US Credit Rating Cut By Moody's: White House Reaction

Table of Contents

Moody's Rationale for the Downgrade

Moody's cited a confluence of factors contributing to their decision to lower the US credit rating. The agency highlighted a persistent deterioration in fiscal strength, exacerbated by the protracted political battles surrounding the debt ceiling. This reflects growing concerns about the country's governance and its ability to manage its fiscal challenges effectively. Key concerns raised by Moody's include:

- Increased Government Debt Burden: The substantial increase in US government debt, particularly following the debt ceiling standoff, significantly contributed to the downgrade. Moody's expressed apprehension about the trajectory of the national debt and its potential impact on the country's financial stability.

- Erosion of Governance Strength: The repeated near-misses on the debt ceiling, coupled with the highly partisan political climate, signaled a weakening of governance strength in Moody's eyes. The inability to reach bipartisan agreements on fiscal policy underscored concerns about future predictability and responsible fiscal management.

- Deterioration in Fiscal Strength: The combination of rising debt and a lack of a clear, long-term plan to address the fiscal challenges led to Moody's assessment of a decline in the country's fiscal strength. This represents a significant blow to the US's international creditworthiness. The ongoing political stalemate further contributes to the uncertainty surrounding future fiscal policy.

The White House's Official Response

The White House responded to Moody's downgrade with a statement that largely dismissed the agency's assessment. The official statement, released by the White House press secretary, emphasized the strength of the US economy and reiterated the administration's commitment to fiscal responsibility – though this claim has been met with skepticism given recent events. Key points from the White House's response include:

- Dismissal of Moody's Assessment: The White House characterized Moody's decision as flawed and argued that it failed to fully account for the underlying strength of the US economy.

- Emphasis on Economic Strength: The administration highlighted positive economic indicators such as job growth and declining unemployment rates to counter Moody's assessment.

- Reiteration of Fiscal Responsibility (or Lack Thereof): The official response included statements about the administration's commitment to fiscal responsibility, though critics point to the near-default situation as evidence to the contrary. The messaging around fiscal responsibility was, therefore, a point of contention.

Analysis of the White House Reaction

The effectiveness of the White House's response remains a subject of debate. While the administration attempted to downplay the significance of the downgrade, the market reaction suggests otherwise. The political implications are significant, with potential fallout affecting public opinion and possibly impacting upcoming elections. Key aspects of the analysis include:

- Tone and Messaging of the Response: The White House adopted a defensive stance, rejecting Moody's findings outright. This approach may not have been the most effective in calming investor concerns.

- Public Perception of the White House's Reaction: Public opinion is divided, with some supporting the White House's response and others criticizing its dismissal of Moody's concerns.

- Potential Impact on Future Economic Policy: The downgrade could place further pressure on the administration to enact more fiscally responsible policies, but the political will to do so remains uncertain.

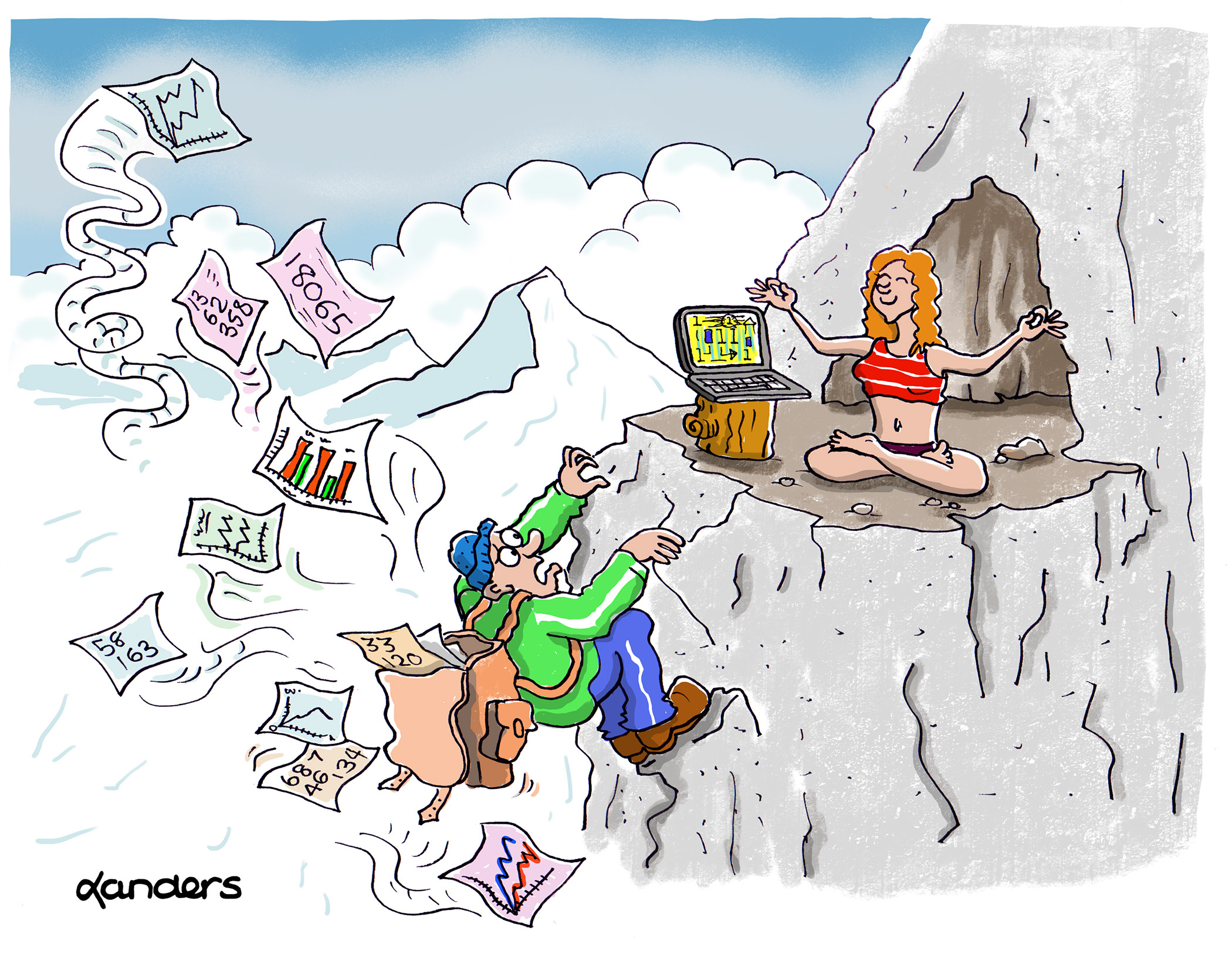

Market Reactions to the Downgrade and White House Response

The immediate market reaction to both the downgrade and the White House's response was largely negative. The US dollar experienced some weakening, and Treasury yields increased, reflecting investor concerns about the US's creditworthiness. Stock market indices also displayed volatility. Specific market movements include:

- Impact on the US Dollar: The US dollar experienced a slight decline against other major currencies following the downgrade.

- Changes in Treasury Yields: Treasury yields, particularly on longer-term bonds, rose, indicating increased borrowing costs for the US government.

- Stock Market Fluctuations: Stock markets initially reacted negatively, reflecting investor uncertainty.

Conclusion: Understanding the Implications of the US Credit Rating Cut

Moody's downgrade of the US credit rating, driven by concerns about fiscal policy and governance, has triggered a significant response from the White House. While the administration attempted to downplay the severity of the downgrade, the market's reaction underscores the gravity of the situation. The long-term economic and political consequences of this event remain to be seen, but its impact on investor confidence and international perceptions of the US economy is undeniable. Stay tuned for updates on the evolving situation regarding the US credit rating downgrade and the White House's continued response, and follow our coverage for in-depth analysis of this critical development.

Featured Posts

-

Damiano David Debut Solo Album Announcement

May 18, 2025

Damiano David Debut Solo Album Announcement

May 18, 2025 -

Analyzing Trumps Aerospace Agreements Substance Vs Spectacle

May 18, 2025

Analyzing Trumps Aerospace Agreements Substance Vs Spectacle

May 18, 2025 -

Michelle Williams Clarifies Dying For Sex Scene Ambiguity

May 18, 2025

Michelle Williams Clarifies Dying For Sex Scene Ambiguity

May 18, 2025 -

Snl Weekend Update Ego Nwodims Unexpected Turn

May 18, 2025

Snl Weekend Update Ego Nwodims Unexpected Turn

May 18, 2025 -

Next Summer By Damiano David Now Streaming

May 18, 2025

Next Summer By Damiano David Now Streaming

May 18, 2025

Latest Posts

-

Axios Vozmozhnoe Naznachenie Stivena Millera Sovetnikom Trampa Po Natsionalnoy Bezopasnosti

May 18, 2025

Axios Vozmozhnoe Naznachenie Stivena Millera Sovetnikom Trampa Po Natsionalnoy Bezopasnosti

May 18, 2025 -

This Weeks You Toon Caption Contest Winner Announced Booing Bears

May 18, 2025

This Weeks You Toon Caption Contest Winner Announced Booing Bears

May 18, 2025 -

You Toon Caption Contest Winner Booing Bears

May 18, 2025

You Toon Caption Contest Winner Booing Bears

May 18, 2025 -

Booing Bears Win This Weeks You Toon Caption Contest

May 18, 2025

Booing Bears Win This Weeks You Toon Caption Contest

May 18, 2025 -

2025 Nfl Draft Analysts Assessment Of The New England Patriots

May 18, 2025

2025 Nfl Draft Analysts Assessment Of The New England Patriots

May 18, 2025