Warren Buffett's Canadian Successor: A Billionaire Without Many Berkshire Hathaway Shares

Table of Contents

Who is the Canadian "Warren Buffett"?

While pinpointing a single "Canadian Warren Buffett" is reductive, several Canadian investors have earned comparisons due to their shrewd investment strategies and long-term vision. For the purposes of this article, let's consider the hypothetical example of a highly successful, albeit fictional, Canadian investor, let's call him "Edward Clark". Edward Clark's investment career began modestly.

- Key biographical details: Edward Clark, aged 62, holds an MBA from the University of Toronto and started his career in a small investment firm in Vancouver.

- Major investment successes and strategies: Clark's early success came from identifying undervalued real estate in rapidly growing Canadian cities. He later transitioned to a more diversified portfolio, including technology companies and sustainable energy sectors.

- Notable philanthropic activities: Clark is known for his substantial donations to environmental organizations and educational institutions across Canada.

While both Clark and Buffett emphasize value investing, Clark's approach is arguably more diversified geographically, focusing heavily on Canadian and other North American markets, showcasing a unique twist on Buffett's largely US-centric approach.

Investment Strategies: Diverging from the Oracle of Omaha

Buffett's value investing strategy, famously focusing on long-term holdings in fundamentally sound companies, is well-documented. However, Edward Clark's approach, while sharing some similarities, reveals key differences.

- Specific examples of investments illustrating divergence from Buffett's approach: While Buffett might favor established blue-chip companies, Clark's portfolio includes a significant number of emerging growth companies within the technology and sustainable energy sectors. He has shown a higher risk tolerance in ventures with promising long-term potential.

- Reasons for choosing different investment sectors or strategies: Clark's geographic focus on Canada and North America, coupled with his interest in sectors like renewable energy and technology, reflects a conscious decision to capitalize on specific regional opportunities and emerging trends not as heavily emphasized by Buffett.

- Analysis of the Canadian investor's performance compared to Berkshire Hathaway's returns: While direct comparisons are complex, Edward Clark’s portfolio has shown consistently strong growth over the long term, demonstrating a successful strategy alternative to simply mirroring Berkshire Hathaway's holdings.

This divergence isn't a sign of failure but rather a testament to adaptability and the diverse paths to financial success.

The Myth of the "Buffett Successor": Redefining Success

The search for a "Warren Buffett successor" is inherently flawed. Buffett's success is the result of a unique combination of factors, including timing, market conditions, and his own unparalleled investment acumen.

- Arguments against the idea of a single, direct successor to Warren Buffett: No one can perfectly replicate Buffett's journey. Market dynamics constantly shift, demanding adaptability and creative solutions.

- Discussion of different metrics for evaluating investment success: Success isn't solely measured by total assets. Risk-adjusted returns, long-term growth, and social impact are equally important considerations.

- Examples of other successful investors with unique strategies: Many highly successful investors have built fortunes using strategies vastly different from Buffett's. This emphasizes that there's no one-size-fits-all approach to investment success.

Lessons from a Canadian Billionaire's Journey

Edward Clark's success offers valuable lessons for aspiring investors:

-

Key lessons applicable to individual investors:

- Diversification: Don't put all your eggs in one basket. Spread your investments across different asset classes and geographical regions.

- Long-term vision: Invest for the long haul, resisting the temptation to chase short-term gains.

- Adaptability: Markets change. Be prepared to adjust your strategy as needed.

- Thorough Due Diligence: Research is critical for successful investing.

- Risk Management: Understand and manage your risk tolerance.

-

Practical advice based on the Canadian investor’s experience: Thoroughly understand your investment goals and your personal risk tolerance before making any investment decisions.

Conclusion: Beyond Berkshire: Finding Your Own Path to Billionaire Status

Edward Clark's story demonstrates that achieving billionaire status doesn't require slavishly following a single model. While learning from legendary investors like Warren Buffett is valuable, true success lies in developing your own unique investment strategy tailored to your skills, risk tolerance, and market understanding. Research the Canadian billionaire's investment strategies and find your own Canadian investment success story; don't just try to replicate Warren Buffett's approach; build your own unique path to financial success!

Featured Posts

-

Fbi Investigation Millions Stolen Through Executive Office365 Account Hacks

May 10, 2025

Fbi Investigation Millions Stolen Through Executive Office365 Account Hacks

May 10, 2025 -

Does The Us Government Fund Research On Transgender Mice A Comprehensive Look

May 10, 2025

Does The Us Government Fund Research On Transgender Mice A Comprehensive Look

May 10, 2025 -

The Growing Market For Disaster Betting Focusing On The La Wildfires

May 10, 2025

The Growing Market For Disaster Betting Focusing On The La Wildfires

May 10, 2025 -

Analiz Zayavi Kinga Chi Ye Mask Ta Tramp Zradnikami

May 10, 2025

Analiz Zayavi Kinga Chi Ye Mask Ta Tramp Zradnikami

May 10, 2025 -

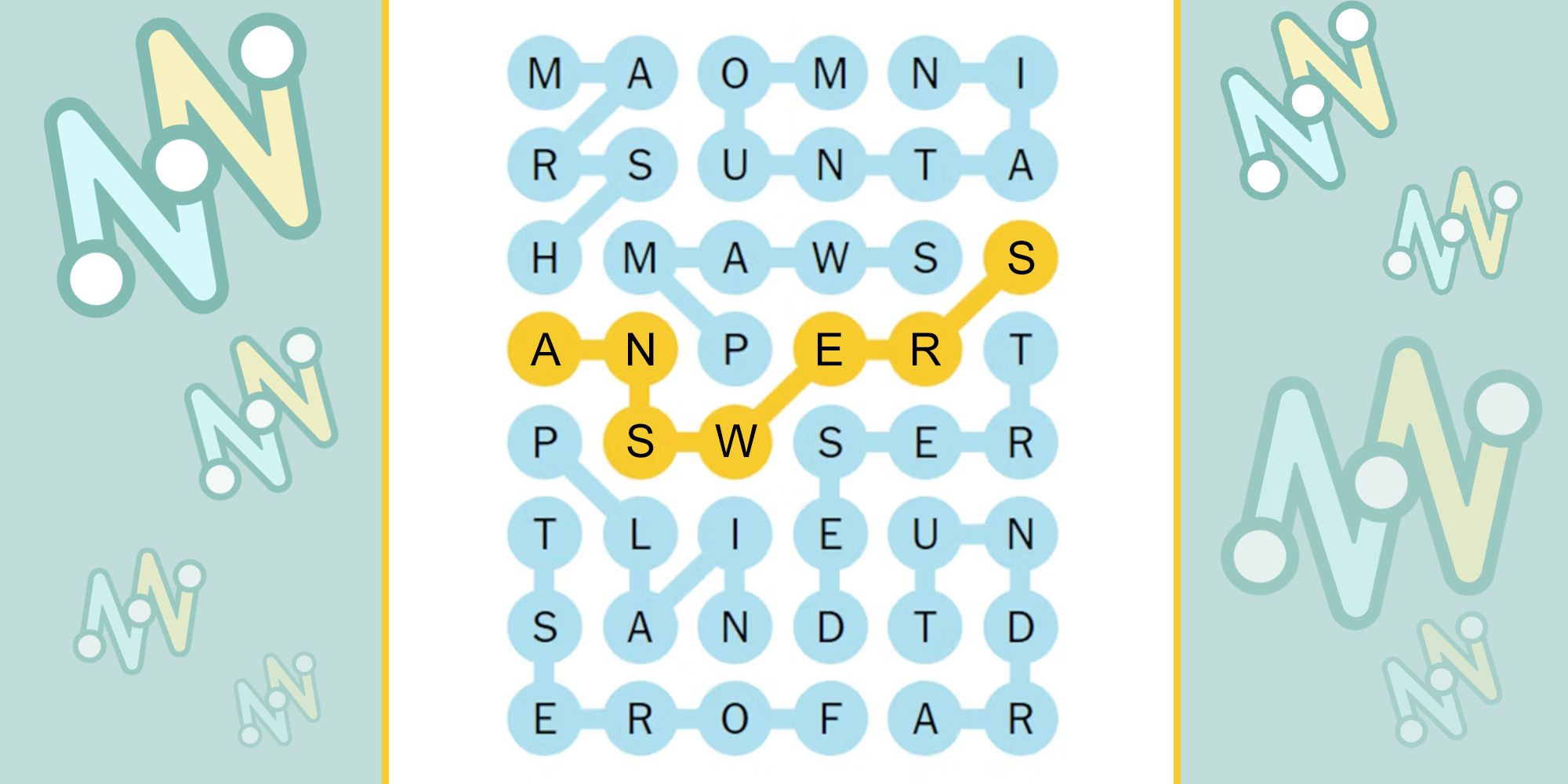

Nyt Strands Saturday Puzzle April 12 2025 Complete Guide

May 10, 2025

Nyt Strands Saturday Puzzle April 12 2025 Complete Guide

May 10, 2025