Who Is Weihong Liu? His Major Hudson's Bay Investment Explained

Table of Contents

Who is Weihong Liu? A Closer Look at the Investor

Liu's Background and Business Acumen

Weihong Liu is a prominent investor known for his shrewd business acumen and strategic investments. While details about his early career remain somewhat private, his track record speaks volumes. His success is built on a foundation of meticulous research, a long-term investment perspective, and a keen understanding of market dynamics.

- Previous Successful Investments: While specific details of his past investments are not always publicly available, sources suggest a history of successful ventures in diverse sectors, including technology and real estate. His strategic choices show a penchant for identifying undervalued assets and nurturing their growth.

- Notable Business Awards and Recognitions: While he may not actively seek public recognition, his influence in the financial world is undeniable. His achievements speak for themselves, demonstrating a clear ability to spot and capitalize on opportunities.

- Strategic Partnerships and Collaborations: Liu's success often stems from building strong strategic partnerships. His network of contacts and collaborative approach allow him to leverage diverse expertise and resources.

Liu's Investment Philosophy

Weihong Liu's investment style appears to be characterized by long-term vision and a focus on value creation. He doesn't appear to be driven by short-term market fluctuations. Instead, he seems to prioritize identifying companies with solid fundamentals and growth potential.

- Investment Approach Summary: Liu favors a fundamental analysis-driven approach, thoroughly assessing a company's financial health, management team, and market position before committing capital. His focus is on identifying undervalued assets and patiently waiting for their intrinsic value to be reflected in the market.

- Investment Criteria: While his exact investment criteria remain undisclosed, his past successes suggest a preference for companies with strong management, a defensible business model, and a clear path to sustainable growth.

- Relevant News and Interviews: Unfortunately, public information on Weihong Liu's investment philosophy is limited. More transparency from the investor himself would allow for a more comprehensive understanding of his approach.

The Weihong Liu Hudson's Bay Investment: A Detailed Analysis

The Size and Structure of the Investment

The precise amount of Weihong Liu's investment in HBC hasn't been publicly disclosed in its entirety. However, reports suggest a significant stake, making him a notable shareholder. The investment likely consists primarily of shares, though the exact structure requires confirmation from official sources. The timing of the investment suggests a strategic move, capitalizing on potential market opportunities or undervaluation of HBC assets.

- Associated Agreements and Conditions: The terms of Liu's investment remain largely undisclosed, adding an element of mystery to the situation. Further details would provide crucial context to fully analyze the investment's implications.

- Precise Figures and Data: The lack of transparency makes it difficult to provide precise figures and data surrounding the investment’s details. Official statements from HBC or Weihong Liu himself would greatly benefit a more comprehensive understanding.

The Rationale Behind the Investment

Liu's interest in HBC likely stems from several factors. The company's extensive real estate portfolio, coupled with its established retail presence, presents an attractive investment opportunity. HBC's strategic repositioning and potential for growth in the evolving retail landscape might also have been significant factors in Liu's decision.

- HBC's Strengths and Weaknesses: HBC possesses valuable real estate assets and a strong brand recognition. However, it also faces challenges in the competitive retail environment. Liu likely sees an opportunity to leverage these strengths while mitigating the weaknesses.

- Synergies between Liu's Expertise and HBC's Operations: Liu's expertise in real estate and investment management could offer significant synergies with HBC's operations, potentially unlocking significant value.

- Market Conditions Influencing the Decision: Favorable market conditions or a perceived undervaluation of HBC’s assets could have influenced Liu’s decision to invest at this particular time.

Impact on Hudson's Bay Company

The impact of Liu's investment on HBC is still unfolding. While it's too early to definitively assess the long-term effects, his involvement is likely to bring a new perspective and potentially influence HBC's strategic direction.

- Changes in HBC's Strategy: Any changes in HBC’s strategic direction will need to be observed and analyzed over time.

- Press Releases and Statements: Official statements from HBC regarding Liu's investment are crucial for a thorough understanding of the partnership and its impact on the company’s future operations.

- Consequences for Stakeholders: The implications for HBC’s employees, customers, and other stakeholders will depend greatly on how the investment is managed and the strategies employed.

Future Implications of Liu's Investment in HBC

Potential for Growth and Expansion

Liu's investment could potentially unlock significant growth opportunities for HBC. His expertise and resources could facilitate strategic alliances, acquisitions, and innovative initiatives, boosting profitability and market share.

- Strategic Alliances and Acquisitions: This investment could enable HBC to pursue strategic alliances and acquisitions to expand its operations and strengthen its market position.

- Future Projects and Plans: The long-term vision of the investment will become clearer as time progresses and future projects are revealed.

Potential Challenges and Risks

Despite the potential for growth, risks remain associated with Liu's investment. Competitive pressures, economic downturns, and unforeseen challenges in the retail and real estate sectors could impact the investment's success.

- Factors Affecting Investment Success: Economic factors, changes in consumer behavior, and successful competition within the market pose potential threats to the success of the investment.

- Competitive Challenges: The ever-evolving retail landscape presents significant challenges for HBC, requiring strategic adaptation to remain competitive.

- Economic and Regulatory Factors: Macroeconomic conditions and regulatory changes could also affect the overall success of Liu’s investment.

Conclusion: Understanding the Weihong Liu and Hudson's Bay Investment Story

Weihong Liu's investment in Hudson's Bay Company represents a significant development in the retail and real estate sectors. While details remain somewhat elusive, the potential implications are considerable. Liu's strategic approach, coupled with HBC's assets and potential, could lead to significant growth and transformation. However, challenges and risks also exist, necessitating careful monitoring and strategic adaptation. To fully grasp the long-term consequences, staying informed about future developments is crucial. Follow for updates on Weihong Liu investment updates, Hudson's Bay future, and detailed HBC stock analysis. Stay tuned for further developments in this evolving story.

Featured Posts

-

100 Forintos Erme Ritkasagertekek Es Hogyan Ismerd Fel Oket

May 29, 2025

100 Forintos Erme Ritkasagertekek Es Hogyan Ismerd Fel Oket

May 29, 2025 -

Ramalan Cuaca Bali Sebagian Besar Berawan Potensi Hujan Ringan

May 29, 2025

Ramalan Cuaca Bali Sebagian Besar Berawan Potensi Hujan Ringan

May 29, 2025 -

Olcso Gyujtoi Markak A Lidl Ben Vasarlasi Tippek

May 29, 2025

Olcso Gyujtoi Markak A Lidl Ben Vasarlasi Tippek

May 29, 2025 -

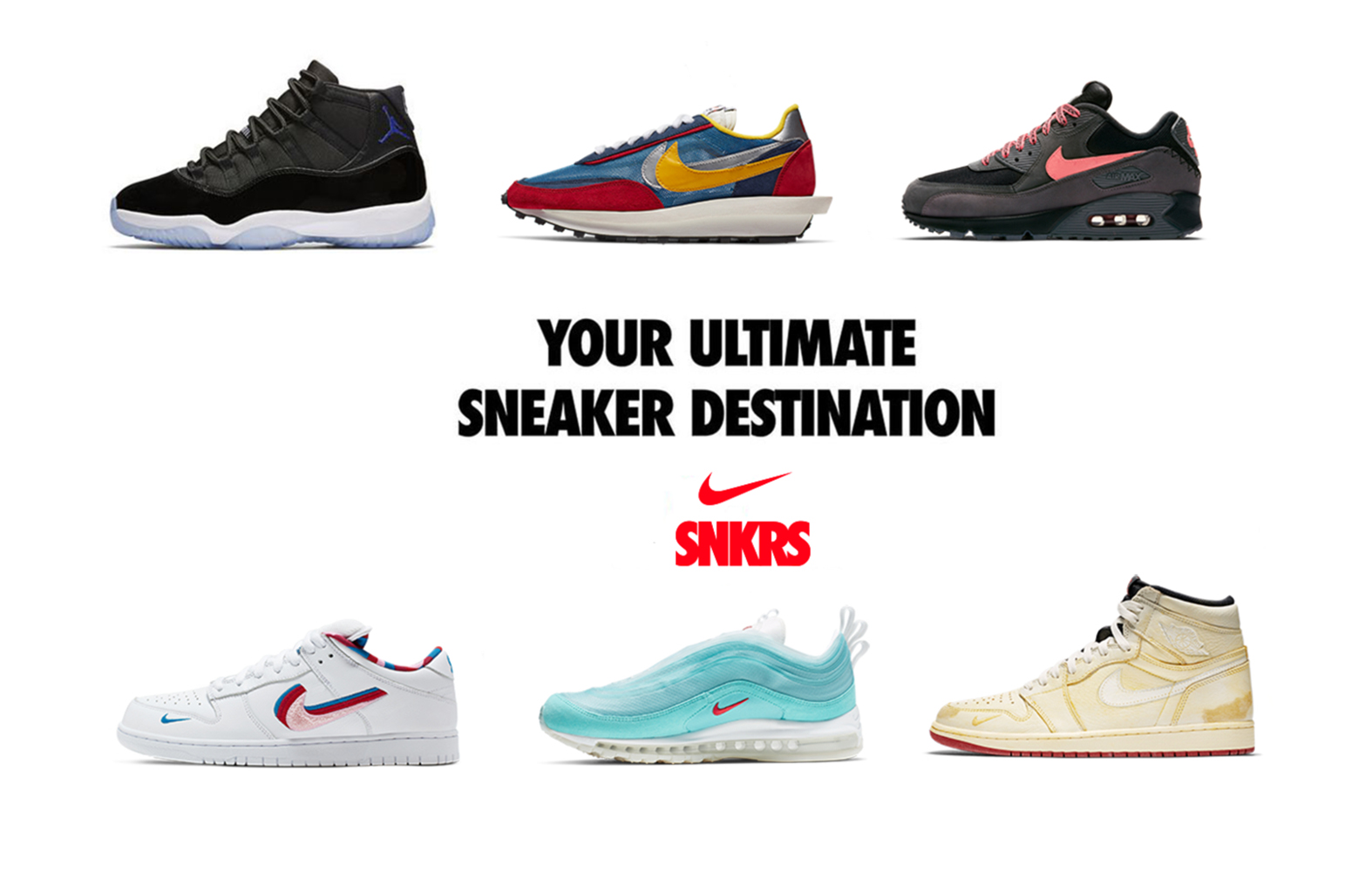

Nike Sneakers May 2025 Release Calendar Your Pre Purchase Guide

May 29, 2025

Nike Sneakers May 2025 Release Calendar Your Pre Purchase Guide

May 29, 2025 -

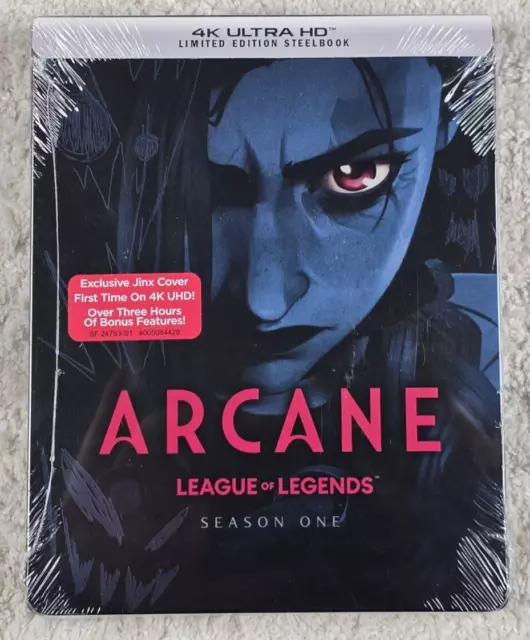

Amazons Arcane League Of Legends 4 K Blu Ray Steelbook Sale 50 Off

May 29, 2025

Amazons Arcane League Of Legends 4 K Blu Ray Steelbook Sale 50 Off

May 29, 2025

Latest Posts

-

Ouistreham Carnaval Estival Pour Inaugurer La Saison Touristique

May 31, 2025

Ouistreham Carnaval Estival Pour Inaugurer La Saison Touristique

May 31, 2025 -

Decouvrez Le Festival De La Camargue A Port Saint Louis Du Rhone Un Evenement Maritime

May 31, 2025

Decouvrez Le Festival De La Camargue A Port Saint Louis Du Rhone Un Evenement Maritime

May 31, 2025 -

Camargue Le Festival De Port Saint Louis Du Rhone Met En Lumiere Les Mers Et Les Oceans

May 31, 2025

Camargue Le Festival De Port Saint Louis Du Rhone Met En Lumiere Les Mers Et Les Oceans

May 31, 2025 -

Critiques D Isabelle Autissier Sur La Division Environnementale

May 31, 2025

Critiques D Isabelle Autissier Sur La Division Environnementale

May 31, 2025 -

Les Mers Et Les Oceans Au Coeur Du Festival De La Camargue A Port Saint Louis Du Rhone

May 31, 2025

Les Mers Et Les Oceans Au Coeur Du Festival De La Camargue A Port Saint Louis Du Rhone

May 31, 2025