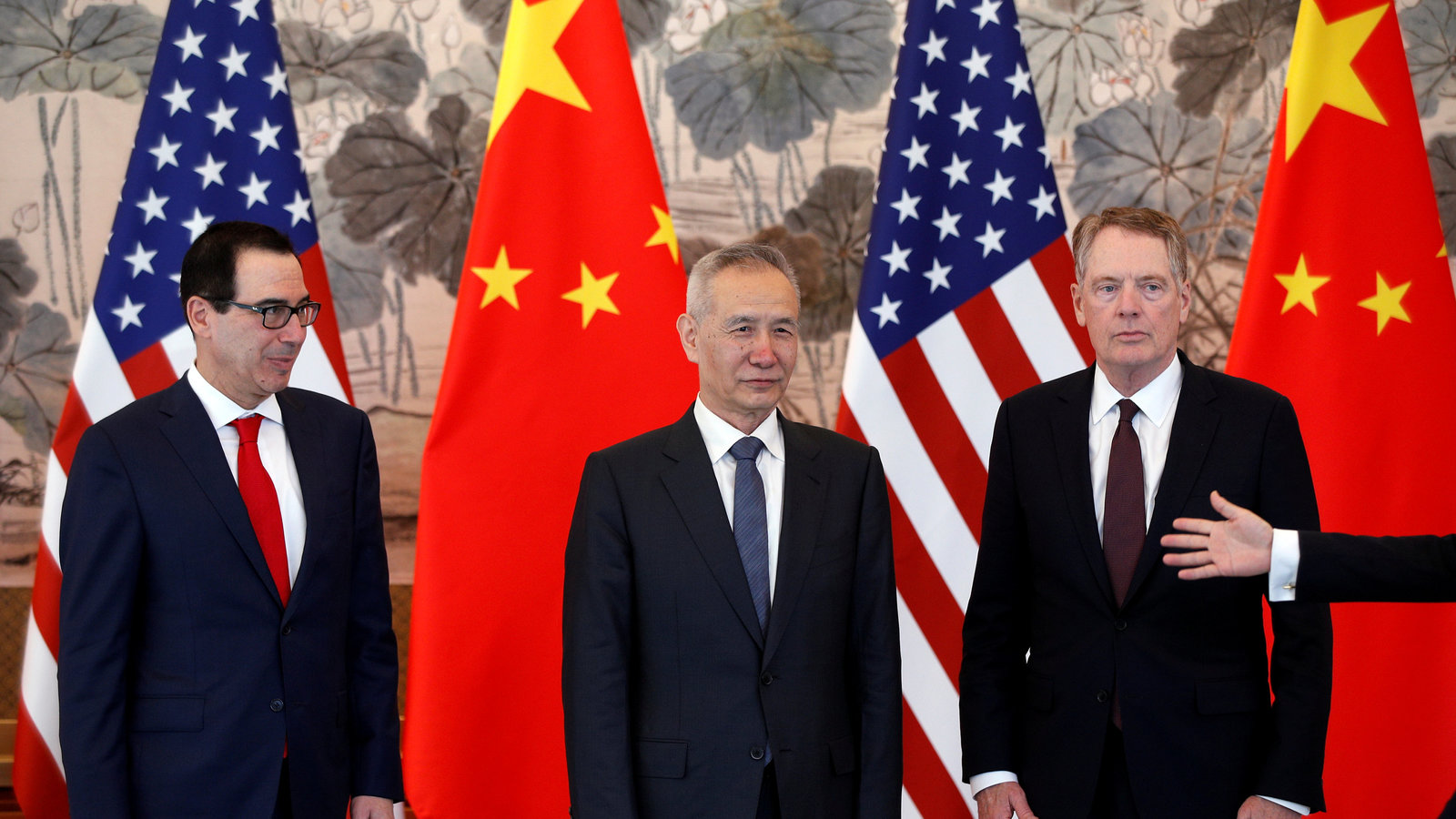

US-China Trade Talks: Market Sentiment As The Decisive Factor

Table of Contents

The Impact of Market Volatility on Negotiation Outcomes

Fluctuating stock markets, currency exchange rates, and investor confidence directly affect the negotiating power and willingness to compromise of both the United States and China in US-China trade talks. Market volatility introduces significant uncertainty, impacting decision-making on both sides of the Pacific.

-

Impact of market downturns on domestic political pressure: A weakening economy, reflected in falling stock markets, can increase domestic political pressure on negotiators to secure favorable trade deals, even if it means compromising on key principles. This pressure can lead to concessions that might not be made in a more stable economic environment. For example, a sharp decline in the Shanghai Composite could influence China's negotiating stance.

-

Increased risk aversion and its effect on investment decisions related to trade agreements: Market uncertainty stemming from unpredictable trade negotiations increases risk aversion among investors. This can lead to decreased foreign direct investment (FDI) and hinder economic growth in both countries, creating a powerful incentive for negotiators to reach a stable agreement. The uncertainty around tariffs, for example, directly impacts investment strategies.

-

The role of market forecasts in influencing policy decisions: Governments and negotiators closely monitor market forecasts and economic indicators to gauge the potential economic consequences of different trade outcomes. These forecasts influence their strategic decision-making, shaping the concessions they are willing to make or the demands they are prepared to push.

-

Examples of how past market reactions have shaped trade negotiation outcomes: The initial imposition of tariffs in 2018 led to immediate market turmoil, highlighting the interconnectedness of trade policy and market sentiment. This initial reaction likely influenced subsequent negotiation rounds, prompting both sides to seek a resolution to mitigate further economic damage.

Analyzing Market Sentiment Indicators

Gauging market sentiment regarding US-China trade requires careful monitoring of various indicators. These indicators provide valuable insights into investor confidence and expectations surrounding the negotiations.

-

Stock market indices (e.g., S&P 500, Shanghai Composite): Sharp declines or significant gains in these major indices reflect overall investor confidence and can signal positive or negative reactions to developments in US-China trade talks. A drop in the S&P 500, for example, could indicate negative sentiment towards a particular trade outcome.

-

Commodity prices (e.g., soybeans, oil): Commodity prices, particularly those heavily traded between the US and China, are sensitive to trade tensions. Price fluctuations can serve as a barometer of market sentiment and the perceived impact of trade policies on specific sectors.

-

Currency exchange rates (e.g., USD/CNY): The exchange rate between the US dollar and the Chinese yuan is a critical indicator, reflecting market expectations about the relative economic strength and stability of both countries. Significant fluctuations can signal growing uncertainty or shifts in investor confidence.

-

Investor confidence surveys and indices: Surveys and indices measuring investor confidence provide valuable qualitative insights into market sentiment. These surveys often capture the nuanced views of investors, offering a broader understanding than simply looking at quantitative data.

-

News sentiment analysis using natural language processing (NLP): Advanced techniques like NLP can analyze vast amounts of news articles and social media posts to gauge public and expert opinion, providing a real-time assessment of prevailing market sentiment.

The Role of Media and Public Opinion in Shaping Market Sentiment

Media coverage and public perception significantly influence market reactions to US-China trade developments. The narrative spun by media outlets in both countries shapes investor behavior and expectations.

-

The impact of positive and negative news headlines on investor behavior: Positive news about progress in the talks can boost investor confidence, while negative headlines can trigger sell-offs and increased volatility. The framing of news stories is therefore crucial.

-

The influence of social media and public discourse: Social media platforms amplify public opinion, shaping market sentiment quickly and sometimes irrationally. Viral news and opinion pieces can impact investor behavior independently of traditional media outlets.

-

The role of government communication strategies in managing market expectations: Both US and Chinese governments actively manage public expectations through carefully crafted statements and releases. These communications aim to influence market sentiment and shape the narrative surrounding the negotiations.

-

Examples of how media narratives have shaped market sentiment: Instances of overly optimistic or pessimistic reporting in the past have directly contributed to market volatility, showcasing the significant influence of media narratives on investor behaviour.

Predicting Future Trade Relations Based on Market Sentiment

Forecasting the outcome of US-China trade talks requires incorporating market sentiment analysis into predictive models. However, it's crucial to remember that market sentiment is just one piece of the puzzle.

-

Using econometric models to predict market reactions to various trade scenarios: Econometric models can simulate different trade scenarios and predict their potential impact on various economic indicators, providing insights into how markets might react to different outcomes.

-

Scenario planning based on different levels of market confidence: This approach involves developing various scenarios based on different levels of market confidence—high, medium, and low—to assess potential outcomes under varying degrees of uncertainty.

-

Identifying key turning points in market sentiment that signal shifts in negotiation dynamics: Monitoring changes in sentiment can help identify pivotal moments where market expectations shift dramatically, indicating potential turning points in the negotiations.

-

The limitations of relying solely on market sentiment for prediction: While market sentiment offers valuable insights, it's essential to consider other factors such as political dynamics, domestic policy considerations, and geopolitical influences, as these factors cannot be completely captured by market data alone.

Conclusion

Market sentiment is not just a bystander in US-China trade talks; it’s a powerful force that significantly influences the negotiation process and its ultimate outcome. By carefully monitoring market indicators, understanding the influence of media and public opinion, and employing robust forecasting methods, we can gain valuable insights into the potential trajectory of these crucial trade relations. Staying informed about the shifts in market sentiment regarding US-China trade talks is essential for businesses, investors, and policymakers alike. Continue to monitor developments and analyze US-China trade talks to stay ahead of the curve.

Featured Posts

-

Payton Pritchards Case For Sixth Man Of The Year

May 12, 2025

Payton Pritchards Case For Sixth Man Of The Year

May 12, 2025 -

Doom The Dark Ages Global Release Times Confirmed

May 12, 2025

Doom The Dark Ages Global Release Times Confirmed

May 12, 2025 -

Zahabi Vs Aldo A L Ufc 315 Montreal Predictions Et Analyse

May 12, 2025

Zahabi Vs Aldo A L Ufc 315 Montreal Predictions Et Analyse

May 12, 2025 -

Mission Impossible Fallout Tom Cruise On Henry Cavills Mid Scene Beard

May 12, 2025

Mission Impossible Fallout Tom Cruise On Henry Cavills Mid Scene Beard

May 12, 2025 -

Lily Collins In Calvin Klein A Look At Photo 5133598

May 12, 2025

Lily Collins In Calvin Klein A Look At Photo 5133598

May 12, 2025