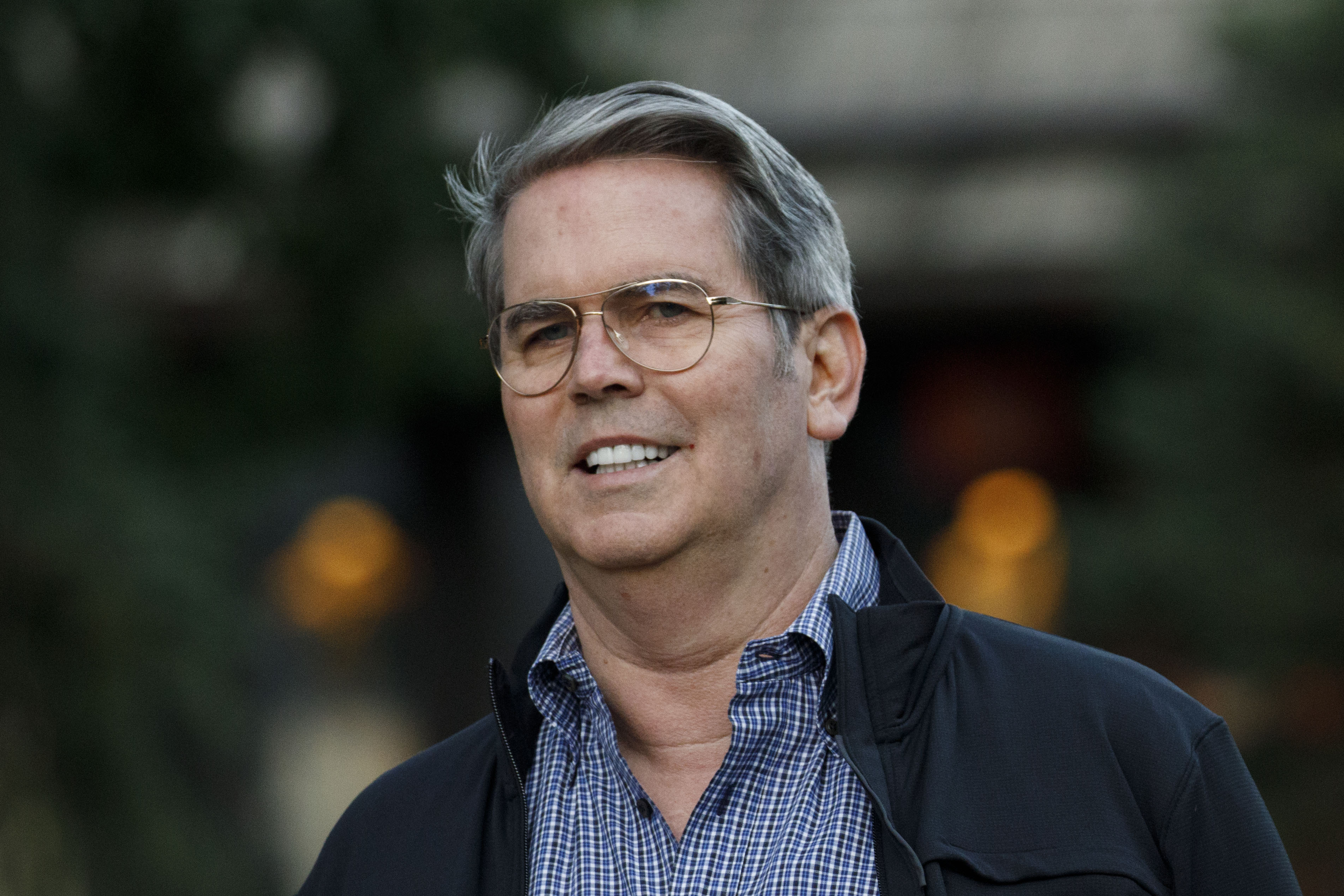

US Debt Limit Could Expire In August: Treasury's Bessent Sounds Alarm

Table of Contents

H2: Treasury Secretary Yellen's Warning and the X-Date

Treasury Secretary Yellen has repeatedly sounded the alarm about the rapidly approaching deadline. She has warned that the US government could reach its borrowing limit by early August, leading to the so-called "X-date" – the day the Treasury is no longer able to meet all of its financial obligations. To temporarily avoid this, the Treasury has already implemented extraordinary measures, such as suspending certain investments in federal retirement funds. However, these measures are temporary and will eventually be exhausted. Exceeding the US debt ceiling carries grave consequences:

- Default on US debt obligations: The US government could default on its debt, potentially impacting Social Security payments, military salaries, and other crucial government functions.

- Negative impact on global financial markets: A US default would send shockwaves through global financial markets, potentially leading to stock market crashes, increased volatility, and a loss of confidence in the US dollar.

- Credit rating downgrade for the United States: Rating agencies could downgrade the US credit rating, making it more expensive for the government to borrow money in the future.

- Economic recession: A US debt default could trigger a recession, leading to job losses, reduced consumer spending, and a decline in economic growth. The ripple effect would be felt worldwide.

H2: The Political Implications of the US Debt Ceiling Debate

The US debt ceiling debate is deeply entangled in partisan politics. Democrats and Republicans hold differing views on government spending and the appropriate level of the debt ceiling. Republicans have demanded spending cuts in exchange for raising the debt limit, while Democrats have argued that raising the debt limit is crucial to avoid a catastrophic default. This deadlock presents significant political hurdles:

- Partisan gridlock in Congress: The deeply divided Congress makes finding a bipartisan solution extremely challenging. Compromise is difficult to achieve, increasing the risk of inaction.

- Differing opinions on government spending: Fundamental disagreements on government spending levels and priorities further complicate negotiations. Reaching a consensus on a fiscally responsible path forward is proving difficult.

- Potential for government shutdown: The debt ceiling crisis is often intertwined with budget negotiations, increasing the risk of a government shutdown if no agreement is reached. A shutdown would further exacerbate economic uncertainty.

H2: Economic Consequences of a US Debt Default

A US debt default would have far-reaching and potentially devastating economic consequences, both domestically and internationally. The immediate impact would likely include:

- Increased interest rates for consumers and businesses: The cost of borrowing money would increase significantly, impacting everything from mortgages and auto loans to business investments.

- Stock market volatility and potential crashes: Financial markets would likely experience significant volatility, potentially leading to sharp declines in stock prices and a loss of investor confidence.

- Increased unemployment: A recession triggered by a default could lead to widespread job losses and increased unemployment.

- Reduced consumer confidence: Uncertainty and fear surrounding a default would likely lead to a decline in consumer spending, further hindering economic growth. Global supply chains could also be seriously disrupted.

H2: Potential Solutions and Pathways Forward

Several potential solutions could prevent a US debt default. However, each faces significant political challenges:

- Raising the debt ceiling without conditions: This is the simplest solution but faces strong opposition from Republicans who demand spending cuts.

- Raising the debt ceiling with conditions (e.g., spending cuts): This option could garner bipartisan support but requires negotiating significant spending reductions, a challenging task given the political divisions.

- Suspending the debt limit temporarily: A temporary suspension would provide more time for negotiations but would only delay the inevitable unless longer-term solutions are found.

- Exploring alternative budgetary mechanisms: This involves exploring alternative ways to manage government spending and borrowing, potentially through reforms to the budgeting process.

Conclusion: Addressing the Urgent US Debt Limit Challenge

The looming US debt ceiling deadline presents an urgent and serious challenge. Failure to act before August could result in a US debt default, triggering potentially catastrophic economic and political consequences. The implications – including a potential global financial crisis, widespread job losses, and severely damaged US credibility – cannot be overstated. Understanding the political hurdles and potential economic fallout is crucial to pushing for a swift resolution. We must urge our elected officials to prioritize finding a bipartisan solution to prevent this impending economic catastrophe. Stay informed on developments regarding the US debt limit by visiting the Treasury Department website [insert link] and following reputable news sources [insert links]. Contact your elected officials – their contact information can be found here [insert link] – and demand they work together to prevent a national crisis. The future of the US economy depends on it.

Featured Posts

-

Nyt Spelling Bee April 4 2025 Clues Hints And Pangram

May 10, 2025

Nyt Spelling Bee April 4 2025 Clues Hints And Pangram

May 10, 2025 -

Analyzing The Link Between The Fentanyl Crisis And U S China Trade Deals

May 10, 2025

Analyzing The Link Between The Fentanyl Crisis And U S China Trade Deals

May 10, 2025 -

Mental Illness And Violence Reframing The Monster Narrative

May 10, 2025

Mental Illness And Violence Reframing The Monster Narrative

May 10, 2025 -

Le Nucleaire Francais Et L Europe Declaration Du Ministre

May 10, 2025

Le Nucleaire Francais Et L Europe Declaration Du Ministre

May 10, 2025 -

Nigerias Petrol Prices The Roles Of Nnpc And Dangote

May 10, 2025

Nigerias Petrol Prices The Roles Of Nnpc And Dangote

May 10, 2025