Wedbush's Apple Outlook: Bullish Despite Price Target Reduction

Table of Contents

The Revised Price Target and its Implications

Wedbush recently lowered its Apple price target from $200 to $175 per share. This reduction, while noteworthy, doesn't signal a bearish shift in their overall sentiment.

-

Reasons for the Reduction: Wedbush cited several factors contributing to the price target reduction. These include macroeconomic headwinds, potential weakening consumer spending due to inflation, and ongoing supply chain challenges impacting the production and delivery of Apple products.

-

Comparison to Other Analysts: While Wedbush's revised price target is lower, it still sits relatively high compared to the average price target among other analysts covering Apple. This suggests a degree of consensus on Apple's long-term value, even amidst short-term uncertainties.

-

Impact on Apple's Stock Price: Following the announcement, Apple's stock price experienced a minor dip, reflecting the market's initial reaction to the reduced price target. However, the drop was relatively muted, suggesting that the market largely anticipated the adjustment and continues to hold a positive view of Apple's prospects. The impact on Apple's market capitalization was proportionally limited. The overall valuation, while adjusted, still suggests a healthy outlook. Earnings Per Share (EPS) projections remain strong, further supporting the bullish outlook.

Wedbush's Rationale for Maintaining a Bullish Stance

Despite lowering the price target, Wedbush remains bullish on Apple's future. Their rationale centers on several key factors:

-

Robust Growth of Apple Services: Wedbush emphasizes the continuing strong performance and growth potential of Apple's Services segment, which includes subscriptions like Apple Music, iCloud, and the App Store. This recurring revenue stream provides significant stability and predictable growth.

-

Anticipation of Successful New Product Launches: Wedbush expects strong demand for upcoming Apple products, including new iPhone models, improved wearables like the Apple Watch, and potential advancements in other product categories such as augmented reality (AR) and virtual reality (VR) technology. These new releases will contribute to improved iPhone sales and overall revenue.

-

Unwavering Brand Loyalty and Market Share: Apple maintains an unparalleled brand loyalty among its customer base. This translates to consistent high demand for its products and a substantial market share, providing a significant competitive advantage.

-

Opportunities for Expansion: Wedbush sees significant potential for Apple to expand into new markets and product categories, further driving future growth and revenue diversification. This includes strengthening presence in emerging markets and introducing innovative products and services.

Key Risks and Uncertainties

While Wedbush maintains a bullish outlook, it acknowledges potential risks and challenges:

-

Intense Competition: Apple faces fierce competition from other tech giants, including Samsung, Google, and Amazon. These competitors constantly innovate, introducing products and services that can disrupt Apple's dominance in various market segments. This competitive landscape demands continuous innovation from Apple to maintain its market share.

-

Economic Slowdown and Consumer Spending: A potential economic downturn could negatively impact consumer spending on discretionary items, including Apple products. This could lead to decreased demand and affect sales growth, especially in more expensive product categories.

-

Geopolitical Risks and Supply Chain Issues: Geopolitical instability and ongoing supply chain disruptions pose significant risks to Apple's production and distribution capabilities. These factors could lead to delays, shortages, and increased costs.

-

Regulatory Scrutiny and Antitrust Concerns: Apple faces increasing regulatory scrutiny and potential antitrust investigations, particularly regarding its App Store practices and data privacy policies. These legal challenges could result in significant financial penalties and changes to Apple's business model.

What This Means for Investors

Wedbush's report suggests a nuanced approach to Apple stock:

-

Investment Strategy: While the reduced price target warrants cautious optimism, Wedbush's continued bullish stance suggests holding Apple stock remains a viable long-term strategy for many investors.

-

Risk Tolerance: Investors should assess their individual risk tolerance before making any investment decisions. Apple, despite its robust fundamentals, is not immune to market fluctuations and potential risks.

-

Long-Term vs. Short-Term: The report emphasizes a long-term perspective on Apple’s investment potential. Short-term market volatility shouldn't overshadow the company's strong long-term growth prospects.

-

Portfolio Diversification: Diversification remains crucial in managing investment risk. Investors should not over-concentrate their portfolio in any single stock, including Apple.

Conclusion

Wedbush's Apple outlook presents a compelling case for long-term bullishness, despite the recent price target reduction. The firm cites strong growth potential in Apple Services, anticipated success with new products, and unwavering brand loyalty as key drivers. However, it's crucial to acknowledge the risks associated with macroeconomic headwinds, competition, and regulatory uncertainties. While Wedbush's Apple analysis provides valuable insights, remember to conduct your own thorough research before making any investment decisions. Stay informed about future developments in Wedbush's Apple outlook and other market analyses to make well-informed choices for your investment portfolio.

Featured Posts

-

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025 -

Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025

Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025 -

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Analyse Snelle Koerswijziging Europese Aandelen Vergeleken Met Wall Street

May 24, 2025

Analyse Snelle Koerswijziging Europese Aandelen Vergeleken Met Wall Street

May 24, 2025 -

Sergey Yurskiy Legendarniy Akter 90 Let So Dnya Rozhdeniya

May 24, 2025

Sergey Yurskiy Legendarniy Akter 90 Let So Dnya Rozhdeniya

May 24, 2025

Latest Posts

-

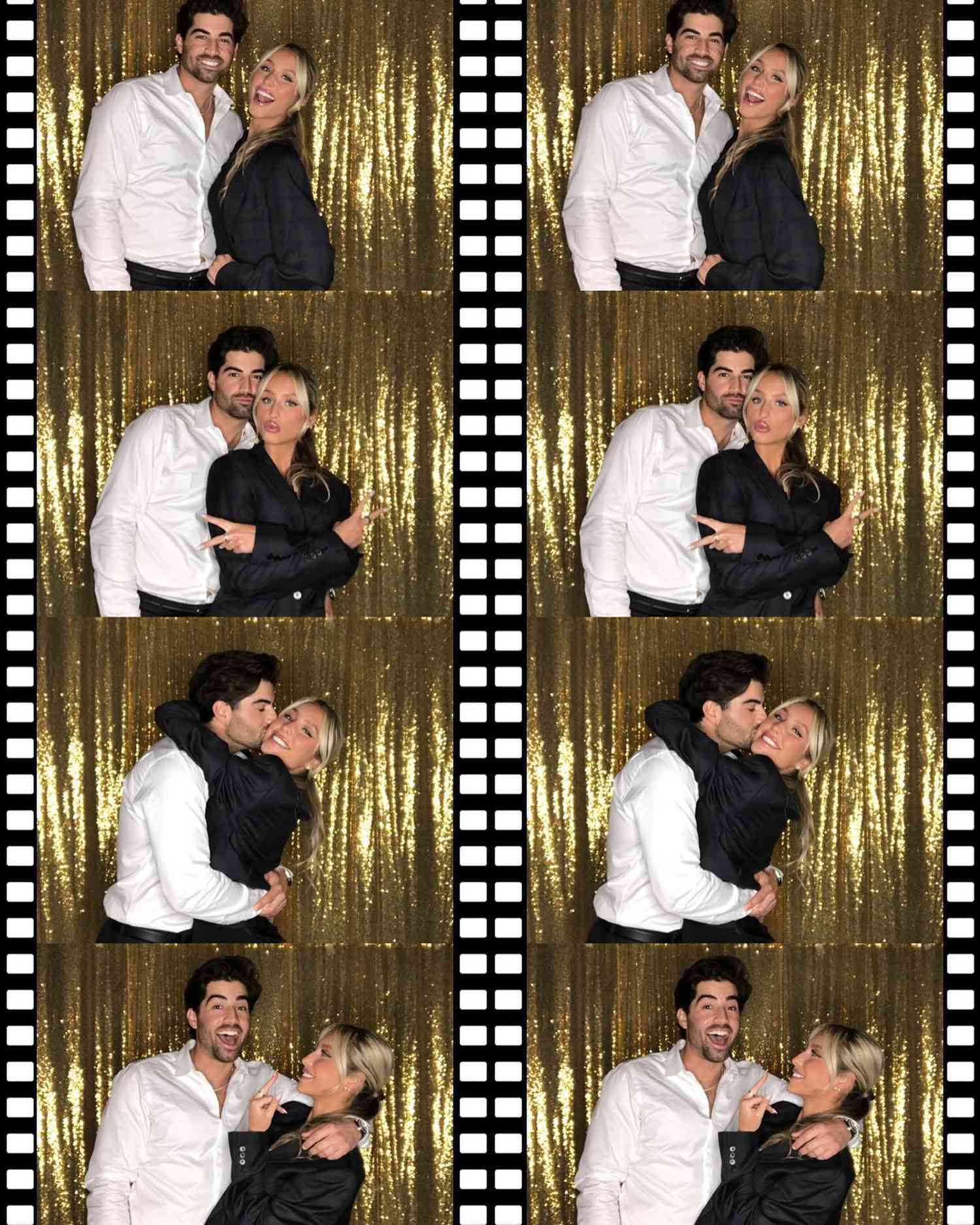

Dancing With The Stars Alix Earle Gen Zs Savviest Pitchwoman

May 24, 2025

Dancing With The Stars Alix Earle Gen Zs Savviest Pitchwoman

May 24, 2025 -

Universals Epic 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025

Universals Epic 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025 -

The Tush Push Triumphs How The Nfls Butt Ban Failed

May 24, 2025

The Tush Push Triumphs How The Nfls Butt Ban Failed

May 24, 2025 -

Alix Earle How The Dancing With The Stars Star Became Gen Zs Top Influencer

May 24, 2025

Alix Earle How The Dancing With The Stars Star Became Gen Zs Top Influencer

May 24, 2025 -

The Nfls Tush Push Lives On The End Of The Butt Ban

May 24, 2025

The Nfls Tush Push Lives On The End Of The Butt Ban

May 24, 2025