US Dollar Gains Ground Against Major Peers Amid Easing Trump-Powell Tensions

Table of Contents

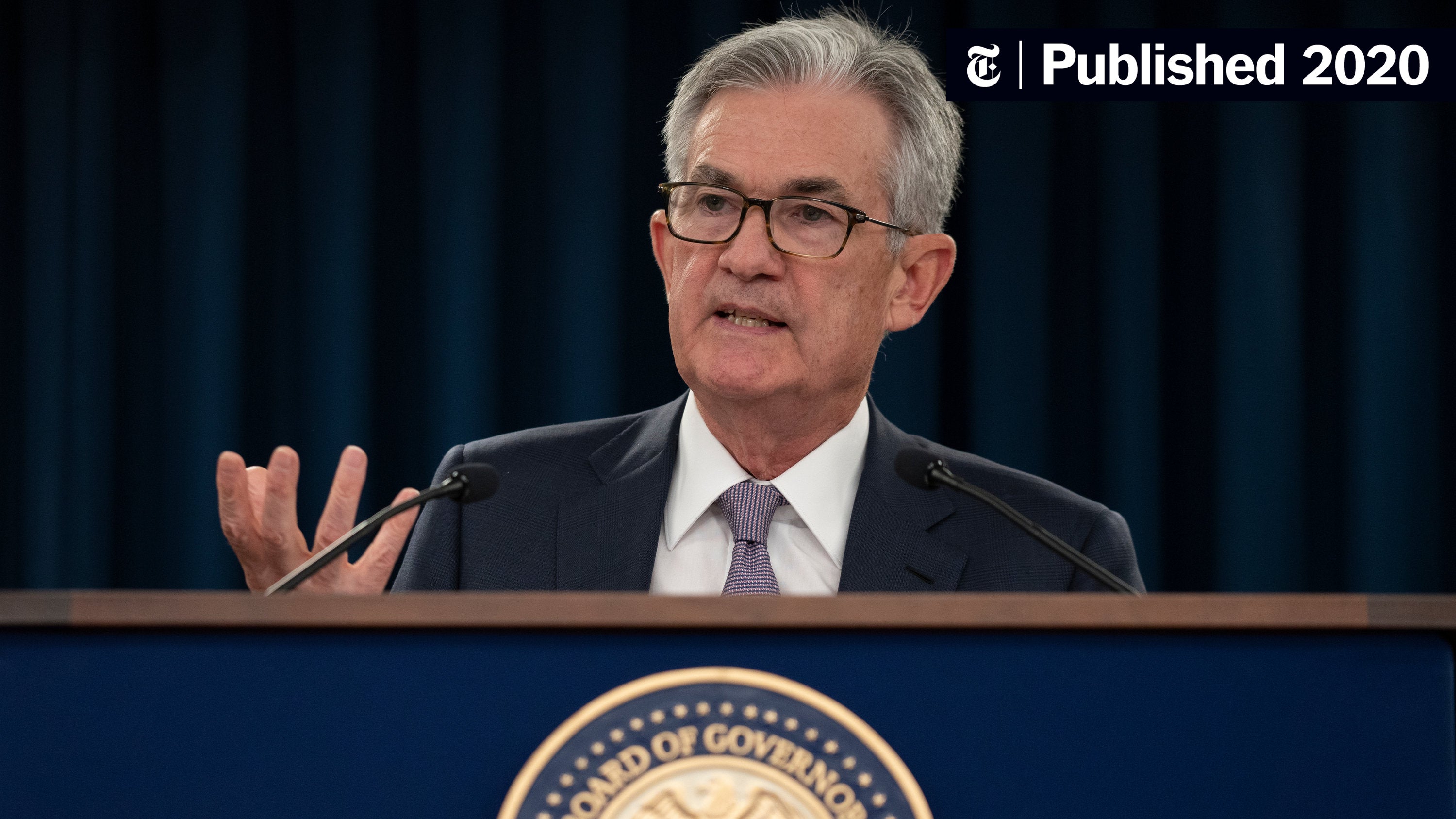

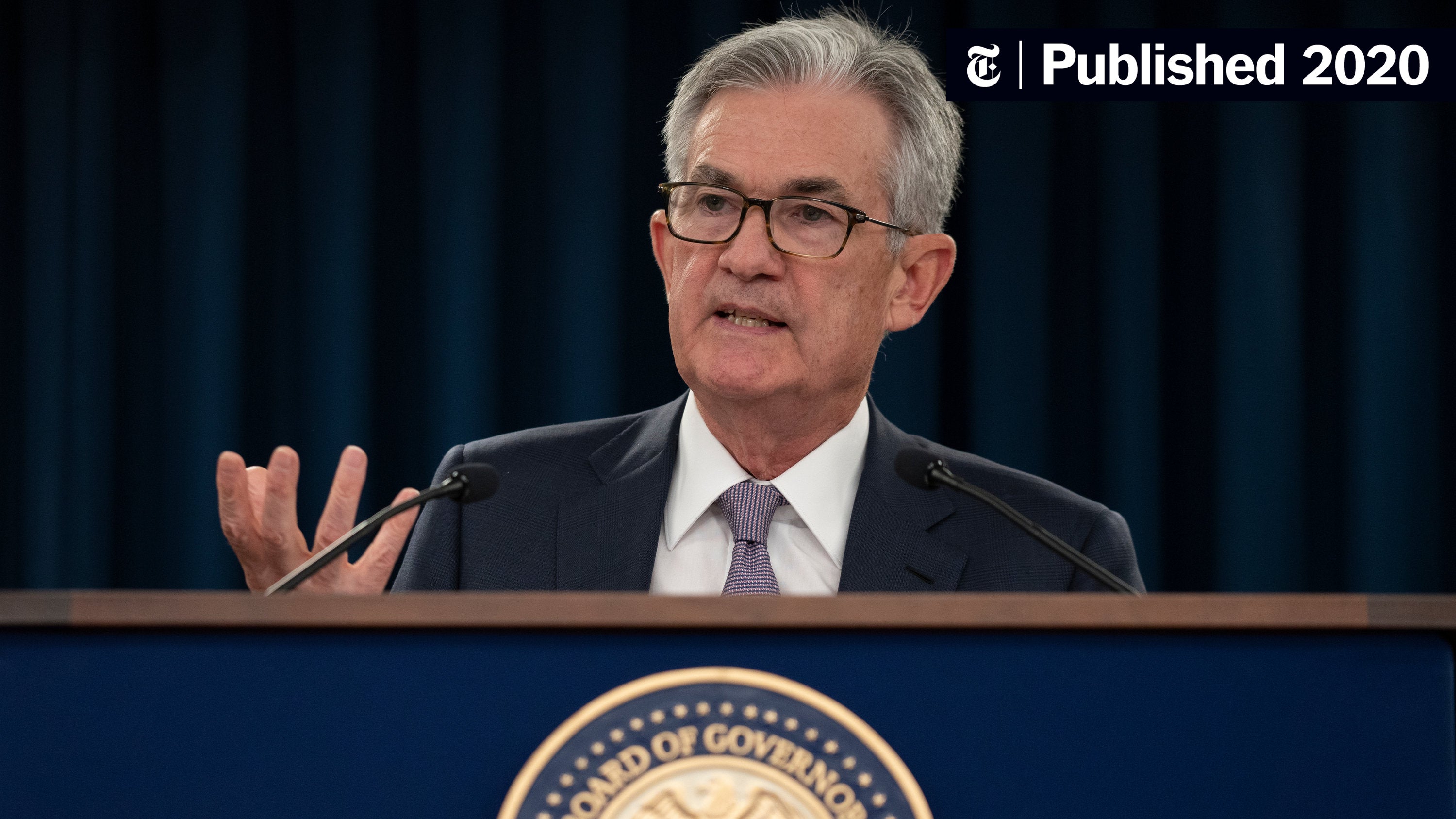

Easing Trump-Powell Tensions and Market Stability

The recent reduction in public clashes between President Trump and Federal Reserve Chairman Powell has significantly contributed to increased market stability and investor confidence. This calmer political climate is a key factor in the current US Dollar Gains Ground Against Major Peers trend.

Reduced Uncertainty Boosts Investor Confidence

The decrease in unpredictable policy pronouncements has had a profoundly positive impact on investor sentiment. The previous period of heightened tension created uncertainty, deterring investment. Now, the improved relationship between the President and the Fed Chair is:

- Lowering uncertainty: This encourages foreign investment in US assets, as investors feel more secure about the stability of the US economy.

- Reducing risk of unpredictable policy changes: This leads to a more predictable investment environment, attracting both domestic and international capital.

- Positively impacting US economic forecasts: Analysts are revising upwards their predictions for US economic growth, further boosting the dollar's appeal.

- Increasing demand for US dollar-denominated assets: This increased demand directly translates to a stronger US dollar in the forex market.

Impact on Interest Rates and Monetary Policy

The improved Trump-Powell dynamic also influences the Federal Reserve's monetary policy decisions and subsequent interest rate adjustments. This impacts the attractiveness of the dollar relative to other currencies.

- Potential for continued interest rate hikes (or stable rates): The Fed's ability to act independently, without undue political pressure, allows for more data-driven decisions on interest rates. A stable or rising interest rate environment makes US Treasury bonds more attractive to international investors.

- Impact on the US yield curve: Changes in interest rates affect the shape of the yield curve, influencing borrowing costs and investment strategies.

- Attractiveness of US Treasury bonds to international investors: Higher interest rates on US debt make these bonds more appealing to global investors, increasing demand for the US dollar.

- Influence on global capital flows: The US dollar's strength can attract capital from other countries, further strengthening its position in the forex market.

US Dollar's Performance Against Major Currencies

The strengthening of the US dollar is evident in its performance against major currencies. The US Dollar Index (DXY), a measure of the dollar's value against a basket of other currencies, has shown a significant increase.

Dollar Index Strength

The DXY has seen a notable rise, reflecting the US Dollar Gains Ground Against Major Peers trend. This is accompanied by specific gains against key currencies:

- Specific percentage gains against major currencies: For example, the EUR/USD pair has shown a decline, indicating dollar strength against the Euro. Similar trends are observable against the Yen (USD/JPY), Pound (GBP/USD), and other major currencies. (Specific percentage data would be included here in a published article).

- Charts and graphs illustrating the dollar's rise: (Visual representations would be included here).

- Analysis of technical indicators supporting the dollar's strength: Technical analysis of the forex market would support the observed trends. (Specific analysis would be included here).

- Mention specific trading pairs (e.g., EUR/USD, USD/JPY): Tracking these pairs allows investors and traders to monitor the dollar's performance against specific currencies.

Factors Contributing to Dollar Appreciation

While the easing of Trump-Powell tensions is a key driver, other factors contribute to the current US Dollar Gains Ground Against Major Peers situation:

- Global economic slowdown in other regions: Relative economic strength compared to other major economies boosts the dollar's appeal.

- Increased demand for safe-haven assets during times of uncertainty: The dollar is often viewed as a safe-haven currency, attracting investment during periods of global uncertainty.

- Comparison of US interest rates with other major economies: Higher US interest rates compared to other countries attract foreign investment.

- Potential impact of trade wars and geopolitical risks: Geopolitical instability can increase demand for the US dollar as a safe haven.

Implications for Global Markets and Businesses

The strengthening dollar has significant implications for international trade and businesses operating across borders.

Impact on International Trade

The stronger dollar affects US exports and imports, impacting trade balances:

- Increased cost of US goods for foreign buyers: This reduces the competitiveness of US exports in the global market.

- Decreased competitiveness of US exports: This can lead to a decline in US export volumes.

- Implications for US trade deficits: The impact on trade balances needs to be carefully considered.

- Impact on multinational corporations with operations in multiple currencies: Companies need to manage currency risk effectively.

Currency Risk Management

Given the recent fluctuations in the dollar's value, effective currency risk management is crucial for businesses:

- Strategies for hedging against currency risk: Businesses need to employ strategies to mitigate potential losses from currency fluctuations.

- Importance of currency forecasting and analysis: Accurate forecasting is essential for effective risk management.

- Role of foreign exchange derivatives in managing risk: Derivatives like forwards and options can help mitigate currency risk.

- Advice for businesses to mitigate potential losses: Seeking professional advice on currency risk management is strongly recommended.

Conclusion

The easing of tensions between President Trump and Federal Reserve Chairman Powell has significantly contributed to the current trend of US Dollar Gains Ground Against Major Peers. This improved relationship has boosted investor confidence, leading to increased demand for the dollar and its appreciation against other major currencies. Understanding the implications of this trend, including its effects on interest rates, international trade, and currency risk, is crucial for businesses and investors alike. The US Dollar strength is a dynamic situation, and staying informed is key.

To stay ahead of the curve and effectively navigate the evolving forex market landscape, subscribe to our updates, follow reputable financial news sources, and consider consulting with financial professionals for personalized guidance on managing currency risk in your business operations. Keep a close eye on the US Dollar strength and its impact on the global economy. Understanding the shifts in US Dollar Gains Ground Against Major Peers is essential for informed decision-making in today's interconnected world.

Featured Posts

-

High Rollers Exclusive First Look At The New John Travolta Action Movie

Apr 24, 2025

High Rollers Exclusive First Look At The New John Travolta Action Movie

Apr 24, 2025 -

Nbas Investigation Into Ja Morant Key Questions Answered

Apr 24, 2025

Nbas Investigation Into Ja Morant Key Questions Answered

Apr 24, 2025 -

My 77 Lg C3 Oled Tv Experience A Comprehensive Look

Apr 24, 2025

My 77 Lg C3 Oled Tv Experience A Comprehensive Look

Apr 24, 2025 -

Soaring California Gas Prices Prompt Governor Newsom To Seek Oil Industry Collaboration

Apr 24, 2025

Soaring California Gas Prices Prompt Governor Newsom To Seek Oil Industry Collaboration

Apr 24, 2025 -

24 Year Old Ella Bleu Travoltas New Look A Fashion Cover Story

Apr 24, 2025

24 Year Old Ella Bleu Travoltas New Look A Fashion Cover Story

Apr 24, 2025