When Professionals Sell, Individuals Buy: Understanding Market Volatility

Table of Contents

Professional Investor Behavior During Volatility

Short-Term Focus and Risk Management

Professional investors, such as hedge fund managers and institutional traders, often prioritize short-term gains and risk mitigation. Their actions are driven by a number of factors:

- Sophisticated Risk Models and Hedging Strategies: Professionals utilize complex models to assess and manage risk, employing hedging strategies to protect against potential losses. This often involves selling assets to reduce exposure during periods of heightened uncertainty.

- Meeting Client Demands and Portfolio Rebalancing: Professional investors manage funds for clients with varying investment goals and timelines. They may need to sell assets to meet client redemption requests or to rebalance portfolios to maintain a desired asset allocation.

- Fund Deadlines and Performance Targets: Many professional investors operate under strict performance targets and reporting deadlines. This can influence their trading decisions, potentially leading to selling even in the face of long-term growth potential.

- Advanced Technical Analysis: Professionals frequently use advanced technical analysis tools and predictive models to identify short-term market trends and make informed trading decisions, often leading to quicker responses to market shifts than individual investors.

Access to Information and Resources

Professionals possess a significant advantage in accessing market data and research resources:

- Proprietary Trading Algorithms and Predictive Models: Many firms utilize proprietary algorithms and sophisticated predictive models to analyze vast amounts of data and identify potential trading opportunities.

- Exclusive Research and Analyst Reports: Professionals often subscribe to premium research services and have access to exclusive analyst reports providing deep insights into market trends and individual company performance.

- Sophisticated Trading Tools and Technologies: They use advanced trading platforms and technologies enabling them to execute trades quickly and efficiently, reacting to market changes with speed and precision.

- Rapid Response to Changing Market Conditions: The combination of superior information, resources, and technology allows professionals to react much more quickly to shifting market conditions than the average individual investor.

Individual Investor Behavior During Volatility

Emotional Decision-Making

Individual investors are often more susceptible to emotional biases during periods of market volatility:

- Fear and Panic Selling: Fear can lead to panic selling, where investors rush to liquidate assets at potentially unfavorable prices, often exacerbating market downturns.

- Lack of Discipline: Many individuals struggle to adhere to long-term investment plans during periods of volatility, deviating from their strategies based on short-term market fluctuations.

- Influence of Media Narratives: Individual investors can be heavily swayed by media narratives and market sentiment, making emotional rather than rational investment decisions.

- Missed Long-Term Growth Opportunities: Short-term reactions driven by fear or greed can cause individuals to miss out on potentially significant long-term growth opportunities.

Limited Resources and Expertise

Individual investors typically have limited access to the information and resources enjoyed by professionals:

- Reliance on Unreliable Information: Individuals may rely on less reliable information sources, such as social media or unreliable news outlets, leading to poorly informed decisions.

- Lack of Access to Professional Advice: Many individuals lack access to the guidance of experienced financial advisors, hindering their ability to navigate complex market situations.

- Difficulty Interpreting Market Data: Individual investors may struggle to understand and interpret complex market data and trends, making it difficult to make informed decisions.

- Overestimation of Understanding: Individuals often overestimate their own understanding of market dynamics and risk, leading to poor investment choices.

Navigating Market Volatility: Strategies for Individual Investors

Long-Term Perspective

To mitigate the impact of short-term market fluctuations, individual investors should prioritize a long-term perspective:

- Focus on Long-Term Growth: Concentrate on the long-term growth potential of your investments rather than reacting to short-term price movements.

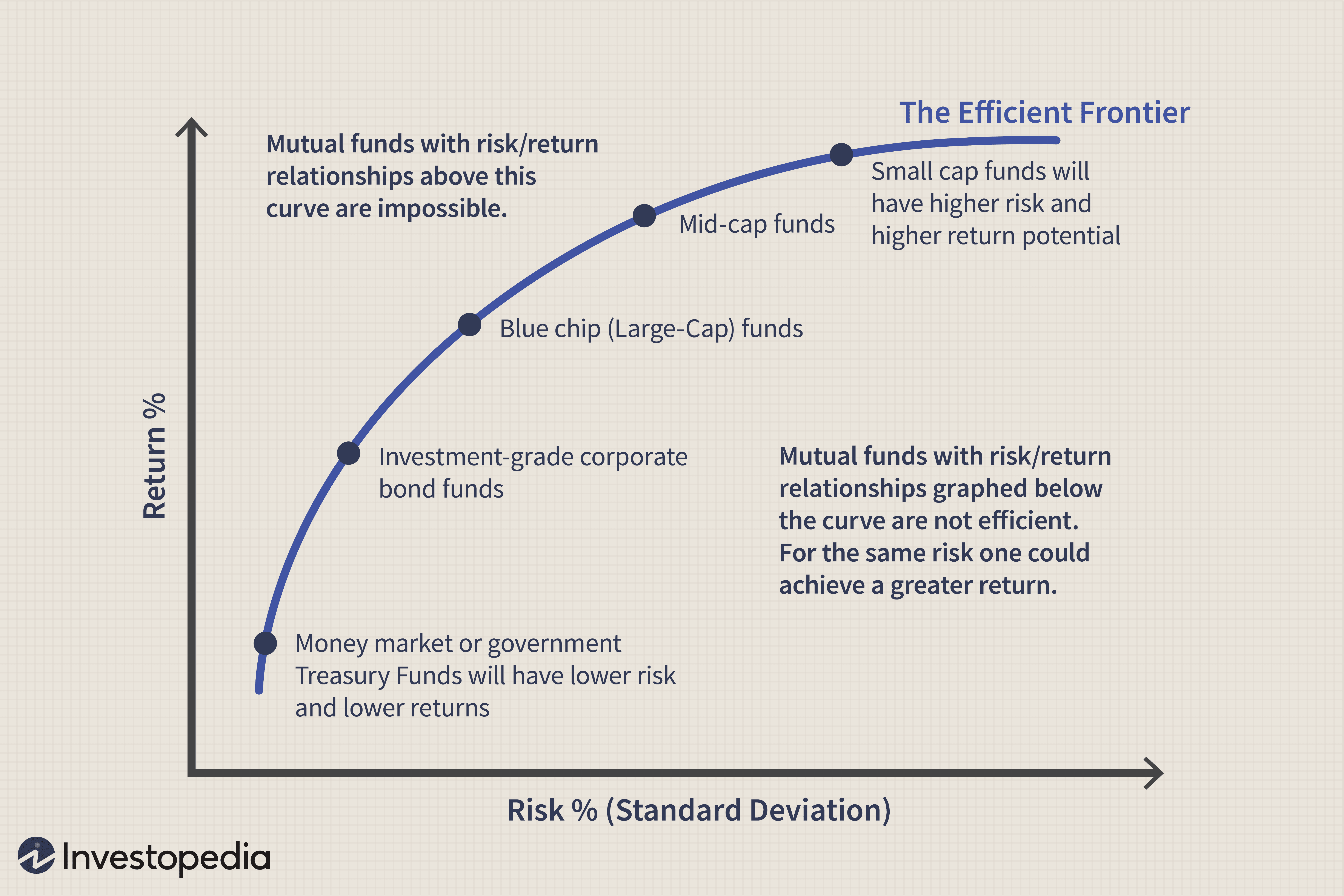

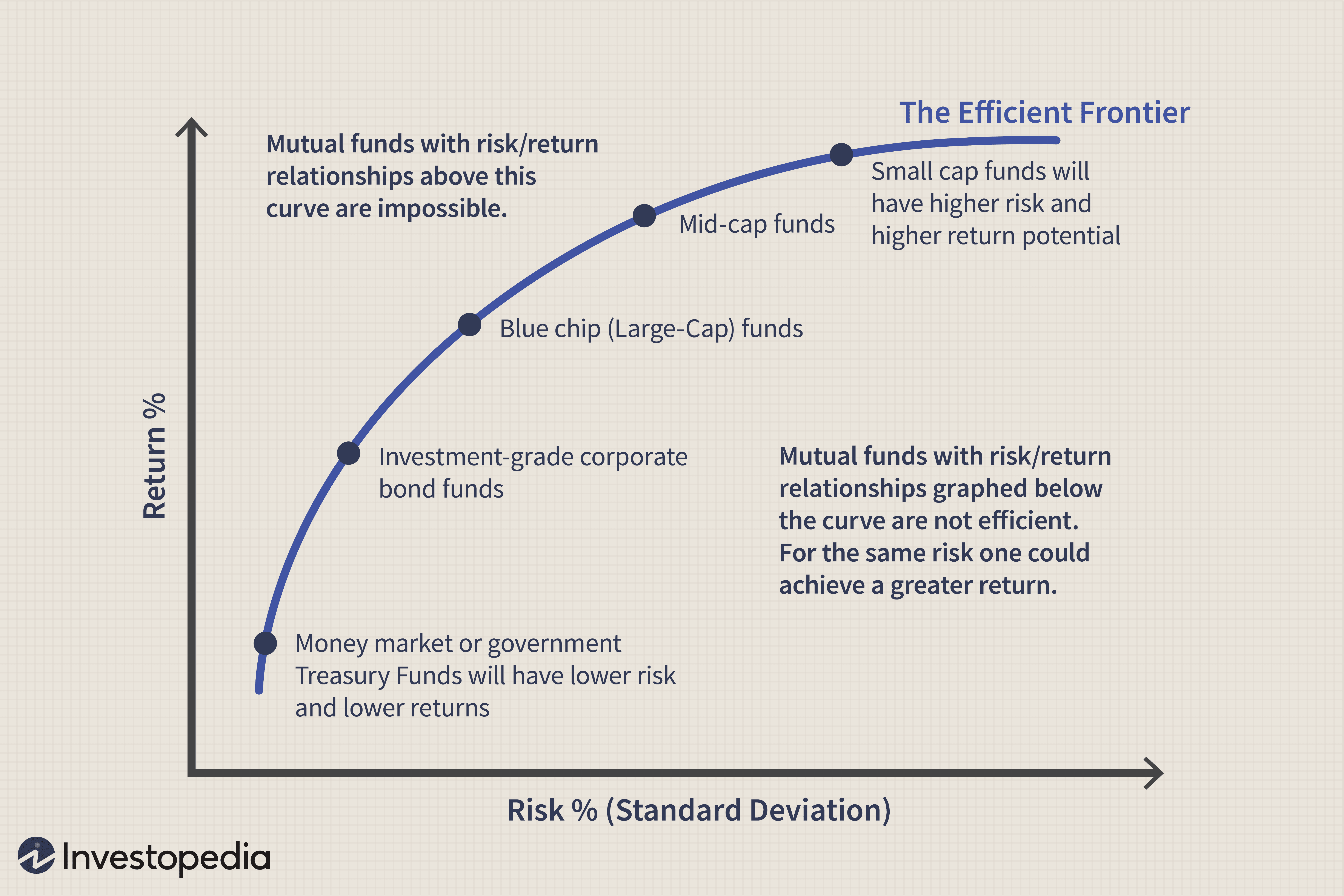

- Diversify Your Portfolio: Diversification across different asset classes reduces the overall risk of your investments.

- Develop a Well-Defined Investment Plan: Create a detailed investment plan aligned with your financial goals and risk tolerance, and stick to it.

- Avoid Emotional Decision-Making: Rely on research, data, and your investment plan to guide your decisions, rather than reacting emotionally to market fluctuations.

Seeking Professional Advice

Seeking professional guidance from a qualified financial advisor is highly recommended:

- Personalized Investment Plan: A financial advisor can help you create a personalized investment plan tailored to your unique financial situation and goals.

- Risk Tolerance Assessment: Understanding your risk tolerance is crucial for making appropriate investment decisions.

- Regular Portfolio Reviews: Regular reviews with your advisor ensure your investments remain aligned with your goals and risk tolerance.

- Access to Professional Insights: Professional advisors provide valuable insights and support, helping you navigate the complexities of the market.

Understanding Market Volatility for Informed Decisions

In summary, professional and individual investors react to market volatility in vastly different ways. Professionals often prioritize short-term gains and risk mitigation, leveraging superior resources and information. Individuals, however, are more susceptible to emotional biases and lack the same resources. Understanding these differences is crucial. For individual investors, a long-term investment strategy, diversification, and seeking professional advice are essential for navigating market volatility effectively. Don't let market volatility dictate your financial future; take control with a well-informed approach to investing.

Featured Posts

-

2000 Yankees Diary Posadas Homer Silences The Royals

Apr 28, 2025

2000 Yankees Diary Posadas Homer Silences The Royals

Apr 28, 2025 -

Is This Mets Pitcher Ready For A Starting Role

Apr 28, 2025

Is This Mets Pitcher Ready For A Starting Role

Apr 28, 2025 -

Cassidy Hubbarth Honored By Espn Colleagues In Final Broadcast

Apr 28, 2025

Cassidy Hubbarth Honored By Espn Colleagues In Final Broadcast

Apr 28, 2025 -

Red Sox Breakout Candidate Is This The Year For Players Name

Apr 28, 2025

Red Sox Breakout Candidate Is This The Year For Players Name

Apr 28, 2025 -

Auto Dealers Double Down On Opposition To Electric Vehicle Requirements

Apr 28, 2025

Auto Dealers Double Down On Opposition To Electric Vehicle Requirements

Apr 28, 2025