US Credit Downgrade: Dow Futures And Dollar React

Table of Contents

Immediate Market Reactions to the US Credit Downgrade

The announcement of the US credit downgrade triggered a swift and dramatic response across global financial markets. The initial reaction was characterized by heightened uncertainty and risk aversion, leading to significant volatility.

- Dow Jones Industrial Average futures plunged 2% immediately following the announcement, reflecting a sharp decline in investor confidence.

- The US dollar experienced a modest depreciation against major currencies like the Euro and the Japanese Yen, as investors sought alternative safe haven assets.

- Increased volatility was observed in treasury yields and other fixed-income securities, as investors reassessed risk and sought safer investments.

- Global equity markets showed signs of significant concern and uncertainty, with many major indices experiencing declines.

This immediate market reaction stemmed from several key factors. Investor sentiment shifted dramatically, with a widespread increase in risk aversion. The downgrade signaled increased uncertainty about the US economy's stability and fiscal strength, prompting a flight to safety. Investors moved their capital towards perceived safer haven assets, such as gold and government bonds of countries with higher credit ratings. This sudden shift in market sentiment fueled the significant market volatility we witnessed. Risk assessment models were immediately recalibrated, forcing a re-evaluation of previously held investment strategies.

Analysis of the Dow Futures Decline

The decline in Dow futures following the US credit downgrade reflects a complex interplay of factors impacting investor confidence and future earnings expectations. Several sectors felt the impact more significantly than others.

- Impact on technology stocks: The downgrade increases interest rates, making borrowing more expensive for tech companies, many of which rely on debt financing for expansion and innovation. Reduced investor confidence further dampens their growth prospects.

- Effect on consumer discretionary sectors: A weakening economy, often a consequence of a credit downgrade, can lead to decreased consumer spending. This negatively affects businesses reliant on consumer demand.

- Influence of the downgrade on future economic growth projections: The downgrade signals a less optimistic economic outlook, potentially slowing economic growth and reducing corporate earnings.

- Analysis of trading volume and investor sentiment data: High trading volumes and a negative shift in investor sentiment data confirmed the severity of the impact.

The economic implications of the downgrade are far-reaching. It casts a shadow over future earnings expectations, as companies face increased borrowing costs and potentially lower demand. The economic outlook is now significantly less certain, leading to a reassessment of long-term investment strategies and a potential reduction in capital expenditures. The anticipated interest rate hikes by the Federal Reserve in response to the downgrade further add to the uncertainty.

The US Dollar's Response and Implications for Global Trade

The US dollar's reaction to the US credit downgrade holds significant implications for global trade and capital flows. While the initial reaction was a slight depreciation, the longer-term effects are more complex and uncertain.

- Dollar strength/weakness and its effect on US imports and exports: A weaker dollar makes US exports more competitive but increases the cost of imports, potentially fueling inflation.

- Impact on emerging markets and developing economies: Emerging markets heavily reliant on US investment may experience capital flight and economic instability.

- Changes in international capital flows and foreign investment: The downgrade may deter foreign investment into the US, affecting economic growth.

- Potential for increased inflation due to import costs: A weaker dollar combined with supply chain disruptions could contribute to higher inflation.

Long-Term Economic Consequences of the Downgrade

The long-term economic consequences of a US credit downgrade are substantial and multifaceted, potentially impacting various aspects of the economy.

- Increased borrowing costs for the US government: The downgrade makes it more expensive for the government to borrow money, potentially impacting government spending and programs.

- Potential inflationary pressures due to reduced investor confidence: Reduced investor confidence can lead to increased uncertainty and higher inflation as businesses struggle to access credit.

- Impact on long-term economic growth prospects: A sustained period of reduced investment and slower economic activity could hinder long-term economic growth.

- Implications for future monetary policy decisions: The Federal Reserve might need to adjust its monetary policy to address the economic fallout from the downgrade.

Conclusion:

The US credit downgrade's impact on Dow futures and the US dollar underscores the interconnectedness of global financial markets. The immediate reactions, as well as the potential long-term consequences, highlight the significant implications of this event for investors and policymakers alike. Staying informed about the evolving situation surrounding the US credit downgrade is crucial for navigating the uncertainty in the markets. Continue to monitor the situation and consult with financial advisors for personalized guidance on managing your investments during this period of market volatility. Understanding the nuances of the US credit downgrade and its impact on Dow futures and the US dollar is critical for informed decision-making in these turbulent times.

Featured Posts

-

Retorno De Jennifer Lawrence Magra E Radiante Apos Rumores De Parto

May 20, 2025

Retorno De Jennifer Lawrence Magra E Radiante Apos Rumores De Parto

May 20, 2025 -

Kyf Astkhdm Aldhkae Alastnaey Lieadt Ihyae Aemal Ajatha Krysty

May 20, 2025

Kyf Astkhdm Aldhkae Alastnaey Lieadt Ihyae Aemal Ajatha Krysty

May 20, 2025 -

The Intriguing Absence Of Murder In Agatha Christies Towards Zero Episode 1

May 20, 2025

The Intriguing Absence Of Murder In Agatha Christies Towards Zero Episode 1

May 20, 2025 -

Adverse Weather Conditions Impact Sinners Start In Monte Carlo

May 20, 2025

Adverse Weather Conditions Impact Sinners Start In Monte Carlo

May 20, 2025 -

Americas Factory Jobs Trumps Promises And The Economic Landscape

May 20, 2025

Americas Factory Jobs Trumps Promises And The Economic Landscape

May 20, 2025

Latest Posts

-

Cobollis Triumph Winning The Bucharest Atp Tournament

May 20, 2025

Cobollis Triumph Winning The Bucharest Atp Tournament

May 20, 2025 -

Flavio Cobolli Wins Bucharest Tiriac Open

May 20, 2025

Flavio Cobolli Wins Bucharest Tiriac Open

May 20, 2025 -

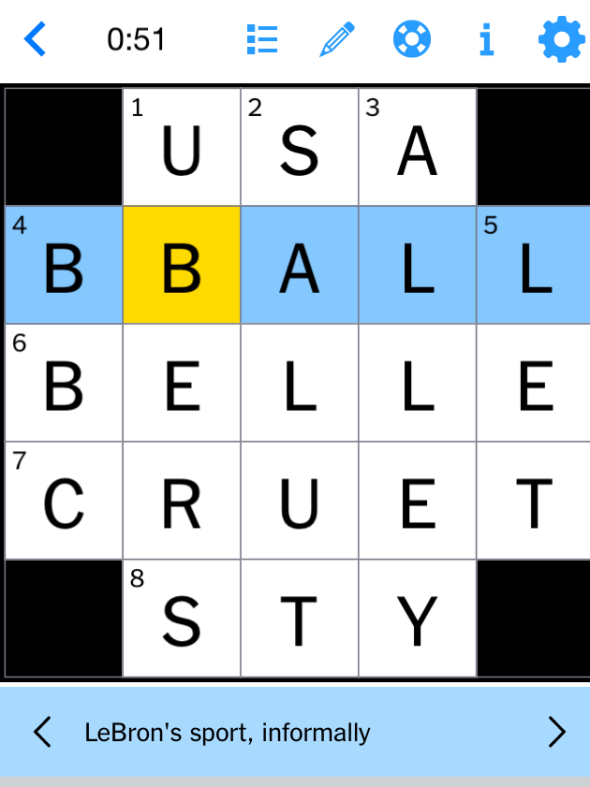

Nyt Mini Crossword Answers And Hints March 26 2025

May 20, 2025

Nyt Mini Crossword Answers And Hints March 26 2025

May 20, 2025 -

Flavio Cobolli First Atp Title In Bucharest

May 20, 2025

Flavio Cobolli First Atp Title In Bucharest

May 20, 2025 -

Nyt Mini Crossword Solutions And Hints April 26 2025

May 20, 2025

Nyt Mini Crossword Solutions And Hints April 26 2025

May 20, 2025