US Debt Limit Could Expire In August, Says Treasury's Scott Bessent

Table of Contents

The Imminent Threat of the US Debt Limit Expiration

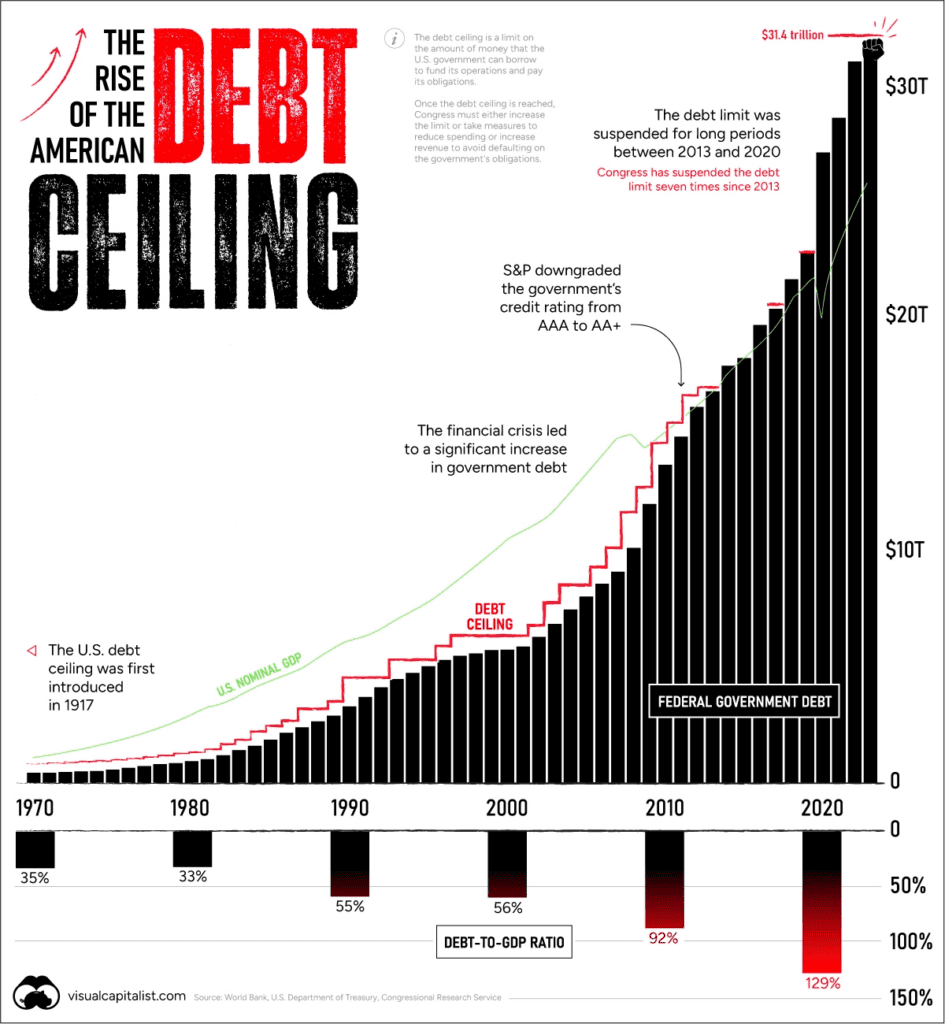

The US debt limit is the total amount of money the federal government is legally allowed to borrow to meet its existing obligations. It's a crucial mechanism that ensures the government can pay its bills, from salaries to Social Security benefits and national defense. However, when the debt limit is reached, the government's ability to borrow is restricted, potentially leading to a financial crisis. Bessent's warning, reported in [insert reputable news source here], highlights the urgency of the situation.

- Potential economic consequences of exceeding the debt limit: A failure to raise the debt ceiling could lead to a partial or complete government shutdown, impacting various sectors of the economy. This could trigger a decline in consumer confidence, reduced investment, and increased uncertainty in global markets.

- Historical precedents of debt limit crises and their impact: The US has faced similar situations in the past, often resulting in periods of market volatility and uncertainty. These past events serve as a cautionary tale of the potential severity of a debt ceiling breach. Reviewing these historical precedents is crucial for understanding the potential implications of the current situation.

- The political implications and potential for gridlock in Congress: Raising the debt ceiling typically requires bipartisan support in Congress. Political gridlock and disagreements over government spending could significantly delay a resolution, exacerbating the risk of a crisis.

Potential Economic Consequences of Reaching the Debt Ceiling

Reaching the debt ceiling without a resolution could trigger a government shutdown, halting numerous government operations. This shutdown could have devastating ripple effects throughout the economy.

-

Government services (Social Security, Medicare, etc.): Payments for essential programs like Social Security and Medicare could be delayed or suspended, impacting millions of Americans. The disruption of these vital services would have widespread social and economic consequences.

-

US credit rating and borrowing costs: A failure to raise the debt limit could lead to a downgrade of the US credit rating, increasing borrowing costs for the government and potentially for businesses and consumers. Higher interest rates could stifle economic growth and increase the national debt further.

-

Global financial markets: The US plays a dominant role in the global economy. A debt ceiling crisis could trigger significant volatility in global financial markets, impacting stock prices, exchange rates, and investment flows.

-

Mechanics of exceeding the debt limit's impact on government operations: When the debt limit is reached, the Treasury Department must prioritize payments, potentially leading to delayed payments for certain obligations. This prioritization could create significant uncertainty and disruption for government agencies and the public.

-

Examples of potential market reactions (e.g., stock market volatility, interest rate increases): Historical data shows that past debt ceiling debates have often coincided with increased stock market volatility and upward pressure on interest rates. This could translate to higher borrowing costs for consumers and businesses.

-

Potential impacts on consumer confidence and spending: Uncertainty surrounding the debt ceiling can erode consumer confidence, leading to decreased spending and potentially a slowdown in economic growth. This reduction in consumer spending could further exacerbate the economic downturn.

Political Ramifications and Potential Solutions

The political landscape surrounding the debt ceiling is highly charged. Republicans and Democrats hold differing views on government spending and the appropriate level of the debt limit.

- Differing viewpoints of Republicans and Democrats on raising the debt ceiling: Republicans often advocate for spending cuts as a condition for raising the debt ceiling, while Democrats generally favor raising the limit without major spending reductions. This divergence in viewpoints makes reaching a compromise challenging.

- Potential compromise solutions (if any are being discussed): Negotiations typically involve discussions of spending cuts, tax increases, or a combination of both. The details of any potential compromise will be crucial in determining the economic impact of a resolution.

- Chances of a successful negotiation before the deadline: The likelihood of a successful negotiation hinges on the willingness of both parties to compromise. The closer the deadline approaches, the higher the risk of a crisis.

What Investors and Citizens Can Do

The potential for economic instability necessitates proactive measures from both investors and citizens.

- Recommendations for diversifying investments: Investors should consider diversifying their portfolios to mitigate potential market volatility resulting from a debt ceiling crisis. This diversification can help reduce the overall risk of investment losses.

- Suggest monitoring credible news sources for updates: Staying informed about developments related to the US debt limit is crucial. Reliance on reputable news sources is essential for obtaining accurate and reliable information.

- Encourage engagement with elected officials to voice concerns: Citizens should engage with their elected officials to express their concerns and advocate for a timely resolution to avoid a potential economic crisis.

Conclusion

The impending expiration of the US debt limit presents a significant risk to the US economy and global financial markets. Treasury warnings underscore the urgency of addressing this issue. The potential consequences – from government shutdowns to credit rating downgrades – are substantial. Political gridlock could exacerbate the situation.

Call to Action: Stay informed about the evolving situation surrounding the US debt limit. Understanding the potential ramifications is crucial for making informed financial decisions and advocating for responsible fiscal policy. Monitor credible news sources and engage with your elected officials to express your concerns about the US debt limit and its potential impact on the American economy. The future of the US financial system depends, in part, on a timely and responsible resolution to this critical issue.

Featured Posts

-

Refugee Holiday Camps Cancelled Fabers New Policy

May 11, 2025

Refugee Holiday Camps Cancelled Fabers New Policy

May 11, 2025 -

Yankees Vs Diamondbacks Injury Report April 1 3 Series

May 11, 2025

Yankees Vs Diamondbacks Injury Report April 1 3 Series

May 11, 2025 -

Halls Crossroads Baseball Tournament Honors Chris Newsom

May 11, 2025

Halls Crossroads Baseball Tournament Honors Chris Newsom

May 11, 2025 -

Grand Slam Track Meet Michael Johnson Promises Speed Stars And Significant Prize Money

May 11, 2025

Grand Slam Track Meet Michael Johnson Promises Speed Stars And Significant Prize Money

May 11, 2025 -

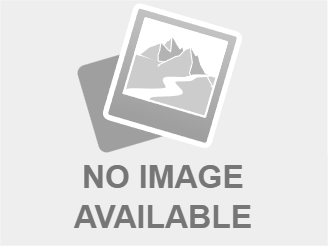

Car Dealers Intensify Fight Against Ev Mandate Requirements

May 11, 2025

Car Dealers Intensify Fight Against Ev Mandate Requirements

May 11, 2025