US-China Trade War Impact: Dow Futures And China's Economic Measures

Table of Contents

The Dow Futures' Volatility During the Trade War

The escalating tensions between the US and China created significant volatility in Dow futures. Announcements regarding new tariffs or the breakdown of trade negotiations often triggered sharp fluctuations in the market. The uncertainty surrounding the trade war’s outcome led to significant investor anxiety, impacting market sentiment and risk assessment.

-

Impact on Investor Sentiment and Market Uncertainty: The unpredictable nature of the trade war created an environment of considerable market uncertainty. Investors struggled to accurately predict future outcomes, leading to both sharp price increases and decreases in Dow futures contracts. This uncertainty directly translated into higher investment risk premiums.

-

Analysis of Specific Dow Futures Contract Price Movements: Examining specific instances, such as the announcement of the initial tariffs in 2018 or the subsequent rounds of escalation, reveals a clear correlation between negative trade news and downward pressure on Dow futures. Conversely, positive developments in trade talks often resulted in temporary rallies. Analyzing these specific price movements highlights the significant sensitivity of Dow futures to trade war developments.

-

The Role of Speculation and Market Psychology: Market psychology played a significant role. Speculation about the ultimate outcome of the trade war influenced trading behavior, amplifying both positive and negative market reactions. This amplified the volatility in Dow futures, making them a sensitive barometer of trade war sentiment. Charts and graphs depicting these price movements during crucial periods would visually demonstrate this volatility. (Note: Charts and graphs would be inserted here in an actual published article).

China's Economic Countermeasures and Their Effectiveness

In response to the US trade war, China implemented a range of economic countermeasures aimed at mitigating the negative impacts on its economy. These measures included retaliatory tariffs, domestic stimulus packages, and efforts to foster technological self-reliance.

-

Analysis of the Impact of Retaliatory Tariffs on US and Chinese Businesses: While China's retaliatory tariffs targeted US goods, they also impacted Chinese businesses involved in the import and export of these goods. The effectiveness of these tariffs as a tool for negotiation varied, with some sectors experiencing significant disruption while others demonstrated resilience.

-

Evaluation of the Success of Domestic Stimulus Efforts in Boosting Economic Activity: China implemented significant fiscal and monetary stimulus measures to offset the negative economic consequences of the trade war. These measures aimed to support domestic demand and investment. The effectiveness of these stimulus efforts in boosting economic growth is a subject of ongoing debate, with varying assessments depending on the chosen metrics and time frame.

-

Discussion on the Structural Changes Within the Chinese Economy as a Result: The trade war accelerated existing efforts within China to diversify its economic partnerships and reduce reliance on the US market. This led to increased investment in domestic industries and a renewed focus on technological innovation.

Interdependence and Global Economic Consequences

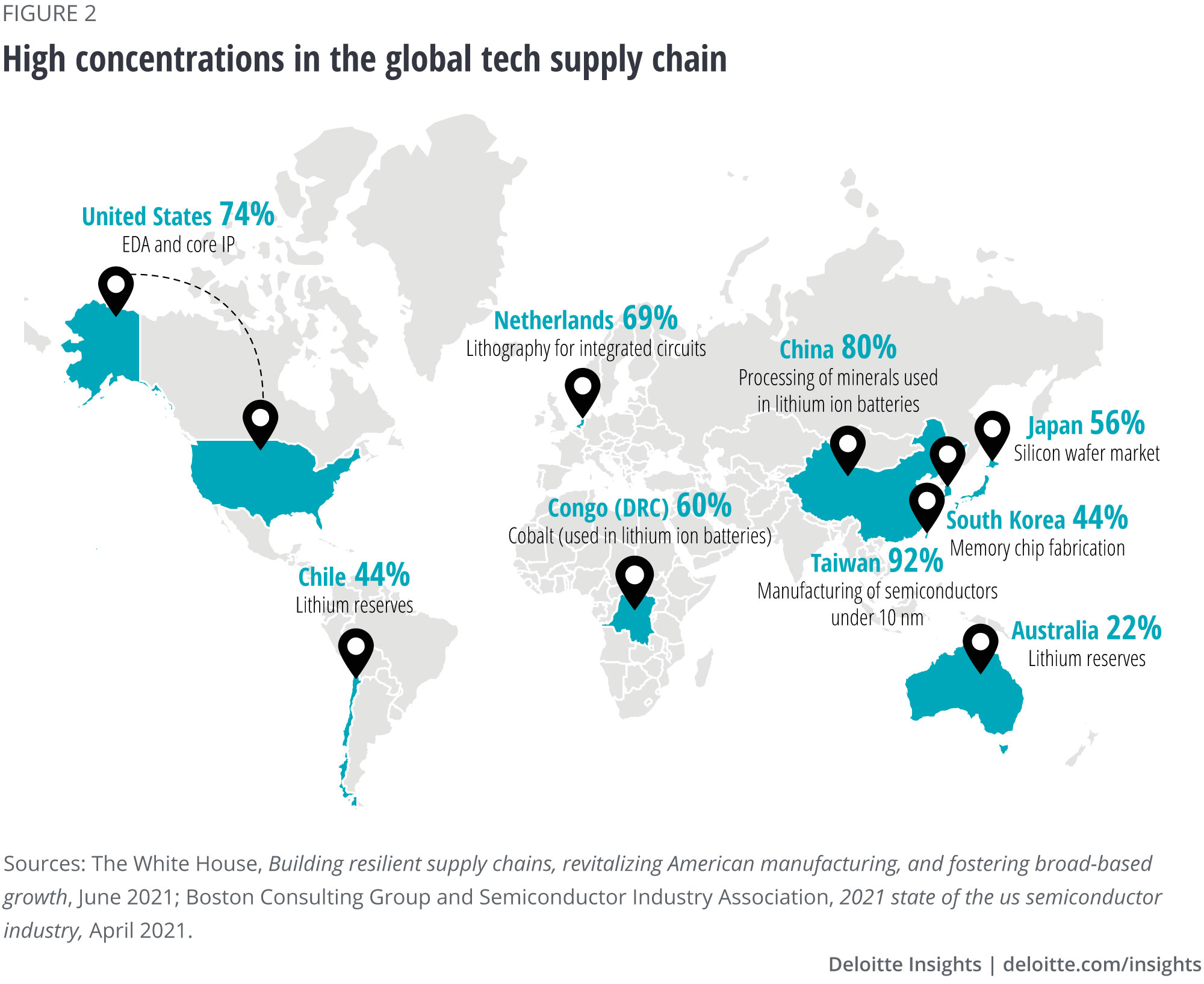

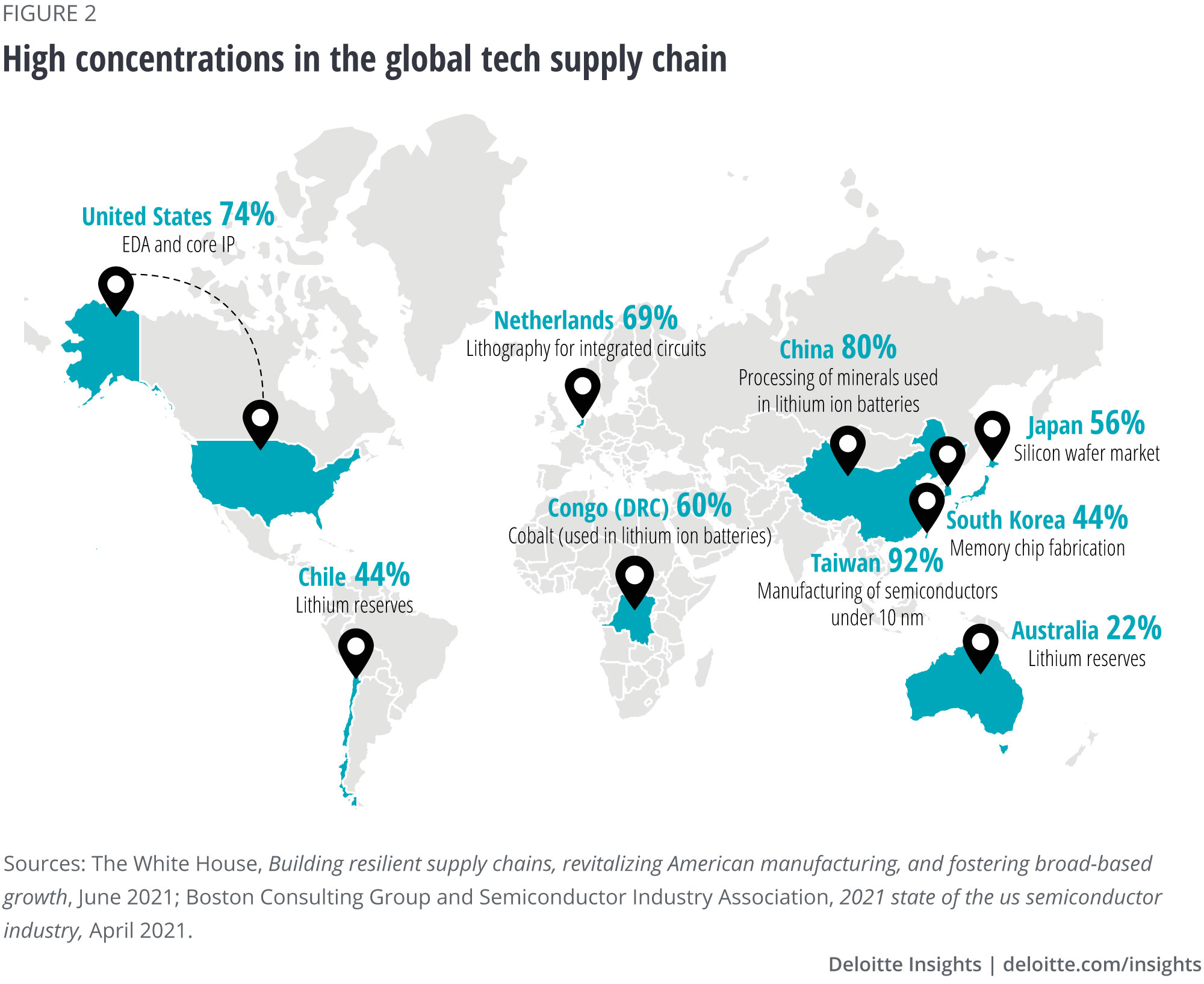

The US-China trade war’s impact extended far beyond the two main players. The interconnectedness of global supply chains meant that disruptions rippled across numerous countries and industries.

-

Examples of Industries Severely Impacted by Trade War Disruptions: Agriculture and technology were significantly affected. Farmers faced reduced export opportunities, while technology companies experienced supply chain disruptions and increased production costs.

-

Discussion of the Impact on Global Inflation and Commodity Prices: The trade war contributed to global uncertainty, which impacted commodity prices and overall inflation. The disruption to global supply chains influenced the availability and cost of goods, contributing to inflationary pressures in some regions.

-

Analysis of the Role of WTO and Other International Bodies: International organizations like the World Trade Organization (WTO) attempted to mediate the trade dispute, highlighting the challenges of multilateralism in resolving major trade conflicts. Their influence was limited, illustrating the limitations of current international trade governance structures in the face of major bilateral conflicts.

Conclusion: Navigating the Future of US-China Trade Relations and Their Impact on Dow Futures

The US-China trade war demonstrated the significant interconnectedness of the global economy and the profound impact that trade disputes can have on financial markets, notably Dow futures. China's economic countermeasures, while aimed at mitigating negative effects, also brought about structural changes within its economy. The global ripple effects were substantial, highlighting the interconnectedness of supply chains and the challenges of resolving major trade conflicts.

Understanding the future of US-China trade relations is vital for investors and policymakers alike. While the most intense phase of the trade war has subsided, ongoing tensions and uncertainties remain. Continued monitoring of trade negotiations, economic indicators, and policy shifts is crucial for effective Dow futures analysis and informed decision-making in a globally interconnected economy. Stay informed about developments in US-China trade relations and their effect on Dow futures and global market trends to navigate the complexities of this crucial relationship.

Featured Posts

-

Floridas Allure A Cnn Anchor Shares His Go To Vacation Place

Apr 26, 2025

Floridas Allure A Cnn Anchor Shares His Go To Vacation Place

Apr 26, 2025 -

Fighting The Worlds Richest An American Battleground

Apr 26, 2025

Fighting The Worlds Richest An American Battleground

Apr 26, 2025 -

Why Current Stock Market Valuations Are Not A Cause For Investor Concern Bof A

Apr 26, 2025

Why Current Stock Market Valuations Are Not A Cause For Investor Concern Bof A

Apr 26, 2025 -

The Strategic Importance Of A Military Base In The Us China Power Struggle

Apr 26, 2025

The Strategic Importance Of A Military Base In The Us China Power Struggle

Apr 26, 2025 -

Over The Counter Birth Control Implications For Reproductive Rights After Roe V Wade

Apr 26, 2025

Over The Counter Birth Control Implications For Reproductive Rights After Roe V Wade

Apr 26, 2025

Latest Posts

-

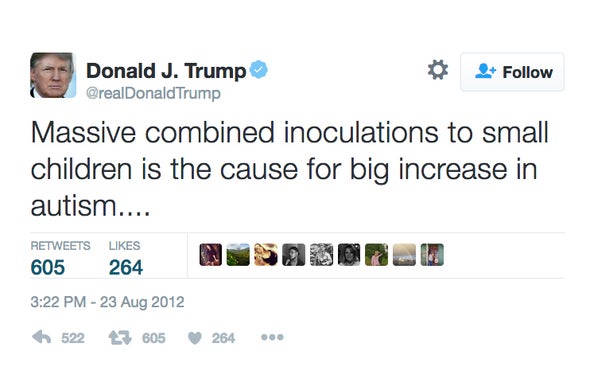

Anti Vaccine Advocate Review Of Autism Vaccine Connection Sparks Outrage Nbc 10 Philadelphia Reports

Apr 27, 2025

Anti Vaccine Advocate Review Of Autism Vaccine Connection Sparks Outrage Nbc 10 Philadelphia Reports

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Claims

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025 -

Anti Vaccine Activist Review Of Autism Vaccine Link Sparks Outrage Nbc Chicago Sources

Apr 27, 2025

Anti Vaccine Activist Review Of Autism Vaccine Link Sparks Outrage Nbc Chicago Sources

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Connection

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Connection

Apr 27, 2025