US Economic Trends And Their Impact On Elon Musk's Net Worth

Table of Contents

The Influence of Inflation on Musk's Wealth

Impact of rising inflation on consumer spending and demand for Tesla vehicles

Inflation significantly impacts consumer behavior and, consequently, the demand for Tesla vehicles. Rising inflation erodes purchasing power, meaning consumers have less disposable income to spend on discretionary items like electric vehicles (EVs). This decreased consumer spending directly affects Tesla's sales figures and, ultimately, its stock price.

- Decreased consumer spending on discretionary items like electric vehicles: As inflation rises, consumers prioritize essential goods and services, delaying or forgoing purchases of luxury items such as Teslas.

- Increased production costs for Tesla due to inflation in raw materials: Inflation increases the cost of raw materials, components, and manufacturing, squeezing Tesla's profit margins and potentially impacting its ability to maintain competitive pricing.

- Potential impact on Tesla stock price due to reduced demand or increased production costs: Reduced demand and increased production costs put downward pressure on Tesla's stock price, directly affecting Musk's net worth.

Inflation's effect on the valuation of Tesla and SpaceX

Inflation's impact extends beyond consumer demand; it also affects investor sentiment and market valuations. Higher inflation typically leads to increased interest rates, impacting the overall stock market and valuations of growth stocks like Tesla and SpaceX.

- Increased interest rates to combat inflation impacting stock market valuations: Central banks often raise interest rates to combat inflation, leading to a decrease in the present value of future earnings, reducing stock valuations.

- Changes in investor confidence affecting Tesla and SpaceX stock prices: Uncertainty surrounding inflation can impact investor confidence, potentially leading to increased volatility and decreased valuations for Tesla and SpaceX.

- Relationship between inflation and the overall market capitalization of Musk's companies: The overall market capitalization of Tesla and SpaceX is directly influenced by investor perception of the inflationary environment and its impact on future growth prospects.

Interest Rate Hikes and Their Ripple Effect on Musk's Net Worth

The Federal Reserve's monetary policy and its consequences for Tesla and SpaceX

The Federal Reserve's monetary policy, particularly interest rate hikes, significantly impacts the performance of growth stocks like Tesla. Higher interest rates increase the cost of borrowing, making it more expensive for companies to expand operations and hindering growth.

- Higher interest rates making borrowing more expensive for business expansion: Tesla and SpaceX rely on borrowing to fund research, development, and expansion; higher interest rates increase these borrowing costs.

- Impact on investor preference for higher-yielding bonds over riskier stocks: Higher interest rates make bonds more attractive to investors, potentially diverting capital away from riskier growth stocks like Tesla and SpaceX.

- The effect of a changing economic outlook on future projections for Tesla and SpaceX: Interest rate hikes often signal a tightening economic outlook, potentially impacting future projections for Tesla and SpaceX, leading to reduced valuations.

Impact on private investments and funding rounds for SpaceX

Interest rate hikes also affect private equity and venture capital funding, crucial for SpaceX's ambitious projects. Increased interest rates raise the cost of capital, making it more expensive for SpaceX to secure funding.

- Increased cost of capital for SpaceX's ambitious projects: Higher interest rates directly increase the cost of debt financing for SpaceX's space exploration endeavors.

- Potential impact on the valuation of SpaceX during future funding rounds: A higher cost of capital can lead to lower valuations during funding rounds, impacting Musk's net worth.

- The influence of the overall economic climate on securing private investments: A generally negative economic climate fueled by high interest rates can make securing private investments more challenging for SpaceX.

The Role of Technological Innovation and Economic Growth

Tesla's contribution to the EV market and its economic impact

Tesla's contribution to the electric vehicle market is a significant driver of economic growth. Technological advancements, like those pioneered by Tesla, often fuel economic expansion by creating new industries, jobs, and opportunities.

- Tesla's role as a driving force in the electric vehicle revolution: Tesla's innovations have significantly accelerated the adoption of electric vehicles, creating a new market segment and driving related industries.

- The creation of jobs and economic opportunities linked to the EV industry: Tesla's success has led to the creation of numerous jobs within the company and across its supply chain, stimulating broader economic growth.

- Positive economic impact of Tesla's innovative technologies: Tesla's technological advancements contribute to overall economic productivity and efficiency, boosting economic growth.

SpaceX's contribution to the space exploration industry and its future potential

SpaceX's impact on space technology holds immense potential for future economic growth. Lowering the cost of space travel opens doors to new industries and opportunities, fostering economic expansion.

- SpaceX's role in lowering the cost of space travel: SpaceX's reusable rocket technology has drastically reduced the cost of space travel, opening access to space for a wider range of applications and industries.

- Potential for new economic opportunities arising from space exploration: Space-based industries such as satellite communication, space tourism, and asteroid mining hold immense potential for future economic growth.

- Long-term economic benefits associated with SpaceX's technological advancements: SpaceX's technological breakthroughs have long-term implications for economic growth and innovation across various sectors.

US Economic Trends and Their Impact on Elon Musk's Net Worth - Key Takeaways and Call to Action

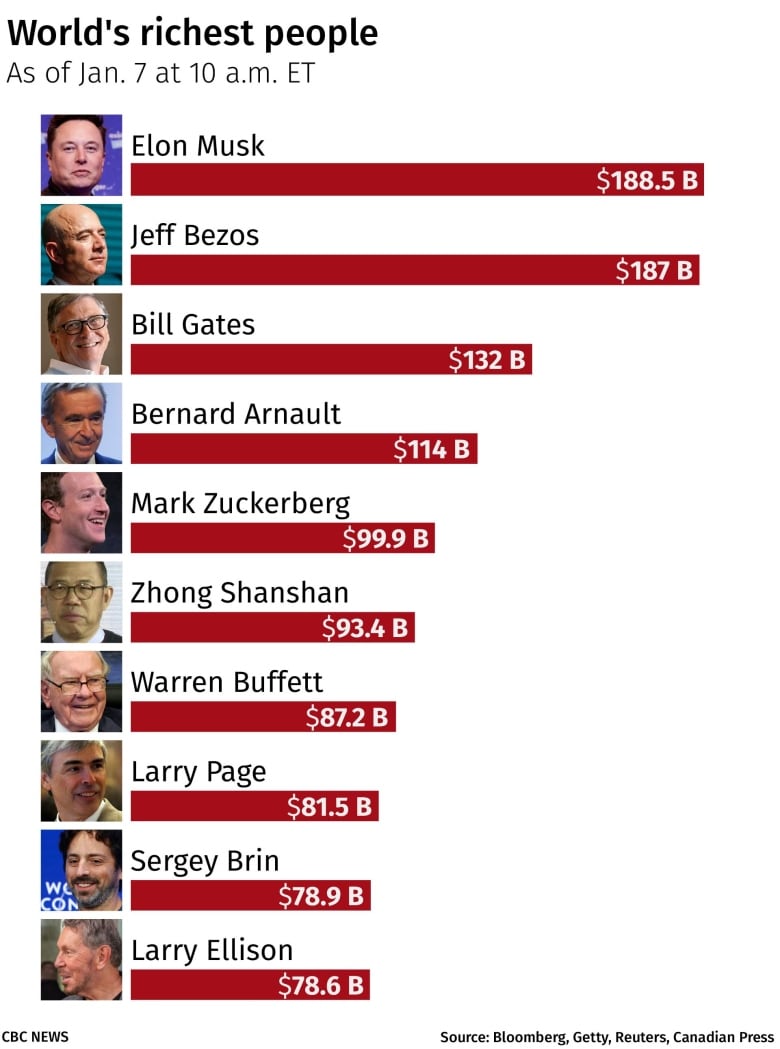

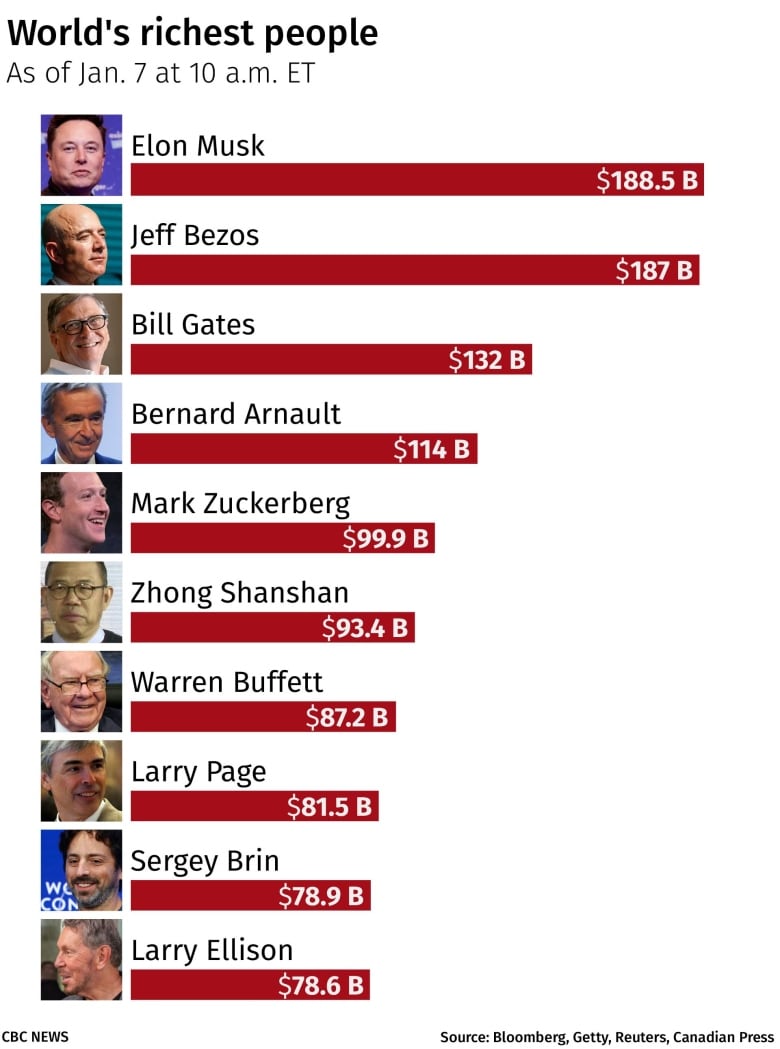

In summary, US economic trends, particularly inflation, interest rates, and technological innovation, significantly impact Elon Musk's net worth. The strong correlation between the health of the US economy and the valuation of Musk's business ventures highlights the interconnectedness of individual wealth and macroeconomic factors. Understanding these dynamics is crucial for comprehending the fluctuations in Musk's fortune. Understanding US economic trends is crucial for comprehending the fluctuating net worth of influential figures like Elon Musk. Stay informed about key economic indicators to better grasp the dynamics at play. For further reading on US economic indicators, visit [link to a relevant resource, e.g., Federal Reserve website].

Featured Posts

-

Colapinto To Williams Team Principals Comments On Doohans Position

May 09, 2025

Colapinto To Williams Team Principals Comments On Doohans Position

May 09, 2025 -

Is The Us Attorney Generals Fox News Strategy Effective An Analysis

May 09, 2025

Is The Us Attorney Generals Fox News Strategy Effective An Analysis

May 09, 2025 -

Joanna Page And Wynne Evans Bbc Show Dispute A Heated Exchange

May 09, 2025

Joanna Page And Wynne Evans Bbc Show Dispute A Heated Exchange

May 09, 2025 -

Wireless Mesh Networks Market 9 8 Cagr Projected Growth

May 09, 2025

Wireless Mesh Networks Market 9 8 Cagr Projected Growth

May 09, 2025 -

Trump Appoints Jeanine Pirro As Dc Top Prosecutor Fox News Role And Implications

May 09, 2025

Trump Appoints Jeanine Pirro As Dc Top Prosecutor Fox News Role And Implications

May 09, 2025