VMware Price Hike Controversy: AT&T Challenges Broadcom's Acquisition

Table of Contents

Broadcom's Acquisition of VMware: A Closer Look

Broadcom's $61 billion acquisition of VMware, announced in May 2022, aims to create a dominant player in the infrastructure software market. Broadcom, known for its semiconductor chips and networking solutions, has a history of acquisitions, often leading to concerns about potential price increases for acquired companies' products. This deal, if finalized, will significantly reshape the tech landscape.

- Acquisition details: Announced May 26, 2022; expected closing in 2023 (pending regulatory approvals).

- Broadcom's market position and strategy: Broadcom is a leading provider of semiconductor and infrastructure software solutions. This acquisition expands their portfolio significantly. Their strategy often involves integrating acquired technologies into their existing offerings.

- Potential synergies and benefits (for Broadcom): The merger promises cost savings through economies of scale and the potential for cross-selling VMware's virtualization solutions to Broadcom's existing customer base.

- Relevant links: [Link to official press release] [Link to relevant news article 1] [Link to relevant news article 2]

AT&T's Concerns Regarding VMware Price Hikes

AT&T, a massive telecommunications company, relies heavily on VMware's virtualization solutions for its data center operations. They've publicly expressed serious concerns that Broadcom's acquisition could lead to substantial VMware price hikes, impacting their operational budgets and potentially forcing them to reconsider their technology choices.

- Specific examples of VMware products used by AT&T: vSphere, vCenter, NSX.

- Quantitative estimates of potential price increase impacts: While specific numbers haven't been publicly released by AT&T, analysts suggest potential increases ranging from 10% to 20% or more for various VMware products.

- AT&T's lobbying efforts and regulatory challenges: AT&T is actively engaging with regulatory bodies to highlight their concerns and potentially block or modify the acquisition. They've likely submitted formal comments to agencies reviewing the deal.

- Quotes from AT&T executives expressing concerns: [Insert relevant quotes from AT&T executives if available – cite the source]

The Impact on Competition in the Virtualization Market

The Broadcom-VMware merger has raised significant antitrust concerns. VMware is a major player in the virtualization market, and this acquisition could reduce competition, potentially leading to higher prices and less innovation. Competitors like Nutanix and Citrix may see a surge in demand, but the overall market dynamics will likely shift.

- Key VMware competitors: Nutanix, Citrix, Microsoft Azure Stack HCI.

- Potential implications for innovation and product development: Reduced competition could stifle innovation as there's less pressure to improve offerings or offer competitive pricing.

- Market share and concentration: The merger would significantly increase market concentration, potentially creating a dominant player with less incentive to compete on price.

- Regulatory scrutiny and antitrust concerns: Regulatory bodies are carefully examining the potential anti-competitive effects of the acquisition, particularly concerning potential VMware pricing increases.

Regulatory Scrutiny and Antitrust Concerns

The FTC (Federal Trade Commission) in the US and the EU Commission are scrutinizing the Broadcom-VMware deal for potential antitrust violations. Their investigations are focused on the impact on competition and the potential for higher VMware pricing for consumers. The outcome of these reviews will be crucial in determining the fate of the acquisition.

- Details on ongoing investigations and hearings: [Insert details on ongoing investigations and hearings, including links to relevant documents if available]

- Potential outcomes of regulatory review: Approval (with or without conditions), rejection, or a request for further information from Broadcom.

- Links to relevant regulatory documents and filings: [Insert links to relevant documents and filings from regulatory bodies]

- Expert opinions on the likelihood of approval or rejection: [Include summaries of expert opinions and analysis from industry analysts].

Conclusion

The Broadcom acquisition of VMware presents a complex situation, with AT&T's concerns regarding potential VMware price hikes raising significant antitrust issues. Regulatory scrutiny will play a crucial role in determining the outcome, impacting competition within the virtualization market and the future pricing of VMware products. The ongoing debate highlights the importance of considering the long-term effects of large-scale mergers and acquisitions on consumers and the broader technology landscape. The potential for a VMware price hike remains a key uncertainty.

Call to Action: Stay informed about the latest developments in the VMware price hike controversy and the Broadcom acquisition. Follow our updates on the impact of this deal on VMware pricing and the future of the virtualization market. Continue the conversation by sharing your thoughts on the potential impact of the VMware price hike and the Broadcom acquisition.

Featured Posts

-

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025 -

Nuovi Dazi Stati Uniti Cosa Aspettarsi Per I Prezzi Della Moda

May 24, 2025

Nuovi Dazi Stati Uniti Cosa Aspettarsi Per I Prezzi Della Moda

May 24, 2025 -

Kazakhstan Triumfalnoe Vozvraschenie V Final Kubka Billi Dzhin King

May 24, 2025

Kazakhstan Triumfalnoe Vozvraschenie V Final Kubka Billi Dzhin King

May 24, 2025 -

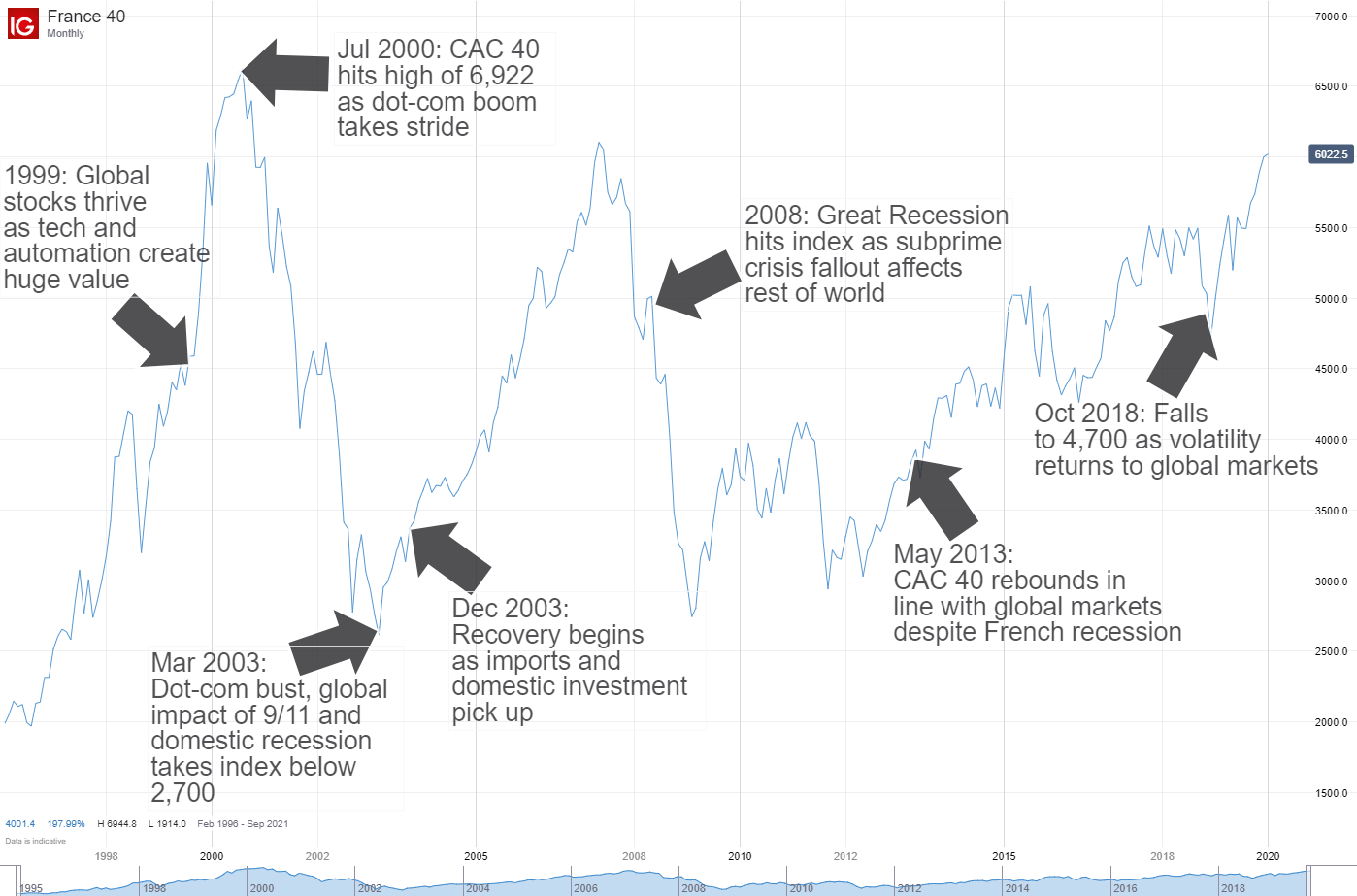

Cac 40 Index Week Ends Down But Shows Resilience March 7 2025

May 24, 2025

Cac 40 Index Week Ends Down But Shows Resilience March 7 2025

May 24, 2025 -

Reaction To Glastonbury 2025 Lineup Anger And Disappointment

May 24, 2025

Reaction To Glastonbury 2025 Lineup Anger And Disappointment

May 24, 2025

Latest Posts

-

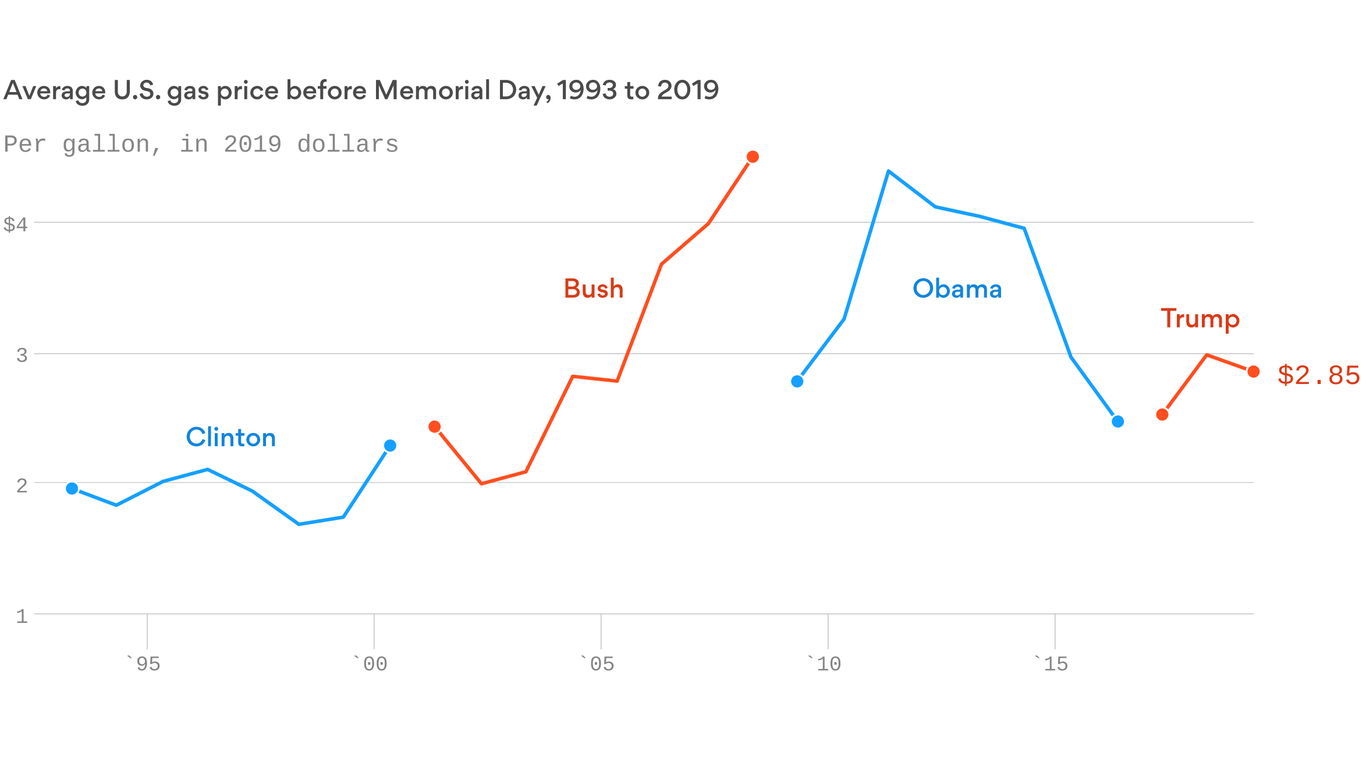

When Is Memorial Day 2025 Your Guide To The May Holiday Weekend

May 24, 2025

When Is Memorial Day 2025 Your Guide To The May Holiday Weekend

May 24, 2025 -

Affordable Memorial Day Travel Low Gas Prices Expected

May 24, 2025

Affordable Memorial Day Travel Low Gas Prices Expected

May 24, 2025 -

Memorial Day 2025 Date History And Three Day Weekend

May 24, 2025

Memorial Day 2025 Date History And Three Day Weekend

May 24, 2025 -

Fueling Your Memorial Day Trip Low Gas Prices Ahead

May 24, 2025

Fueling Your Memorial Day Trip Low Gas Prices Ahead

May 24, 2025 -

Lowest Gas Prices In Decades Expected For Memorial Day Weekend

May 24, 2025

Lowest Gas Prices In Decades Expected For Memorial Day Weekend

May 24, 2025