US-China Trade War: Ackman's Time-Based Analysis

Table of Contents

The Initial Phase: Escalation and Market Reactions (2018-2019)

The initial salvo in the US-China trade war involved the imposition of tariffs on billions of dollars worth of goods by both nations. This period, spanning roughly from 2018 to 2019, was characterized by escalating tensions and significant market volatility. While we don't have direct quotes from Bill Ackman detailing his precise strategies during this period, we can infer likely responses based on his known investment style, which often involves both long and short positions, and a focus on identifying market inefficiencies.

- Stock market volatility: The imposition of tariffs led to considerable uncertainty, causing significant swings in stock prices across various sectors.

- Impact on specific sectors: Technology companies, heavily reliant on global supply chains, and agricultural producers were particularly vulnerable. The uncertainty created numerous opportunities and risks.

- Potential investment strategies: Given Ackman's history, strategies during this phase likely included hedging against market downturns, potentially through short-selling specific sectors anticipated to be negatively impacted by the trade war. Identifying undervalued companies negatively affected by the trade war's early stages may also have been a key focus.

- Public statements/actions: While specific details of Ackman's actions during this phase may not be publicly available, monitoring news from that period for any statements or actions related to the trade war could give further insights.

The Period of Uncertainty and Negotiation (2019-2020)

The period from 2019 to 2020 saw a shift toward negotiation, with the signing of the "Phase One" trade deal. However, uncertainty persisted, making a time-based analysis crucial for interpreting market behavior and potential investment opportunities.

- Phase One trade deal – its implications: The deal offered some relief but didn't fully resolve underlying tensions. A time-based analysis would highlight the temporary nature of this relief and the need for continued monitoring of the situation.

- Shifting market sentiment: Market sentiment fluctuated wildly, depending on the progress (or lack thereof) in trade negotiations.

- Ackman's potential long-term investment strategy considerations: Ackman's approach likely involved assessing the long-term implications of the deal's successes and failures, and adjusting his portfolio accordingly. A time-based lens would underscore the importance of patience and long-term perspective.

- Related news/actions: Analyzing news and financial reports from this period concerning Ackman's firm, Pershing Square Capital Management, may reveal clues about the types of trades made and investments taken during this phase of the trade war.

The COVID-19 Pandemic and its Impact (2020-Present)

The COVID-19 pandemic introduced a new layer of complexity to the US-China trade relationship. Disruptions to global supply chains and increased geopolitical tensions further complicated the situation.

- Disruptions to global supply chains: The pandemic exposed vulnerabilities in global supply chains, highlighting the risks of over-reliance on a single country for crucial goods.

- Increased geopolitical tensions: The pandemic exacerbated existing tensions, adding to the uncertainty surrounding the future of US-China relations and trade flows.

- Impact on specific industries: Industries reliant on global supply chains faced disruptions. Ackman's analysis would likely focus on which sectors were best positioned to adapt and thrive within this new landscape.

- Ackman’s presumed response: Given the unprecedented nature of the pandemic, Ackman's responses likely involved assessing which companies could adapt quickly and potentially benefit from the new realities of supply chains. His investments likely reflected that strategy.

Future Outlook: Long-Term Implications and Investment Strategies

Predicting the future of the US-China trade relationship is challenging. However, a time-based analysis can help investors identify potential scenarios and develop informed strategies.

- Potential for further escalation or de-escalation: The relationship remains volatile, so a time-based analysis would consider various potential scenarios and their implications for investments.

- Long-term economic effects: The long-term effects on global economic growth and market dynamics are substantial and should inform long-term investment decisions.

- Investment strategies for navigating future uncertainties: Diversification, hedging, and a focus on companies with strong fundamentals are crucial strategies for navigating future uncertainty in this complex geopolitical climate.

- Strategies suitable for long-term investors: Value investing and long-term holding strategies, aligned with Ackman's value investing philosophy, could offer resilience in the face of trade war volatility.

Conclusion: Analyzing the US-China Trade War Through Ackman's Time-Based Lens – Key Takeaways and Future Implications

Analyzing the US-China trade war through a time-based lens, informed by Bill Ackman's likely investment approach, provides valuable insights into navigating this complex geopolitical event. The war's impact on global markets is undeniable, demanding a strategic and adaptable investment approach. Long-term thinking and careful consideration of temporal factors are crucial for success.

Learn more about implementing a time-based analysis in your own investment strategies concerning the US-China trade war. Conduct your own research into Ackman's investment philosophy and consider engaging in further analysis of similar geopolitical events to develop informed and effective investment strategies.

Featured Posts

-

Green Bay Packers Two Opportunities For A 2025 International Game

Apr 27, 2025

Green Bay Packers Two Opportunities For A 2025 International Game

Apr 27, 2025 -

Justin Herbert And The Chargers A Brazilian Nfl Season Opener In 2025

Apr 27, 2025

Justin Herbert And The Chargers A Brazilian Nfl Season Opener In 2025

Apr 27, 2025 -

10

Apr 27, 2025

10

Apr 27, 2025 -

Canadas Trade Strategy Waiting For A Favorable Us Deal

Apr 27, 2025

Canadas Trade Strategy Waiting For A Favorable Us Deal

Apr 27, 2025 -

Gensol Promoters Face Pfc Scrutiny Over Fabricated Documents Eo W Transfer Halted

Apr 27, 2025

Gensol Promoters Face Pfc Scrutiny Over Fabricated Documents Eo W Transfer Halted

Apr 27, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

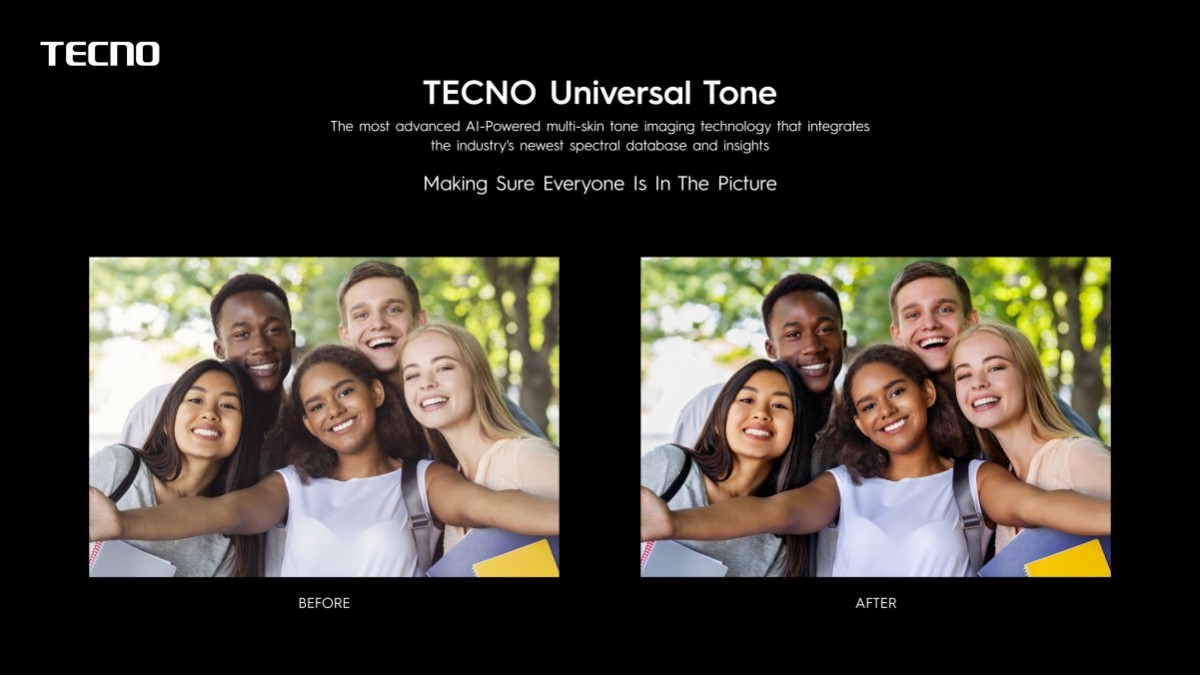

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025 -

Red Sox Injury Updates For Crawford Bello Abreu And Rafaela

Apr 28, 2025

Red Sox Injury Updates For Crawford Bello Abreu And Rafaela

Apr 28, 2025 -

Boston Red Sox Injury News Kutter Crawford Brayan Bello Wilyer Abreu And Ceddanne Rafaela

Apr 28, 2025

Boston Red Sox Injury News Kutter Crawford Brayan Bello Wilyer Abreu And Ceddanne Rafaela

Apr 28, 2025