Warner Bros. Discovery Faces $1.1 Billion Advertising Loss Without NBA

Table of Contents

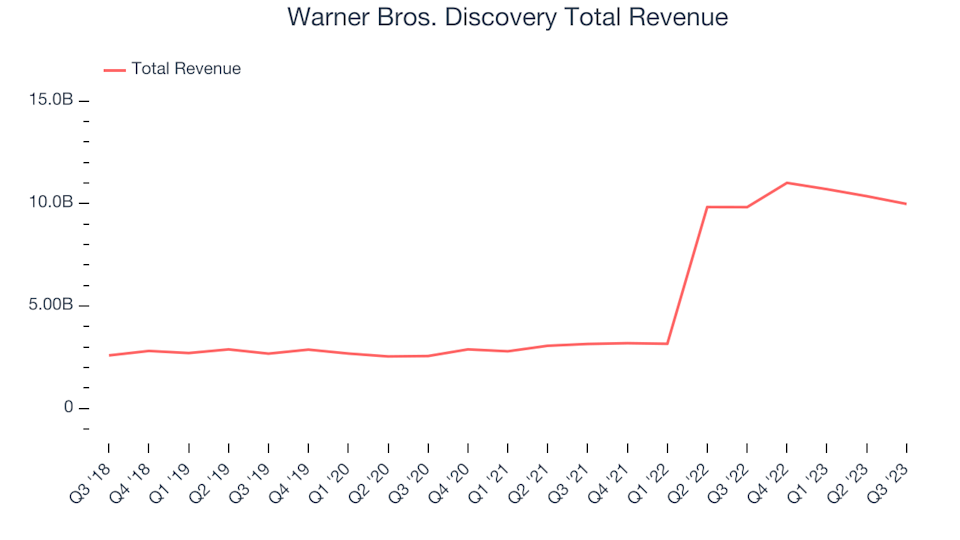

The Magnitude of the NBA's Advertising Contribution to WBD

The NBA's contribution to WBD's advertising revenue is substantial. The broadcasting rights generate income from various streams, including lucrative advertising slots during games themselves, extensive sponsorship deals tied to the league and individual teams, and digital advertising opportunities surrounding NBA content. While precise figures remain confidential, industry analysts estimate that NBA broadcasts contribute a significant percentage – potentially exceeding 10% – of WBD's overall annual advertising revenue. The loss of these revenue streams represents a significant blow.

The lost advertising opportunities are diverse and far-reaching:

- National advertising spots during games: High-value ad slots during nationally televised games represent a major revenue source lost.

- Regional advertising based on team locations: Local businesses heavily rely on regional advertising during team games, further impacting revenue.

- Digital advertising surrounding NBA content: WBD's digital platforms lose a significant stream of advertising revenue tied to online NBA content.

- Sponsorship deals associated with NBA programming: Numerous sponsorship deals are directly linked to NBA broadcasts, all now lost.

Impact on WBD's Financial Performance and Stock Price

The $1.1 billion shortfall directly impacts WBD's quarterly and annual financial reports, significantly reducing profitability and potentially impacting its bottom line. This translates into a considerable negative impact on WBD's stock price, eroding investor confidence and potentially leading to a decline in its market valuation. To offset this loss, WBD may undertake several cost-cutting measures, including:

- Layoffs or hiring freezes: Reducing personnel costs is a common response to significant revenue shortfalls.

- Reduced spending on other programming: WBD may cut back on investments in other shows and films to compensate.

- Restructuring of departments: Reorganizing internal structures to streamline operations and improve efficiency is another possibility.

Broader Implications for the Media Industry and Future Sports Broadcasting Rights

The financial impact on WBD serves as a stark warning for the broader media industry. Other media companies heavily reliant on sports broadcasting rights face similar risks. The incident highlights the increasing competition for securing these rights and the potential for spiraling costs in future negotiations. The shift in media consumption from traditional television to streaming services further complicates the situation, impacting advertising revenue streams.

Key considerations for the future include:

- Increased competition among streaming platforms for live sports: Streaming giants are aggressively vying for exclusive sports broadcasting rights, driving up prices.

- Negotiations for future sports broadcasting contracts: Securing broadcasting rights is becoming increasingly expensive and competitive.

- The evolving role of advertising in the digital media age: Advertising revenue models are shifting, requiring adaptation and diversification.

Strategies for WBD to Mitigate Future Losses

To mitigate future losses and reduce reliance on any single sports league, WBD needs a multi-pronged approach to diversifying its revenue streams. This includes exploring alternative programming options and strategic partnerships:

- Invest in original programming: Developing high-quality original content can attract viewers and generate advertising revenue.

- Secure broadcasting rights for other major sporting events: Diversifying its sports portfolio reduces the impact of any single league's absence.

- Expand into new digital advertising avenues: Exploring new and innovative digital advertising strategies is crucial.

- Develop stronger direct-to-consumer streaming strategies: A robust streaming platform with a diverse content offering is essential for long-term success.

Conclusion: The Long-Term Outlook for Warner Bros. Discovery and the Importance of Diversification

The Warner Bros. Discovery NBA advertising revenue loss highlights the significant financial vulnerability of relying heavily on a single source of revenue in the media industry. The $1.1 billion shortfall serves as a stark reminder of the crucial need for diversification. WBD, and indeed all media companies, must adapt to the evolving media landscape and secure diverse revenue streams to ensure financial stability and avoid future situations similar to this substantial loss. The Warner Bros. Discovery NBA advertising revenue loss underscores the importance of strategic planning and a diversified approach to programming and advertising. Understanding the challenges and adapting to the ever-changing media landscape is crucial for future success.

Featured Posts

-

Negotiating With Trump Mastering The Art Of The Deal

May 06, 2025

Negotiating With Trump Mastering The Art Of The Deal

May 06, 2025 -

Nike Teams Up With Hyperice Details On The New Collection

May 06, 2025

Nike Teams Up With Hyperice Details On The New Collection

May 06, 2025 -

Understanding The Postponement Of Patrick Schwarzenegger And Abby Champions Wedding

May 06, 2025

Understanding The Postponement Of Patrick Schwarzenegger And Abby Champions Wedding

May 06, 2025 -

Vdkhnovenieto Na Riana Analiz Na Khitovete Na Ed Shiyrn

May 06, 2025

Vdkhnovenieto Na Riana Analiz Na Khitovete Na Ed Shiyrn

May 06, 2025 -

2025 Gold Market Facing First Double Digit Weekly Loss

May 06, 2025

2025 Gold Market Facing First Double Digit Weekly Loss

May 06, 2025

Latest Posts

-

Vogues May Issue Colman Domingo A Ap Rocky And Pharrell Williams

May 06, 2025

Vogues May Issue Colman Domingo A Ap Rocky And Pharrell Williams

May 06, 2025 -

Norman Osborns Potential Return Colman Domingo And A Spider Man Co Stars Reaction

May 06, 2025

Norman Osborns Potential Return Colman Domingo And A Spider Man Co Stars Reaction

May 06, 2025 -

Colman Domingo A Ap Rocky And Pharrell Vogues May 2024 Cover Stars

May 06, 2025

Colman Domingo A Ap Rocky And Pharrell Vogues May 2024 Cover Stars

May 06, 2025 -

Will Colman Domingo Return As Norman Osborn A Spider Man Co Star Weighs In

May 06, 2025

Will Colman Domingo Return As Norman Osborn A Spider Man Co Star Weighs In

May 06, 2025 -

Colman Domingo A Ap Rocky And Pharrell Williams Cover Vogues May Issue

May 06, 2025

Colman Domingo A Ap Rocky And Pharrell Williams Cover Vogues May Issue

May 06, 2025