US Debt Ceiling: August Deadline Looms, Warns Treasury Official

Table of Contents

Understanding the US Debt Ceiling

The US debt ceiling, also known as the debt limit, is a legal limit on the total amount of money that the US government can borrow to meet its existing obligations. It's not a limit on how much the government can spend; rather, it's a constraint on how the government finances its already-approved spending. Think of it like a household's credit limit on their credit card – it doesn't determine how much they spend, but rather how they pay for it. The federal borrowing power, therefore, is directly tied to the debt ceiling. The national debt, in contrast, represents the total accumulation of past government borrowing.

- Definition of debt ceiling: A legally mandated limit on the total amount of money the US government can borrow.

- Explanation of its function in government finance: Allows the government to finance previously authorized spending and meet its existing obligations.

- Comparison to household budgets: Similar to a credit limit on a credit card, it doesn't control spending but how it's financed.

- Examples of past debt ceiling standoffs: The US has faced numerous debt ceiling standoffs throughout history, some resulting in near-defaults and market volatility (e.g., 2011, 2013). These historical precedents provide valuable insight into the potential consequences of inaction.

The August Deadline and Potential Consequences

Treasury officials have warned that the US could reach the debt ceiling limit as early as August, potentially leading to a default on US debt. The consequences of hitting this limit without Congressional action are potentially severe and far-reaching.

- Potential impacts on the US economy: A default could trigger a credit rating downgrade, leading to increased borrowing costs for the government and potentially the private sector. This could cripple economic growth.

- Risks to global financial markets: The US plays a central role in the global financial system. A US default would send shockwaves through global markets, potentially triggering a global recession.

- Potential social consequences for citizens: Government services could be disrupted, including Social Security and Medicare payments. This would have devastating consequences for millions of Americans.

- Economic repercussions of past debt ceiling crises: Past debt ceiling crises have shown increased market volatility, decreased consumer confidence, and increased uncertainty in the financial markets.

Congressional Actions and Political Implications

The political climate surrounding the debt ceiling debate is highly charged. Both Democrats and Republicans hold differing views on how to address the issue, creating significant obstacles to reaching a timely and effective solution. The House and Senate must work together to find a compromise, but partisan gridlock has hampered progress in the past.

- Political positions on the debt ceiling: Democrats generally favor raising the debt ceiling without conditions, while some Republicans advocate for spending cuts in exchange.

- Potential legislative solutions: Raising the debt ceiling, suspending the debt ceiling temporarily, or enacting significant spending cuts.

- Obstacles to reaching a compromise: Deep partisan divisions and differing views on fiscal policy create major hurdles to finding common ground.

- Impact on upcoming elections: The debt ceiling debate will likely play a significant role in upcoming elections, influencing voter preferences and shaping campaign strategies.

Possible Solutions and Negotiations

Several solutions are being proposed to navigate this crisis, including raising the debt ceiling, suspending it temporarily, or enacting spending cuts alongside a debt ceiling increase. The feasibility and potential impact of these solutions are hotly debated. Negotiations between the White House and Congress are ongoing, but reaching a bipartisan agreement remains challenging.

- Proposed solutions by Democrats and Republicans: Democrats often favor a clean increase without conditions, while Republicans may link it to spending cuts.

- Short-term versus long-term solutions: A temporary suspension could provide breathing room but doesn't address the underlying fiscal issues. A long-term solution requires bipartisan cooperation on fiscal responsibility.

- Potential compromises and their likelihood: Negotiations could lead to a compromise involving targeted spending cuts or reforms in exchange for a debt ceiling increase.

- Negotiation strategies and challenges: Finding common ground on fiscal policy is incredibly challenging due to differing ideological perspectives and political agendas.

Conclusion

The looming August deadline for the US debt ceiling presents a grave threat to the US economy and global financial stability. The potential consequences of Congressional inaction are severe, ranging from credit rating downgrades and market volatility to government shutdowns and social disruptions. The political implications are equally significant, with the potential to profoundly impact both domestic and international relations.

Call to Action: Stay informed about the ongoing developments surrounding the US debt ceiling and urge your representatives to prioritize a bipartisan solution to avert a potential economic catastrophe. Understanding the complexities of the US debt limit and the national debt is crucial for every citizen. Demand responsible fiscal policy from your elected officials and actively engage in the democratic process to ensure a stable economic future.

Featured Posts

-

The Unexpected Consequences Of Apples Choices On Googles Success

May 10, 2025

The Unexpected Consequences Of Apples Choices On Googles Success

May 10, 2025 -

Emmerdale Star Shows Solidarity With Wynne Evans Amidst Strictly Scandal

May 10, 2025

Emmerdale Star Shows Solidarity With Wynne Evans Amidst Strictly Scandal

May 10, 2025 -

5 Times Stephen King Publicly Clashed With Other Celebrities

May 10, 2025

5 Times Stephen King Publicly Clashed With Other Celebrities

May 10, 2025 -

Dijon Accident Rue Michel Servet Un Vehicule S Ecrase Contre Un Mur

May 10, 2025

Dijon Accident Rue Michel Servet Un Vehicule S Ecrase Contre Un Mur

May 10, 2025 -

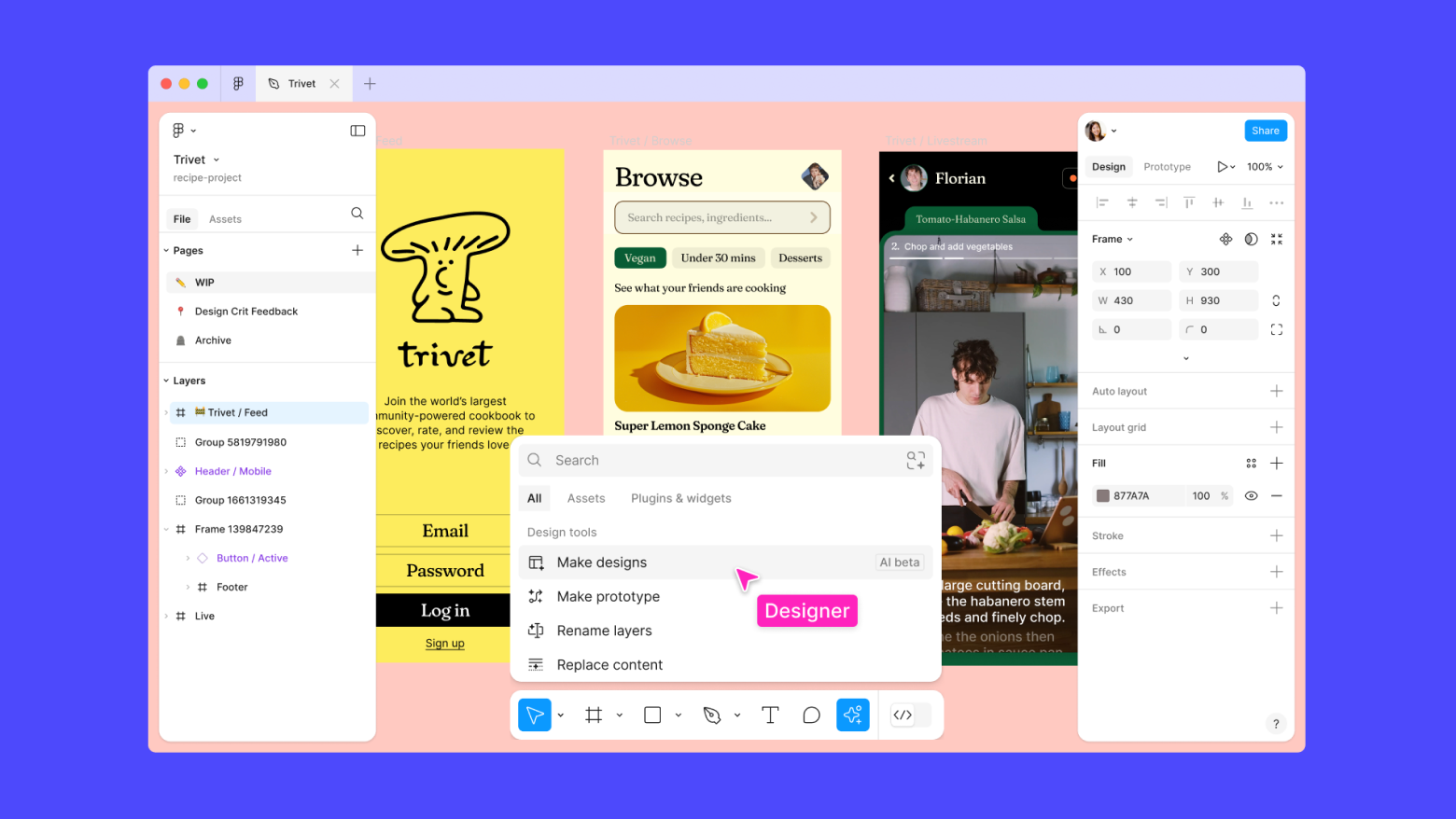

Understanding The Competitive Advantage Of Figmas Ai

May 10, 2025

Understanding The Competitive Advantage Of Figmas Ai

May 10, 2025