Westpac's (WBC) Falling Profits: A Deep Dive Into Margin Squeeze

Table of Contents

The Impact of Rising Interest Rates on Westpac's NIM

The Reserve Bank of Australia (RBA)'s recent interest rate hikes, while generally beneficial for banks by widening lending margins, haven't translated into substantial profit growth for Westpac. This is due to several factors impacting the crucial Net Interest Margin (NIM).

- Lag in Passing on Rate Rises: While the RBA has increased interest rates, banks haven't always immediately passed these increases onto borrowers. This lag in adjusting lending rates impacts the potential gains from higher interest rates. The timing of these adjustments is crucial for maximizing NIM.

- Rising Cost of Funds: The increased interest rates also impact Westpac's cost of funds. The bank pays interest on deposits, and as these rates rise, so do the bank's expenses, directly impacting the NIM. This cost pressure offsets some of the benefits of higher lending rates.

- NIM Compression: The gap between lending rates and deposit rates – a key determinant of NIM – has been compressed. This compression directly reduces Westpac's profitability despite rising interest rates. Analyzing this gap provides a clear picture of the extent of the challenge.

- RBA's Influence: The RBA's monetary policy decisions, driven by inflation targets and economic conditions, play a significant role in shaping interest rate fluctuations. Understanding the RBA's actions and their timing is crucial to comprehending the impact on Westpac's NIM.

Heightened Competition in the Australian Banking Sector

The Australian banking sector is increasingly competitive, putting pressure on Westpac's profitability. This competition comes from both established players and new entrants, significantly influencing pricing strategies and market share.

- Intense Price Competition: Established banks and the emergence of fintech companies are fiercely competing for customers, leading to more competitive pricing. This intense competition forces banks to offer better deals, often reducing profit margins.

- Price-Sensitive Customers: Customers are becoming increasingly price-sensitive, readily using comparison websites and switching banks for better offers. This increased customer awareness necessitates a more strategic pricing approach.

- Market Share Battles: The fight for market share is intensifying, with banks offering various incentives and lower fees to attract and retain customers. This directly affects the profitability of each transaction.

- Digital Disruption: The rise of digital banking and fintech solutions is disrupting traditional banking models. This technological shift demands substantial investment and adaptation from established banks like Westpac.

Operational Costs and Efficiency Ratios

Westpac's profitability is also impacted by increasing operational costs. These costs, coupled with efficiency ratios, provide insight into the bank's operational effectiveness.

- Regulatory Compliance: Stricter regulatory compliance requirements are adding to operational expenses. Meeting these requirements necessitates significant investment in compliance infrastructure and personnel.

- Technology Investment: The need for technological upgrades and investments in digital banking platforms requires significant capital expenditure, impacting profitability in the short term.

- Efficiency Ratio Analysis: Westpac's efficiency ratio (operating costs as a percentage of revenue) is a key indicator of its operational efficiency. Comparing this ratio to competitors reveals Westpac's relative performance and areas for improvement.

- Cost-Cutting Measures: Westpac has implemented various cost-cutting measures, but their effectiveness needs to be carefully evaluated against the ongoing pressure on profitability.

Implications for Investors and the Future Outlook

The decline in Westpac's profits has had a noticeable impact on investor sentiment and its share price. Understanding the future outlook requires careful consideration of strategic responses and growth prospects.

- Impact on Share Price: The falling profits have negatively impacted Westpac's share price and investor confidence. This underscores the importance of addressing the margin squeeze.

- Strategic Responses: Westpac needs to implement strategic responses to navigate the margin squeeze. These could include cost-cutting initiatives, diversification into new revenue streams, or adjustments to lending and deposit strategies.

- Long-Term Growth: The long-term growth prospects for Westpac depend on its ability to adapt to the changing banking landscape and overcome the challenges presented by the current economic climate. A successful response to the margin squeeze is key to future growth.

Conclusion

Westpac's (WBC) declining profits, driven by the ongoing margin squeeze, reflect the significant challenges facing Australian banks. Interest rate fluctuations, intensified competition, and rising operational costs are all contributing factors. To overcome this "Westpac margin squeeze," strategic action is crucial, focusing on operational efficiency and pricing strategies. Investors and stakeholders must closely monitor Westpac's performance, paying close attention to its strategic responses and long-term growth prospects. Understanding the dynamics of the Westpac margin squeeze is vital for navigating the complexities of the Australian banking sector. Stay informed on further developments concerning the Westpac margin squeeze and the bank's efforts to overcome this challenge.

Featured Posts

-

From Puerto Rican Pride To King Of New York Edgar Berlangas Bold Claim Before Sheeraz Fight

May 05, 2025

From Puerto Rican Pride To King Of New York Edgar Berlangas Bold Claim Before Sheeraz Fight

May 05, 2025 -

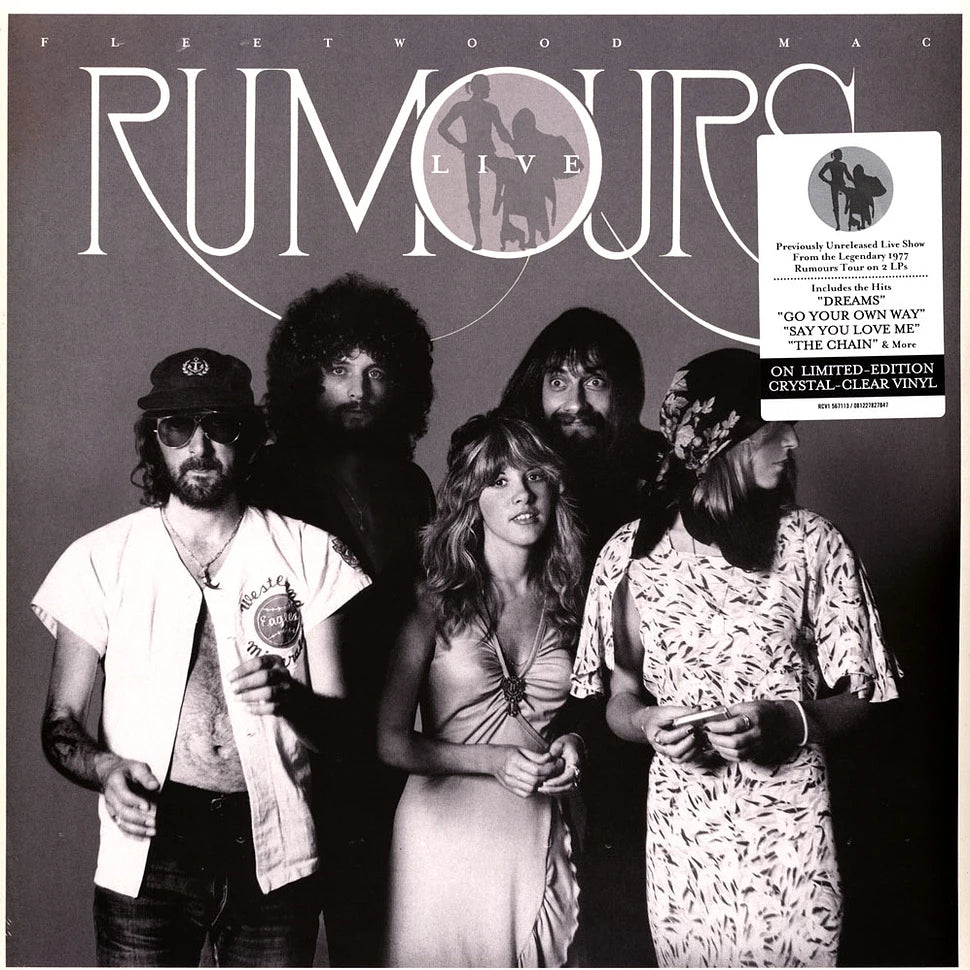

Rumours 48th Anniversary The Impact Of Personal Conflict On Fleetwood Macs Iconic Album

May 05, 2025

Rumours 48th Anniversary The Impact Of Personal Conflict On Fleetwood Macs Iconic Album

May 05, 2025 -

The Count Of Monte Cristo A Review Of Revenge And Redemption

May 05, 2025

The Count Of Monte Cristo A Review Of Revenge And Redemption

May 05, 2025 -

Run Bianca Run The Aftermath Of Kanye Wests Controversial Actions

May 05, 2025

Run Bianca Run The Aftermath Of Kanye Wests Controversial Actions

May 05, 2025 -

Britains Got Talent Show Halted Full Story And Host Statement

May 05, 2025

Britains Got Talent Show Halted Full Story And Host Statement

May 05, 2025

Latest Posts

-

Jeff Goldblum Releases Surprise Jazz Album

May 06, 2025

Jeff Goldblum Releases Surprise Jazz Album

May 06, 2025 -

New Album From Actor Jeff Goldblum Listen Now

May 06, 2025

New Album From Actor Jeff Goldblum Listen Now

May 06, 2025 -

Jeff Goldblum Checks His Own Oscars Photos The Internets Hilarious Response

May 06, 2025

Jeff Goldblum Checks His Own Oscars Photos The Internets Hilarious Response

May 06, 2025 -

Why Jeff Goldblum Wanted A Different Ending For The Fly

May 06, 2025

Why Jeff Goldblum Wanted A Different Ending For The Fly

May 06, 2025 -

The Flys Ending Jeff Goldblums Thoughts And Why He D Change It

May 06, 2025

The Flys Ending Jeff Goldblums Thoughts And Why He D Change It

May 06, 2025