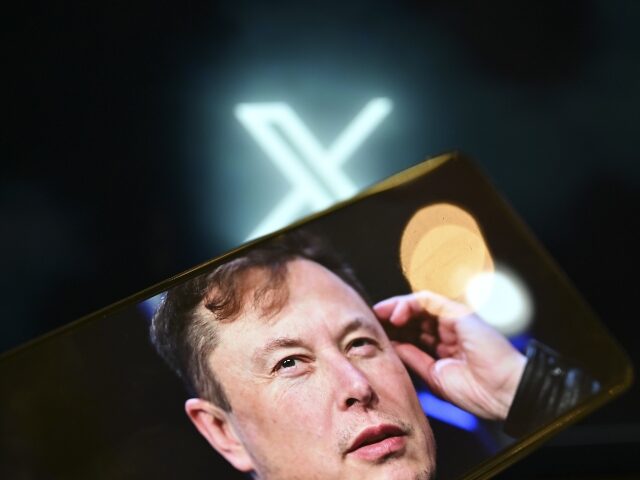

Wall Street Banks Sell Final Portion Of Elon Musk's X Corp Debt: An Exclusive Report

Table of Contents

The Sale and its Implications for X Corp's Financial Health

The complete sale of Elon Musk's X Corp debt represents a crucial step in the company's financial restructuring. This culmination of a long process, which involved the gradual offloading of substantial debt acquired during Musk's acquisition of the platform, significantly alters X Corp's financial landscape.

Debt Repayment Timeline and Strategy

The timeline of the debt repayment remains somewhat opaque, but reports suggest a phased approach, with the final tranche sold recently. The original debt burden incurred during the acquisition was substantial, requiring a calculated and strategic approach to repayment. This final sale likely reflects a successful execution of this long-term strategy.

- Types of Debt Sold: The sold debt likely encompassed a mix of high-yield bonds and potentially bank loans initially secured to facilitate the acquisition.

- Banks Involved: While the precise details of which banks participated in the final sale may not be publicly available immediately, major Wall Street players were heavily involved in the initial debt financing.

- Impact on X Corp's Credit Rating and Borrowing Capacity: The elimination of this significant debt burden will undoubtedly improve X Corp's credit rating, enabling it to access future financing at more favorable terms. This improved financial standing opens doors for potential acquisitions and investments.

- Impact on Musk's Personal Finances: The successful offloading of the debt also reduces the financial pressure on Elon Musk personally, as he had a significant stake in the success of the debt repayment.

Market Reactions and Investor Sentiment

The market's response to the final debt sale is multifaceted and complex. While some analysts see it as a positive sign for X Corp's long-term stability, others remain cautious.

Stock Market Response and Volatility (If Applicable)

If X Corp were a publicly traded company, the stock price would likely experience some volatility following the announcement. However, since it is privately held, the impact is felt indirectly through related companies and the broader market sentiment.

- Stock Price Fluctuations of Related Companies: Companies associated with X Corp or benefiting from its services might experience positive or negative impacts on their stock prices depending on investor perceptions of this debt resolution.

- Expert Opinions and Analyses: Financial analysts are likely offering varying opinions, with some highlighting the improved financial flexibility for X Corp, and others expressing concerns about the company's future profitability and strategic direction.

- Investor Confidence: The successful debt repayment should generally improve investor confidence, especially if X Corp demonstrates a clear path towards future profitability.

- Implications for the Tech Industry: The event could be interpreted as a case study in the challenges of large-scale tech acquisitions and the importance of careful financial planning.

Strategic Implications for Elon Musk and X Corp's Future

With the debt burden lifted, X Corp is poised for a new chapter in its development. The successful resolution of this financial hurdle opens numerous strategic avenues.

Future Funding and Expansion Plans

The debt-free status significantly enhances X Corp's financial flexibility. It allows for increased investment in product development, potential acquisitions, and expansion into new markets.

- Future Investment Decisions: X Corp now has greater capacity to pursue innovative projects, invest in research and development, and potentially acquire other companies to expand its product portfolio.

- Potential for New Product Launches or Acquisitions: We can expect increased activity in terms of new feature releases on the platform and possibly acquisitions of complementary businesses.

- Impact on Long-Term Growth Prospects: The removal of the debt overhang significantly enhances X Corp's long-term growth prospects.

- Musk's Broader Business Strategies: This move fits into Elon Musk's overall strategy of building a diverse portfolio of companies focused on innovation and technological disruption.

Conclusion

The sale of the final portion of Elon Musk's X Corp debt represents a pivotal moment for the company. This successful resolution of the significant debt burden significantly improves X Corp's financial health, potentially bolstering investor confidence and paving the way for future growth and expansion. Market reactions are complex, but generally leaning towards positive sentiment. The long-term strategic implications for X Corp and Elon Musk remain to be fully revealed, but the improved financial flexibility creates exciting opportunities for future innovation and expansion. Stay informed about the latest developments surrounding Wall Street Banks and Elon Musk's X Corp debt by following our updates. Share your thoughts – what are your predictions for X Corp's future?

Featured Posts

-

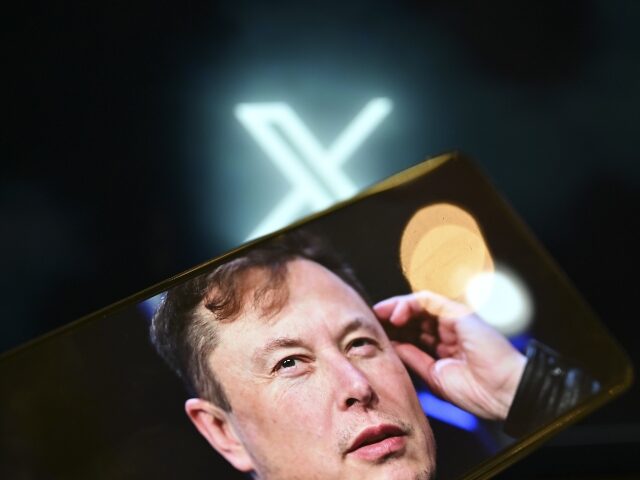

Commodity Classification For Xrp Ripples Settlement With The Sec

May 01, 2025

Commodity Classification For Xrp Ripples Settlement With The Sec

May 01, 2025 -

Ftc V Meta Live Updates On Instagram And Whats App Antitrust Case

May 01, 2025

Ftc V Meta Live Updates On Instagram And Whats App Antitrust Case

May 01, 2025 -

Another Dallas Star Passes Remembering The 80s Soap Icon

May 01, 2025

Another Dallas Star Passes Remembering The 80s Soap Icon

May 01, 2025 -

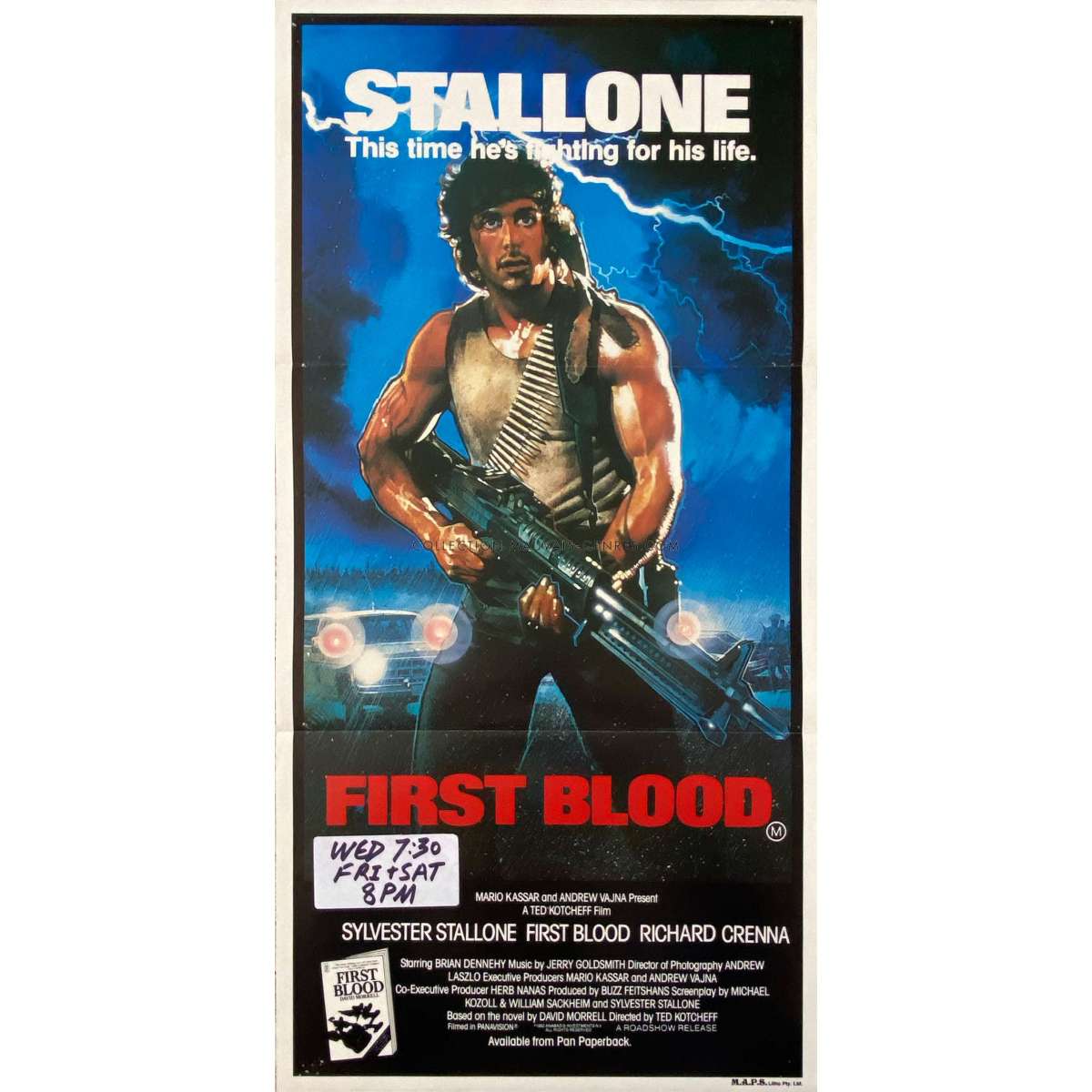

Ted Kotcheff Rambo First Bloods Director Dies Aged 94

May 01, 2025

Ted Kotcheff Rambo First Bloods Director Dies Aged 94

May 01, 2025 -

Rugby World Cup Dupont Leads France To Victory Against Italy

May 01, 2025

Rugby World Cup Dupont Leads France To Victory Against Italy

May 01, 2025

Latest Posts

-

Hunters 32 Points Power Cavaliers To 10th Straight Win

May 01, 2025

Hunters 32 Points Power Cavaliers To 10th Straight Win

May 01, 2025 -

4 Takeaways From The Celtics Win Over The Cavaliers Derrick Whites Impact

May 01, 2025

4 Takeaways From The Celtics Win Over The Cavaliers Derrick Whites Impact

May 01, 2025 -

Celtics Beat Cavaliers 4 Key Takeaways From Derrick Whites Heroics

May 01, 2025

Celtics Beat Cavaliers 4 Key Takeaways From Derrick Whites Heroics

May 01, 2025 -

10th Straight Win For Cavaliers De Andre Hunters Key Role In Victory Over Trail Blazers

May 01, 2025

10th Straight Win For Cavaliers De Andre Hunters Key Role In Victory Over Trail Blazers

May 01, 2025 -

Cleveland Cavaliers Defeat Portland Trail Blazers De Andre Hunters Stellar Game Secures 10th Consecutive Victory

May 01, 2025

Cleveland Cavaliers Defeat Portland Trail Blazers De Andre Hunters Stellar Game Secures 10th Consecutive Victory

May 01, 2025