US Tech IPO Freeze: Tariffs Chill Investor Sentiment

Table of Contents

The Impact of Tariffs on Investor Confidence

Trade tensions and the imposition of tariffs have created a climate of uncertainty that is profoundly impacting investor confidence. High-risk investments, such as tech IPOs, are particularly vulnerable in this environment. Investors are hesitant to commit significant capital when facing unpredictable variables impacting profitability and long-term growth.

Tariffs directly impact tech companies’ supply chains and profitability, leading to reduced IPO valuations. Increased costs associated with imported components or raw materials squeeze profit margins, making a company less attractive to potential investors. This translates to lower valuations and a decreased likelihood of proceeding with an IPO.

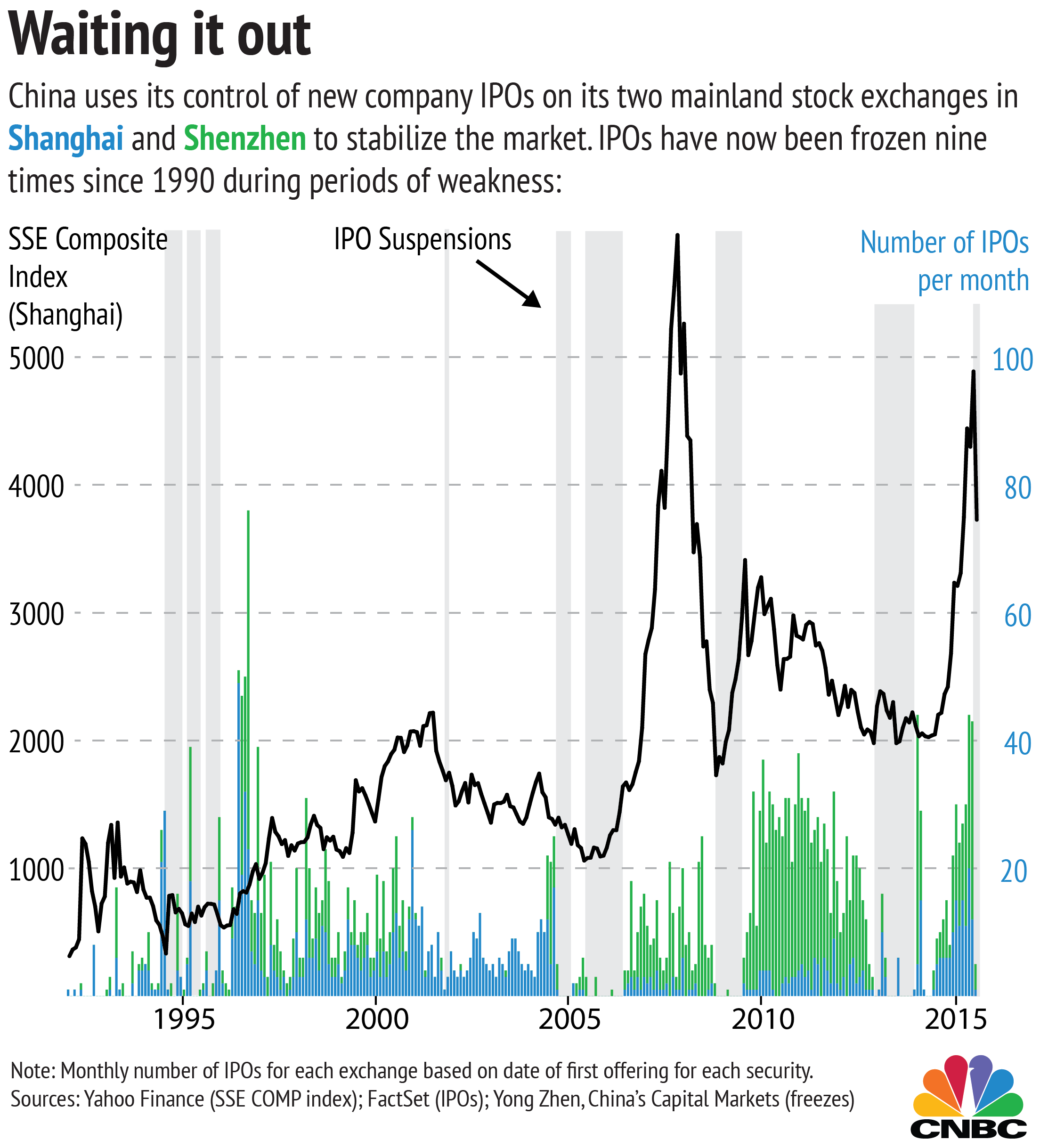

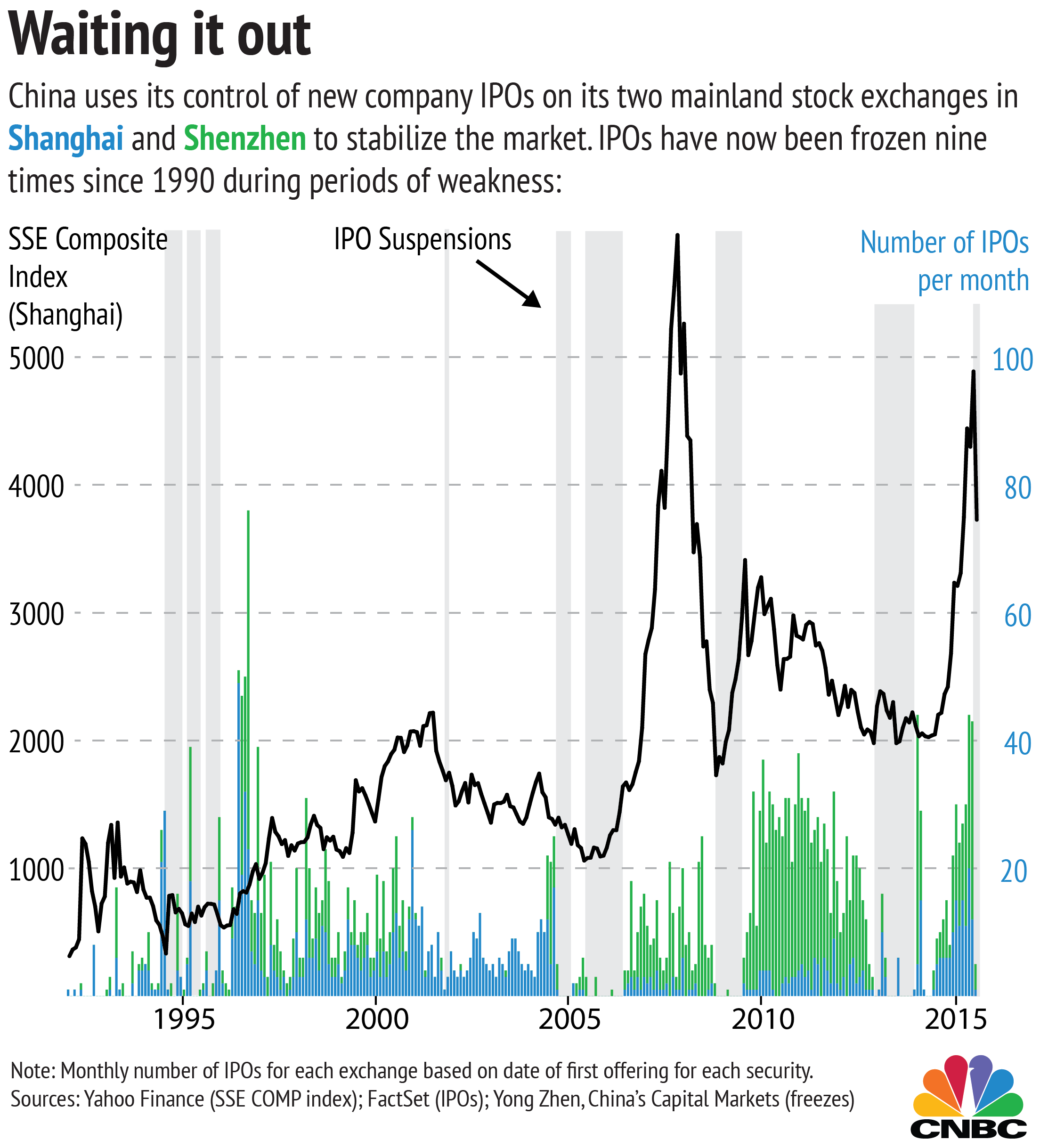

Statistics clearly show a correlation between tariff increases and a decline in tech IPO activity. For example, [insert relevant statistic or data showing correlation between tariffs and decreased IPOs – cite source]. This data underscores the tangible impact of tariffs on the decision-making process for both companies and investors.

- Increased operational costs due to tariffs: Higher import duties translate directly to increased production costs, reducing profit margins.

- Uncertainty about future revenue streams: The unpredictability of tariff policies makes it difficult for companies to forecast future revenue, deterring investors.

- Reduced investor confidence in long-term growth prospects: Uncertainty about the future economic landscape reduces investor confidence in the long-term viability of tech companies, leading to reluctance to invest.

- Examples of tech companies delaying or canceling IPOs due to tariff concerns: [Cite specific examples of companies that have delayed or cancelled IPOs, citing credible sources].

Geopolitical Risks and Their Influence on the Tech IPO Market

Beyond tariffs, broader geopolitical risks further contribute to market uncertainty and investor hesitancy. Trade wars, political instability in key markets, and even unexpected global events can create a risk-averse environment where investors favor safer, more established investments.

The current global economic slowdown also plays a role. Investors are less likely to take risks with growth stocks, such as those often associated with tech IPOs, when a recession or economic downturn is a possibility. This shift in sentiment leads to a decrease in investment in the tech sector and a slowdown in IPO activity.

- Examples of recent geopolitical events affecting the tech industry: [Cite specific examples of recent geopolitical events and explain their impact on the tech industry].

- Analysis of how these events impact investor confidence: [Analyze how these events have created uncertainty and reduced investor confidence].

- Discussion on the flight to safety: [Discuss how investors are moving toward safer investments like government bonds or blue-chip stocks].

Alternative Investment Opportunities and Their Role in the Freeze

The current environment has made alternative investment opportunities more attractive compared to tech IPOs. Investors are seeking stability and lower risk, leading to a shift in preference from growth stocks often associated with tech IPOs to more defensive investments.

The allure of these alternatives lies in their perceived lower risk and potentially higher, more predictable returns in the current climate. This shift in investor preference is a significant factor contributing to the US tech IPO freeze.

- Examples of alternative investment options attracting investors: [Include examples such as government bonds, established blue-chip stocks, real estate, and private equity].

- Comparison of risk profiles between tech IPOs and alternative investments: [Compare the risk profiles of tech IPOs with alternative investments, highlighting the reasons for the shift in investor preference].

- Analysis of expected returns in each sector: [Analyze expected returns in different sectors, explaining why alternative investments might seem more attractive in the current market].

Potential Future Scenarios for US Tech IPOs

The future of the US tech IPO market depends heavily on several factors, including potential tariff reductions, resolutions to trade disputes, and overall improvements in global economic conditions. Several scenarios are possible:

- Optimistic scenario: Resolution of trade disputes and a reduction in tariffs could lead to renewed investor confidence, potentially triggering a resurgence in tech IPO activity. A robust economic recovery would further enhance this positive outlook.

- Pessimistic scenario: Continued trade tensions, escalating tariffs, and a prolonged global economic slowdown could lead to a prolonged IPO freeze, with tech companies delaying or forgoing public offerings altogether.

- Neutral scenario: A gradual recovery is possible, with investors adopting a cautious approach, leading to a slow but steady increase in tech IPO activity.

Conclusion: Navigating the Chill – The Future of US Tech IPOs

The current US tech IPO freeze is a complex issue with multiple contributing factors. This article has highlighted the significant role of tariffs in chilling investor sentiment, coupled with broader geopolitical uncertainties and the appeal of alternative investment options. Tariffs are undeniably a major contributing factor to the current situation, creating significant uncertainty for both companies and investors.

The future of the US tech IPO market remains uncertain, depending on future developments in trade policy, geopolitical stability, and global economic conditions. Staying informed about these crucial factors is essential for understanding the dynamics of this crucial sector. We urge you to remain updated on developments in trade policy and geopolitical events affecting the US tech IPO market. Regularly review reputable financial news sources and industry analyses to track the progress of the US tech IPO freeze and its eventual thaw.

Featured Posts

-

How To Watch Captain America Brave New World Online Streaming Guide

May 14, 2025

How To Watch Captain America Brave New World Online Streaming Guide

May 14, 2025 -

Sinner Advances To Italian Open Round Of 16 Osakas Early Exit

May 14, 2025

Sinner Advances To Italian Open Round Of 16 Osakas Early Exit

May 14, 2025 -

Teammate Confirms Liverpool Transfer Targets Summer Move

May 14, 2025

Teammate Confirms Liverpool Transfer Targets Summer Move

May 14, 2025 -

Dove Passa Il Giro Di Milano Sanremo 2025 Percorso E Strade Chiuse In Lombardia

May 14, 2025

Dove Passa Il Giro Di Milano Sanremo 2025 Percorso E Strade Chiuse In Lombardia

May 14, 2025 -

Johan Derksen Onthult Donny Huijsen En De Verkeerde Vrienden Van Zijn Zoon Dean

May 14, 2025

Johan Derksen Onthult Donny Huijsen En De Verkeerde Vrienden Van Zijn Zoon Dean

May 14, 2025