When One Partner Earns Significantly Less: Handling Financial Stress In Marriage

Table of Contents

Open Communication: The Foundation of Financial Stability

Open and honest communication is the bedrock of any successful marriage, especially when facing the added pressure of financial stress in marriage. Talking about money can be difficult, but it's crucial to address concerns before they fester into resentment.

Talking About Money Without Fighting

Many couples avoid discussing finances due to past negative experiences or fear of conflict. However, productive conversations are possible with the right approach.

- Schedule regular financial meetings: Dedicate specific time slots to discuss finances, free from distractions.

- Use "I" statements to express concerns: Frame your feelings without blaming your partner. For example, instead of saying "You never save enough," try "I feel anxious about our savings given our current expenses."

- Focus on solutions, not blame: Brainstorm together to find practical solutions to financial challenges.

- Seek professional help if needed: A financial therapist or counselor can provide guidance and facilitate productive conversations.

Active listening is paramount. Truly hear your partner's perspective, even if you don't agree. Employ conflict resolution strategies like finding common ground and compromising.

Unveiling Hidden Financial Stressors

Unequal earning power can create emotional distress beyond the purely financial. It's vital to acknowledge and address these hidden stressors.

- Identify sources of stress: Pinpoint specific financial concerns, such as high debt, insufficient savings for retirement, or concerns about future lifestyle choices.

- Acknowledge each partner's feelings: Validate your partner's emotions, even if they seem disproportionate to the situation. Feeling inadequate or insecure is a valid response to financial imbalance in marriage.

- Validate concerns: Show empathy and understanding, creating a safe space for open dialogue about feelings of insecurity or inadequacy related to the income difference.

Remember, emotional support and understanding are just as important as financial planning in mitigating financial stress in marriage.

Strategic Financial Planning for Unequal Incomes

Effective financial planning is essential for couples facing income disparity marriage. It requires realistic budgeting, strategic saving, and proactive debt management.

Budgeting and Prioritization

Creating a budget that works for both incomes requires collaboration and compromise.

- Track expenses: Use budgeting apps, spreadsheets, or even a simple notebook to monitor spending habits.

- Identify areas for savings: Look for areas where you can reduce expenses without sacrificing essential needs.

- Differentiate needs vs. wants: Prioritize essential expenses (housing, food, transportation) over non-essential wants (eating out, entertainment).

- Allocate funds for shared expenses and individual needs: Determine how shared expenses (mortgage, utilities) will be covered and allocate funds for each partner's individual needs and desires.

Using budgeting tools can simplify the process and provide valuable insights into spending patterns.

Investing for the Future Despite Income Disparity

Even with unequal incomes, planning for the future is crucial.

- Consider individual retirement accounts (IRAs): Both partners should contribute to IRAs, maximizing tax advantages whenever possible.

- Explore joint accounts: A joint account can facilitate shared financial goals and expenses.

- Consult a financial advisor: A professional can create a personalized financial plan considering the unique circumstances of your unequal earning marriage.

Investing early and consistently, even in small amounts, can have a significant impact on long-term financial security. Diversification of investments is also key to mitigating risk.

Debt Management Strategies

High-interest debt can exacerbate financial stress in marriage, especially when one partner earns less.

- Debt consolidation: Combine multiple debts into a single loan with a lower interest rate.

- Create a debt repayment plan: Prioritize debts based on interest rates and develop a realistic repayment schedule.

- Explore options for financial assistance: Consider seeking help from credit counseling agencies or debt management programs.

High-interest debt significantly impacts long-term financial health; strategies to minimize its effect are crucial for maintaining financial stability within the marriage.

Redefining Roles and Responsibilities

Fairly distributing responsibilities, regardless of income, is vital for a healthy marriage.

Fair Division of Labor

Income shouldn't dictate household responsibilities.

- Openly discuss expectations: Communicate clearly about expectations regarding household chores and childcare.

- Create a chore chart: Visualize tasks and responsibilities for a more equitable distribution.

- Appreciate contributions beyond financial input: Acknowledge and appreciate the non-monetary contributions of each partner.

An unequal workload can create resentment and strain the relationship; ensuring a fair division is essential for maintaining marital harmony.

Appreciating Non-Monetary Contributions

Non-financial contributions are equally valuable.

- Acknowledge the value of these contributions: Openly appreciate childcare, homemaking, or emotional support.

- Find ways to express appreciation: Show gratitude through words, actions, or small gestures.

- Adjust expectations based on individual capabilities: Be realistic about what each partner can contribute, given their individual circumstances and limitations.

Recognizing and valuing non-monetary contributions strengthens the relationship and reduces the feeling of inequity that can arise from financial stress in marriage.

Conclusion

Successfully navigating financial stress in marriage when one partner earns significantly less requires a multifaceted approach. Open communication, strategic financial planning, and a fair division of responsibilities are crucial elements for building a strong, financially secure, and emotionally fulfilling relationship. Teamwork and seeking professional guidance when needed are vital. Don't let financial stress in marriage silently erode your relationship. Take control by initiating open conversations, creating a collaborative financial plan, and appreciating each other's contributions. Start building a financially secure and emotionally fulfilling future together.

Featured Posts

-

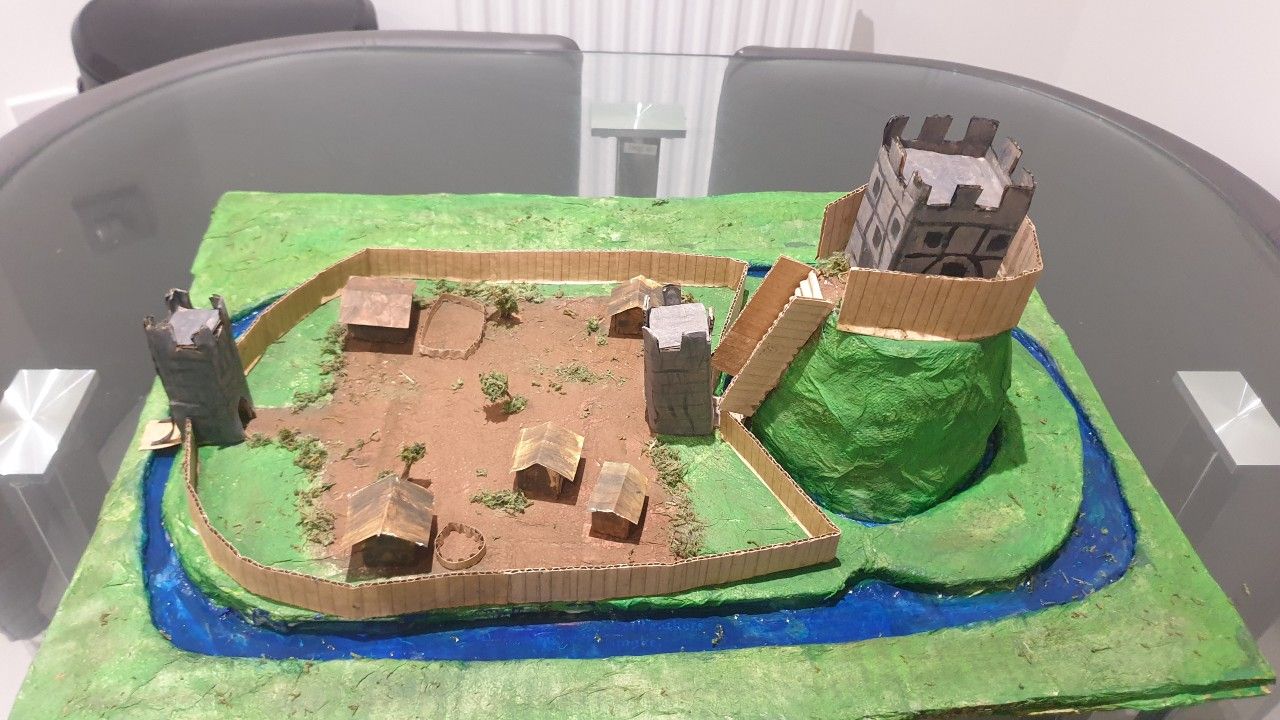

Diy Chateau Planning And Construction Tips For Your Castle Project

May 19, 2025

Diy Chateau Planning And Construction Tips For Your Castle Project

May 19, 2025 -

Steczkowska Na Eurowizji Werdykt Fanow I Ich Reakcje

May 19, 2025

Steczkowska Na Eurowizji Werdykt Fanow I Ich Reakcje

May 19, 2025 -

Tragedy At Fsu The Untold Story Of A Victims Cia Linked Father

May 19, 2025

Tragedy At Fsu The Untold Story Of A Victims Cia Linked Father

May 19, 2025 -

Preserving History The Struggle To Save The Jersey Battle Of Flowers

May 19, 2025

Preserving History The Struggle To Save The Jersey Battle Of Flowers

May 19, 2025 -

Survivor With Armenian Lyrics Pargs Eurovision Bid

May 19, 2025

Survivor With Armenian Lyrics Pargs Eurovision Bid

May 19, 2025