What Is The Real Safe Bet For Retirement Savings?

Table of Contents

Understanding Risk Tolerance and Retirement Goals

Defining your risk tolerance—conservative, moderate, or aggressive—is paramount in determining the best safe retirement investments for you. Your risk tolerance significantly impacts your investment choices and the potential returns you can expect. Risk-averse retirement planning often involves prioritizing capital preservation over high-growth potential.

- Consider your age and time horizon until retirement: Younger individuals generally have a longer time horizon and can tolerate more risk, while those closer to retirement may prefer more conservative options.

- Evaluate your current financial situation and potential income streams: Assess your current savings, debts, and any potential future income sources like pensions or Social Security.

- Determine your desired retirement lifestyle and associated costs: Imagine your ideal retirement. What activities will you pursue? What will your living expenses be? This will help you determine how much you need to save.

Setting realistic retirement goals is equally important. Don't aim for the impossible; instead, establish achievable targets based on your financial situation and risk tolerance. This will help guide your investment decisions and ensure you stay on track.

Diversification: The Cornerstone of a Safe Retirement Strategy

Diversifying your investment portfolio across different asset classes is a cornerstone of any safe retirement strategy. This approach helps mitigate risk by reducing the impact of any single investment performing poorly. A diversified retirement portfolio typically includes:

- Stocks (equities): Offer higher growth potential but carry more risk. Stocks are a key component for long-term growth, but their value can fluctuate significantly.

- Bonds (fixed income): Provide stability and regular income but generally offer lower growth than stocks. Bonds are considered less risky and can provide a more predictable income stream.

- Real Estate: Can offer diversification and potential rental income, acting as both a store of value and a potential source of cash flow.

- Alternative Investments (e.g., commodities, precious metals): These assets can serve as a smaller component of a diversified portfolio, offering potential diversification benefits.

Asset allocation strategies tailored to individual risk profiles are key to successful diversification. A financial advisor can help you create an asset allocation strategy that aligns with your goals and risk tolerance, optimizing your low-risk retirement investments.

The Role of Guaranteed Income Streams

Securing a reliable income during retirement is crucial. Guaranteed retirement income streams, such as annuities and pensions, play a vital role in providing financial security.

- Annuities: Provide guaranteed income for a specified period or lifetime, offering predictable payments and peace of mind. They can be a valuable component of a safe retirement options strategy.

- Pensions: Offer a steady stream of income from previous employment, acting as a critical source of retirement income for many individuals.

These options provide a level of certainty that can reduce anxiety about outliving your savings. They represent a significant part of a well-rounded safe retirement investment strategy for many people.

The Importance of Tax-Advantaged Retirement Accounts

Utilizing tax-advantaged retirement accounts, such as 401(k)s and IRAs, significantly boosts your savings potential. These accounts offer benefits that can dramatically improve your long-term retirement security.

- Tax deferral or tax-free growth: Depending on the account type, you either defer paying taxes on your earnings until retirement or enjoy tax-free growth. This can substantially increase your savings over time.

- Traditional vs. Roth accounts: Traditional accounts offer tax deductions on contributions, while Roth accounts provide tax-free withdrawals in retirement. The best choice depends on your individual tax bracket and financial projections.

- Maximize contributions: Contributing early and consistently to these accounts is crucial to maximizing their benefits and building a strong foundation for your tax-advantaged retirement savings. This is a cornerstone of safe retirement planning.

Regularly Reviewing and Adjusting Your Retirement Plan

Your retirement plan shouldn't be a "set it and forget it" endeavor. Life changes and market fluctuations necessitate regular review and adjustment.

- Annual review: Conducting an annual review of your retirement portfolio allows for necessary adjustments and monitoring of your progress towards your goals.

- Professional financial advice: Seek professional assistance to ensure your portfolio aligns with your objectives and risk tolerance. A financial advisor can help you make informed adjustments and stay on track.

- Adaptability: Be prepared to adapt your retirement plan as circumstances change. Life throws curveballs, and your financial strategy should be flexible enough to handle them. Retirement portfolio management requires continuous monitoring and recalibration.

Conclusion

Finding the real safe bet for retirement savings isn't about eliminating all risk; it's about strategically managing it. By understanding your risk tolerance, diversifying your investments, leveraging tax-advantaged accounts, and seeking professional guidance, you can build a secure financial foundation for a comfortable retirement. Don't delay – start planning for your future today. Take the first step towards securing your financial well-being by exploring different safe retirement investment strategies. Contact a financial advisor to discuss your personalized retirement savings plan.

Featured Posts

-

Analyzing Cryptos Future Which Coin Will Weather The Trade War

May 09, 2025

Analyzing Cryptos Future Which Coin Will Weather The Trade War

May 09, 2025 -

Trump Selects Jeanine Pirro For Key D C Prosecutor Role

May 09, 2025

Trump Selects Jeanine Pirro For Key D C Prosecutor Role

May 09, 2025 -

Ra Soat And Quan Ly Co So Giu Tre Bao Ve Tre Khoi Bao Hanh

May 09, 2025

Ra Soat And Quan Ly Co So Giu Tre Bao Ve Tre Khoi Bao Hanh

May 09, 2025 -

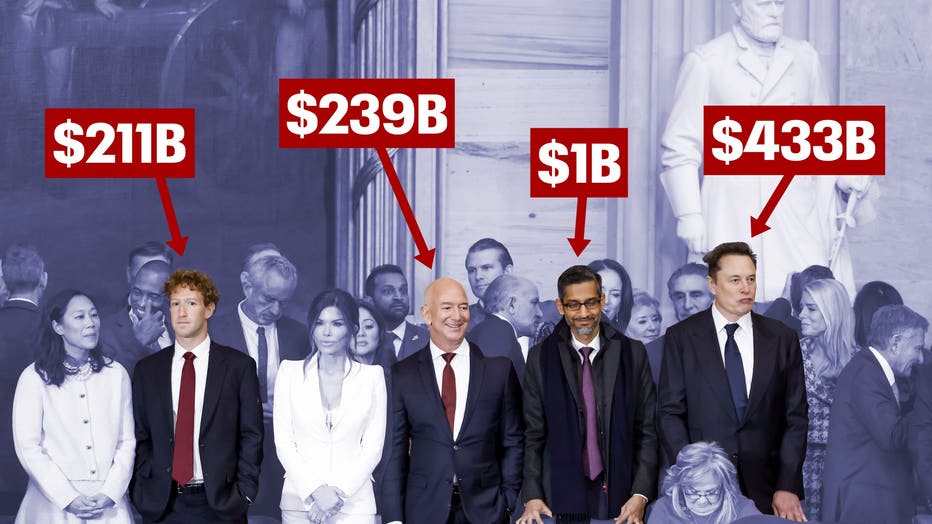

100 Days Of Losses How Trump Inauguration Donations Cost Tech Billionaires 194 Billion

May 09, 2025

100 Days Of Losses How Trump Inauguration Donations Cost Tech Billionaires 194 Billion

May 09, 2025 -

Sharp Decline In Indonesias Reserves Two Year Low Amidst Rupiah Volatility

May 09, 2025

Sharp Decline In Indonesias Reserves Two Year Low Amidst Rupiah Volatility

May 09, 2025