Who Is Warren Buffett's Canadian Successor? A Billionaire's Berkshire-Free Approach

Table of Contents

Examining the Qualities of a Buffett-esque Investor

To identify a potential "Warren Buffett's Canadian Successor," we must first define the essential characteristics. These go beyond simply achieving high returns; they encompass a philosophy and approach to investing.

Value Investing Principles: The Cornerstone of Success

Buffett's success rests on unwavering adherence to value investing principles. These include:

- Long-term perspective: Value investors aren't swayed by short-term market fluctuations. They focus on long-term growth and intrinsic value.

- Intrinsic value assessment: They meticulously analyze a company's fundamentals to determine its true worth, often below its market price.

- Margin of safety: They buy assets significantly below their estimated intrinsic value, creating a buffer against potential losses.

- Understanding business fundamentals: They delve deep into a company's financials, competitive landscape, and management team.

- Patience: Value investing requires patience; it's a marathon, not a sprint.

These principles translate to the Canadian context, but with nuances. The Canadian market, while closely tied to the US, possesses unique characteristics, including a robust resource sector and a different regulatory environment. A Canadian Buffett would need to adapt these core tenets to effectively navigate this landscape.

Beyond Financial Acumen: The Human Element

Beyond financial expertise, several other crucial qualities define a successful investor:

- Strong business ethics and integrity: Building trust and maintaining ethical standards are paramount for long-term success.

- Exceptional management skills: Effectively managing a portfolio and navigating complex investment decisions requires strong managerial skills.

- Long-term vision: Maintaining focus on long-term growth despite short-term market volatility is essential.

- Risk management: Understanding and mitigating risk is crucial to preserving capital and achieving sustainable growth.

- Adaptability to changing market conditions: The ability to adjust strategies in response to evolving economic and market dynamics.

For independent Canadian investors, these qualities are magnified. Without the support structure of a large conglomerate like Berkshire Hathaway, adaptability and strong risk management become even more critical for survival and success.

Potential Canadian Candidates: A Deep Dive

Identifying a direct "successor" is unrealistic, but several prominent Canadian investors exhibit Buffett-like qualities. While their strategies differ, their success showcases the Canadian market's potential to nurture such talent.

Analyzing Prominent Canadian Investors

While pinpointing a single "successor" is difficult, let's examine a few successful Canadian investors who demonstrate value-investing principles:

(Note: This section would include profiles of 2-3 real-life Canadian investors. Each profile would require significant research and would include biographical information, investment strategy details, notable investment successes and failures, and a comparison to Warren Buffett's approach. Relevant links to their firms' websites, financial news articles, and interviews should be included.)

For example, one might profile a Canadian investor known for their focus on undervalued resource companies, highlighting their success in navigating the cyclical nature of the commodity market. Another profile could showcase an investor concentrating on technology companies, demonstrating the ability to spot long-term growth in emerging sectors.

Assessing Their Berkshire-Free Strategies

These Canadian investors operate independently, outside the Berkshire Hathaway umbrella. This offers both advantages and disadvantages:

- Advantages: Greater flexibility in investment choices, less bureaucratic constraints, the potential for higher returns (though also higher risk).

- Disadvantages: Limited access to capital compared to Berkshire Hathaway, increased reliance on individual network and resources. Navigating the Canadian regulatory environment independently presents its own set of challenges.

The Canadian Market Landscape and Its Influence

Understanding the Canadian market's unique characteristics is crucial to identifying potential successors.

Unique Opportunities and Challenges

The Canadian investment landscape presents distinct opportunities and challenges:

- Differences from the US market: Smaller market capitalization, a stronger resource sector, and different regulatory frameworks.

- Canadian regulatory environment: Stringent regulations can impact investment strategies.

- Specific industry sectors showing potential: The Canadian market offers opportunities in various sectors such as technology, healthcare, and renewable energy.

- Macroeconomic factors: Interest rates, currency fluctuations, and global economic conditions all influence investment strategies.

- Resource sectors: The energy and mining sectors play a significant role in the Canadian economy, requiring specialized expertise.

Growth Potential and Future Outlook

Canada's long-term growth prospects are positive, presenting fertile ground for future investment giants. Technological advancements, emerging industries, and projected economic growth create exciting opportunities for investors to replicate Buffett's success, albeit with unique Canadian characteristics.

Conclusion: Finding Warren Buffett's Canadian Successor - The Ongoing Quest

While a perfect "Warren Buffett's Canadian Successor" might remain elusive, Canada boasts talented investors who successfully apply value investing principles in their own unique ways. The profiles presented highlight the potential for future success stories, driven by independent strategies within a distinct market landscape. The key takeaways are that value investing remains a potent strategy, and the Canadian market offers unique opportunities.

Call to Action: Continue researching the Canadian investment scene! Who do you believe could be the next Warren Buffett from Canada? Share your insights and potential candidates in the comments below. Let's continue the discussion and identify future potential "Warren Buffett's Canadian Successor[s]".

Featured Posts

-

Transgender Lives And Trumps Executive Actions Personal Stories

May 10, 2025

Transgender Lives And Trumps Executive Actions Personal Stories

May 10, 2025 -

King Zvinuvachuye Maska Ta Trampa U Zradi Detali Zayavi

May 10, 2025

King Zvinuvachuye Maska Ta Trampa U Zradi Detali Zayavi

May 10, 2025 -

Analysis Aocs Fact Check Response To Jeanine Pirros Fox News Commentary

May 10, 2025

Analysis Aocs Fact Check Response To Jeanine Pirros Fox News Commentary

May 10, 2025 -

Ashhr Almdkhnyn Fy Tarykh Krt Alqdm Drast Fy Altnaqdat

May 10, 2025

Ashhr Almdkhnyn Fy Tarykh Krt Alqdm Drast Fy Altnaqdat

May 10, 2025 -

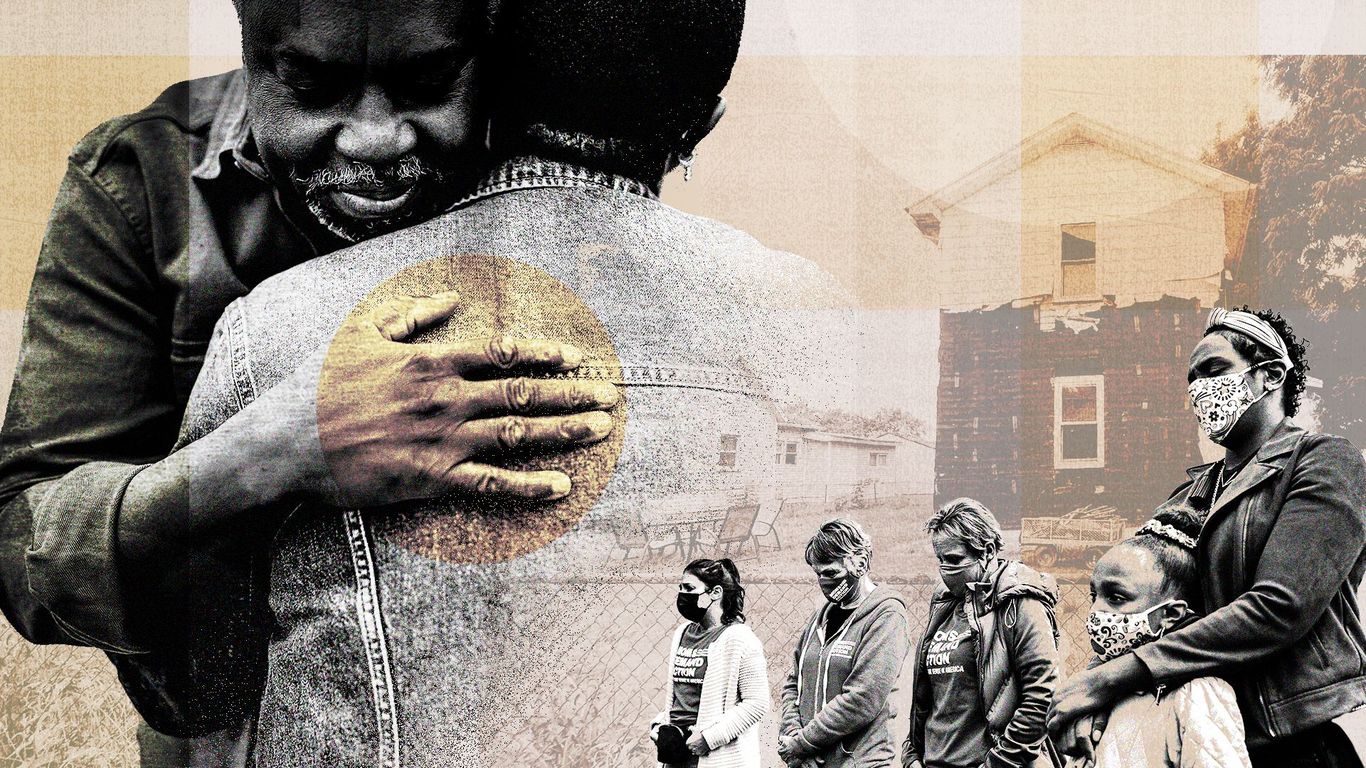

Racial Violence Claims Life Leaving Family In Despair

May 10, 2025

Racial Violence Claims Life Leaving Family In Despair

May 10, 2025