What Recession? Stock Investors Remain Bullish

Table of Contents

Strong Corporate Earnings Despite Economic Headwinds

Robust corporate earnings are a key factor defying recession predictions. Many companies are reporting surprisingly strong financial performance, showcasing resilience in the face of economic challenges. This indicates that while the overall economic climate may be uncertain, the fundamentals of many individual companies remain strong.

- Increased profitability in specific sectors: The technology and energy sectors, for instance, have shown remarkable resilience, with several companies reporting record profits. This is partly due to strong demand and innovative business models.

- Strong consumer spending in certain areas: While overall consumer spending might be slowing, spending in specific areas like experiences and luxury goods remains robust, bolstering the performance of related companies.

- Innovative business strategies mitigating economic impacts: Companies are employing various strategies – from streamlining operations to leveraging technological advancements – to minimize the impact of economic headwinds. This adaptability is crucial in maintaining profitability.

- Data points and statistics to support claims: Q3 2023 earnings reports from major corporations reveal impressive revenue and profit growth, providing concrete evidence of this trend. These figures offer compelling counterpoints to the pervasive recessionary narrative.

Inflation Cooling and Interest Rate Expectations

Recent trends in inflation, while still elevated, show signs of cooling. This cooling, coupled with expectations regarding the Federal Reserve's monetary policy, is influencing investor confidence. While further interest rate hikes are possible, the market is beginning to anticipate a potential slowdown or even rate cuts in the future.

- Explanation of inflation's effect on stock valuations: High inflation erodes purchasing power and increases the cost of borrowing, impacting business profitability and stock valuations. However, cooling inflation suggests reduced pressure on corporate margins and potentially higher future earnings.

- Analysis of interest rate hikes and their potential impact: Interest rate hikes increase borrowing costs for companies, potentially slowing down economic growth. However, the expectation of a future peak and potential rate cuts is tempering investor concerns.

- Expert opinions on the future trajectory of interest rates: Many economic analysts predict a peak in interest rates followed by a gradual decline, creating a more positive outlook for stock market performance.

- Mentioning potential for rate cuts and their positive impact on stocks: The potential for future rate cuts could inject significant liquidity into the market, boosting stock prices and investor confidence.

Long-Term Growth Potential and Strategic Investing

Bullish investors are focusing on the long-term growth potential of specific sectors and companies with strong fundamentals and future prospects. This long-term perspective allows them to navigate short-term volatility and capitalize on opportunities.

- Focus on companies with strong fundamentals and future prospects: Investors are increasingly choosing companies demonstrating consistent growth, strong balance sheets, and innovative business models, regardless of short-term economic fluctuations.

- Discussion of value investing vs. growth investing strategies: Both value and growth investing strategies are employed, with investors carefully analyzing individual company performance and potential within the current economic landscape.

- Mentioning diversification and risk management techniques: Diversification across different sectors and asset classes remains crucial to mitigating risk. Risk management strategies are paramount in navigating economic uncertainty.

- Highlighting the importance of long-term perspective in stock market investing: A long-term investment horizon allows investors to weather short-term market corrections and benefit from the potential for long-term growth.

The Psychological Factor: Investor Sentiment and Market Resilience

The persistent bullishness also reflects a psychological factor – investor sentiment and market resilience. Positive news, media coverage, and a sense of market momentum contribute to maintaining confidence, even in the face of uncertainty.

- Impact of positive news and media coverage on investor psychology: Positive news stories, even if incremental, can influence investor perception and reinforce a bullish outlook. Conversely, overly negative coverage can foster fear and uncertainty.

- Role of herd mentality and market momentum in driving stock prices: Market momentum, amplified by herd mentality, can drive stock prices higher, regardless of fundamental shifts in the economy.

- Discussion on potential investor overconfidence or underestimation of risks: It's crucial to acknowledge the potential for investor overconfidence and the underestimation of risks, highlighting the importance of balanced and informed decision-making.

- Mentioning the importance of emotional intelligence in investment decisions: Emotional intelligence helps investors avoid impulsive decisions based on fear or greed, promoting a more rational approach to investing.

Maintaining a Bullish Outlook: Navigating Uncertainty in the Stock Market

In conclusion, while recessionary concerns are valid, several factors explain why "Stock Investors Remain Bullish." Strong corporate earnings, cooling inflation, long-term growth potential, and the psychological aspects of investor sentiment all contribute to this prevailing optimism. However, it’s crucial to remember that navigating the stock market always requires careful consideration of various factors and a balanced approach. Stay informed about the latest market trends and continue to monitor your investments while maintaining a balanced approach to navigating the current economic uncertainty. Remember, even with recessionary whispers, understanding the factors driving "Stock Investors Remain Bullish" can help you make strategic investment decisions.

Featured Posts

-

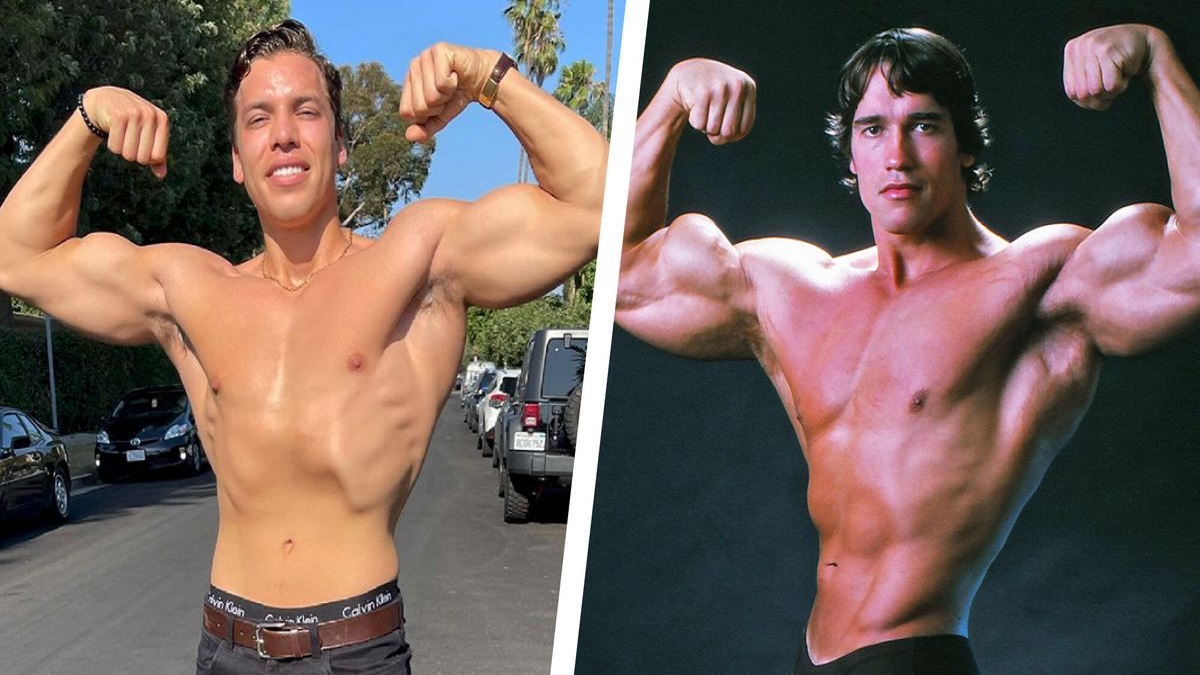

Joseph Baena Arnold Schwarzenegger Oeroekoese

May 06, 2025

Joseph Baena Arnold Schwarzenegger Oeroekoese

May 06, 2025 -

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcast Content

May 06, 2025

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcast Content

May 06, 2025 -

Mindy Kalings Love Life Past Relationships And Current Status

May 06, 2025

Mindy Kalings Love Life Past Relationships And Current Status

May 06, 2025 -

Sukces Nitro Chem Dostawa Polskiego Trotylu Do Wojska Amerykanskiego

May 06, 2025

Sukces Nitro Chem Dostawa Polskiego Trotylu Do Wojska Amerykanskiego

May 06, 2025 -

Nitro Chem I Us Army Ogromne Zamowienie Na Polski Trotyl

May 06, 2025

Nitro Chem I Us Army Ogromne Zamowienie Na Polski Trotyl

May 06, 2025

Latest Posts

-

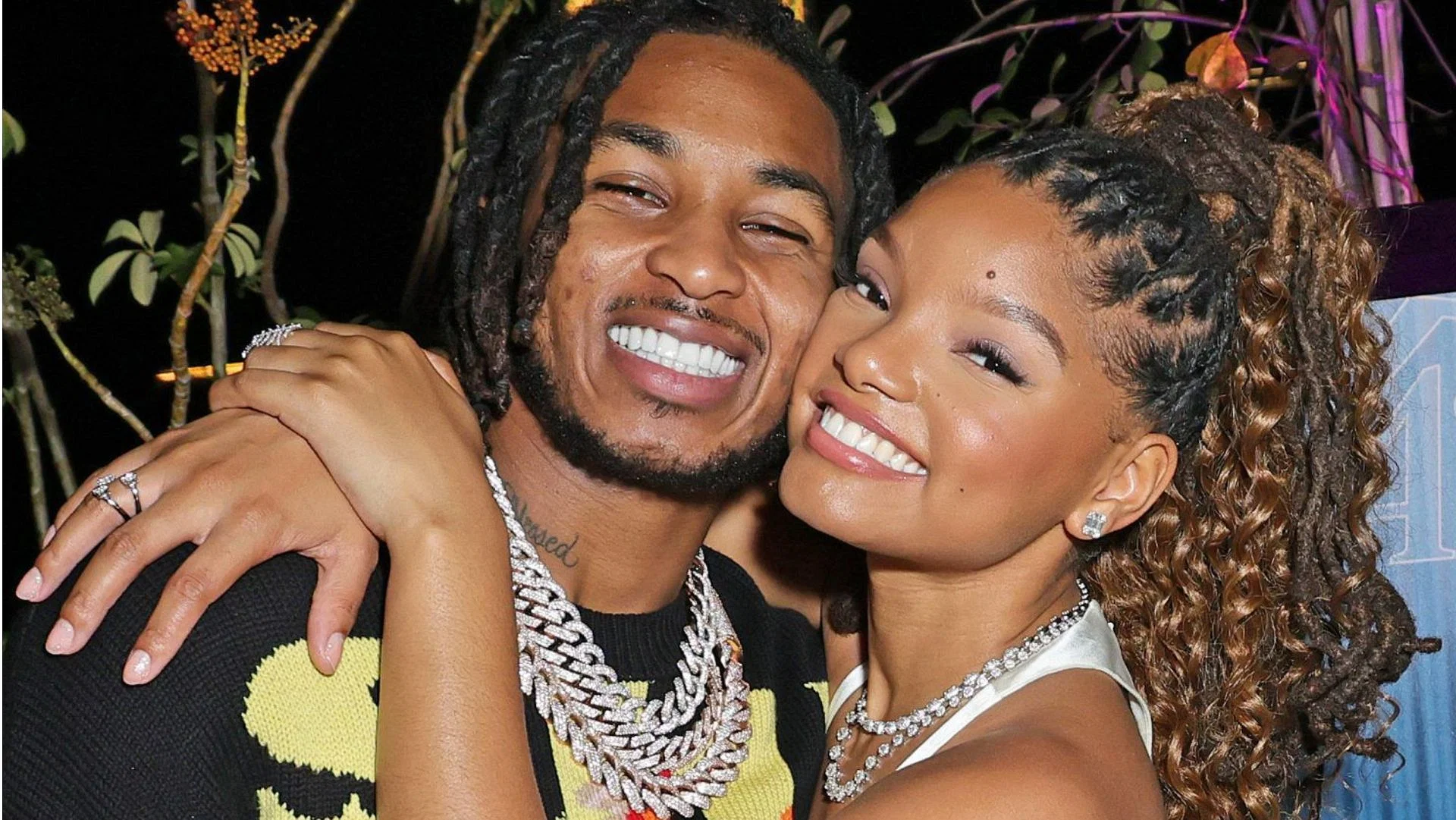

Controversy Erupts Ddgs Dont Take My Son Diss Track Directed At Halle Bailey

May 06, 2025

Controversy Erupts Ddgs Dont Take My Son Diss Track Directed At Halle Bailey

May 06, 2025 -

Dont Take My Son Ddgs Fiery Diss Track Against Halle Bailey

May 06, 2025

Dont Take My Son Ddgs Fiery Diss Track Against Halle Bailey

May 06, 2025 -

New Music Ddg Releases Diss Track Dont Take My Son Aimed At Halle Bailey

May 06, 2025

New Music Ddg Releases Diss Track Dont Take My Son Aimed At Halle Bailey

May 06, 2025 -

Ddg Diss Track Dont Take My Son Targets Halle Bailey

May 06, 2025

Ddg Diss Track Dont Take My Son Targets Halle Bailey

May 06, 2025 -

The Lyrics Explained Ddgs Dont Take My Son And Its Alleged Halle Bailey Target

May 06, 2025

The Lyrics Explained Ddgs Dont Take My Son And Its Alleged Halle Bailey Target

May 06, 2025