Wall Street's Resurgence: A Look At The Failed Bear Market Predictions

Table of Contents

Overly Pessimistic Forecasts and Their Underlying Assumptions

Numerous bear market predictions underestimated the resilience of the US economy and global markets. These forecasts often relied on overly simplistic models and failed to account for several crucial factors. The underlying assumptions behind many of these predictions proved to be fundamentally flawed.

-

Overreliance on inflation predictions without considering mitigating factors: Many forecasts focused heavily on inflation rates without adequately considering the potential for supply chain improvements, easing commodity prices, or the impact of government policies designed to curb inflation.

-

Underestimation of consumer resilience and spending power: Consumer spending remained surprisingly robust despite rising prices, demonstrating a greater ability to weather economic headwinds than many analysts predicted. This resilient consumer base significantly contributed to Wall Street's resurgence.

-

Failure to account for technological advancements and their impact on the economy: The rapid advancement of technologies like AI and sustainable energy created new growth opportunities and investment avenues, positively impacting market sentiment and bolstering Wall Street's resurgence. These sectors attracted significant investment, counteracting negative predictions.

-

Ignoring the influence of government intervention and fiscal stimulus packages: Government intervention, including fiscal stimulus packages and targeted support for specific industries, played a crucial role in mitigating the potential severity of economic downturns, contributing to the ongoing Wall Street's resurgence.

Unexpected Economic Resilience and Positive Surprises

Several positive economic indicators defied bearish forecasts and fueled Wall Street's resurgence. These unexpected positive surprises played a crucial role in shifting market sentiment.

-

Stronger-than-anticipated job growth figures: The labor market exhibited surprising strength, with unemployment rates remaining lower than predicted, boosting consumer confidence and supporting economic growth.

-

Unexpectedly robust retail sales data: Despite inflation, consumer spending remained robust, indicating sustained demand and resilience in the face of economic uncertainty, a key factor in Wall Street's resurgence.

-

Positive revisions to GDP growth projections: Initial pessimistic GDP growth projections were revised upwards, reflecting better-than-expected economic performance and further bolstering the narrative of Wall Street's resurgence.

-

Successful navigation of geopolitical risks by businesses: Businesses demonstrated a remarkable ability to adapt and mitigate the impact of geopolitical risks, contributing to sustained economic activity and reinforcing the strength behind Wall Street's resurgence.

The Role of Federal Reserve Policy and Interest Rate Hikes

The Federal Reserve's monetary policy, particularly its interest rate hikes, played a significant role in shaping market performance. While intended to curb inflation, the impact was complex and, in some ways, unexpected.

-

Analysis of the effectiveness of interest rate hikes in controlling inflation: The interest rate hikes have had a measurable impact on inflation, although the effectiveness is still being debated. The full effect on inflation and its impact on Wall Street's resurgence is yet to be fully understood.

-

Discussion of the market's response to rate hike announcements: The market's response to rate hike announcements has been mixed, reflecting the uncertainty surrounding the effectiveness and potential consequences of these policies.

-

Examination of the unintended consequences of the Federal Reserve's actions: The Federal Reserve's actions have had unintended consequences, including potential impacts on economic growth and market volatility. Understanding these is vital for analyzing Wall Street's resurgence.

-

Comparison of current interest rate hikes with those of previous cycles: Comparing current interest rate hikes with past cycles provides valuable context and helps assess the potential long-term effects on the economy and Wall Street's resurgence.

Technological Innovation and its Influence on Market Sentiment

Technological innovation played a significant role in countering negative predictions and fueling Wall Street's resurgence. Emerging technologies created new growth opportunities and investor confidence.

-

Investment in AI-related companies and their market impact: Significant investment in AI-related companies has driven market growth and contributed to positive investor sentiment, a key element of Wall Street's resurgence.

-

Growth of the sustainable energy sector and investor interest: The sustainable energy sector experienced significant growth, attracting substantial investment and driving economic expansion, a crucial part of Wall Street's resurgence.

-

The role of technological innovation in boosting productivity and efficiency: Technological advancements have enhanced productivity and efficiency across various sectors, leading to improved profitability and contributing to Wall Street's resurgence.

-

Impact of technological advancements on consumer behavior and spending: Technological changes have influenced consumer behavior and spending patterns, contributing to the overall economic resilience that underpinned Wall Street's resurgence.

Conclusion: Understanding Wall Street's Resurgence and Looking Ahead

The unexpected strength of the market highlights the limitations of relying solely on simplistic economic models to predict future market performance. Several factors contributed to Wall Street's resurgence, including surprisingly robust consumer spending, successful navigation of geopolitical risks, and the positive impact of technological innovation. While the current market strength is encouraging, future volatility remains a possibility. Understanding the dynamics behind Wall Street's resilience is crucial for navigating future market uncertainties. Stay informed about the latest developments impacting Wall Street's resurgence and adapt your investment strategy accordingly. Diversification and a long-term investment approach are crucial for weathering any future market fluctuations. Understanding the nuances of Wall Street's resurgence is key to successful long-term investing.

Featured Posts

-

Can Androids Redesigned Interface Compete With I Phones For Gen Z

May 10, 2025

Can Androids Redesigned Interface Compete With I Phones For Gen Z

May 10, 2025 -

Pentagon Orders Review Of Military Academy Books Potential Removals

May 10, 2025

Pentagon Orders Review Of Military Academy Books Potential Removals

May 10, 2025 -

Newark Mayor Ras Baraka Arrested Protest At Ice Detention Center

May 10, 2025

Newark Mayor Ras Baraka Arrested Protest At Ice Detention Center

May 10, 2025 -

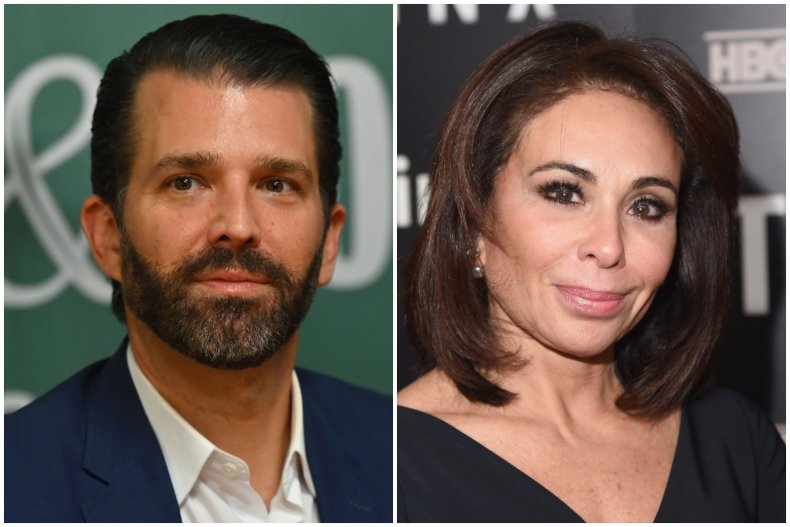

Trump Names Pirro D C S Top Prosecutor A Deep Dive

May 10, 2025

Trump Names Pirro D C S Top Prosecutor A Deep Dive

May 10, 2025 -

Nhl Predictions Oilers Vs Sharks Betting Analysis And Odds

May 10, 2025

Nhl Predictions Oilers Vs Sharks Betting Analysis And Odds

May 10, 2025