Why Current Stock Market Valuations Shouldn't Deter Investors: BofA

Table of Contents

The Limitations of Traditional Valuation Metrics

Traditional valuation metrics, while useful, often provide an incomplete picture of a stock's true worth. Relying solely on these metrics to assess whether the market is overvalued can be misleading.

PE Ratios and Their Context

The Price-to-Earnings (PE) ratio, a widely used metric, is often misinterpreted. A high PE ratio doesn't automatically equate to overvaluation.

- Interest Rates: Lower interest rates generally support higher PE ratios as the cost of capital decreases, making future earnings more valuable.

- Industry Differences: Comparing PE ratios across different industries is flawed. High-growth technology companies, for example, often command higher PE ratios than more mature, stable industries.

- Growth Prospects: A company with strong future growth prospects may justify a higher PE ratio than a company with slower anticipated growth, even if current earnings are similar. Consider comparing PE ratios within sectors and against historical averages for a more accurate assessment. For example, a tech company with a PE ratio of 30 might be undervalued compared to its historical average of 40, while a utility company with a PE ratio of 20 might be overvalued compared to its historical average of 15.

Beyond PE: Considering Other Valuation Metrics

A holistic approach requires looking beyond the PE ratio. Other valuable metrics include:

- Price-to-Sales (P/S): This compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with negative earnings. A lower P/S ratio generally suggests a more attractive valuation.

- Price-to-Book (P/B): This compares a company's market value to its book value (assets minus liabilities). A low P/B ratio can indicate undervaluation, although it's important to consider factors like intangible assets.

- Dividend Yield: This represents the annual dividend payment relative to the stock price. A high dividend yield can be attractive to income-oriented investors, but it's crucial to assess the sustainability of the dividend payouts.

By employing a combination of these metrics, investors can develop a more comprehensive understanding of a company's value and the overall market valuation.

The Impact of Long-Term Growth Prospects

Current stock market valuations must be viewed within the context of long-term growth prospects. Several significant factors support a positive outlook.

Technological Innovation and its Influence

Technological advancements are revolutionizing industries and driving long-term economic expansion.

- Artificial Intelligence (AI): AI's transformative potential spans numerous sectors, from healthcare to finance, boosting productivity and creating new revenue streams for companies.

- Renewable Energy: The transition to renewable energy sources presents immense growth opportunities for companies involved in solar, wind, and other clean energy technologies.

- Biotechnology: Advancements in biotechnology are leading to groundbreaking medical treatments and diagnostics, generating substantial returns for investors.

These disruptive technologies are likely to fuel corporate earnings growth for years to come, justifying higher valuations in the present.

Global Macroeconomic Factors

Global macroeconomic trends play a significant role in shaping market valuations.

- Global Growth: While there are pockets of weakness, the global economy remains resilient. Continued growth in emerging markets, coupled with sustained growth in developed economies, contributes to higher corporate earnings.

- Interest Rates: While interest rates are rising, they remain historically low in many parts of the world, making equities a more attractive investment compared to bonds.

- Inflation: While inflation remains a concern, central banks are actively managing it, mitigating the risks to long-term economic growth.

BofA's positive outlook considers these macroeconomic factors and their potential impact on stock prices, emphasizing the opportunities that outweigh the risks.

The Role of Interest Rates and Monetary Policy

Interest rates and central bank policies profoundly affect stock market valuations.

Interest Rate Environment and its Effect on Valuations

There's an inverse relationship between interest rates and stock valuations.

- Current Rates vs. Historical Levels: While interest rates are rising, they remain relatively low compared to historical levels. This low-rate environment makes stocks more attractive relative to bonds, boosting their valuation.

- Attractiveness of Stocks vs. Bonds: Lower interest rates reduce the yield on bonds, making stocks, with their potential for higher returns, a more compelling investment option.

- Future Interest Rate Changes: The trajectory of future interest rate changes will impact stock valuations. However, the current environment suggests that the potential for substantial increases is limited.

Central Bank Policies and Market Sentiment

Central bank policies significantly shape investor sentiment and market valuations.

- Federal Reserve Actions: The Federal Reserve's monetary policies, including interest rate adjustments and quantitative easing programs, directly influence market liquidity and investor confidence.

- Market Expectations for Future Growth: Central bank actions shape market expectations for future economic growth, impacting stock prices. Predictable and transparent policies tend to create a more stable investment environment.

Conclusion

In conclusion, while seemingly high stock market valuations might initially deter some investors, BofA's perspective highlights the importance of considering a broader picture. The limitations of relying solely on traditional metrics like PE ratios, the substantial influence of long-term growth prospects fueled by technological innovation and favorable macroeconomic factors, and the current interest rate environment all contribute to a more nuanced understanding of current valuations. A holistic approach, incorporating multiple valuation metrics and a long-term view, is crucial. Don't let perceived high stock market valuations dissuade you; carefully consider a long-term investment strategy based on thorough research and a balanced understanding of current market dynamics and [link to relevant BofA resources or other helpful links]. Remember to always consult with a financial advisor before making any investment decisions.

Featured Posts

-

Hertha Berlins Struggles A Boateng Kruse Perspective

May 11, 2025

Hertha Berlins Struggles A Boateng Kruse Perspective

May 11, 2025 -

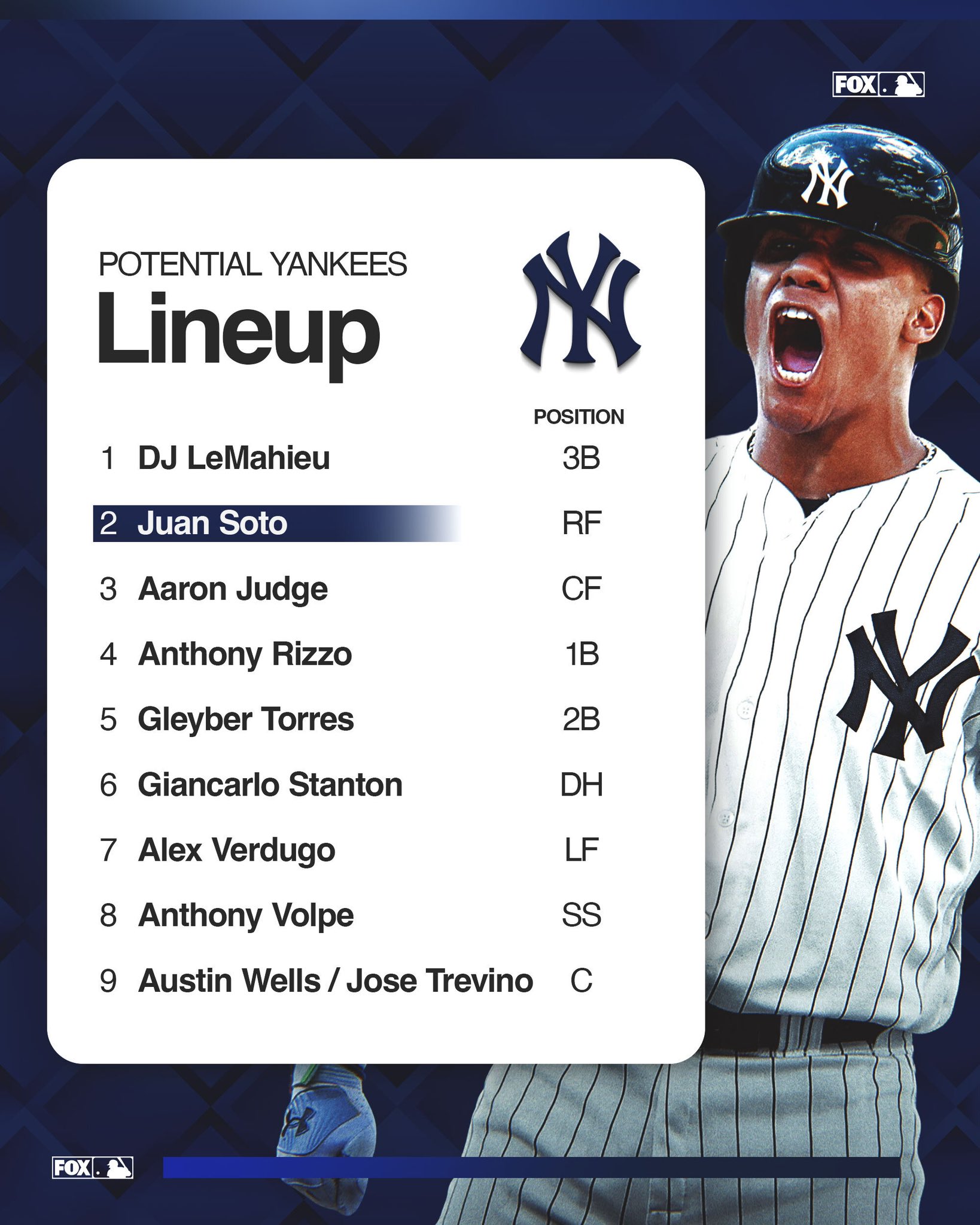

Aaron Judges 2024 Season A Yankees Magazine Deep Dive

May 11, 2025

Aaron Judges 2024 Season A Yankees Magazine Deep Dive

May 11, 2025 -

Tom Cruise And Suri Cruise A Fathers Uncommon Response

May 11, 2025

Tom Cruise And Suri Cruise A Fathers Uncommon Response

May 11, 2025 -

Exclusive Report High Level Security Talks Dominate U S China Trade Agenda

May 11, 2025

Exclusive Report High Level Security Talks Dominate U S China Trade Agenda

May 11, 2025 -

Zavershennya Viyni Kritika Dzhonsonom Mirnogo Planu Trampa

May 11, 2025

Zavershennya Viyni Kritika Dzhonsonom Mirnogo Planu Trampa

May 11, 2025