Warren Buffett On Leadership: The Importance Of Humility And Error Prevention

Table of Contents

The Humility of a Master Investor

Warren Buffett's humility is not merely a personality trait; it's a cornerstone of his leadership philosophy. This humble leadership approach is crucial to his success and offers valuable insights into effective management. Keywords associated with this section include: Warren Buffett Humility, Humble Leadership, Self-Awareness, Continuous Learning, and Openness to Criticism.

-

Self-Reflection and Acknowledgment of Limitations: Buffett consistently demonstrates self-awareness, readily admitting his own limitations and acknowledging what he doesn't know. This contrasts sharply with many leaders who project an image of infallibility. He famously operates within his "circle of competence," focusing on areas he understands thoroughly, avoiding ventures outside his expertise.

-

Learning from Mistakes: Buffett's willingness to admit mistakes and learn from them is integral to his continuous learning process. He doesn't shy away from discussing past investment errors, viewing them as invaluable learning opportunities. This openness fosters a culture of learning and improvement within Berkshire Hathaway.

-

Fostering Trust and Collaboration: Buffett's humility fosters trust and open communication. His approachable demeanor and willingness to listen to diverse perspectives create an environment where employees feel comfortable sharing their ideas and concerns, even if they differ from his own. This collaborative environment is crucial for effective decision-making.

-

Valuing Dissenting Voices: Buffett actively seeks out diverse opinions and values dissenting voices. He understands that challenging assumptions is crucial to identifying potential flaws in strategy or investment decisions. This demonstrates a profound understanding of the importance of intellectual diversity in effective leadership.

-

Attracting and Retaining Top Talent: Buffett's humble leadership style plays a significant role in attracting and retaining top talent at Berkshire Hathaway. Individuals are drawn to an environment where their contributions are valued and their perspectives are heard, regardless of their position within the hierarchy.

Proactive Error Prevention: A Buffett Strategy

Proactive error prevention is as important to Buffett's success as his investment strategies. This section delves into his approach to risk management and decision-making, with relevant keywords: Risk Management, Warren Buffett Risk, Due Diligence, Decision-Making Process, and Mistake Avoidance.

-

Thorough Due Diligence: Before making any significant investment, Buffett undertakes extensive due diligence. He meticulously researches companies, analyzes their financials, and evaluates their management teams. This thorough approach significantly reduces the risk of making costly errors.

-

The "Circle of Competence": Buffett’s adherence to his "circle of competence" is a key element of his risk management strategy. He focuses his investments on businesses he understands well, avoiding ventures where his expertise is lacking. This disciplined approach significantly minimizes the chances of making ill-informed decisions.

-

Margin of Safety: Buffett's emphasis on the margin of safety is a crucial aspect of his risk mitigation strategy. He only invests in companies at prices significantly below his estimated intrinsic value, providing a buffer against potential losses. This strategy is a cornerstone of his long-term investment philosophy.

-

Long-Term Perspective and Patience: Buffett's long-term perspective helps avoid impulsive decisions that often lead to errors. He invests with a long-term horizon, resisting the urge to react to short-term market fluctuations. This patience significantly reduces the likelihood of making emotionally driven mistakes.

-

Berkshire Hathaway's Risk Management Success: Berkshire Hathaway's impressive track record is a testament to the effectiveness of Buffett's risk management strategies. Their sustained success demonstrates the tangible benefits of a cautious and well-considered approach to investment and business decisions.

Applying Buffett's Principles to Your Leadership

The principles of humility and error prevention aren't limited to the world of finance. They are applicable to leaders in any field. Keywords for this section: Leadership Lessons, Practical Application, Improving Leadership, Business Strategy, and Organizational Success.

-

Cultivating Humility: Leaders can cultivate humility by actively seeking feedback, admitting mistakes openly, and acknowledging the contributions of their team members. Regular self-reflection and continuous learning are also crucial aspects of this process.

-

Implementing Proactive Error Prevention: Instituting rigorous due diligence processes, fostering a culture of open communication, and implementing robust risk management systems are key strategies for preventing errors. This involves establishing clear decision-making frameworks and encouraging critical thinking.

-

Building a Culture of Learning: Creating an environment where mistakes are viewed as learning opportunities fosters a culture of continuous improvement. This includes providing employees with the resources and support they need to learn from their mistakes and grow professionally.

-

Embracing a Long-Term Perspective: Leaders should focus on long-term goals rather than being driven by short-term pressures. This long-term perspective helps to avoid impulsive decisions that can lead to costly errors and hinders sustainable growth.

-

Implementing Buffett's Approach Across Industries: Businesses of all sizes, from startups to large corporations, can benefit from implementing aspects of Buffett's leadership style. By emphasizing humility, fostering open communication, and prioritizing error prevention, organizations can create a more effective, resilient, and successful environment.

Conclusion

Warren Buffett's leadership style, characterized by profound humility and a relentless focus on error prevention, provides invaluable lessons for leaders across industries. By embracing self-awareness, actively seeking diverse viewpoints, and implementing rigorous due diligence, leaders can significantly reduce risks, foster a more collaborative environment, and ultimately achieve greater success. His approach highlights that sustainable success is not just about skill, but also about character and a commitment to continuous learning and improvement.

Call to Action: Learn more about applying Warren Buffett's principles of humility and error prevention to enhance your leadership style and achieve sustainable success. Embrace the power of humble leadership and proactive mistake avoidance – it’s a winning combination!

Featured Posts

-

Krikunov Podtverdil Ovechkin V Zale Slavy Iihf

May 07, 2025

Krikunov Podtverdil Ovechkin V Zale Slavy Iihf

May 07, 2025 -

Xrps Uncertain Future A Look At The Derivatives Market

May 07, 2025

Xrps Uncertain Future A Look At The Derivatives Market

May 07, 2025 -

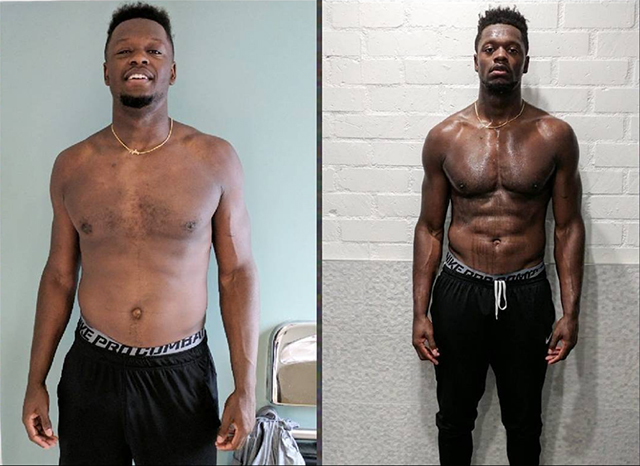

Julius Randles Transformation Timberwolves Vs Knicks Approach

May 07, 2025

Julius Randles Transformation Timberwolves Vs Knicks Approach

May 07, 2025 -

Open Ai Unveils Simplified Voice Assistant Development

May 07, 2025

Open Ai Unveils Simplified Voice Assistant Development

May 07, 2025 -

Iyqaf Tyar Ajnby Mn Trf Albwlysaryw Rdwd Alfel Aldwlyt

May 07, 2025

Iyqaf Tyar Ajnby Mn Trf Albwlysaryw Rdwd Alfel Aldwlyt

May 07, 2025

Latest Posts

-

Wall Street Predicts 110 Growth Billionaire Backed Black Rock Etf

May 08, 2025

Wall Street Predicts 110 Growth Billionaire Backed Black Rock Etf

May 08, 2025 -

Black Rock Etf A Billionaire Investment Poised For Massive Growth In 2025

May 08, 2025

Black Rock Etf A Billionaire Investment Poised For Massive Growth In 2025

May 08, 2025 -

Billionaires Favorite Etf Projected 110 Growth By 2025

May 08, 2025

Billionaires Favorite Etf Projected 110 Growth By 2025

May 08, 2025 -

Billionaires Favorite Etf Projected 110 Surge In 2025

May 08, 2025

Billionaires Favorite Etf Projected 110 Surge In 2025

May 08, 2025 -

Sudden Bitcoin Spike Insights From Trumps Cryptocurrency Expert

May 08, 2025

Sudden Bitcoin Spike Insights From Trumps Cryptocurrency Expert

May 08, 2025