USD Strengthens Against Major Currencies As Trump Softens Stance On Fed

Table of Contents

Trump's Shift in Fed Policy Rhetoric

President Trump's previous outspoken criticisms of the Federal Reserve's interest rate hikes and perceived independence had fueled considerable market volatility. His frequent public pronouncements questioning the Fed's autonomy created uncertainty among investors, impacting the confidence in the US economy and influencing the value of the USD. However, a notable shift in his rhetoric has been observed recently.

- Reduced Public Criticism: Recent statements suggest a more hands-off approach from the President, reducing the uncertainty that previously plagued the markets. This change in tone has been widely interpreted as a sign of increased respect for the Fed's independence.

- Impact on Investor Sentiment: This reduced uncertainty has demonstrably led to increased confidence in the US economy. Investors, feeling more secure about the economic outlook, are increasingly seeking USD-denominated assets, driving up demand and strengthening the dollar.

- Specific Examples: For instance, [insert link to relevant news article showcasing a recent statement by Trump indicating a more conciliatory stance towards the Fed]. This shift, contrasted with previous pronouncements [insert link to a news article showing past criticism], clearly demonstrates a change in his approach. The impact of this change is visible in the strengthening USD.

Impact on Major Currencies

The strengthening USD has had a notable impact on major global currencies. We've seen significant gains for the USD against several key players in the forex market:

- USD/EUR: The Euro (EUR) has weakened against the USD, with the EUR/USD exchange rate falling [insert percentage and timeframe]. This reflects a shift in investor sentiment away from the Eurozone and towards the US dollar.

- USD/JPY: Similarly, the Japanese Yen (JPY) has also depreciated against the USD, with the USD/JPY pair rising [insert percentage and timeframe]. This movement indicates a flight to safety into the USD, a common trend during periods of economic uncertainty elsewhere.

- USD/GBP: The British Pound (GBP) has also experienced downward pressure against the USD, with the USD/GBP pair increasing [insert percentage and timeframe]. This can be attributed to a combination of factors including Brexit-related uncertainties and the overall strengthening of the dollar.

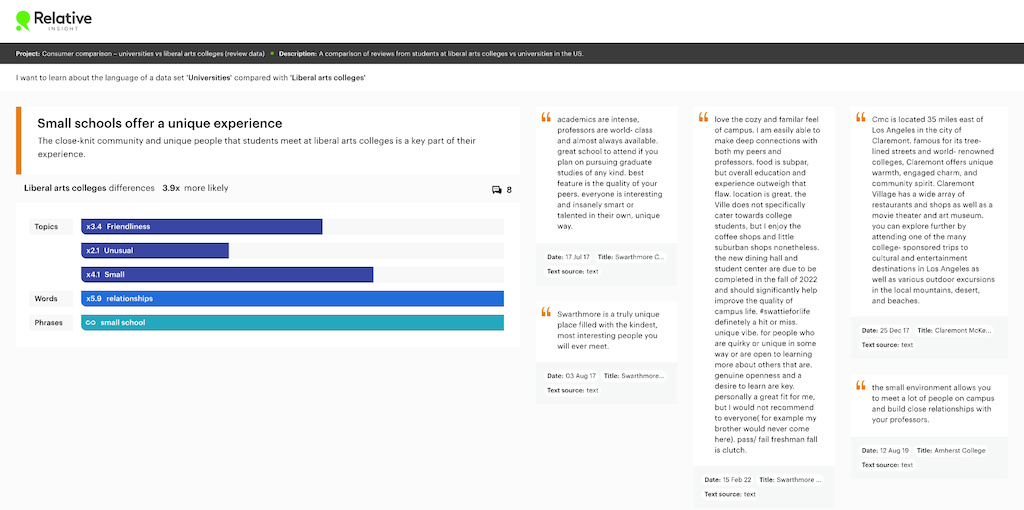

[Insert chart or graph visually showcasing the recent currency exchange rate movements between the USD and EUR, JPY, and GBP.]

This shifting landscape in currency exchange rates has substantial implications for international trade and investment. Businesses involved in importing and exporting goods are directly affected by these fluctuations, impacting their profitability and competitiveness in the global market.

Analysis of the Euro (EUR/USD)

Beyond Trump's softened stance on the Fed, other factors influence the EUR/USD exchange rate. The Eurozone's economic performance, including growth rates, inflation, and political stability, plays a crucial role.

- Eurozone Economic Conditions: Current economic challenges within the Eurozone [briefly discuss current economic conditions in the Eurozone, e.g., slow growth, potential recession in certain countries], contribute to a weaker Euro.

- Political Uncertainty: Political instability or major policy shifts within the Eurozone can also create uncertainty and pressure the EUR/USD rate.

- Future Predictions: Based on current trends and economic forecasts, the EUR/USD pair is projected to [insert cautiously worded prediction about future EUR/USD movement]. However, unforeseen events could alter this forecast.

Implications for the US and Global Economy

A strong USD has both advantages and disadvantages for the US and the global economy.

- Benefits for the US: Cheaper imports can benefit US consumers, leading to lower prices for goods and services.

- Drawbacks for the US: A strong USD makes US exports more expensive, potentially impacting US businesses' competitiveness in international markets and hindering economic growth.

- Global Trade Imbalances: A strong USD can exacerbate global trade imbalances, as it makes US goods more expensive for international buyers while making imports cheaper for US consumers. This can lead to trade deficits for the US and surpluses for other countries.

- Inflation and Interest Rates: The USD's strength can influence inflation and interest rates both domestically and internationally. A stronger USD can put downward pressure on inflation in the US, but it can also impact interest rates in other countries.

Conclusion

The recent strengthening of the USD is largely attributable to President Trump's altered stance toward the Federal Reserve's policies. This shift has reduced market uncertainty, thereby bolstering investor confidence and fueling demand for the US dollar. This has significant repercussions on major currencies globally and broad implications for both the US and global economies. Understanding the interplay between political rhetoric, central bank policies, and USD strength is critical for navigating the forex market.

Call to Action: Stay informed about the ever-evolving dynamics of the USD and its impact on global markets. Continue monitoring the USD's performance against major currencies to make well-informed decisions related to currency exchange and international investments. Understanding USD strength and its drivers is crucial for effective financial planning.

Featured Posts

-

Herros Hot Shots Cavs Skills Prowess Nba All Star Weekend Winners

Apr 24, 2025

Herros Hot Shots Cavs Skills Prowess Nba All Star Weekend Winners

Apr 24, 2025 -

Vote Informed William Watsons Analysis Of The Liberal Platform

Apr 24, 2025

Vote Informed William Watsons Analysis Of The Liberal Platform

Apr 24, 2025 -

Nba All Star Weekend Green Moody And Hield Among Participants

Apr 24, 2025

Nba All Star Weekend Green Moody And Hield Among Participants

Apr 24, 2025 -

Wildfire Betting In Los Angeles A Growing Concern

Apr 24, 2025

Wildfire Betting In Los Angeles A Growing Concern

Apr 24, 2025 -

From Scatological Data To Engaging Audio An Ais Poop Podcast Revolution

Apr 24, 2025

From Scatological Data To Engaging Audio An Ais Poop Podcast Revolution

Apr 24, 2025