Wall Street Comeback Threatens DAX's Recent Surge: A Market Analysis

Table of Contents

Wall Street's Resurgence: Factors Driving the Comeback

Wall Street's renewed strength is fueled by several key factors, creating a complex interplay with the performance of the DAX.

Strong US Economic Data

Positive US economic data is a significant driver of Wall Street's resurgence.

- Positive GDP growth figures: Consistent growth signals a healthy economy, boosting investor confidence.

- Robust job creation and falling unemployment rates: A strong labor market indicates increased consumer spending and overall economic health.

- Increased consumer spending and business confidence: These factors fuel economic growth and drive corporate profits, benefiting the stock market.

- Impact on investor sentiment and capital flows towards US equities: Positive data translates into increased investment in US stocks, further pushing up the market. This influx of capital strengthens the US dollar, potentially impacting international markets like the DAX.

Federal Reserve Policy and its Influence

The Federal Reserve's monetary policy plays a crucial role in shaping the US stock market's trajectory and subsequently its influence on the DAX.

- Analysis of the current interest rate environment: Current interest rates significantly impact borrowing costs for businesses and consumers, affecting economic growth and market performance.

- Impact of potential future rate hikes or cuts on the US stock market: Rate hikes can curb inflation but might slow economic growth, potentially impacting stock prices. Conversely, rate cuts can stimulate the economy but may increase inflation.

- Comparison to European Central Bank policies and their effect on the DAX: Differences in monetary policies between the US and Europe create divergences in market performance, influencing the relationship between Wall Street and the DAX.

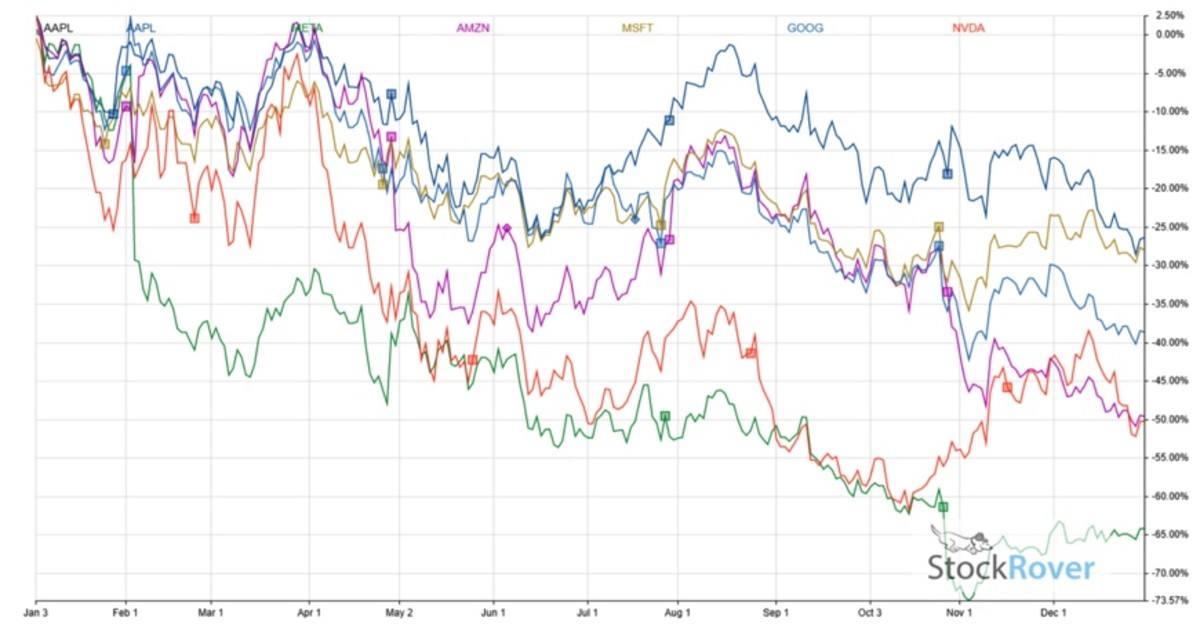

Technological Sector Performance

The technology sector's performance is a key indicator of Wall Street's overall health.

- The role of tech giants in driving Wall Street's performance: The performance of large tech companies significantly influences the overall market sentiment and direction.

- Comparison of tech sector growth in the US vs. Europe: The US tech sector generally outpaces its European counterpart, contributing to the relative strength of Wall Street.

- Impact of technological innovation on market trends: Technological advancements consistently create new investment opportunities and disrupt existing industries, influencing market trends in both the US and Europe.

DAX's Recent Surge: Underlying Strengths and Vulnerabilities

Despite the threat from a resurgent Wall Street, the DAX has shown recent strength, driven by several factors, but also facing significant vulnerabilities.

European Economic Recovery

Post-pandemic recovery in the Eurozone has provided a boost to the DAX.

- Analysis of post-pandemic recovery in the Eurozone: While recovery has been uneven across the Eurozone, Germany's robust export-oriented economy has benefitted.

- Key economic indicators affecting the DAX's performance: GDP growth, inflation rates, and consumer confidence are key indicators shaping the DAX's performance.

- Strength and weaknesses of the German economy: Germany's reliance on exports makes it vulnerable to global economic shocks and geopolitical instability.

Geopolitical Risks Affecting the DAX

Geopolitical factors, particularly the war in Ukraine, pose significant risks to the DAX.

- The impact of the war in Ukraine on the German economy: The war has disrupted supply chains, increased energy prices, and dampened investor confidence.

- Energy crisis and its effect on German industries: Germany's dependence on Russian energy has made it particularly vulnerable to the energy crisis.

- Supply chain disruptions and their consequences: Disruptions in global supply chains have impacted German manufacturing and industrial production.

Sector-Specific Performance in the DAX

Performance varies significantly across different sectors within the DAX.

- Analysis of performance across various sectors (automobiles, industrials, etc.): The automotive and industrial sectors are particularly sensitive to global economic conditions and geopolitical risks.

- Identification of leading and lagging sectors within the DAX: Identifying these trends allows investors to make informed decisions about asset allocation.

- Potential for sector rotation in the near future: As market conditions change, investors may shift their investments from lagging to leading sectors.

The Interplay Between Wall Street and the DAX: Implications for Investors

Understanding the correlation and divergence between Wall Street and the DAX is crucial for investors.

Correlation and Divergence

Historical data reveals periods of both correlation and divergence between the two markets.

- Analyzing historical correlations between Wall Street and the DAX: Understanding historical trends helps predict future movements.

- Assessing the current level of correlation and its implications: The current level of correlation indicates the degree to which the two markets are influenced by similar factors.

- Potential for future divergence or convergence: Factors like monetary policies and geopolitical events can cause divergence or convergence.

Investment Strategies in a Volatile Market

Navigating this volatile market requires careful consideration of investment strategies.

- Recommendations for diversification strategies: Diversification across different asset classes and geographies is crucial to mitigate risk.

- Advice on risk management techniques: Risk management is paramount in a volatile market.

- Suggestions for asset allocation in this uncertain environment: Asset allocation should be adjusted based on risk tolerance and market outlook.

Opportunities and Risks

Both markets present opportunities and risks.

- Identifying potential investment opportunities in both markets: Careful analysis can uncover undervalued assets.

- Highlighting potential risks associated with each market: Understanding these risks is crucial for risk management.

- Offering insights into potential future market trends: Analyzing current trends helps in anticipating future market movements.

Conclusion

The resurgence of Wall Street poses a notable challenge to the DAX's recent gains. This analysis highlighted key economic indicators, geopolitical risks, and sector-specific performances, providing insights into navigating this dynamic market environment. By carefully considering these factors and employing sound investment strategies, investors can potentially capitalize on opportunities and mitigate risks. Stay updated on the latest developments in both Wall Street and DAX markets to make well-informed investment decisions. Continue your research into Wall Street and DAX market analysis to refine your investment strategies and make informed decisions in this ever-changing market.

Featured Posts

-

Najvaecsie Nemecke Firmy Prepustaju Tisice Ludi Bez Prace

May 24, 2025

Najvaecsie Nemecke Firmy Prepustaju Tisice Ludi Bez Prace

May 24, 2025 -

Apple Stock Underperforms Ahead Of Q2 Results

May 24, 2025

Apple Stock Underperforms Ahead Of Q2 Results

May 24, 2025 -

Sharp Decline In Amsterdam Stock Market Plunges 7 At Open

May 24, 2025

Sharp Decline In Amsterdam Stock Market Plunges 7 At Open

May 24, 2025 -

Urgency For Action The Philips Future Health Index 2025 Report On Ai In Healthcare

May 24, 2025

Urgency For Action The Philips Future Health Index 2025 Report On Ai In Healthcare

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist Nav Calculation And Implications

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Nav Calculation And Implications

May 24, 2025

Latest Posts

-

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025 -

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025 -

The Farrow Warning Trump Congress And The 3 4 Month Countdown For American Democracy

May 24, 2025

The Farrow Warning Trump Congress And The 3 4 Month Countdown For American Democracy

May 24, 2025 -

Florida Film Festival 2024 Celebrity Sightings Include Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival 2024 Celebrity Sightings Include Mia Farrow And Christina Ricci

May 24, 2025 -

Mia Farrow And Christina Ricci At The Florida Film Festival A Star Studded Event

May 24, 2025

Mia Farrow And Christina Ricci At The Florida Film Festival A Star Studded Event

May 24, 2025