Weak Retail Sales Signal Potential Bank Of Canada Rate Cut

Table of Contents

Declining Retail Sales Figures: A Closer Look

The latest data from Statistics Canada paints a concerning picture. Canadian retail sales experienced a [Insert Percentage]% decrease in [Month, Year], marking a significant downturn in consumer spending. This follows a [mention trend from previous months] trend, indicating a potential broader economic slowdown. Key sectors showing particular weakness include: clothing, furniture, and [mention other affected sectors]. These figures highlight a worrying trend in Canadian consumer spending and serve as a key economic indicator.

- Specific Percentage Drop: [Insert Precise Percentage and Source]

- Most Affected Sectors: Clothing, furniture, and [list other sectors and percentages if available] experienced the most significant declines.

- Year-over-Year Comparison: Compared to the same period last year, retail sales are down by [Insert Percentage]%, further emphasizing the severity of the decline.

These weak Canadian retail sales figures are directly linked to broader macroeconomic trends, impacting consumer confidence and spending habits.

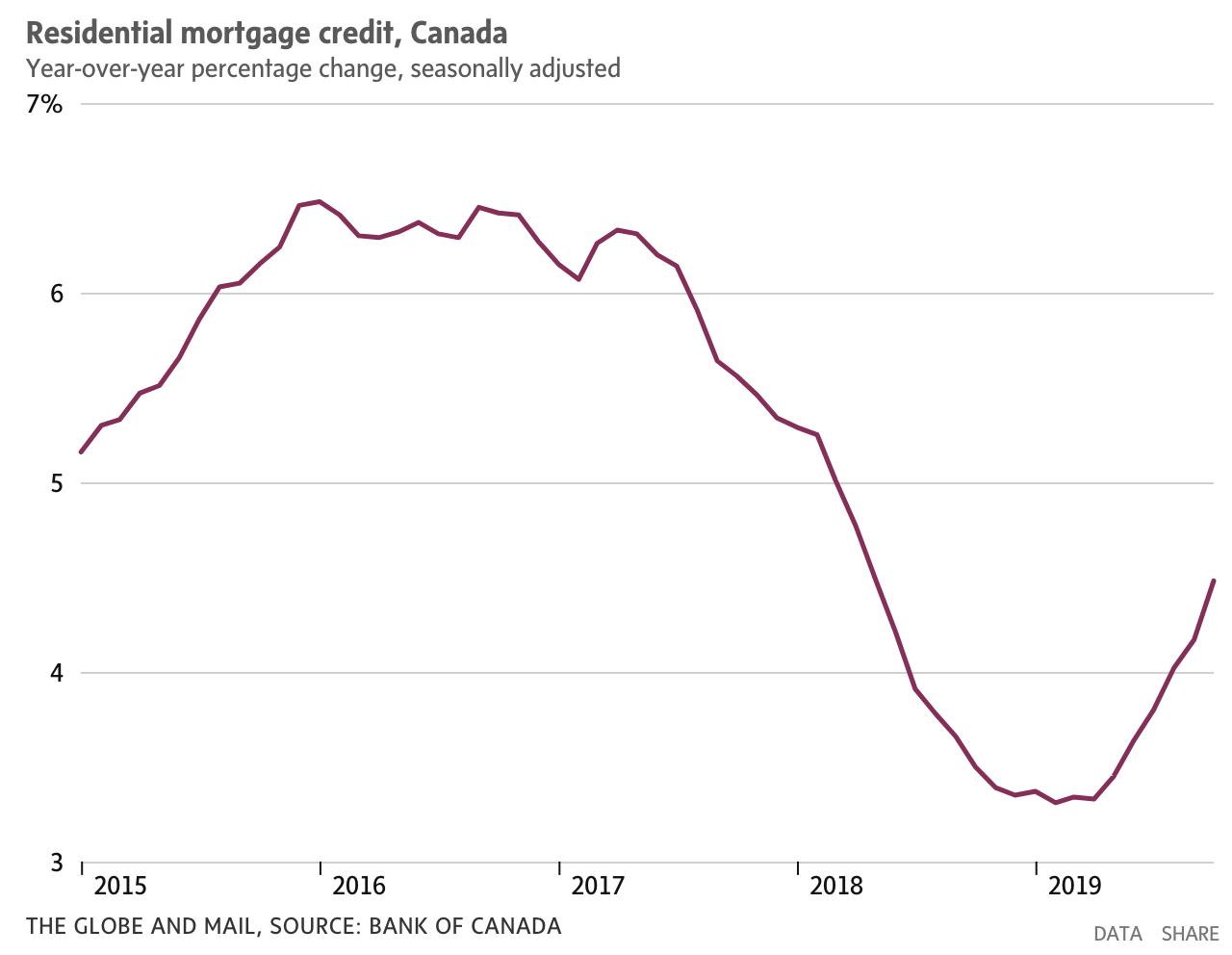

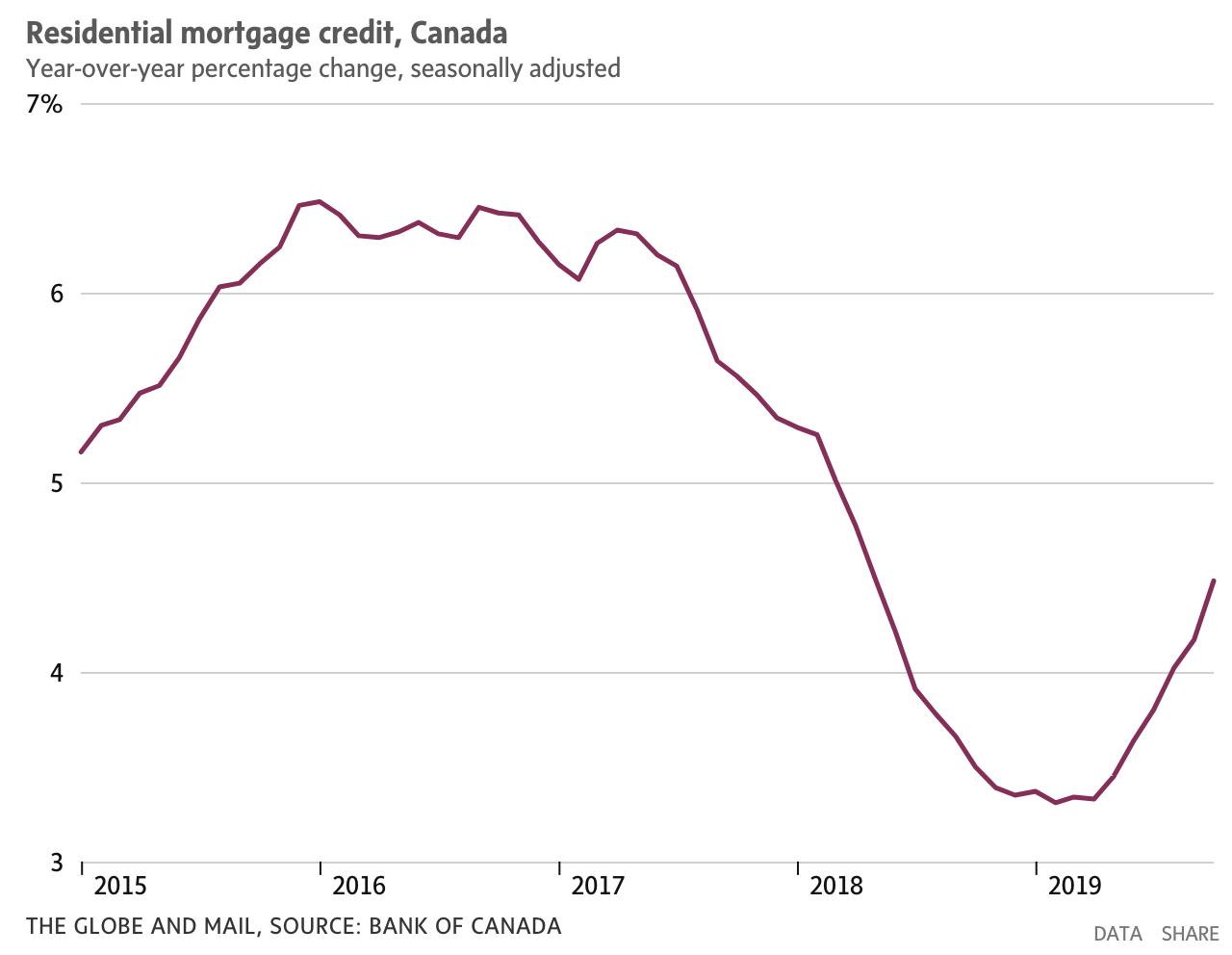

Impact of Inflation and Rising Interest Rates

The current economic climate is characterized by persistent inflation and the Bank of Canada's previous interest rate hikes. These factors have significantly dampened consumer spending. Higher interest rates increase borrowing costs, making it more expensive for consumers to finance purchases, particularly big-ticket items like homes and vehicles. Simultaneously, inflation erodes purchasing power, leaving consumers with less disposable income.

- Higher Interest Rates: Increased interest rates directly impact borrowing costs, reducing consumer's ability to finance purchases.

- Inflation's Impact: Persistent inflation reduces the real value of income, leading to decreased consumer spending.

- Weakened Consumer Confidence: Surveys show a decline in consumer confidence, further contributing to reduced spending and fueling the concerns around a potential Bank of Canada rate cut.

Bank of Canada's Response and Potential Rate Cut

The Bank of Canada is closely monitoring these developments. While their recent statements haven't explicitly indicated a rate cut, the weakening retail sales figures add pressure to consider adjusting their monetary policy. The Bank's current stance on inflation remains [State the current stance - e.g., hawkish, cautiously optimistic], but the softening consumer spending data could influence their decision-making process.

- Current Stance on Inflation: The Bank of Canada is aiming for an inflation target of [Insert Target Percentage]%, but current inflation remains above this target.

- Potential for a Rate Cut: The declining retail sales, coupled with [mention other factors influencing the decision], increase the likelihood of a Bank of Canada rate decision to cut interest rates.

- Dissenting Opinions: [Mention any known internal disagreements within the Bank of Canada regarding monetary policy].

Alternative Economic Factors Influencing the Decision

While weak retail sales are a significant concern, the Bank of Canada considers other crucial economic factors when formulating its monetary policy. These include:

- Labour Market: The current employment rate stands at [Insert current rate]%, indicating [mention whether it's strong or weak and its implication]. A strong labor market generally supports continued economic growth.

- Housing Market: The housing market is currently experiencing [Describe current state - e.g., a slowdown, price corrections], impacting consumer confidence and overall economic activity.

- GDP Growth: Projected GDP growth for the next quarters is [Insert projected growth and source], offering another perspective on the overall economic health.

Considering these multiple factors alongside the weak retail sales data is crucial for understanding the Bank of Canada's upcoming rate decision.

Conclusion: The Likelihood of a Bank of Canada Rate Cut Based on Weak Retail Sales

The weak retail sales figures are a significant indicator of a potential economic slowdown and contribute to the growing possibility of a Bank of Canada rate cut. While the Bank of Canada will consider various other economic factors, the declining consumer spending paints a clear picture of weakening economic activity. The interplay between inflation, interest rates, and consumer confidence, reflected in these retail sales figures, significantly influences the likelihood of a rate adjustment. To stay informed about this evolving situation and future Bank of Canada rate cuts, it is crucial to follow economic news closely. Subscribe to reputable financial news sources and follow leading economists to stay updated on potential interest rate changes and their impact on the Canadian economy. Understanding these potential Bank of Canada rate cuts is vital for informed financial planning.

Featured Posts

-

Deportation Case Harvard Researchers Future Hangs In The Balance In Louisiana

Apr 28, 2025

Deportation Case Harvard Researchers Future Hangs In The Balance In Louisiana

Apr 28, 2025 -

Mets Starters Consistent Performance A Sign Of Growth

Apr 28, 2025

Mets Starters Consistent Performance A Sign Of Growth

Apr 28, 2025 -

Last Chance Up To 70 Off At Hudsons Bay Liquidation Sales

Apr 28, 2025

Last Chance Up To 70 Off At Hudsons Bay Liquidation Sales

Apr 28, 2025 -

The Greatest Basketball Announcer Mike Breens Pick And Why

Apr 28, 2025

The Greatest Basketball Announcer Mike Breens Pick And Why

Apr 28, 2025 -

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025