US Regulatory Developments Boost Bitcoin To Record High

Table of Contents

Increased Institutional Investment Driven by Regulatory Clarity

The rise of Bitcoin is not just fueled by retail investors; institutional money is pouring in, largely due to increasing regulatory clarity. This influx of capital is a significant factor in Bitcoin's price appreciation.

Grayscale Bitcoin Trust and SEC Approval

Grayscale's Bitcoin Trust (GBTC) has played a pivotal role in attracting institutional investors. GBTC offers a regulated pathway for institutions to gain exposure to Bitcoin without the complexities of directly managing cryptocurrency holdings.

- Increased Institutional Adoption: The SEC's (lack of) action against GBTC, often interpreted as tacit approval, significantly reduced regulatory uncertainty, leading to a massive increase in institutional investment.

- Reduced Regulatory Uncertainty: The existence of a publicly traded, SEC-reporting vehicle like GBTC provides comfort to institutional investors concerned about regulatory risks.

- Resulting Price Increase: The substantial influx of institutional capital through GBTC and similar vehicles directly contributed to Bitcoin's price appreciation. Data from [insert source and data here, e.g., CoinMetrics] shows a strong correlation between GBTC's AUM and Bitcoin's price.

The SEC's handling of GBTC, while not explicitly endorsing Bitcoin, has created a de facto approval, encouraging larger players to enter the Bitcoin market. This is a crucial step towards Bitcoin's mainstream acceptance.

Bank Involvement and Custody Solutions

Traditional banks are increasingly offering Bitcoin custody and related services, further legitimizing the cryptocurrency in the eyes of institutional investors.

- Examples of Banks Offering Bitcoin Services: [Insert examples of banks offering Bitcoin services here, citing sources]. This trend signifies a growing acceptance of Bitcoin within the traditional financial system.

- Increased Security and Legitimacy: Banks' involvement provides enhanced security for Bitcoin holdings and adds a layer of legitimacy that appeals to more risk-averse investors.

This institutional embrace signifies a significant shift. The involvement of established financial institutions validates Bitcoin as an asset class, attracting more conservative investors who previously avoided the space due to regulatory uncertainty and perceived risks.

Easing Regulatory Uncertainty Fuels Bitcoin Adoption

Reduced regulatory uncertainty is a key catalyst for broader Bitcoin adoption. Clearer guidelines regarding taxation, trading, and usage are encouraging both individual and institutional investors to participate.

Improved Regulatory Framework

Several state and federal initiatives are shaping a more favorable regulatory landscape for Bitcoin.

- Specific Examples of Beneficial Regulatory Actions: [Insert specific examples of state or federal bills or initiatives impacting Bitcoin positively, citing sources. Examples could include tax clarification bills or initiatives promoting blockchain technology]. These measures provide much-needed clarity and predictability.

- Impact on Reducing Ambiguity: These regulatory efforts significantly reduce ambiguity surrounding Bitcoin taxation, trading, and general usage, making it easier for businesses and individuals to operate legally within the Bitcoin ecosystem.

These developments address key concerns that previously hindered wider adoption, paving the way for increased market participation.

Reduced Regulatory Scrutiny on Exchanges

Decreased regulatory scrutiny on cryptocurrency exchanges plays a crucial role in increasing trading volume and price stability.

- Changes in Regulatory Oversight: [Discuss potential changes in regulatory oversight of exchanges and their effect on Bitcoin's liquidity and price stability. Cite sources and be specific].

- Influence on Bitcoin Liquidity and Price Stability: A less hostile regulatory environment encourages more robust and liquid exchanges, contributing to a more stable Bitcoin price.

Reduced fear of exchange crackdowns directly impacts trading confidence. Increased trading volume, in turn, fuels price appreciation and further drives Bitcoin adoption.

The Ripple Effect: Increased Interest and Demand for Bitcoin

Positive regulatory news creates a ripple effect, increasing public awareness and driving demand for Bitcoin.

Growing Public Awareness and Media Coverage

Positive regulatory developments are generating significantly more positive media coverage.

- Examples of Positive News Coverage: [Provide examples of positive news articles or media coverage focusing on Bitcoin's regulatory progress. Cite sources]. This increased media attention drives public interest and understanding.

- Influence on Retail Investor Participation: Positive media narratives play a crucial role in attracting retail investors, contributing to increased demand and driving up Bitcoin's price.

Positive press shapes public perception and normalizes Bitcoin as an investment asset.

Positive Sentiment and Price Prediction

The improved regulatory clarity has shifted market sentiment toward optimism.

- Expert Opinions and Price Forecasts: [Include expert opinions and price forecasts (with appropriate attribution). Be cautious and responsible with any price predictions, emphasizing inherent market volatility].

- Improved Regulatory Clarity Leads to Higher Price Expectations: As regulatory uncertainty decreases, investors become more confident, leading to higher price expectations and fueling further investment.

Conclusion

The recent surge in Bitcoin's price is directly linked to positive US regulatory developments. Increased institutional investment, reduced regulatory uncertainty, and growing public awareness have all contributed to this record high. These developments signal a potential paradigm shift in the relationship between government and cryptocurrency, paving the way for broader Bitcoin adoption.

Call to Action: Stay informed about the latest developments in US Bitcoin regulation and capitalize on this exciting market opportunity. Learn more about how to invest in Bitcoin safely and responsibly. Keep up-to-date on the latest Bitcoin news and analysis to make informed investment decisions. Consider diversifying your portfolio with Bitcoin, but always remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

2025 Memorial Day Travel When To Fly And When Not To

May 24, 2025

2025 Memorial Day Travel When To Fly And When Not To

May 24, 2025 -

Konchita Vurst Evrovidenie 2014 Coming Out V 13 Let I Ambitsii Stat Devushkoy Bonda

May 24, 2025

Konchita Vurst Evrovidenie 2014 Coming Out V 13 Let I Ambitsii Stat Devushkoy Bonda

May 24, 2025 -

Strengthening Ties Bangladeshs Return To Collaborative Growth In Europe

May 24, 2025

Strengthening Ties Bangladeshs Return To Collaborative Growth In Europe

May 24, 2025 -

8 Stock Market Surge On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Surge On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

Nicki Chapman Shares Her Stunning Chiswick Garden Design

May 24, 2025

Nicki Chapman Shares Her Stunning Chiswick Garden Design

May 24, 2025

Latest Posts

-

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

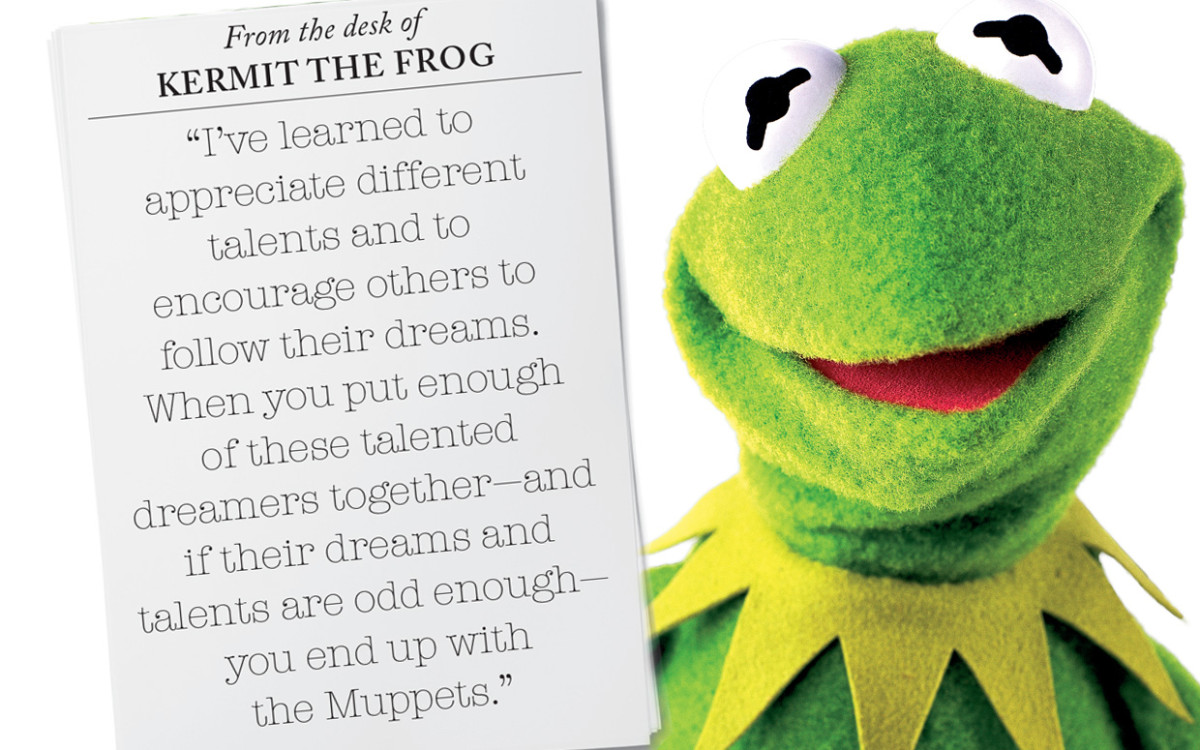

Graduation Inspiration Kermit The Frog At The University Of Maryland

May 24, 2025

Graduation Inspiration Kermit The Frog At The University Of Maryland

May 24, 2025 -

Commencement 2024 University Of Maryland Welcomes Famous Amphibian Speaker

May 24, 2025

Commencement 2024 University Of Maryland Welcomes Famous Amphibian Speaker

May 24, 2025 -

Kermits Words Of Wisdom A Look At His University Of Maryland Speech

May 24, 2025

Kermits Words Of Wisdom A Look At His University Of Maryland Speech

May 24, 2025 -

University Of Maryland Graduation Kermit The Frogs Motivational Message

May 24, 2025

University Of Maryland Graduation Kermit The Frogs Motivational Message

May 24, 2025