US Solar Panel Tariffs: The Impact On Southeast Asian Producers

Table of Contents

The Rise of Southeast Asia in Solar Panel Manufacturing

Southeast Asia's ascent in solar panel manufacturing is a story of strategic advantages and economic opportunity. Lower labor costs compared to traditional manufacturing hubs like China, coupled with government incentives promoting renewable energy development, have created a fertile ground for growth. Several factors contributed to this rapid expansion:

- Lower labor costs: Significantly lower wages compared to countries like China and the US make manufacturing in Southeast Asia more cost-effective.

- Government incentives: Many Southeast Asian nations offer tax breaks, subsidies, and streamlined regulatory processes to attract foreign investment in solar energy projects.

- Strategic location: The region's proximity to major markets in Asia and the Pacific facilitates efficient transportation and distribution.

Key players, both multinational corporations and local businesses, have established a significant presence. While precise market share data fluctuates, Vietnam, Malaysia, and Thailand stand out as major contributors:

- Vietnam: Focuses heavily on polysilicon and cell production, positioning itself as a key link in the solar panel supply chain.

- Malaysia: Specializes in the assembly and module manufacturing stages, leveraging its established electronics manufacturing capabilities.

- Thailand: Shows increasing investment in solar panel technology and manufacturing, aiming to become a more significant player in the global market. This growth is fueled by government initiatives promoting renewable energy adoption within the country.

The Immediate Impact of US Solar Panel Tariffs on Production and Exports

The US imposed tariffs on imported solar panels, significantly impacting Southeast Asian producers. These tariffs, implemented in [Insert specific dates and tariff percentages here], immediately affected export volumes to the US market. The consequences were swift and substantial:

- Loss of US market share: Southeast Asian producers experienced a sharp decline in exports to the US, as American buyers sought alternative sources or absorbed higher costs. [Include a chart or graph here visually demonstrating the decline in exports].

- Increased production costs: To maintain competitiveness in the US market, some producers attempted to circumvent tariffs through various means, leading to increased production costs.

- Shift in export focus: Many companies redirected their efforts towards other markets, particularly in the European Union and other Asian countries, attempting to mitigate the impact of the US tariffs.

Long-Term Economic and Social Consequences for Southeast Asian Economies

The long-term effects of US solar panel tariffs extend beyond immediate export figures, impacting employment, foreign investment, and overall economic growth.

- Job losses and potential for unemployment: Reduced exports and factory closures due to decreased demand directly affected employment levels within the solar panel industry. The scale of job losses varies across countries.

- Reduced foreign direct investment (FDI): The uncertainty created by the tariffs has impacted investor confidence, potentially slowing down future investments in the renewable energy sector within the region.

- Government responses and policy adjustments: Governments in Southeast Asia are responding with various policies aimed at supporting the solar industry, promoting diversification, and attracting new investments.

- Opportunities for innovation and technological upskilling: The challenges posed by the tariffs have spurred innovation, pushing producers to invest in research and development to improve efficiency, lower costs, and develop new technologies.

Strategies Adopted by Southeast Asian Solar Panel Producers to Mitigate the Impact

Facing significant headwinds, Southeast Asian solar panel producers have employed several strategies to counter the impact of US tariffs:

- Diversification of export markets: Expanding into new markets in Europe, Asia, and other regions has helped reduce reliance on the US market.

- Investment in R&D and technological innovation: Improving production efficiency, developing more advanced solar panel technology, and reducing reliance on imported components are key strategies.

- Cost-cutting measures: Streamlining operations, improving supply chain management, and negotiating better deals with suppliers have been implemented to enhance competitiveness.

- Negotiations with the US government: Some companies have engaged in lobbying efforts to influence trade policy and potentially reduce or eliminate the tariffs.

The Future of Solar Panel Production in Southeast Asia in Light of US Tariffs

The long-term outlook for Southeast Asian solar panel producers remains complex. Several scenarios are plausible:

- Continued growth despite tariffs, albeit at a slower pace: The inherent strengths of the region, including lower labor costs and government support, will likely ensure continued growth, although the rate might be slower than anticipated.

- Shift towards regional supply chains within Asia: The tariffs might encourage a shift towards more localized supply chains within Asia, reducing reliance on distant markets like the US.

- Increased focus on domestic markets within Southeast Asia: Growing domestic demand for solar energy within Southeast Asian countries provides a crucial avenue for growth and reduces dependence on exports.

Conclusion: Understanding and Adapting to the Shifting Landscape of US Solar Panel Tariffs

The US solar panel tariffs have undeniably presented significant challenges for Southeast Asian producers. However, the region's inherent advantages, coupled with proactive adaptation strategies, suggest a resilient future for the industry. While the immediate impact was a decline in US exports and job concerns, long-term consequences are likely to be shaped by governmental responses, technological innovation, and market diversification. Understanding the evolving dynamics of US solar panel tariffs and the adaptive capacity of Southeast Asian solar energy producers is crucial for navigating this complex landscape. Stay informed on the evolving landscape of US solar panel tariffs and their continuing impact on Southeast Asian solar energy producers by subscribing to our newsletter!

Featured Posts

-

How Selena Gomez Scored A Top 10 Hit With An Unreleased Track

May 30, 2025

How Selena Gomez Scored A Top 10 Hit With An Unreleased Track

May 30, 2025 -

Sixth Masters 1000 Title For Alcaraz Monte Carlo Domination

May 30, 2025

Sixth Masters 1000 Title For Alcaraz Monte Carlo Domination

May 30, 2025 -

The Lingering Shadow Of Daniel Cormier Jon Joness Unfinished Business

May 30, 2025

The Lingering Shadow Of Daniel Cormier Jon Joness Unfinished Business

May 30, 2025 -

Experience Bioluminescent Waves Best So Cal Beaches And Times

May 30, 2025

Experience Bioluminescent Waves Best So Cal Beaches And Times

May 30, 2025 -

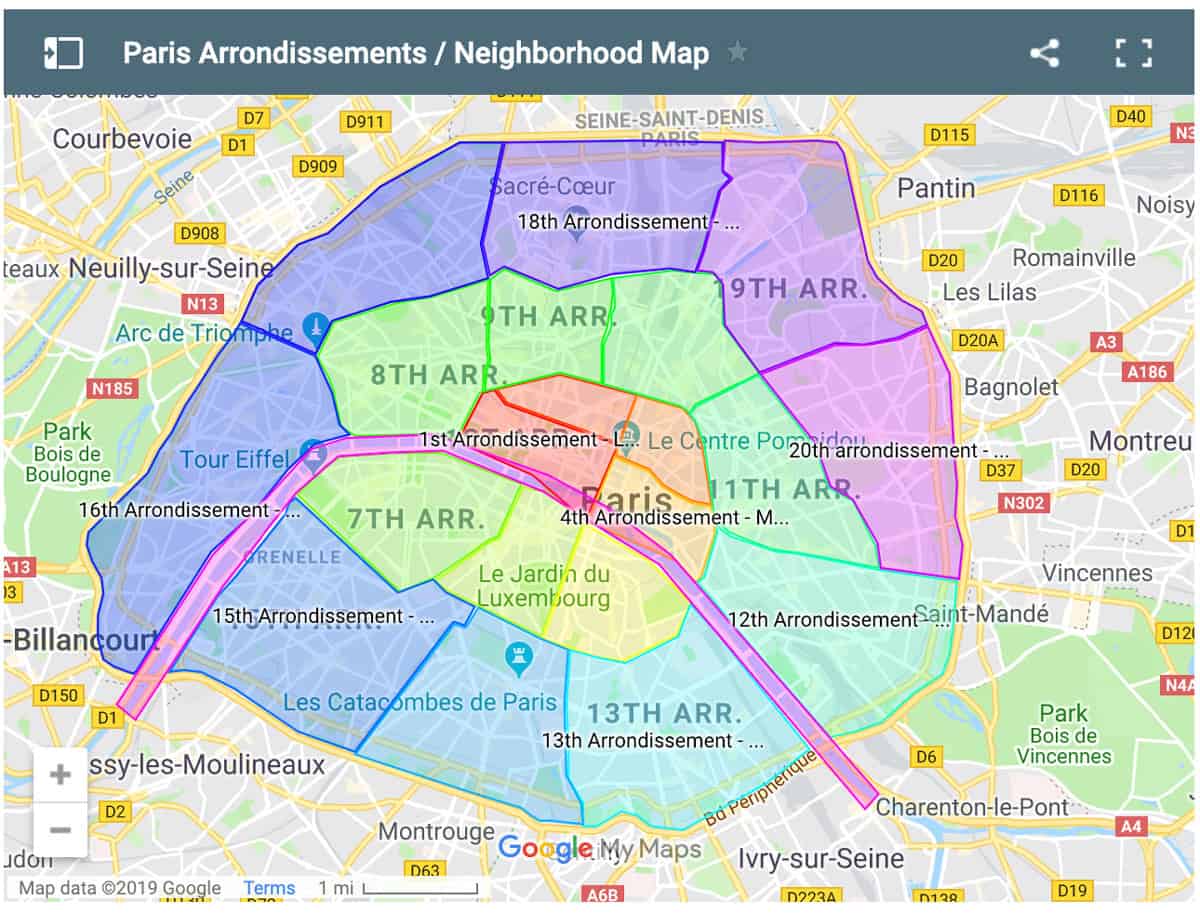

Where To Stay In Paris A Guide To The Citys Best Neighborhoods

May 30, 2025

Where To Stay In Paris A Guide To The Citys Best Neighborhoods

May 30, 2025

Latest Posts

-

Le Combat Des Salaries D Amilly Contre La Vente De L Usine Sanofi

May 31, 2025

Le Combat Des Salaries D Amilly Contre La Vente De L Usine Sanofi

May 31, 2025 -

Sanofi La Vente De L Usine D Aspegic A Amilly Suscite La Mobilisation

May 31, 2025

Sanofi La Vente De L Usine D Aspegic A Amilly Suscite La Mobilisation

May 31, 2025 -

Amilly Luttes Contre La Cession Du Site De Production Sanofi

May 31, 2025

Amilly Luttes Contre La Cession Du Site De Production Sanofi

May 31, 2025 -

Sanofi Investiert 1 9 Milliarden Us Dollar In Neue Autoimmuntherapie

May 31, 2025

Sanofi Investiert 1 9 Milliarden Us Dollar In Neue Autoimmuntherapie

May 31, 2025 -

Sanofi Etend Son Portefeuille Acquisition D Un Anticorps De Dren Bio

May 31, 2025

Sanofi Etend Son Portefeuille Acquisition D Un Anticorps De Dren Bio

May 31, 2025