Why Did CoreWeave (CRWV) Stock Experience A Significant Increase Today?

Table of Contents

Positive Earnings Report and Financial Performance

CoreWeave's recent success is largely attributable to a strong earnings report that significantly exceeded expectations, boosting investor confidence and driving up the stock price.

Exceeding Revenue Expectations

CoreWeave's Q[Quarter] earnings report showcased impressive revenue figures, surpassing analyst predictions by a considerable margin.

- Revenue: [Insert Specific Revenue Number, e.g., $XXX million]

- Percentage Increase: [Insert Percentage Increase Compared to Previous Quarter/Year, e.g., XX% increase year-over-year]

- Competitor Comparison: [Insert Comparative Data Against Key Competitors if available, e.g., outperforming competitor Y by Z%]

This substantial revenue growth signifies a strong market position and robust demand for CoreWeave's services. Such positive results instill confidence among investors, leading to a higher market valuation and increased demand for CRWV stock.

Improved Gross Margins and Operational Efficiency

Beyond revenue growth, CoreWeave demonstrated improvements in its operational efficiency, resulting in enhanced profitability.

- Gross Margin: [Insert Gross Margin Percentage, e.g., XX%]

- Cost-Saving Measures: [Detail specific cost-saving initiatives implemented, e.g., optimized infrastructure, streamlined processes]

- Impact on Bottom Line: [Explain the positive effect on net income, e.g., increased profitability by X%]

These improvements suggest a sustainable business model capable of long-term growth and profitability, further attracting investors seeking stable, high-return opportunities. The improved gross margins are a key indicator of CoreWeave’s ability to manage costs effectively and maximize profits.

Strong Customer Acquisition and Retention

CoreWeave’s success is further evidenced by its robust customer acquisition and retention rates.

- New Customers Acquired: [Insert Number of New Customers Acquired in the Quarter, e.g., XXX new customers]

- Significant Customer Wins: [Mention Specific Companies if Publicly Available, e.g., "Partnership with leading AI company, ZYX Corp."]

- Customer Retention Rate: [Insert Customer Retention Rate, e.g., XX%]

This demonstrable growth in the customer base and high retention rate indicate strong customer satisfaction and the effectiveness of CoreWeave's sales and marketing strategies. Sustained customer growth is a critical factor in fueling future revenue streams and establishing market dominance.

Industry Trends and Market Opportunities

CoreWeave's success is not solely attributable to its internal performance; it also benefits from significant industry tailwinds.

Growing Demand for Cloud Computing and AI

The market for cloud computing and artificial intelligence (AI) is experiencing explosive growth, creating a favorable environment for CoreWeave's business model.

- Cloud Computing Market Growth: [Insert Statistics on Market Growth, e.g., "The global cloud computing market is projected to reach $XXX billion by YYYY."]

- AI Market Growth: [Insert Statistics on AI Market Growth, e.g., "The AI market is expected to grow at a CAGR of XX%."]

- High-Performance Computing Demand: [Highlight the increasing need for high-performance computing resources, crucial for AI and machine learning.]

CoreWeave is well-positioned to capitalize on this burgeoning demand, offering high-performance computing solutions crucial for AI development and deployment.

Strategic Partnerships and Acquisitions

CoreWeave's strategic partnerships and acquisitions have further strengthened its market position and investor confidence.

- Partnerships: [List any key partnerships and briefly explain their benefits.]

- Acquisitions: [List any recent acquisitions and briefly explain how they enhance CoreWeave's offerings.]

- Synergies and Benefits: [Explain how these strategic moves provide CoreWeave with a competitive edge and expansion opportunities.]

These strategic initiatives contribute significantly to CoreWeave’s competitive advantage, expanding its reach and capabilities within the rapidly evolving cloud computing landscape.

Technological Innovation and Competitive Advantage

CoreWeave differentiates itself through continuous technological innovation and a focus on providing cutting-edge solutions.

- Technological Advancements: [Highlight key technological advancements, e.g., "proprietary GPU virtualization technology"]

- Unique Selling Propositions (USPs): [Detail what sets CoreWeave apart from its competitors.]

- Market Differentiation: [Explain how these innovations establish CoreWeave as a leader in the high-performance computing space.]

This commitment to innovation is a key driver of CoreWeave's success and attracts investors seeking exposure to leading-edge technologies.

Analyst Upgrades and Investor Sentiment

Positive analyst sentiment and favorable media coverage have played a crucial role in driving the recent increase in CRWV stock price.

Increased Price Targets

Several prominent analysts have recently upgraded their price targets for CRWV stock, reflecting a positive outlook on the company's future performance.

- Analyst Upgrades: [List analysts who have upgraded their ratings and their new price targets.]

- Reasoning Behind Upgrades: [Summarize the key reasons provided by analysts for their upgrades, referencing their reports if possible.]

These upgrades signal growing confidence in CoreWeave's prospects and can significantly influence investor behavior, leading to increased demand for the stock.

Positive Media Coverage and Investor Confidence

Favorable media coverage and positive press releases have further bolstered investor confidence in CoreWeave.

- Positive Media Coverage: [Provide links to relevant articles and press releases highlighting positive news about CoreWeave.]

- Investor Statements: [Mention any positive statements made by investors or industry experts regarding CoreWeave’s potential.]

Positive media portrayals build trust and credibility, attracting new investors and reinforcing the positive sentiment surrounding CRWV stock.

Conclusion

The recent significant increase in CoreWeave (CRWV) stock price is a result of a confluence of factors: strong financial performance exceeding expectations, positive industry trends driving demand for cloud computing and AI services, strategic moves to enhance competitive advantage, and positive analyst sentiment fueling investor confidence. CoreWeave's commitment to innovation, customer acquisition, and operational efficiency positions it for continued growth in the dynamic cloud computing market. To stay updated on the performance of CoreWeave (CRWV) stock and its future prospects, continue monitoring financial news, analyst reports, and industry developments. Keep a close watch on CoreWeave (CRWV) stock for further insights into its trajectory.

Featured Posts

-

Nyt Wordle Solution Hints And Help For March 7th 1357

May 22, 2025

Nyt Wordle Solution Hints And Help For March 7th 1357

May 22, 2025 -

March 18 Wordle Answer And Clues 1368

May 22, 2025

March 18 Wordle Answer And Clues 1368

May 22, 2025 -

Wordle 1352 Sunday March 2nd Help And Solutions

May 22, 2025

Wordle 1352 Sunday March 2nd Help And Solutions

May 22, 2025 -

Nyt Wordle March 18 Hints And Solution 1368

May 22, 2025

Nyt Wordle March 18 Hints And Solution 1368

May 22, 2025 -

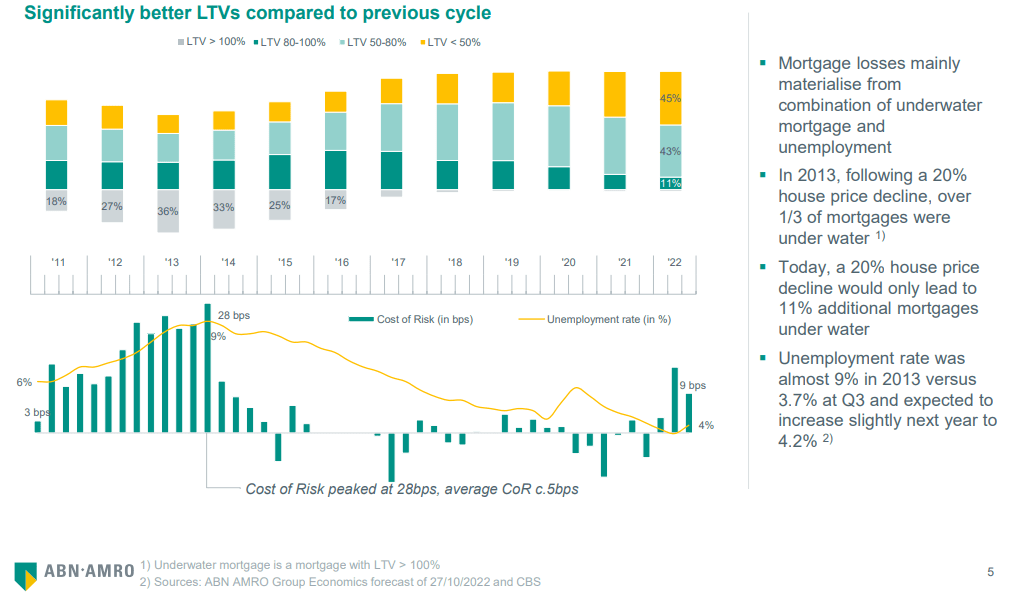

Voedselexport Vs Daalt Abn Amro Analyseert Impact Heffingen

May 22, 2025

Voedselexport Vs Daalt Abn Amro Analyseert Impact Heffingen

May 22, 2025

Latest Posts

-

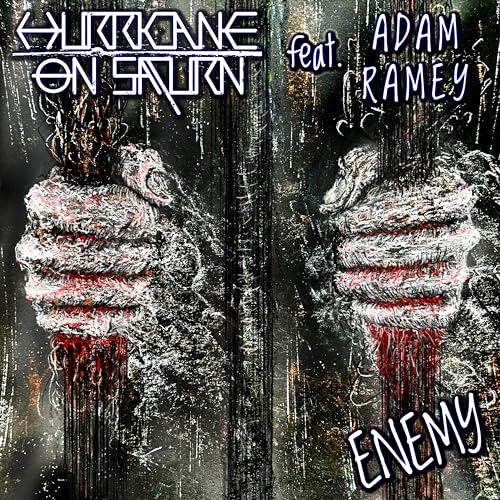

Dropout Kings Frontman Adam Ramey Dies At 32 A Tragic Loss

May 22, 2025

Dropout Kings Frontman Adam Ramey Dies At 32 A Tragic Loss

May 22, 2025 -

Dropout Kings Singer Adam Ramey Dies By Suicide At 31

May 22, 2025

Dropout Kings Singer Adam Ramey Dies By Suicide At 31

May 22, 2025 -

Adam Ramey Dropout Kings Lead Singer Passes Away At 32

May 22, 2025

Adam Ramey Dropout Kings Lead Singer Passes Away At 32

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dead At 31 Suicide Confirmed Go Fund Me Launched

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dead At 31 Suicide Confirmed Go Fund Me Launched

May 22, 2025 -

Wordle April 27th Solution Hints And Clues For Puzzle 1408

May 22, 2025

Wordle April 27th Solution Hints And Clues For Puzzle 1408

May 22, 2025