Weakening Yen And Trade War: Bank Of Japan's Revised Economic Forecast

Table of Contents

The Weakening Yen: A Double-Edged Sword

A weaker yen presents a complex scenario for the Japanese economy, acting as a double-edged sword.

Export Benefits and Import Costs

The depreciation of the yen offers a boost to Japanese exporters. A weaker yen makes Japanese goods cheaper for international buyers, increasing their competitiveness in the global market. This can lead to:

- Increased export volumes: Japanese companies could see a surge in demand for their products, potentially boosting profits and economic growth.

- Improved export revenue: Even if export volumes remain the same, the weaker yen translates to higher revenue in Japanese yen terms.

However, this positive effect is counterbalanced by the negative impact on imports. A weaker yen makes imported goods more expensive, leading to:

- Higher import costs: This contributes to inflation, squeezing consumer purchasing power and potentially dampening domestic demand.

- Increased production costs: Many Japanese businesses rely on imported raw materials and components, leading to increased production costs and potentially impacting corporate profitability.

This interplay between export benefits and import costs creates a delicate balancing act for the BOJ.

BOJ's Response to Yen Fluctuations

The BOJ's response to the weakening yen has been a subject of intense scrutiny. While the BOJ has historically intervened in the foreign exchange market to curb excessive yen depreciation, its tolerance for a weaker yen seems to have increased recently. Factors considered in this approach include:

- Potential for further interventions: The BOJ may still intervene if the yen's depreciation becomes too rapid or disorderly, but such actions are becoming less frequent.

- Tolerance for yen weakness: The BOJ may be accepting a weaker yen as a necessary measure to boost export competitiveness, particularly given the challenges posed by the global trade war.

- Effectiveness of past interventions: The effectiveness of past interventions remains debatable, with some arguing that they only offer temporary solutions.

The BOJ's approach highlights the complexities of managing exchange rates in a globalized economy.

Inflationary Pressures

The rise in import costs due to a weaker yen directly contributes to inflationary pressures. This poses a significant challenge for the BOJ, as:

- Impact on BOJ's inflation targets: Rising inflation may push the inflation rate above the BOJ's target, potentially necessitating policy adjustments.

- Potential for policy changes: To combat inflation, the BOJ might need to reconsider its ultra-loose monetary policy, potentially leading to interest rate hikes.

Managing this inflation risk while maintaining economic growth requires careful calibration of monetary policy.

Impact of the Trade War on Japan's Economy

The ongoing trade war, particularly between the US and China, significantly impacts the Japanese economy, disrupting established trade patterns and creating uncertainty.

Disruption to Supply Chains

The trade war disrupts global supply chains, affecting Japanese businesses reliant on international trade:

- Increased costs and delays: Tariffs and trade restrictions increase costs and lead to delays in shipping goods.

- Shifting of supply chains: Companies are increasingly looking to diversify their supply chains, potentially shifting production away from China. This requires significant investment and adjustments for Japanese companies.

- Impact on various sectors: The automotive, electronics, and manufacturing sectors are particularly vulnerable to supply chain disruptions.

Reduced Global Demand

The trade war contributes to a slowdown in global economic growth, reducing demand for Japanese goods:

- Slowdown in global economic growth impacting exports: Reduced global demand directly affects Japanese exports, potentially leading to decreased production and job losses.

- Potential for decreased investment: Uncertainty about the future of global trade may deter businesses from making new investments.

BOJ's Forecast Adjustments

The BOJ's revised economic forecast reflects the negative impacts of the trade war:

- Specific revisions to GDP growth projections: The forecast likely includes downward revisions to GDP growth projections, reflecting reduced export demand and business investment.

- Changes to inflation forecasts: Inflation forecasts have likely been adjusted upwards to reflect the impact of higher import costs due to the weaker yen and trade disruptions.

- Any alterations to monetary policy plans: The BOJ may need to revise its monetary policy plans in light of the economic challenges presented by the trade war and weaker yen.

BOJ's Revised Economic Forecast: Key Takeaways

The BOJ's revised forecast likely paints a picture of slower economic growth and increased inflationary pressures. Key takeaways may include:

- Downward revisions to GDP growth projections for the current fiscal year and potentially the next.

- Upward revisions to inflation forecasts, reflecting the impact of higher import costs.

- Continued emphasis on supporting economic activity through accommodative monetary policy, despite the rising inflation risk.

- Increased uncertainty surrounding the outlook due to the volatile nature of the trade war and yen fluctuations.

Conclusion: Navigating Uncertainty: The Bank of Japan's Outlook and the Weakening Yen

The weakening yen and the ongoing trade war pose significant challenges for the Japanese economy. The BOJ's revised economic forecast likely reflects a more cautious outlook, acknowledging slower growth and higher inflation risks. The BOJ faces the difficult task of balancing the need to stimulate economic growth with the need to manage inflation. Future policy adjustments will depend on the evolution of the global economic landscape, including the resolution of trade tensions and the stability of the yen. Stay informed about the ongoing developments in the Japanese economy and the Bank of Japan's responses to the weakening yen and trade war by regularly checking reputable financial news sources. Continue to monitor the Bank of Japan's economic forecasts for updates on the evolving economic situation.

Featured Posts

-

Official Announcement Grant Assistance For Mauritius

May 03, 2025

Official Announcement Grant Assistance For Mauritius

May 03, 2025 -

El Sistema Penitenciario Recibe 7 Nuevos Vehiculos Para Mejorar Su Funcionamiento

May 03, 2025

El Sistema Penitenciario Recibe 7 Nuevos Vehiculos Para Mejorar Su Funcionamiento

May 03, 2025 -

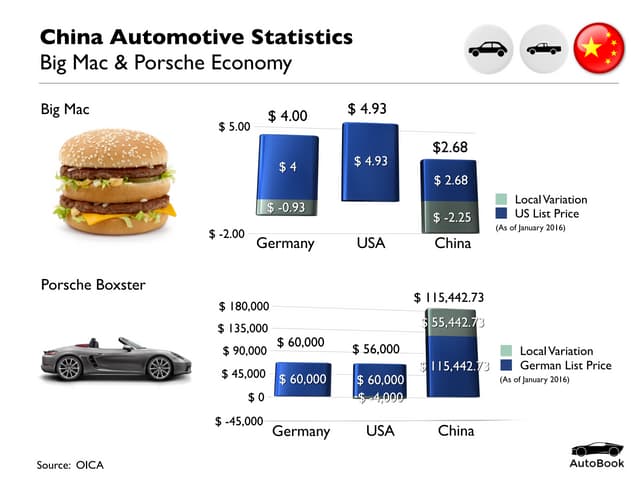

Are Bmw And Porsche Losing Ground In China A Competitive Analysis

May 03, 2025

Are Bmw And Porsche Losing Ground In China A Competitive Analysis

May 03, 2025 -

Netanyahu Desapprouve Le Soutien De Macron A Un Etat Palestinien

May 03, 2025

Netanyahu Desapprouve Le Soutien De Macron A Un Etat Palestinien

May 03, 2025 -

Techiman South Parliamentary Seat Court Throws Out Ndc Petition

May 03, 2025

Techiman South Parliamentary Seat Court Throws Out Ndc Petition

May 03, 2025

Latest Posts

-

Lee Anderson Ignites Tory Civil War With Scathing Lowe Criticism

May 03, 2025

Lee Anderson Ignites Tory Civil War With Scathing Lowe Criticism

May 03, 2025 -

Tory Infighting Intensifies Andersons Comments On Lowe Fuel Party Division

May 03, 2025

Tory Infighting Intensifies Andersons Comments On Lowe Fuel Party Division

May 03, 2025 -

Police Launch Probe Into Mp Rupert Lowes Affairs

May 03, 2025

Police Launch Probe Into Mp Rupert Lowes Affairs

May 03, 2025 -

Nigel Farage Whats App Leaks A Reform Party Scandal

May 03, 2025

Nigel Farage Whats App Leaks A Reform Party Scandal

May 03, 2025 -

Mp Rupert Lowe Under Police Investigation

May 03, 2025

Mp Rupert Lowe Under Police Investigation

May 03, 2025