Where To Invest: A Map Of The Country's Fastest-Growing Businesses

Table of Contents

The Tech Sector: A Leading Contender in Fastest-Growing Businesses

The technology sector consistently ranks among the fastest-growing businesses, driven by rapid innovation and increasing digital adoption. Several sub-sectors within tech offer particularly compelling investment opportunities.

Software as a Service (SaaS): A Booming Market

The SaaS market continues its phenomenal growth, fueled by increasing cloud adoption and the rise of remote work. This trend shows no signs of slowing down, making SaaS a prime area for investment.

- Investment Opportunities:

- Early-stage SaaS companies with disruptive technologies. These businesses often offer high growth potential but also carry higher risk.

- Established SaaS players with proven track records and strong expansion plans into new markets or product offerings. These represent a lower-risk, potentially slower-growth investment.

- Risks:

- Market saturation in specific niches, leading to increased competition and reduced profitability for some players. Thorough market research is crucial.

- Dependence on technological advancements. SaaS companies must continuously innovate to stay ahead of the curve.

Artificial Intelligence (AI) and Machine Learning (ML): Transforming Industries

AI and ML are revolutionizing numerous industries, from healthcare and finance to manufacturing and transportation. The potential applications are vast, making this a high-growth, high-potential investment area.

- Investment Opportunities:

- AI-driven solutions for healthcare, such as diagnostic tools and personalized medicine.

- AI in finance, including algorithmic trading and fraud detection.

- AI-powered automation in manufacturing and logistics.

- Risks:

- High development costs associated with creating and implementing AI and ML solutions.

- Ethical concerns surrounding AI implementation, requiring careful consideration of potential biases and societal impacts.

Cybersecurity: Protecting the Digital World

With the increasing frequency and sophistication of cyber threats, the demand for robust cybersecurity solutions is booming. This creates significant opportunities for investors.

- Investment Opportunities:

- Cybersecurity startups focusing on innovative solutions such as AI-powered threat detection and advanced encryption.

- Established cybersecurity firms expanding their offerings to address emerging threats and meet growing market demand.

- Risks:

- The rapidly evolving threat landscape requires constant adaptation and innovation from cybersecurity companies.

- The need for continuous updates and improvements to stay ahead of new threats can lead to significant ongoing costs.

Renewable Energy: A Sustainable Investment in Fastest-Growing Businesses

The renewable energy sector is experiencing explosive growth, driven by government incentives, growing environmental awareness, and the urgent need to transition away from fossil fuels. This makes it an attractive area for socially responsible and financially rewarding investment.

Solar and Wind Power: Leading the Green Revolution

Solar and wind power are at the forefront of the renewable energy transition. Government support through subsidies and tax credits further fuels their expansion.

- Investment Opportunities:

- Solar panel manufacturers and installers.

- Wind turbine developers and manufacturers.

- Energy storage solutions, such as battery technology, to address the intermittency of renewable energy sources.

- Risks:

- The intermittency of solar and wind power, requiring effective energy storage solutions.

- Dependence on government policies and subsidies for continued growth.

Green Technology: Sustainable Solutions Across Sectors

Companies developing sustainable solutions across various sectors are attracting significant investments. This includes a wide range of environmentally friendly technologies.

- Investment Opportunities:

- Waste management and recycling technologies.

- Sustainable agriculture and food production.

- Companies developing and utilizing eco-friendly materials and building practices.

- Risks:

- High initial investment costs associated with developing and implementing green technologies.

- Market acceptance of new and often more expensive sustainable technologies can be slower than expected.

Healthcare: A Resilient Sector Among Fastest-Growing Businesses

The healthcare sector is a consistently strong performer, with several sub-sectors showing particularly robust growth. This resilience makes it an attractive option for long-term investors.

Telemedicine and Remote Patient Monitoring: Transforming Healthcare Delivery

The rise of telehealth is transforming how healthcare is delivered, offering convenience and accessibility to patients.

- Investment Opportunities:

- Telemedicine platforms and software.

- Remote patient monitoring devices and systems.

- Digital health solutions that improve patient engagement and outcomes.

- Risks:

- Data privacy and security concerns associated with the transmission and storage of sensitive patient information.

- Regulatory hurdles and varying adoption rates across different healthcare systems.

Biotechnology and Pharmaceuticals: Innovation Driving Growth

Ongoing research and development in biotechnology and pharmaceuticals drive continuous growth in this sector.

- Investment Opportunities:

- Biotech startups with promising drug candidates in various therapeutic areas.

- Pharmaceutical companies focusing on innovative treatments and therapies.

- Risks:

- High failure rates in drug development, leading to significant financial losses in some cases.

- Lengthy and complex regulatory approval processes for new drugs and therapies.

Conclusion: Investing in the Future

Identifying the country's fastest-growing businesses is crucial for building a successful investment portfolio. This article highlighted key sectors such as technology, renewable energy, and healthcare, offering insights into potential investment opportunities and associated risks within each area. Remember to conduct thorough due diligence before making any investment decisions. By carefully analyzing these fastest-growing businesses and understanding their growth drivers and potential challenges, you can make informed choices. Start your research today and discover where to invest in the country's most promising fastest-growing businesses!

Featured Posts

-

Anthony Edwards Availability Timberwolves Vs Lakers Preview

Apr 29, 2025

Anthony Edwards Availability Timberwolves Vs Lakers Preview

Apr 29, 2025 -

Adult Adhd Diagnosis Next Steps And Support

Apr 29, 2025

Adult Adhd Diagnosis Next Steps And Support

Apr 29, 2025 -

Willie Nelsons 77th Solo Album A Pre 92nd Birthday Release

Apr 29, 2025

Willie Nelsons 77th Solo Album A Pre 92nd Birthday Release

Apr 29, 2025 -

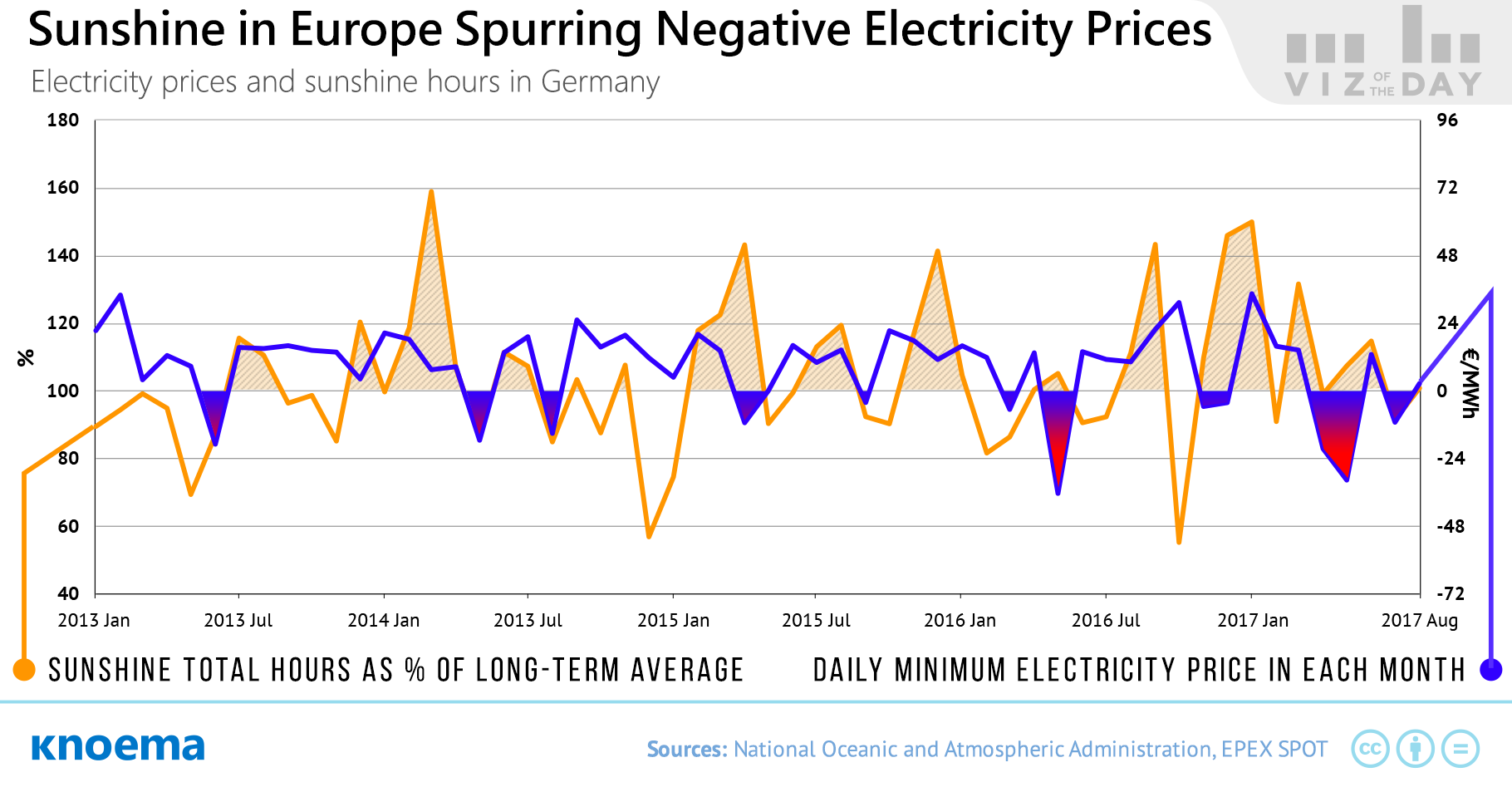

European Power Prices Plunge Solar Energy Surplus Drives Negative Prices

Apr 29, 2025

European Power Prices Plunge Solar Energy Surplus Drives Negative Prices

Apr 29, 2025 -

Canadian Filipinos Mourn After Deadly Car Ramming

Apr 29, 2025

Canadian Filipinos Mourn After Deadly Car Ramming

Apr 29, 2025