Why 10-Year Mortgages Aren't Popular In Canada

Table of Contents

The Risk of High Interest Rates and Prepayment Penalties

Locking into a 10-year mortgage presents a significant risk in Canada's fluctuating interest rate environment. Unlike shorter-term mortgages, a 10-year mortgage binds you to a specific interest rate for a decade. If interest rates fall during that period, you'll miss out on potential savings by refinancing. Conversely, if rates rise, you'll be stuck with potentially high payments for the entire term. Furthermore, breaking a 10-year mortgage early often incurs substantial prepayment penalties.

- Example Scenario: Imagine you secure a 10-year mortgage at 4%. If interest rates jump to 6% after three years, you're locked into the lower rate, but potentially facing financial strain. A comparable 5-year mortgage would allow you to refinance at the lower rate after five years.

- Prepayment Penalty Comparison: Prepayment penalties vary significantly between lenders. Some may charge a percentage of the outstanding principal, while others use an Interest Rate Differential (IRD) calculation, which can be considerably higher. It's crucial to understand the penalty structure before committing to a long-term mortgage.

- Unforeseen Circumstances: Job loss, unexpected medical expenses, or other life events could make maintaining high mortgage payments challenging. A shorter-term mortgage offers greater flexibility in such situations.

Limited Financial Flexibility with a 10-Year Mortgage

A 10-year mortgage significantly restricts your financial flexibility compared to shorter terms. The inability to refinance or renegotiate means missed opportunities to benefit from lower interest rates, potentially costing you thousands of dollars over the life of the mortgage.

- Refinancing Opportunities: Consider needing to renovate your home or seize an unexpected investment opportunity. With a 5-year mortgage, you can refinance at a better rate to fund these ventures. A 10-year mortgage prevents this flexibility.

- Missed Rate Drops: The Canadian interest rate environment is dynamic. Locking into a 10-year term risks missing out on significant rate drops that could reduce your monthly payments substantially.

- Changing Life Circumstances: Life events like marriage, having children, or career changes impact financial priorities. A shorter-term mortgage allows adaptation to these changing needs.

The Psychological Factor: Long-Term Commitment Hesitation

Committing to a 10-year mortgage involves a substantial psychological commitment. Many homeowners feel uneasy about a long-term financial obligation, preferring the greater control and predictability of shorter-term mortgages.

- The "Locked-In" Feeling: The feeling of being "locked in" for a decade can cause stress and anxiety for some borrowers. Shorter-term mortgages offer a sense of control and the opportunity to reassess financial situations regularly.

- Shorter-Term Appeal: The appeal of shorter terms lies in their predictable nature. You know when you’ll renegotiate and can plan accordingly, mitigating psychological discomfort.

- Risk Perception: Many people have a psychological preference for shorter time horizons, perceiving long-term commitments as riskier.

Lack of Availability and Higher Costs

10-year mortgages aren't as readily available in Canada as their shorter-term counterparts. Lenders offer fewer 10-year options, and those that do often charge higher interest rates due to the increased risk associated with longer terms.

- Lender Availability: While some major Canadian banks offer 10-year fixed mortgages, they are not as common as 5-year options. You may find limited choices among lenders.

- Interest Rate Differences: Expect higher interest rates on 10-year mortgages compared to 5-year mortgages to compensate lenders for the extended risk.

- Supply and Demand: The limited supply of 10-year mortgages and lower demand contribute to their pricing structure.

Navigating the Canadian Mortgage Market: Understanding 10-Year Mortgages

In summary, the low popularity of 10-year mortgages in Canada stems from several factors: the inherent risk of fluctuating interest rates and prepayment penalties, limited financial flexibility, psychological preference for shorter-term commitments, and the overall lack of availability and potentially higher costs. It's crucial to carefully consider your individual financial situation, risk tolerance, and long-term goals before committing to any mortgage term. A 5-year fixed-rate mortgage or even a variable-rate mortgage may offer more flexibility and align better with your needs. Consult a mortgage broker to explore your options and make an informed decision about your long-term mortgage commitments in Canada. Don't rush into a 10-year mortgage without thoroughly understanding the implications!

Featured Posts

-

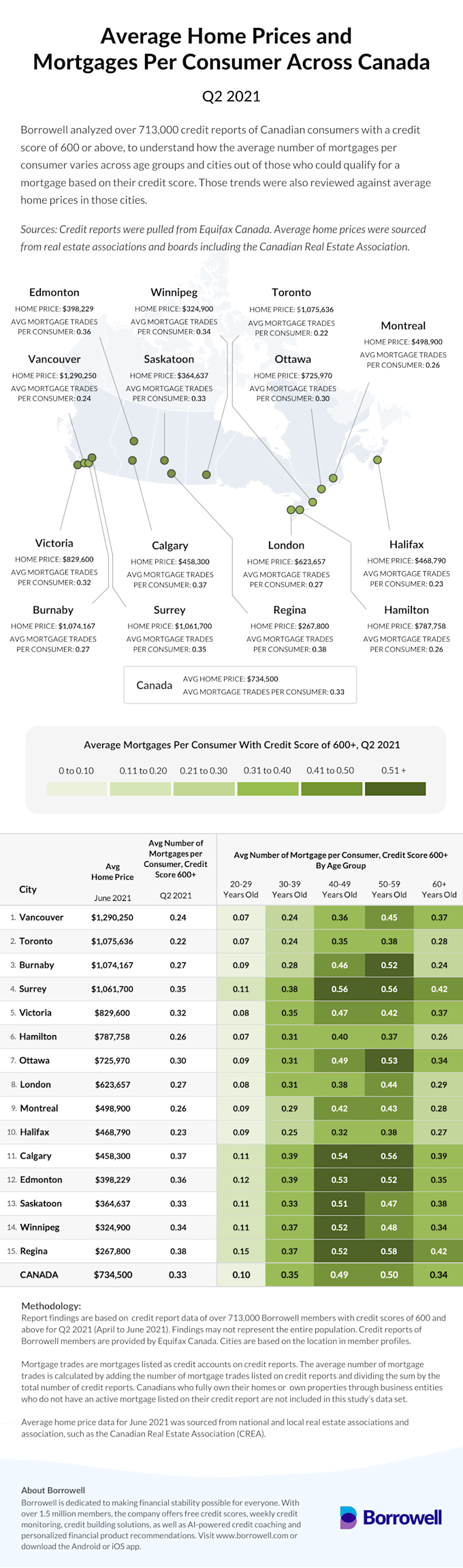

April Jobs Report 177 000 New Jobs Unemployment Remains At 4 2

May 04, 2025

April Jobs Report 177 000 New Jobs Unemployment Remains At 4 2

May 04, 2025 -

Cut The Cord Watch Fox Without Cable Tv

May 04, 2025

Cut The Cord Watch Fox Without Cable Tv

May 04, 2025 -

How Google Trains Its Search Ai Even After Opting Out

May 04, 2025

How Google Trains Its Search Ai Even After Opting Out

May 04, 2025 -

Blake Lively And Anna Kendrick Another Simple Favor Event Highlights Their Friendship

May 04, 2025

Blake Lively And Anna Kendrick Another Simple Favor Event Highlights Their Friendship

May 04, 2025 -

Blake Lively And Anna Kendrick Subtle Style Showdown At Film Premiere

May 04, 2025

Blake Lively And Anna Kendrick Subtle Style Showdown At Film Premiere

May 04, 2025

Latest Posts

-

Peter Distad To Lead Foxs New Direct To Consumer Streaming Service

May 04, 2025

Peter Distad To Lead Foxs New Direct To Consumer Streaming Service

May 04, 2025 -

Access Fox Programming Cord Cutting Guide For Live Tv

May 04, 2025

Access Fox Programming Cord Cutting Guide For Live Tv

May 04, 2025 -

Volkanovski Vs Lopes Ufc 314 Main Event Betting Odds And Preview

May 04, 2025

Volkanovski Vs Lopes Ufc 314 Main Event Betting Odds And Preview

May 04, 2025 -

Stream Fox Live Guide To Watching Without Cable

May 04, 2025

Stream Fox Live Guide To Watching Without Cable

May 04, 2025 -

Ufc 314 Changes To The Fight Card Announced

May 04, 2025

Ufc 314 Changes To The Fight Card Announced

May 04, 2025