Vodacom's Improved Earnings Drive Higher-Than-Expected Payout

Table of Contents

Strong Revenue Growth Fuels Vodacom's Earnings Surge

Vodacom's impressive earnings are primarily fueled by robust revenue growth, driven by two key factors: increased data consumption and subscriber base expansion.

Increased Data Consumption and Subscriber Base

The rise in data usage and subscriber acquisition has significantly contributed to Vodacom's revenue growth. Specifically:

- Data consumption increased by 25% year-on-year, driven by increased smartphone penetration and the rising demand for mobile internet services across all regions.

- Vodacom added 5 million new subscribers in the last fiscal year, expanding its market reach and customer base. This growth was particularly strong in [mention specific region(s) with strong growth].

- The launch of several new, attractive data packages, such as the "DataMax" and "Night Owl" bundles, stimulated data usage and customer acquisition.

- Vodacom's market share grew by 2 percentage points, solidifying its position as a market leader.

Successful Expansion into New Markets and Services

Vodacom's strategic expansion into new geographical areas and diversification into new services have also boosted its revenue streams.

- The successful entry into the [mention specific new market] market has generated [quantify revenue] in additional revenue.

- M-Pesa, Vodacom's mobile money platform, continues to be a significant revenue driver, contributing [quantify revenue] to the overall earnings.

- Partnerships with leading fintech companies have enabled Vodacom to expand its financial services offerings, further driving revenue growth.

- The acquisition of [mention specific company, if applicable] has broadened Vodacom's service portfolio and expanded its market reach.

Improved Operational Efficiency and Cost Management

Vodacom's enhanced operational efficiency and effective cost management have also played a crucial role in driving improved earnings.

Network Optimization and Infrastructure Upgrades

Significant investments in network infrastructure and technological improvements have resulted in cost savings and improved service quality.

- The rollout of 5G technology in key areas has enhanced network capacity and reduced operational costs associated with older technologies.

- Implementation of advanced network optimization strategies has improved network efficiency and reduced energy consumption.

- These infrastructure upgrades have also enhanced customer experience, leading to increased customer satisfaction and retention.

Streamlined Processes and Improved Employee Productivity

Initiatives aimed at improving internal processes and employee productivity have significantly boosted operational efficiency.

- Automation of various processes has streamlined workflows and reduced operational costs.

- Digital transformation initiatives have improved communication and collaboration within the organization.

- Investment in employee training programs has enhanced skills and productivity.

Higher-Than-Expected Dividend Payout – Good News for Investors

The improved Vodacom earnings have translated into a significantly higher-than-expected dividend payout for shareholders, making it attractive news for investors looking for Vodacom dividend returns.

Dividend Increase and its Implications

Vodacom has announced a dividend increase of [percentage]% compared to the previous year.

- The previous dividend payout was [previous payout figure], while the current payout is [current payout figure].

- This increase translates into an attractive dividend yield of [yield percentage] for investors.

- Analysts have hailed this dividend increase as a positive sign, reflecting confidence in Vodacom's future growth prospects. [mention specific analyst quotes if available].

Investor Confidence and Future Outlook

The improved earnings and increased dividend have boosted investor confidence in Vodacom's future prospects.

- The announcement resulted in a [percentage]% increase in Vodacom's stock price.

- Vodacom's management has expressed confidence in maintaining this positive trajectory, citing continued investment in network infrastructure and expansion into new markets.

Conclusion

Vodacom's improved earnings, driving a higher-than-expected dividend payout, are a result of a confluence of factors: strong revenue growth driven by increased data consumption and subscriber acquisition, successful expansion into new markets and services, and significant improvements in operational efficiency and cost management. This positive financial performance translates into a substantial dividend increase, boosting investor confidence and signaling a bright future for the company. To stay informed about future developments in Vodacom's financial performance and understand how Vodacom earnings impact your investment strategy, regularly check their investor relations website or subscribe to relevant financial news sources. Learn more about investing in Vodacom and its potentially lucrative dividend payouts. Understanding Vodacom earnings is key to making informed investment decisions.

Featured Posts

-

O Tyazhelom Sostoyanii Shumakhera Rasskazal Blizkiy Drug

May 20, 2025

O Tyazhelom Sostoyanii Shumakhera Rasskazal Blizkiy Drug

May 20, 2025 -

Uk Luxury Lobby Brexit Impact On Eu Exports

May 20, 2025

Uk Luxury Lobby Brexit Impact On Eu Exports

May 20, 2025 -

April 20 2025 Nyt Mini Crossword Complete Answers And Hints

May 20, 2025

April 20 2025 Nyt Mini Crossword Complete Answers And Hints

May 20, 2025 -

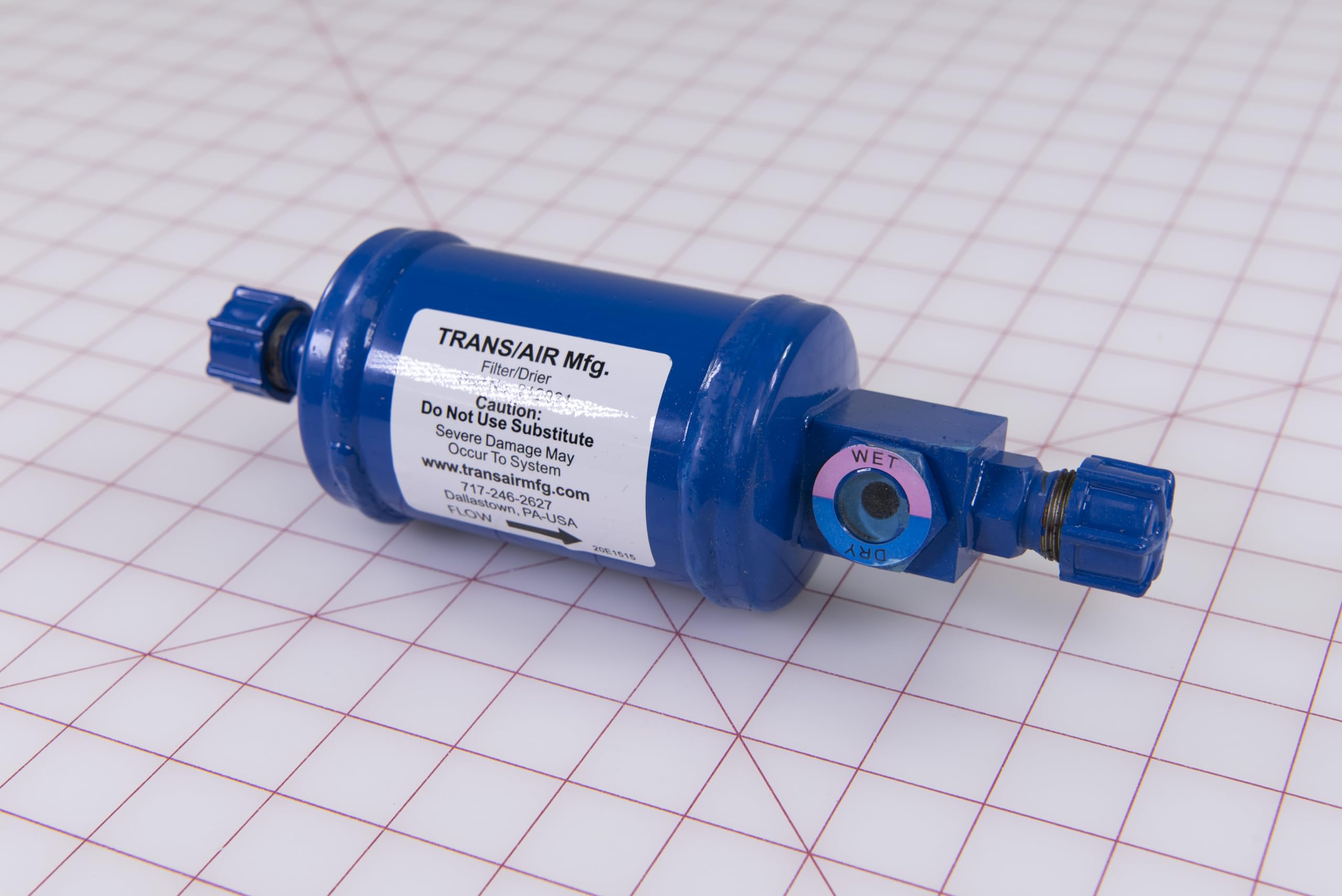

Drier Weather Is In Sight What To Expect And How To Prepare

May 20, 2025

Drier Weather Is In Sight What To Expect And How To Prepare

May 20, 2025 -

Macron Et Le Cameroun 2032 Troisieme Mandat Et Perspectives

May 20, 2025

Macron Et Le Cameroun 2032 Troisieme Mandat Et Perspectives

May 20, 2025

Latest Posts

-

Old North State Report May 9 2025 Key Events And Updates

May 20, 2025

Old North State Report May 9 2025 Key Events And Updates

May 20, 2025 -

Mwafqt Alnwab Ela Mkhalfat Tqryry Dywan Almhasbt Leamy 2022 W 2023

May 20, 2025

Mwafqt Alnwab Ela Mkhalfat Tqryry Dywan Almhasbt Leamy 2022 W 2023

May 20, 2025 -

Alnwab Yqrwn Bmkhalfat Dywan Almhasbt 2022 2023 Tfasyl Altqaryr

May 20, 2025

Alnwab Yqrwn Bmkhalfat Dywan Almhasbt 2022 2023 Tfasyl Altqaryr

May 20, 2025 -

Texas House Bill Aims To Restrict Minors Social Media Access

May 20, 2025

Texas House Bill Aims To Restrict Minors Social Media Access

May 20, 2025 -

Nvidia

May 20, 2025

Nvidia

May 20, 2025