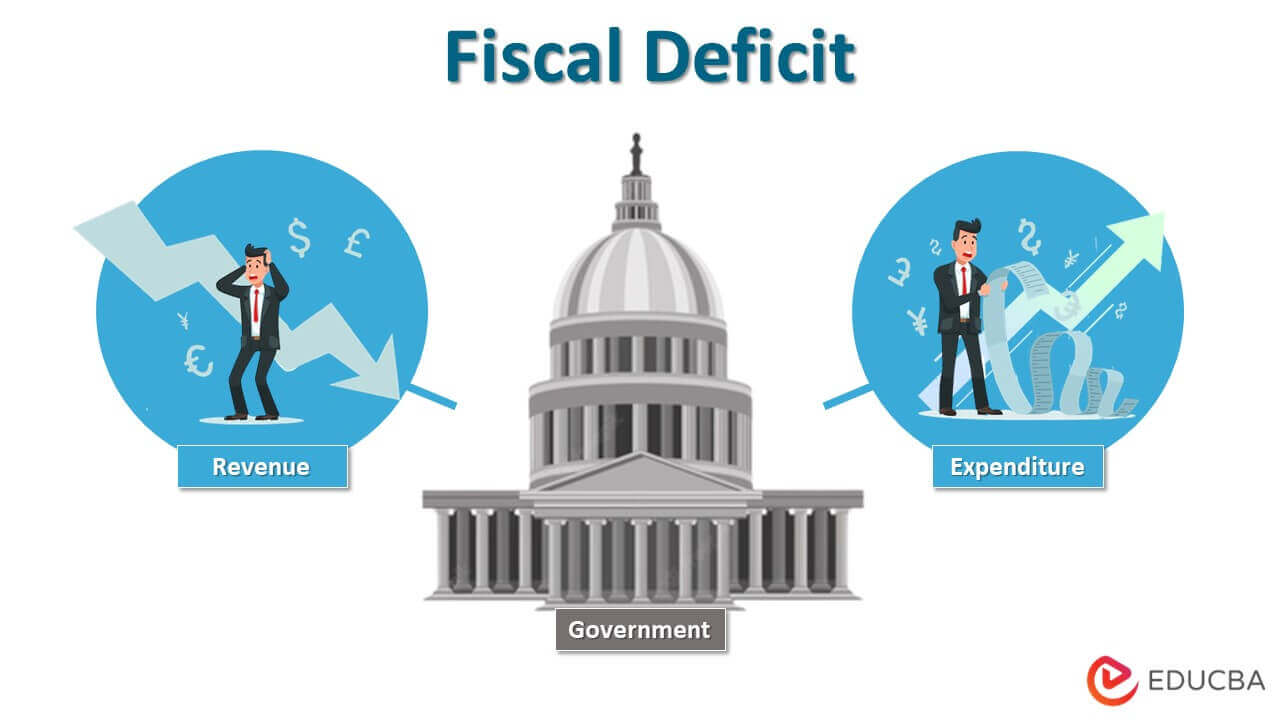

West Ham's £25 Million Financial Deficit: A Detailed Analysis

Table of Contents

1. Causes of West Ham's £25 Million Financial Deficit:

High Player Transfer Spending:

West Ham's ambitious recruitment strategy in recent years has significantly contributed to the deficit. The club's pursuit of high-profile players has resulted in substantial transfer fees, often exceeding the market value of some acquisitions.

- Key Players and Transfer Fees: The signings of players like Lucas Paquetá (reported fee exceeding £50 million) and others represent significant financial commitments. Precise figures for all transfers are difficult to obtain publicly, but the overall trend towards high-spending is clear.

- Return on Investment (ROI): While some signings have delivered on the pitch, others have underperformed, leading to a questionable ROI on substantial investments. A thorough review of player acquisition strategy is needed.

- Overspending Compared to Peers: Compared to clubs with similar ambitions and financial resources, West Ham's spending may be considered disproportionately high, exacerbating the financial strain. A more sustainable model of recruitment is crucial.

Stadium Costs and Maintenance:

Maintaining the London Stadium, while providing a modern setting for matches, represents a substantial ongoing financial burden.

- Ongoing Costs: Rent, maintenance, and potential upgrades contribute significantly to the club's operational expenses. These fixed costs are unavoidable and represent a major pressure on finances.

- Comparison with Other Clubs: Stadium-related costs vary among Premier League teams, with some clubs benefiting from owning their grounds outright. A comparison could reveal strategies for optimization.

- Cost-Saving Measures: Exploring cost-effective alternatives for maintenance and potential improvements are vital to reducing expenses associated with the London Stadium.

Impact of Decreased Broadcasting Revenue:

Changes in broadcasting deals and overall market dynamics have impacted West Ham's revenue streams.

- Changes in Broadcasting Deals: The financial landscape of broadcasting rights has shifted, leading to decreased revenue for some clubs, including West Ham.

- Comparison to Comparable Clubs: Analyzing the revenue streams of comparable Premier League clubs reveals a need for increased commercialization and negotiation prowess to secure more lucrative deals.

- Strategies to Increase Revenue: Developing creative and diversified revenue streams, including increased sponsorship deals and global fan engagement strategies, are key to boosting income.

Wage Bill Analysis:

West Ham's wage bill, like many Premier League clubs, is substantial. Balancing player salaries with financial stability is crucial.

- Top Earners and Salaries: While specifics are confidential, the salaries of top players constitute a considerable portion of the wage bill.

- Wage Spending and Player Performance: The club must carefully evaluate the correlation between player salaries and on-field performance to ensure value for money.

- Cost-Cutting Measures: Strategies for managing the wage bill, such as contract renegotiations and potentially adjusting player salaries based on performance, require careful planning.

2. Consequences of West Ham's £25 Million Financial Deficit:

Impact on Transfer Activity:

The deficit significantly impacts West Ham's future transfer activity, potentially limiting their ability to compete with wealthier clubs.

- Reduced Spending in Upcoming Windows: The £25 million deficit strongly suggests a reduction in transfer spending in the coming windows.

- Implications for Team Performance: Limited spending could affect the team's ability to strengthen and compete effectively on the pitch.

Financial Fair Play Implications:

Breaching UEFA's Financial Fair Play (FFP) regulations could result in severe penalties.

- Potential Sanctions: Sanctions could include transfer bans or hefty fines, significantly hampering the club's competitiveness and future development.

- Addressing FFP Concerns: The club needs to implement robust strategies for financial compliance to avoid any potential sanctions. Careful budgeting and financial planning are key.

Effect on Club Infrastructure and Development:

The deficit may force the postponement or cancellation of investments in infrastructure and youth development programs.

- Delays or Cancellations of Projects: Planned stadium upgrades, youth academy improvements, or other club infrastructure projects may be affected.

- Long-Term Consequences: Reduced investment in these areas could negatively impact the club's long-term growth and sustainability.

3. Conclusion:

West Ham's £25 million financial deficit stems from a combination of high transfer spending, stadium costs, reduced broadcasting revenue, and a substantial wage bill. The consequences could be far-reaching, affecting transfer activity, compliance with FFP regulations, and investment in crucial club infrastructure. The club needs to implement a strategic plan to address these issues, including more prudent spending, improved revenue generation, and stringent financial controls. A move towards a more sustainable financial model is paramount for West Ham's future success.

We encourage you to share your thoughts and insights on West Ham's £25 million financial deficit in the comments section below. What strategies do you think the club should prioritize to overcome this challenge? Let's discuss the path to recovery for the Hammers. For further analysis and related articles on Premier League club finances, explore our website.

Featured Posts

-

Black Rock Etf Billionaire Investment Poised For Massive Growth In 2025

May 09, 2025

Black Rock Etf Billionaire Investment Poised For Massive Growth In 2025

May 09, 2025 -

Palantirs Nato Deal How Ai Will Transform Public Sector Operations

May 09, 2025

Palantirs Nato Deal How Ai Will Transform Public Sector Operations

May 09, 2025 -

The Closure Of Anchor Brewing Company Impact And Future Of The Brewery

May 09, 2025

The Closure Of Anchor Brewing Company Impact And Future Of The Brewery

May 09, 2025 -

Netflix Rimeyk Na Kultov Roman Na Stivn King

May 09, 2025

Netflix Rimeyk Na Kultov Roman Na Stivn King

May 09, 2025 -

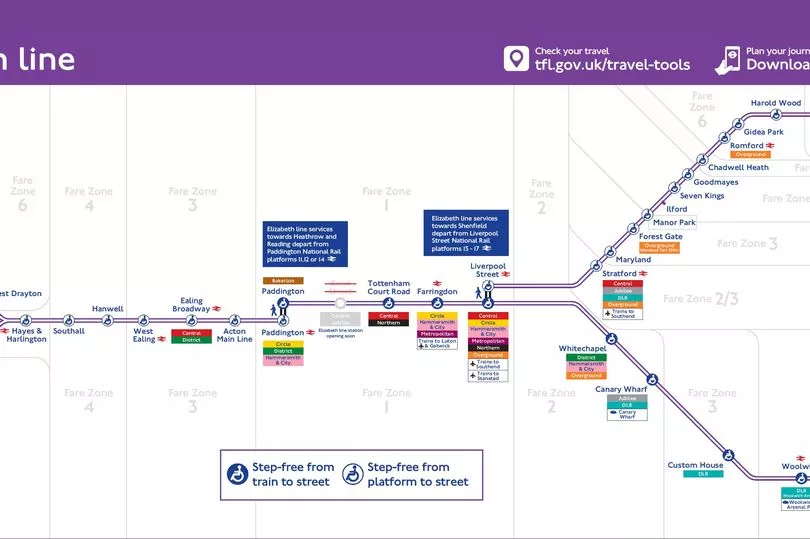

Navigating The Elizabeth Line A Guide For Wheelchair Users

May 09, 2025

Navigating The Elizabeth Line A Guide For Wheelchair Users

May 09, 2025