What's Driving CoreWeave Stock's Recent Activity?

Table of Contents

The Impact of AI Hype and Market Sentiment on CoreWeave Stock

The explosive growth of artificial intelligence is undeniably fueling CoreWeave's success. CoreWeave's business model centers around providing the powerful infrastructure—specifically, cloud computing resources—necessary to train and run sophisticated AI models. This makes them a crucial component of the AI revolution. Positive investor sentiment towards AI directly translates into increased demand for CoreWeave's services and, consequently, a higher CoreWeave price. Conversely, any negative shifts in AI market sentiment can trigger a downturn.

- Increased demand for AI computing power: The insatiable appetite for AI processing power is driving significant growth in the cloud computing sector, benefiting CoreWeave directly.

- CoreWeave's positioning as a key player in the AI infrastructure space: CoreWeave is strategically positioned to capitalize on the escalating need for robust, scalable, and specialized computing resources for AI applications.

- Media coverage and analyst reports influencing investor perception: Positive media coverage and bullish analyst reports can significantly boost investor confidence, leading to increased demand and a higher CoreWeave stock price. Negative press, however, can have the opposite effect.

- Comparison to competitor stock performance in the AI cloud computing market: CoreWeave's performance is often benchmarked against its competitors. Understanding how its stock price fares relative to others in the AI cloud computing market is crucial for assessing its investment potential.

CoreWeave's Financial Performance and Growth Prospects

Analyzing CoreWeave's financial reports is essential for gauging its investment viability. Investors closely scrutinize key metrics to project future growth. While specifics are subject to change, strong revenue growth, increasing profitability, and high customer retention are all positive indicators for CoreWeave investment.

- Revenue growth and profitability trends: Consistent and substantial revenue growth coupled with improving profitability demonstrates a healthy and sustainable business model.

- Customer acquisition and retention rates: High customer acquisition and low churn rates suggest a strong value proposition and a loyal customer base.

- Expansion plans and new market entry strategies: Ambitious expansion plans and successful market entry strategies indicate a commitment to growth and long-term success.

- Potential risks and challenges to growth: Investors must also consider potential risks, such as competition, economic downturns, and technological disruptions, that could affect CoreWeave's growth trajectory.

Competitive Landscape and Market Share Dynamics

CoreWeave operates in a highly competitive market. Understanding its position relative to established players like AWS, Google Cloud, and Microsoft Azure, as well as emerging startups, is vital for evaluating CoreWeave investment opportunities.

- Market share analysis and growth projections: Tracking CoreWeave's market share and projecting its future growth potential provides a clearer picture of its competitive strength.

- Comparison of services and pricing strategies: Analyzing CoreWeave's services, pricing, and overall value proposition against its competitors is key to understanding its competitive advantages and disadvantages.

- Analysis of competitive advantages and disadvantages: Identifying CoreWeave's unique strengths (e.g., specialized AI infrastructure) and weaknesses is crucial for assessing its long-term viability.

- Potential for mergers, acquisitions, or partnerships: The potential for strategic alliances or acquisitions could significantly impact CoreWeave's market position and future growth.

Macroeconomic Factors and Geopolitical Influences

Broader economic conditions and geopolitical events exert considerable influence on CoreWeave stock. A strong economy generally fosters investor confidence and increases technology spending, while instability can trigger sell-offs.

- Interest rate hikes and their impact on investor risk appetite: Increased interest rates can reduce investor risk appetite, potentially leading to decreased investment in growth stocks like CoreWeave.

- Global economic slowdown and its effect on technology spending: Economic downturns typically lead to reduced technology spending, impacting companies like CoreWeave that rely on robust demand for their services.

- Potential regulatory changes impacting the cloud computing industry: New regulations could create hurdles for CoreWeave and the wider cloud computing sector.

- Geopolitical instability and its effect on technology markets: Geopolitical instability can introduce uncertainty and volatility into the technology markets, influencing investor decisions regarding CoreWeave stock.

Conclusion

The CoreWeave stock price is a reflection of the complex interplay between AI market hype, the company's financial performance, its competitive position, and broader macroeconomic and geopolitical factors. While the future of CoreWeave remains promising, given its position in the rapidly growing AI cloud computing sector, investors should carefully consider all these elements before making investment decisions. Stay informed on the latest developments impacting CoreWeave stock and make educated investment choices based on your own thorough research, considering both CoreWeave investment opportunities and the potential risks involved in analyzing CoreWeave price movements.

Featured Posts

-

Nyt Wordle 1389 Hints Answer And Solutions For April 8th

May 22, 2025

Nyt Wordle 1389 Hints Answer And Solutions For April 8th

May 22, 2025 -

Thlatht Njwm Yndmwn Lawl Mrt Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 22, 2025

Thlatht Njwm Yndmwn Lawl Mrt Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 22, 2025 -

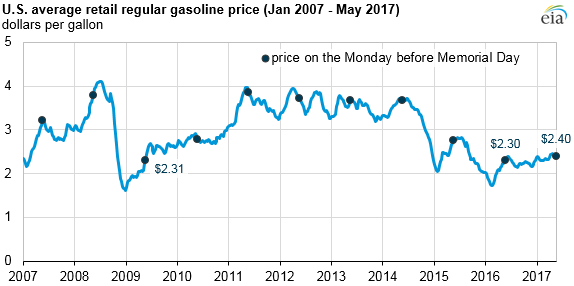

Gas Buddy Update Average Gasoline Prices Fall In Virginia

May 22, 2025

Gas Buddy Update Average Gasoline Prices Fall In Virginia

May 22, 2025 -

Massive Zebra Mussel Find On Casper Boat A Residents Discovery

May 22, 2025

Massive Zebra Mussel Find On Casper Boat A Residents Discovery

May 22, 2025 -

Wordle 1367 Monday March 17th Get The Answer And Clues

May 22, 2025

Wordle 1367 Monday March 17th Get The Answer And Clues

May 22, 2025

Latest Posts

-

Aaron Rodgers At Steelers Facility Speculation And Analysis

May 22, 2025

Aaron Rodgers At Steelers Facility Speculation And Analysis

May 22, 2025 -

George Pickens Trade Explaining Pittsburghs Decision

May 22, 2025

George Pickens Trade Explaining Pittsburghs Decision

May 22, 2025 -

Why The Steelers Didnt Trade George Pickens Insider Analysis

May 22, 2025

Why The Steelers Didnt Trade George Pickens Insider Analysis

May 22, 2025 -

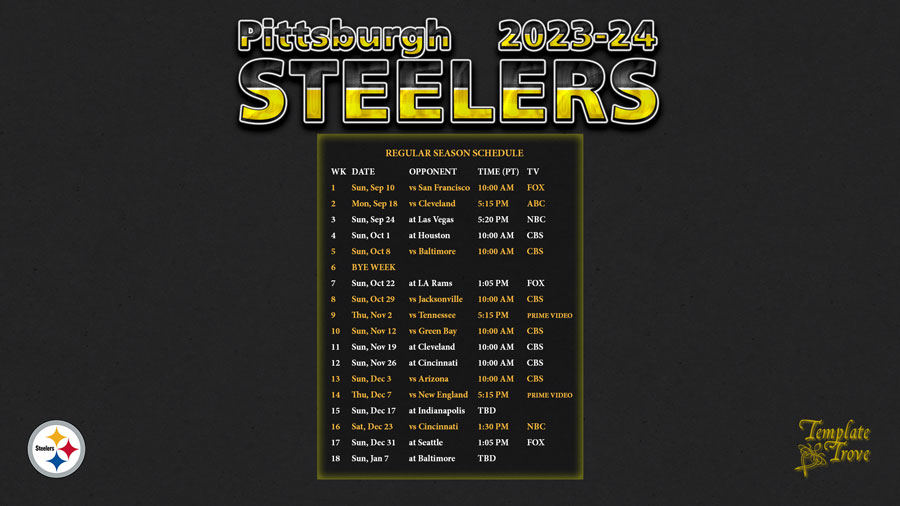

Steelers Schedule Analyzing The Biggest Takeaways From The Release

May 22, 2025

Steelers Schedule Analyzing The Biggest Takeaways From The Release

May 22, 2025 -

What The Steelers Schedule Release Means Key Takeaways And Implications

May 22, 2025

What The Steelers Schedule Release Means Key Takeaways And Implications

May 22, 2025